How to Invest in Databricks in 2026

Databricks is a cloud-based platform that helps enterprise customers manage and analyze big data, conduct data science projects, and develop AI and machine learning tools.

With it, companies are able to make faster, more informed decisions, work more efficiently, and create better technologies.

To outsiders, this may seem rather run-of-the-mill, but Databricks' technology is in high demand. The company crossed $4.8 billion in annualized revenue in Q3 2025, up 55% YoY.

Enterprise software is one of the most valuable spaces to be in, and investors have been pouring in.

In December 2025, Databricks announced it had raised over $4 billion at a $134 billion valuation, up 34% from its valuation in August and more than double its valuation from last December.

Despite being an obvious public market candidate, this funding will more than likely delay Databricks' IPO for another year or two.

But that doesn't mean you have to wait to invest in it.

Here's how to buy Databricks before its IPO.

Can you buy Databricks stock?

Since Databricks is a private company, it doesn't have a stock symbol, and there's no way to buy it in your regular brokerage account.

Retail investors will have to wait for its IPO to buy shares of its stock (more on this below).

However, there is a way for accredited investors to buy its shares today, and there are several ways for retail investors to gain exposure through two different venture capital funds.

How to invest in Databricks

1. Accredited investors

Accredited investors can buy shares of Databricks stock from existing shareholders on Hiive, an investment platform for pre-IPO companies.

Are you an accredited investor?

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000, excluding your primary residence

- You are a qualifying financial professional

Hiive connects existing shareholders — who may be current or former employees, VC firms, or angel investors — with accredited investors who want to buy shares of private companies.

Unsurprisingly, Databricks is one of the most active securities on the platform:

On Hiive, sellers create listings by setting an asking price and quantity of shares available. Similar to a traditional stock exchange, buyers can accept a seller's asking price as listed or place bids.

Buyers can also add companies to their watchlist and get notified of any new listings or successful transactions.

Hit the button below to view current offerings for Databricks:

2. Retail investors

While SEC regulations prevent retail investors from directly buying private companies, there are other ways to gain exposure to Databricks.

a) Fundrise's Innovation Fund

Fundrise's Innovation Fund is a venture capital fund that is open to all investors. The fund targets private, high-growth technology companies for its portfolio.

It invested $25 million in Databricks in July 2023 and is one of the fund's largest holdings. The fund has also invested in Canva, Anduril Industries, Anthropic, and OpenAI.

The fund has a minimum investment of just $10 and an annual management fee of 1.85%.

You can read more about it in our Innovation Fund Review or on the Fundrise website.

b) ARK Venture Fund

The Innovation Fund isn't the only retail-friendly VC fund with exposure to Databricks. Cathie Wood's ARK Venture Fund also has a stake.

At the time of this writing, Databricks makes up 2.35% of the fund, the 15th largest position.*

Its largest positions are SpaceX (7.43%), Figure AI (5.86%), OpenAI (4.17%), Epic Games (3.90%), and Lambda Labs (3.79%). xAI, Neuralink, and Anthropic are also in the top 10.

The fund invests in both public and private companies, so long as they meet the fund's theme of "disruptive innovation."

It charges an annual management fee of 2.90%. You can read more about it (and how to invest) on the ARK website.

c) Invest in Databricks' publicly traded investors

Including its most recent funding, Databricks has raised $19.7 billion from 92 investors over 13 rounds.

While the vast majority of these investors are private equity firms and venture capitalists, there are a handful of publicly traded companies that own stakes in Databricks.

Here's a quick breakdown:

- Microsoft (MSFT) participated in the Series E round in February 2019, which raised $250 million at a valuation of $2.8 billion.

- Microsoft and BlackRock (BLK) both invested in the Series F round in October 2019. The round raised $400 million at a $6.2 billion valuation.

- Amazon (AMZN), Salesforce (CRM), and Franklin Templeton (BEN) participated in the Series G round in February 2021, which raised $1 billion at a $27 billion valuation.

- Morgan Stanley (MS), BlackRock, Franklin Templeton, and T. Rowe Price (TROW) invested in the Series H round in August 2021. $1.6 billion was raised at a $36.4 billion valuation.

- Nvidia (NVDA), Franklin Templeton, Capital One (COF), and T. Rowe Price invested in the September 2023 round, which raised $685 million at a $43 billion valuation.

- Nvidia and Meta Platforms (META) participated in the Series J round in December 2024, which raised $10 billion at a $62 billion valuation.

As you can see, there are plenty of companies with at least some exposure to Databricks. By buying any of these companies' stocks, you will get indirect exposure to Databricks.

However, the problem with investing in any of these companies is that each of their stakes is likely very inconsequential in relation to the total size of their businesses.

d) Invest in Databrick's publicly traded competitors

If you're not happy with any of the above options, you may consider investing in Snowflake (SNOW), Databricks' primary competitor.

Snowflake's platform enables enterprise clients to consolidate data and uncover meaningful business insights. It generated $4.39 billion in revenue in the last 12 months and has a market capitalization of $75 billion.

If you're bullish on data analytics and database provider industries in general, Snowflake should be on your radar.

When will Databricks IPO?

Databricks was on track to IPO back in 2021 after raising $1.6 billion at a valuation of $36.4 billion, but decided to wait until a later date.

In late 2022, Databricks reportedly told its investors it was planning on an IPO by the summer of 2023. In June 2023, however, CEO Ali Ghodsi told Bloomberg those plans were postponed due to the weak market.

After announcing its Series K in August 2025, Ghodsi admitted Databricks hadn't planned to raise again so soon after its $10 billion Series J, but said investors had been reaching out almost daily to invest.

Five months later, in December, the company raised another $4+ billion in its Series L.

Databricks is in a weird spot. It has a mature business and has already raised a lot of capital (Series L rounds are rare), but it's still having no issue raising funds privately at ever-increasing valuations.

Still, I expect its public offering must be coming in the not-too-distant future.

When it does go public, you'll be able to look up its stock symbol and buy it in your brokerage account. If you're looking for a new broker, you may want to check out Public.

Databricks revenue

Databricks passed $4.8 billion in run-rate revenue in Q3 2025, up 55% from a year earlier.

The company has a net revenue retention of > 140%, meaning its existing customers are spending 40% more each year on average which showcases the stickiness and natural upselling of its product.

Databricks' core product is its “lakehouse” platform — a unified data architecture that combines the functionality of traditional data warehouses with the flexibility of data lakes.

This allows enterprises to manage, analyze, and build machine learning models on massive volumes of structured and unstructured data, all within a single environment.

While the lakehouse remains the foundation of its business, Databricks' new AI and data warehousing products — which enable companies to build custom AI applications and integrate LLMs directly into their data pipelines — are now its biggest growth engines.

Both segments surpassed a $1 billion annualized revenue run rate in 2025.

Despite its rapid growth, Databricks is likely still unprofitable. While it turned cash flow positive in September 2025, positive free cash flow doesn't necessarily mean the business is profitable.

For example, in the last 12 months, Snowflake (SNOW, Databricks' main competitor) generated $4.39 billion in revenue and produced $913 million of positive cash flow, but still lost -$1.3 billion.*

*Among other things, stock-based compensation is not included in free cash flow calculations. In Snowflake's case, its free cash flow is positive while its net income is negative in large part due to nearly $1.5 billion of stock-based compensation.

While not definitive, it's reasonable to assume Databricks is also operating at a loss — most late-stage, VC-backed tech companies run at a loss to prioritize growth, especially at this scale.

Who owns Databricks?

In addition to the public companies listed above, there are a number of private equity firms that have invested in Databricks.

Notable investors include Andreessen Horowitz (a16z), Thrive Capital, Tiger Global Management, Founders Future, Green Bay Ventures, Alkeon Capital, Greenoaks Capital Partners, ClearBridge Investments, and more.

Co-founder and CEO Ali Ghodsi and other co-founders (Reynold Xin, Matei Zaharia, and Ion Stoica), as well as other executives and employees, all likely own portions of the company.

The exact ownership breakdown, however, is not publicly available.

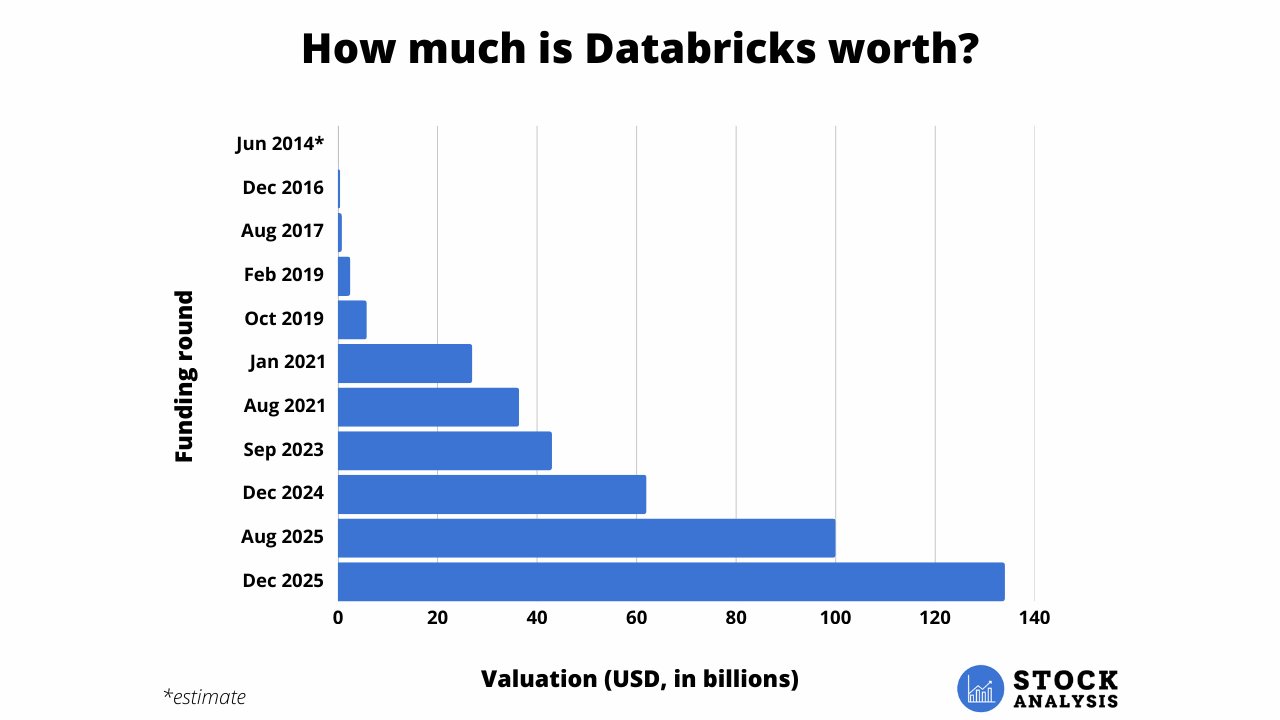

Databricks valuation chart

As mentioned above, Databricks' most recent round was its Series L in December 2025, which raised $4 billion at a $134 billion valuation.

Its Series L marked the company's third major fundraise in under a year — following a $1 billion round at a $100 billion valuation in August 2025 and a $10 billion raise at a $62 billion valuation in December 2024.

Here's a look at how Databricks' valuation has grown over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.