How to Invest in Consensys in 2026

While no one knows the true identity of Bitcoin's creator, Ethereum was developed by Vitalik Buterin and his four co-founders.

One of those co-founders, Joseph Lubin, has been building on the Ethereum blockchain ever since.

In 2015, Lubin founded Consensys, a decentralized blockchain production studio that primarily develops software for the Ethereum blockchain system. It also provides decentralized software and consulting services to companies and governments.

According to Lubin, the world is on the edge of a generational shift away from the traditional monetary system and toward decentralization. In his eyes, blockchain and Web3 are the undeniable future of technology and finance.

Despite raising money at a massive $7 billion valuation in March 2022, Consensys is not publicly traded and does not have a stock symbol.

However, if you're an accredited investor, you can buy shares of Consensys while it's still a private company.

Here's how, plus a few other options for retail investors as well.

Buy Consensys stock from current shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups from existing shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 pre-IPO companies on Hiive, including Databricks, Kraken, and Consensys:

As of the time of writing, there are 32 live orders of Consensys stock on Hiive.

Each of these listings is made by a unique seller who sets their own asking price and quantity of shares available. Sellers may be current or former employees, venture capitalists, or angel investors.

Buyers can either accept the asking price as listed or place bids and negotiate directly with the sellers.

After registering, both buyers and sellers can see the complete order book. This includes all asking prices, bids, quantities offered, and recent transactions.

Check out the order book for Consensys with the button below:

Invest in Consensys indirectly

There are a number of public companies that have invested in Consensys.

In April 2021, Consensys raised $65 million at an undisclosed valuation. Publicly traded investors included UBS (UBS), Mastercard (MA), and JP Morgan (JPM).

In November 2021, the company disclosed a $200 million round at a valuation of $3.2 billion. HSBC (HSBC) and Coinbase (COIN) both participated in this round.

In March 2022, Consensys raised an additional $450 million, this time at a $7 billion valuation. Microsoft (MSFT) and SoftBank (SFTBY) were among the investors in this most recent round.

By buying shares of these companies, you will have indirect exposure to Consensys. That said, your exposure will be very diluted and may not be worth the investment.

While this may be the best way for retail investors to invest in Consensys at this time, you're likely better off waiting for a more direct opportunity or investing in a related company.

Invest in other Web3 companies

Web3 is the name for what proponents claim is the next generation of the World Wide Web, which will include concepts like decentralization and blockchain technologies.

While Consensys may be the only Web3 company founded by an Ethereum co-founder, there are other companies working on similar technology.

If Lubin's vision of a blockchain-centric future comes to fruition, Consensys likely won't be the only company that wins.

Web3 will probably require a large amount of processing power from chips built by companies like Nvidia (NVDA) and Advanced Micro Devices (AMD). Most of these chips will be built in fabs run by TSMC (TSM).

Coinbase is also one of the biggest cryptocurrency exchanges in the world, giving it a significant first-mover advantage in Web3. It continues to acquire and invest in many Web3 companies.

It also introduced a Web3 wallet, which allows secure access to cryptocurrencies, NFTs, and more via direct interaction with on-chain applications, decentralized apps (dapps), and smart contracts.

Block (SQ) is a digital payments company that pioneered a lot of the peer-to-peer payment technology in our world today. The company believes decentralized finance is the future and will play an integral role in Web3.

It also has a subsidiary, Spiral, that builds open-source projects aimed at making Bitcoin the world's leading currency.

To diversify across a wide range of Web3 companies in a single investment, you could also consider the Bitwise Web3 ETF (BWEB).

Wait for the Consensys IPO

If none of those investments fit with what you're looking for, you may want to wait for Consensys to go public. However, you may be waiting awhile.

Consensys reportedly booked “nine figures” in revenue in 2021, so at least $100 million. It's estimated their annual revenue is now $219 million.

This level of annual revenue, coupled with access to plenty of money in the private markets, means Consensys won't need to turn to the public markets for capital.

Remaining private also allows it to operate more independently and with less regulatory scrutiny.

All that said, I don't expect it to IPO any time soon.

But when it does go public, or if you've decided to buy one of the publicly traded companies above, you'll need a brokerage account. If you need a brokerage, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms out there.

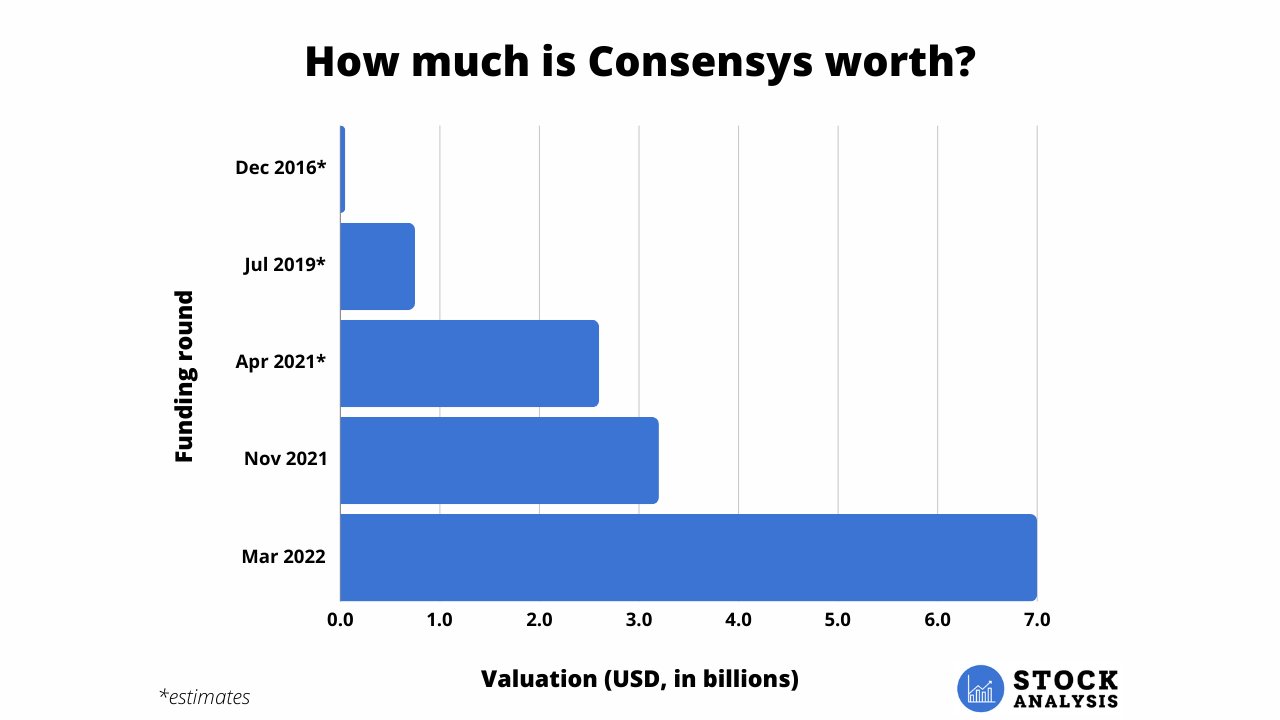

How much is Consensys worth?

The company's most recent funding round came in March 2022 and raised $450 million at a $7 billion valuation. This round was more than double the valuation it had received just four months earlier ($3.2 billion in November 2021).

The company has raised a total of $725 million over 6 rounds.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.