How to Invest in Epic Games Stock in 2026

You probably know Epic Games as the studio that created Fortnite, one of the most popular video games in the world, with over 650 million registered players.

But Fortnite is just one part of Epic's business. The company also built Unreal Engine, a real-time 3D creation platform that powers not only its own games but also films, architectural designs, and other virtual environments across industries.

It also provides an end-to-end ecosystem for developers to build, distribute, and operate video games (via Unreal Engine and the Epic Games Store).

All of this makes Epic far more than a gaming studio, and its partnership with Disney shows how the company's technology could play a major role in the future of interactive media (more on this below).

But more importantly, although it's still a private company, there is a way for you to invest in it before it goes public.

Is Epic Games publicly traded?

Epic Games is still a private company. There is no Epic Games stock symbol (though “EPIC” is available) and no way for you to buy it in your regular brokerage account.

To date, Epic has yet to announce any plans for an initial public offering (IPO).

And why would it? The company is generating more than $6 billion in annual revenue. Plus, it hasn't had any trouble raising money privately, having received investments of $8.13 billion over 16 rounds.

For this reason, Epic will not become publicly traded until it believes it can command a substantial valuation.

Still, if you qualify, there's a way to buy Epic Games stock before its IPO.

How to invest in Epic Games directly

There are shares of Epic Games available on Hiive.

Hiive is a marketplace where shareholders of private, VC-backed companies can list and sell their shares to accredited investors.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

If you qualify as an accredited investor, you can register for Hiive and gain access to thousands of private companies, including Epic Games:

Epic Games is the 21st most active security on Hiive. There are currently 23 listings of its stock available on the platform.

Each listing is made by a different seller who can set their own asking price and volume offered. These sellers may be employees, venture capital firms, or angel investors.

Buyers can either accept the asking price as listed, place a bid and negotiate directly with the sellers, or add the stock to their watchlist.

Register for Hiive and start investing in private companies today:

How to invest in Epic Games as a retail investor

Retail investors cannot invest directly in Epic Games until it becomes publicly traded.

That said, there are a few methods for gaining exposure to the company.

1. ARK Venture Fund

The best way for retail investors to invest in Epic Games is via the ARK Venture Fund. The ARK Venture Fund is a private fund that invests in disruptive technologies in both the public and private markets.

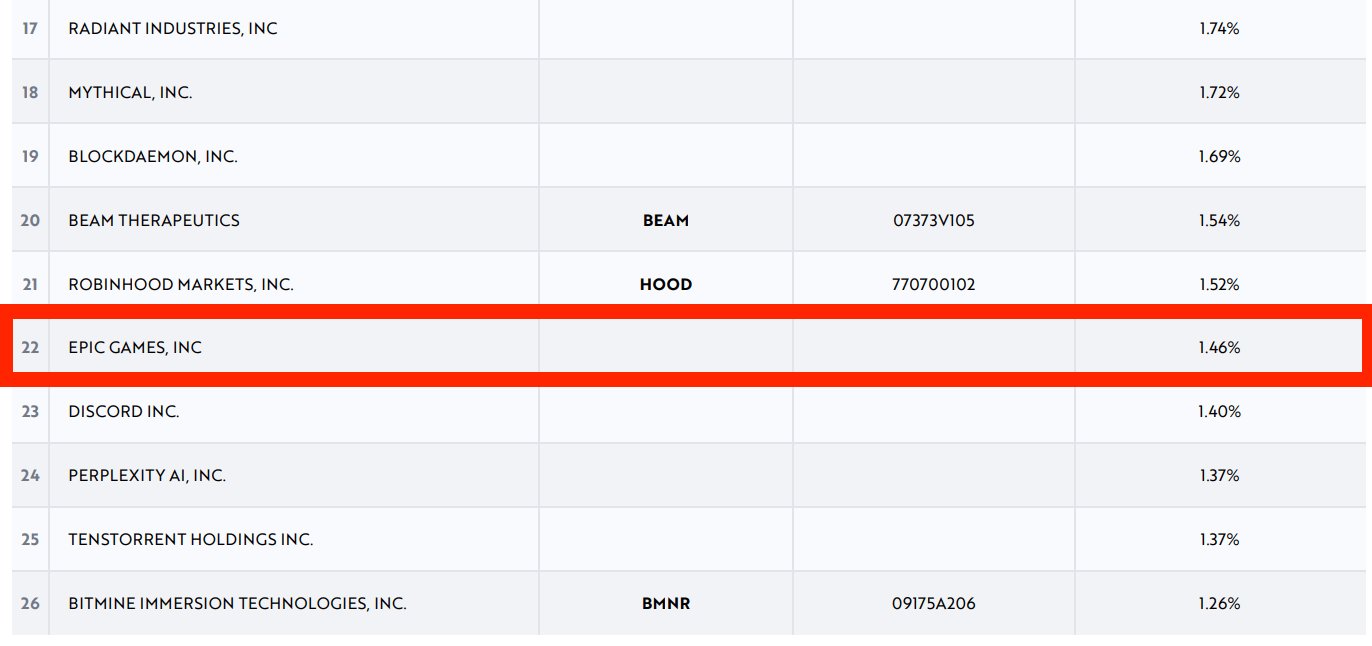

As of October 2025, Epic Games makes up 1.46% of the fund:

While this is a relatively small stake, an investment in the fund will also give you exposure to SpaceX, Figure AI, Neuralink, OpenAI, xAI, Anthropic, and Groq — all of which are in the top 10 holdings.

Accredited investors can buy the fund via the ARK website, while retail investors can invest in it via SoFi. It has an annual management fee of 2.90%.

2. Invest in Epic's investors

Tencent (TCEHY), a Chinese investment holding company, acquired a 40% stake in Epic for $330 million in 2012. This implied a valuation of $825 million.

At a $22.5 billion valuation, this stake is now worth around $8.9 billion. In addition to the equity stake, the investment formed a strategic partnership between the two companies.

Epic was looking to shift to a games-as-a-service business model, which Tencent had done successfully with several of its games (including League of Legends). The result of this partnership is Fortnite.

Despite the size of its investment, buying Tencent stock is still a diluted way of investing in Epic Games. Tencent's $8.9 billion stake represents just 1.1% of its $785 billion market capitalization.

Additionally, both Sony (SONY) and Disney (DIS) have stakes in Epic, though these stakes are similarly immaterial relative to their overall size.

That said, Disney's $1.5 billion investment in Epic Games (in February 2024) also launched a partnership between the two companies to create more realistic games for the Disney, Pixar, Marvel, Star Wars, and Avatar brands.

They also have plans to build immersive experiences for customers to play, shop, and engage with Disney characters and stories.

While this may make Disney more valuable, buying Disney's stock is a fairly indirect way of getting exposure to Epic Games. If you're a retail investor, you're likely better off waiting for the company's IPO or buying one of its publicly traded competitors.

3. Epic Games competitors

While Epic Games is the only company with Fortnite and Unreal Engine, there are several publicly-traded competitors you may be interested in:

- Unity Software (U): Unity operates a platform that provides real-time 3D development tools and is the biggest rival to Epic's Unreal Engine.

- Take-Two Interactive (TTWO): Take-Two is the studio behind Grand Theft Auto, the NBA 2K series, and Red Dead Redemption.

- Electronic Arts (EA): EA is best known for its professional sports video games, like NFL, FIFA, and NHL.

- Roblox (RBLX): Roblox also provides an end-to-end online platform where users can develop and sell their games to other users.

When will Epic Games have its IPO?

The most recent rumors of an Epic Games IPO came in early 2021, when the company hired an investor relations specialist, but nothing materialized that year.

While a few companies had their initial public offerings last year and the IPO market seems to be warming up, Epic Games has not mentioned any plans to become publicly traded.

When Epic Games finally does have its IPO, you'll need a brokerage account to buy shares. If you're in the market, we recommend Public.

On it, you can invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies, all from the same account.

Epic Games' revenue compared to competitors

The most recent information we have regarding Epic Games' revenue was the $6+ billion it generated in 2022.

Here's how that compares to its publicly traded competitors' revenue and market capitalizations:

| Revenue | Market capitalization | |

| Epic Games | $6+ billion (as of 2022) | $22.5 billion (as of 2024) |

| Unity (U) | $1.8 billion | $15.4 billion |

| Take-Two Interactive (TTWO) | $5.8 billion | $47.2 billion |

| Electronic Arts (EA) | $7.5 billion | $49.9 billion |

| Roblox (RBLX) | $4 billion | $86.7 billion |

It's worth noting again, however, that the figures listed for Epic Games are from 2022 and 2024, while the others are current (as of October 2025).

Who owns Epic Games?

Epic Games was founded by Tim Sweeney, who serves as the company's CEO.

Following the most recent funding round in August 2022, it's estimated that Sweeney owns around 28% of the company.

In addition to Sweeney, Tencent, Sony, Disney, and 41 other private equity firms, as well as employees of Epic Games, likely own some portion of the company via stock options and other compensation incentives.

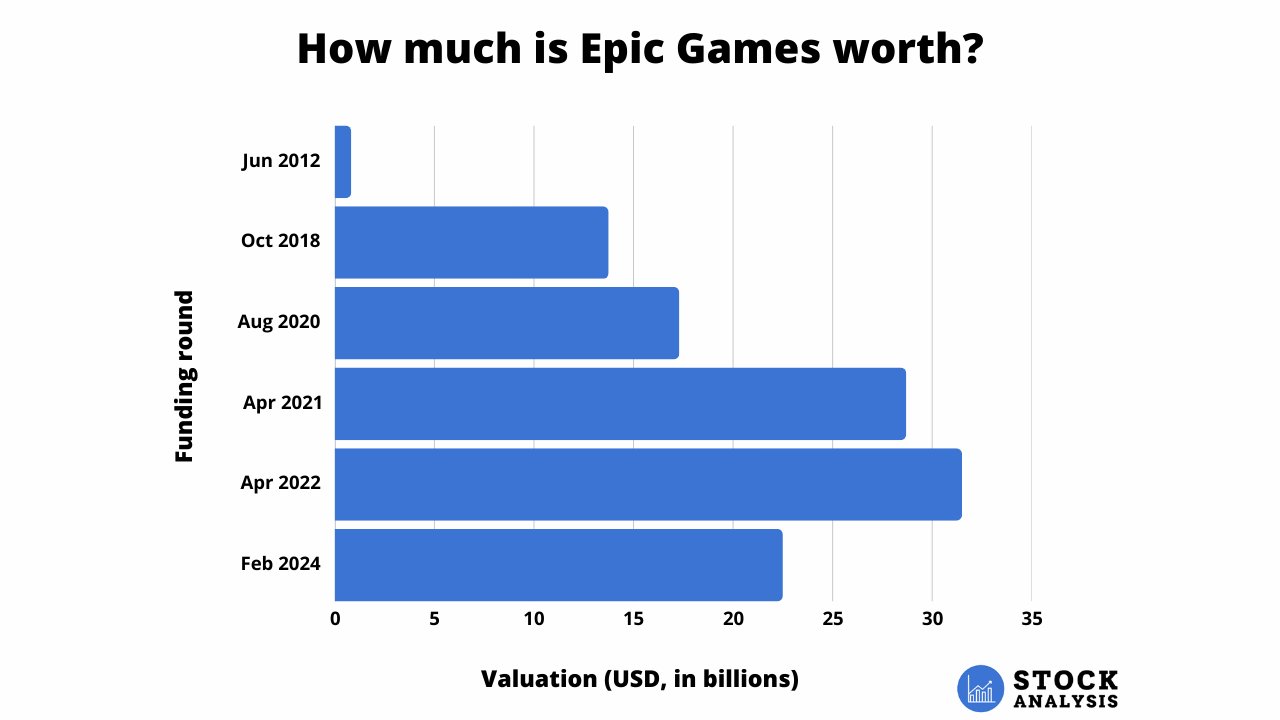

Epic Games valuation chart

In April 2022, Epic Games raised $2 billion at a $31.5 billion valuation, its highest valuation ever.

But in February 2024, Disney bought 9% of the company for $1.5 billion, implying a valuation of $22.5 billion. This was down nearly 29% from its valuation set two years earlier.

Here's a look at the valuation history:

Source: Crunchbase

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.