How to Invest in Stripe Stock in 2024

Stripe expects to process $1 trillion in payments in 2023.

That number is up 20% from the $800 billion it processed in 2022, which was up 25% from 2021's $640 billion and double 2020's $400 billion.

For the sake of comparison, PayPal, a $64-billion company, processed $1.36 trillion worth of payments in 2022.

Given these figures and its impressive list of investors and partnerships, it's not surprising you're wondering how to invest in Stripe.

It's possible Stripe will go public in 2024. Yet regardless of whether or not it's a public company, there are ways you can invest in it now.

Here's how.

Can you buy Stripe stock in your brokerage account?

Stripe is a private company, which means there is no Stripe stock symbol and you can't buy it in your brokerage account.

The company may have its IPO in 2024 or 2025, depending on market conditions.

Stripe is projecting $100 million in EBITDA in 2023. If the company posts a profit and continues to do so, management will be in no rush to go public until they're confident it will command a very high valuation.

If you've been following Stripe closely, this may seem at odds with the company having raised an additional $6.5 billion at a valuation of $50 billion in early 2023.

This capital, however, was not needed to run the business. Instead, the cash raise provided liquidity to current and former employees who wanted to cash in some or all of their stock options

While regular investors had no way of participating in this funding round alongside the private equity firms, there is a way for us to fund employee stock options so we can invest in Stripe stock before its IPO.

How to invest in Stripe

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the next chapter is for you. If you don't qualify as an accredited investor, skip to the following chapter, which is for retail investors.

1. How to buy Stripe stock as an accredited investor

An alternative to the secondary market is Equitybee, an investment platform that gives accredited investors access to high-growth, VC-backed startups and private companies like Stripe:

By funding employee stock options, accredited investors can gain investment exposure to private companies at past valuations.

In exchange for funding the options, you will receive a percentage of future proceeds from any successful liquidity events.

Shares of Stripe are currently trading for $18.51 each at a valuation of $50 billion, the same valuation private equity firms paid in March 2023.

Equitybee is also offering accredited investors access to a data-driven, index-like venture fund.

The Equitybee Venture Portfolio Fund (VPF) provides access to a broadly diversified portfolio of 100+ late-stage, pre-IPO companies, invested at discounts to the last known common share price.

Hit the button below to register and view current offerings at Equitybee.

Disclaimer: Subject to availability. Investments involve risk; Equitybee Securities, member FINRA.

2. How to buy Stripe stock as a retail investor

If you are not an accredited investor, there are still a few other ways to get indirect exposure to Stripe.

Invest in its publicly traded investors

According to Crunchbase, 58 investors have contributed to the $8.75 billion raised by Stripe.

While the vast majority of these are private equity firms, which you can't invest in, there are a few publicly traded companies that have invested in Stripe.

American Express (AXP) invested in Stripe via its Amex Ventures portfolio, participating in Stripe's Series C round, which raised ~$100 million at a valuation of $5 billion in July 2015.

Assuming American Express invested $30 million, that stake is now worth about $300 million. While that ROI is exceptional, this investment represents just 0.24% of AmEx's $123.4 billion market capitalization.

Visa (V) also participated in Stripe's Series C round. Again, assuming a $30 million investment, this stake is also worth $300 million, or .06% of Visa's $516 billion business.

As you can see, both of these companies' investments are inconsequential relative to the total size of their businesses, so this is a very diluted means of gaining exposure to Stripe.

Invest in Stripe's competitors

While you may not be able to buy Stripe stock, you can still invest in the rapidly growing payment processing industry by buying one of its competitors' stocks.

-

PayPal (PYPL): PayPal, which owns PayPal, Venmo, Braintree, and other payment solutions, processed $1.36 trillion in payment volume and generated $27.5 billion in revenue, $4.7 billion in EBITDA, and $5.1 billion in free cash flow in 2022. The company has a $63 billion market capitalization, about 80% lower than its peak, which it set in a massive run-up in 2021.

-

Block (SQ): Block, the $42-billion company behind payment processor Square and the Cash app, generated $17.5 billion in revenue and -$46.5 million in EBITDA on ~$620 billion in total payment volume in 2022.

-

Adyen (ADYEY): Adyen is a Dutch company that operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America. It generated $9.6 billion in revenue, $805 million in EBITDA, and $2 billion in free cash flow in 2022. The company is currently valued at $38.3 billion.

It's worth noting that the level of competition and size of the opportunity have made payment processing and other "fintech" stocks incredibly volatile over the last few years.

Do your due diligence and invest carefully.

Stripe revenue

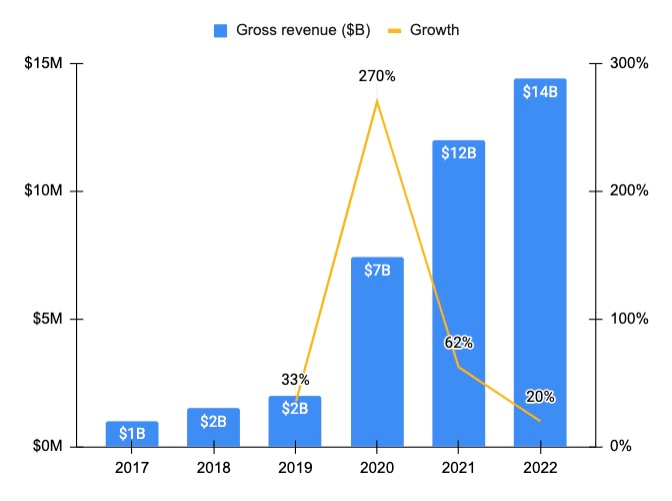

Stripe's revenue increased 20% in 2022 to $14 billion.

Here's a look at how its revenue has grown over time:

Source: Sacra.com

Based on growth in total payment volume, I'm estimating its revenue will hit ~$16.8 billion in 2023, another 20% YoY increase.

Who owns Stripe?

As mentioned above, there are 58 external investors in Stripe at this time.

Notable investors include Elon Musk and Peter Thiel — who co-founded PayPal and were very early investors in Stripe — Andreessen Horowitz (a16z), Sequoia Capital, Tiger Global Management, Visa, American Express, and others.

In addition to these investors, co-founders and brothers Patrick (CEO) and John (president) Collison likely own billion-dollar stakes, though the exact equity breakdown is not public information.

Additionally, C-suite executives and employees — both current and former — likely own some percentage of the company.

How to buy the Stripe IPO

In early 2023, the WSJ reported that Stripe was considering either going public or allowing its employees to sell their shares by the end of the year.

After the capital was raised in March to provide liquidity to its employees, it was clear Stripe wasn't going to IPO in 2023.

Like most other multi-billion dollar private companies, Stripe is likely waiting for a friendlier IPO market so it can command the highest valuation possible.

When Stripe does go public, you'll be able to look up its stock symbol and buy it in your brokerage account. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies, all on one of the most sleek and streamlined investing platforms.

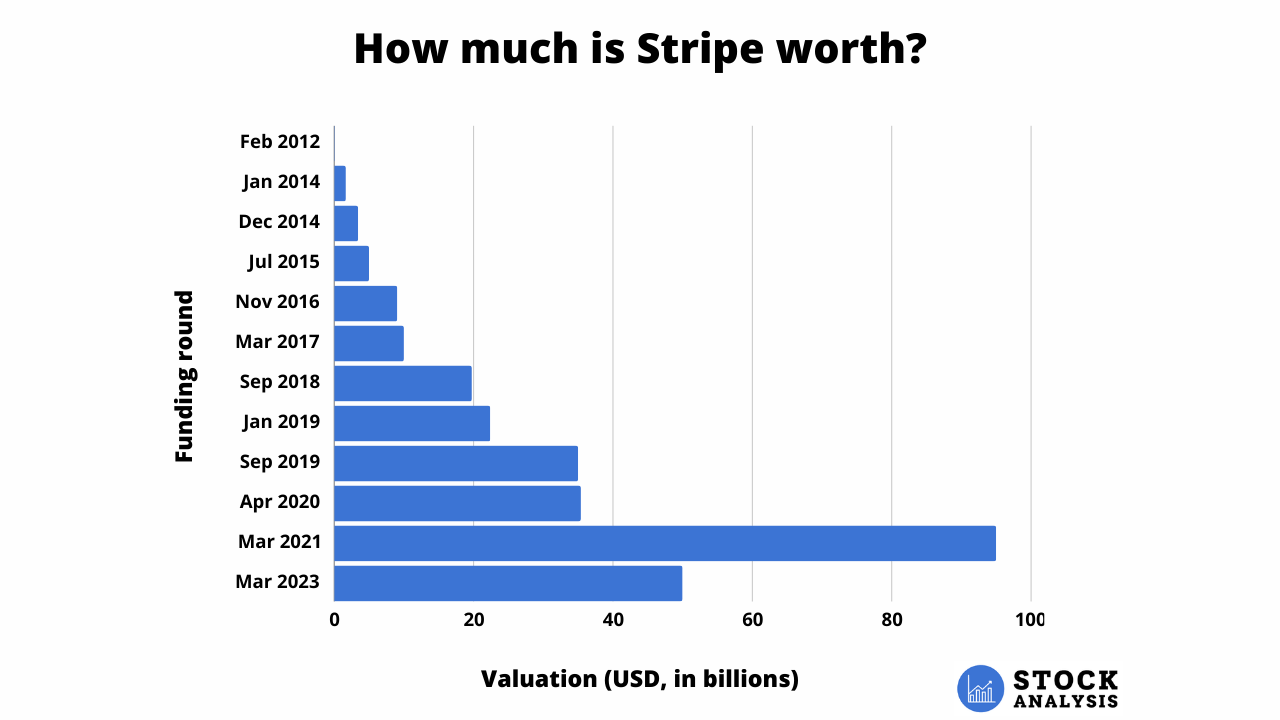

Stripe valuation chart

Here's a look at how Stripe's valuation has changed over time:

Source: Crunchbase

After peaking at a valuation of $95 billion in March 2021, Stripe's most recent funding round in March 2023 valued the company at $50 billion.

.png)