How to Invest in Epic Games Stock in 2024

You may know Epic Games as the studio behind Fortnite — one of the most popular video games in the world with 350 million active accounts.

However, most people haven't heard of Epic's second most popular product, Unreal Engine, which is a real-time 3D creation tool for advanced visuals and graphics. It's what makes playing Fortnite such an immersive experience.

In addition to using Unreal Engine for its own games, Epic licenses the software to other developers and, more recently, to other industries such as film and television, architecture, manufacturing, and others that require realistic simulations.

Epic also provides an end-to-end ecosystem for developers to build, distribute, and operate video games. All this makes Epic a lot more than just a gaming studio.

Though it's still a private company, here's how you can invest before it goes public.

Is Epic Games publicly traded?

Epic Games is still a private company. There is no Epic Games stock symbol (though “EPIC” is available) and no way for you to buy it in your regular brokerage account.

To date, Epic has yet to announce any plans for an initial public offering (IPO).

The company has not had any trouble raising money privately — it has received investments of $6.4 billion. With this level of funding, there's no need to turn to the public markets to raise cash.

Instead, it's likely Epic will not have its IPO until it believes it can command a substantial valuation.

Still, if you qualify, there's a way to buy Epic Games stock before its IPO.

How to invest in Epic Games directly

Accredited investors can buy shares of private companies, like Epic, on Hiive.

Hiive is a marketplace that connects shareholders of private, VC-backed companies who want to sell their shares with accredited buyers.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

If you qualify as an accredited investor, you can register for Hiive and gain access to hundreds of private companies, including Epic Games:

There are currently 12 unique listings of Epic Games stock available on Hiive.

Each listing is made by a different seller who can set their own asking price and volume offered. These sellers may be employees, venture capital firms, or angel investors.

Buyers can either accept the asking price as listed or place a bid and negotiate directly with the sellers. Additionally, there are no buying fees on Hiive.

Register for Hiive and start investing in private companies today:

How to invest in Epic Games as a retail investor

Retail investors cannot invest directly in Epic Games until it becomes publicly traded.

That said, there are a few indirect methods for gaining exposure to the company.

To date, 44 external investors have invested in Epic Games. The vast majority of these are private equity and venture capital firms, but there are a few publicly traded companies that have made investments.

By buying shares of these companies, you can get some access to Epic Games.

Tencent (TCEHY), a Chinese investment holding company, acquired a 40% stake of Epic for $330 million in 2012. This implied a valuation of $825 million.

At a $31.5 billion valuation, this stake is now worth around $12.6 billion, and this investment formed a strategic partnership between the two companies.

Epic was looking to shift to a games-as-a-service business model, which Tencent had done successfully with several of its games (including League of Legends). The result of this partnership is Fortnite.

Despite the size of its investment, buying Tencent stock is still a diluted way of investing in Epic Games. Tencent's $12.6 billion stake represents just 3.6% of its $345.4 billion market capitalization.

Investors may also want to consider potential U.S.-China geopolitical risks.

Additionally, Sony (SONY) and Disney (DIS) have stakes in Epic. Though the exact size of each investment is not disclosed, the stakes are likely an insignificant portion of the investing company's total business.

Nevertheless, Disney recently invested another $1.5 billion into Epic Games with the goal of creating new games using its intellectual property. The Disney-Epic partnership may create games for the Disney, Pixar, Marvel, Star Wars, and Avatar brands.

Furthermore, Epic Games is a holding of the ARK Venture Fund, a private fund that invests in disruptive technologies in both the public and private markets.

Epic Games made up 3.3% of the fund in September 2023 but fell outside the top 10 holdings as of December 31st. It likely makes up around 2% of the fund's holdings.

Retail investors can access the ARK Venture Fund via Titan.

These are viable options for investing in Epic Games, but they're all fairly diluted. If you're a retail investor, you're likely better off waiting for the company's IPO.

When will Epic Games have its IPO?

The most recent rumors of an upcoming Epic Games IPO came in early 2021, when the company hired an investor relations specialist. But nothing materialized that year.

While a few companies decided to go public toward the end of last year, the frozen IPO market has kept the bulk of the highly anticipated IPOs sidelined for the last two years.

Once the market warms up a bit, I expect companies like Stripe, Discord, Epic Games, and many other unicorns (companies valued at over $1 billion) to go public.

When Epic Games finally does have its IPO, you'll need a brokerage account to buy shares. If you're in the market, we recommend Public.

On the platform, you can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles, all from the same account.

Alternatives to Epic Games

While Epic Games is the only company with Fortnite and Unreal Engine, there are several publicly traded competitors you may be interested in:

- Unity Software (U): Unity operates a platform that provides real-time 3D development tools and is the biggest rival to Epic's Unreal Engine.

- Take-Two Interactive (TTWO): Take-Two is the studio behind Grand Theft Auto, the NBA 2K series, and Red Dead Redemption.

- Electronic Arts (EA): EA is best known for its professional sports video games, like NFL, FIFA, and NHL.

- Roblox (RBLX): Roblox also provides an end-to-end online platform where users can develop and sell their games to other users.

Epic Games' revenue compared to competitors

Epic Games most recently disclosed revenue of $5.76 billion in 2021.

Here's how that compares to its publicly traded competitors' revenue and market capitalizations:

| Revenue | Market capitalization | |

| Epic Games | $5.8 billion (as of 2021) | $31.2 billion (as of 2022) |

| Unity | $2.03 billion | $11.7 billion |

| Take-Two Interactive | $5.4 billion | $28.7 billion |

| Electronic Arts | $7.7 billion | $36.8 billion |

| Roblox | $2.6 billion | $27.9 billion |

It's worth noting again, however, that the figures listed for Epic Games are from 2021 and 2022, while the others are current as of the time of writing.

Who owns Epic Games?

Epic Games was founded by Tim Sweeney, who serves as the company's CEO.

Following the most recent funding round in August 2022, it's estimated Sweeney owns around 28% of the company.

In addition to Sweeney, Tencent, Sony, Disney, and 41 other private equity firms, as well as employees of Epic Games, likely own some portion of the company via stock options and other compensation incentives.

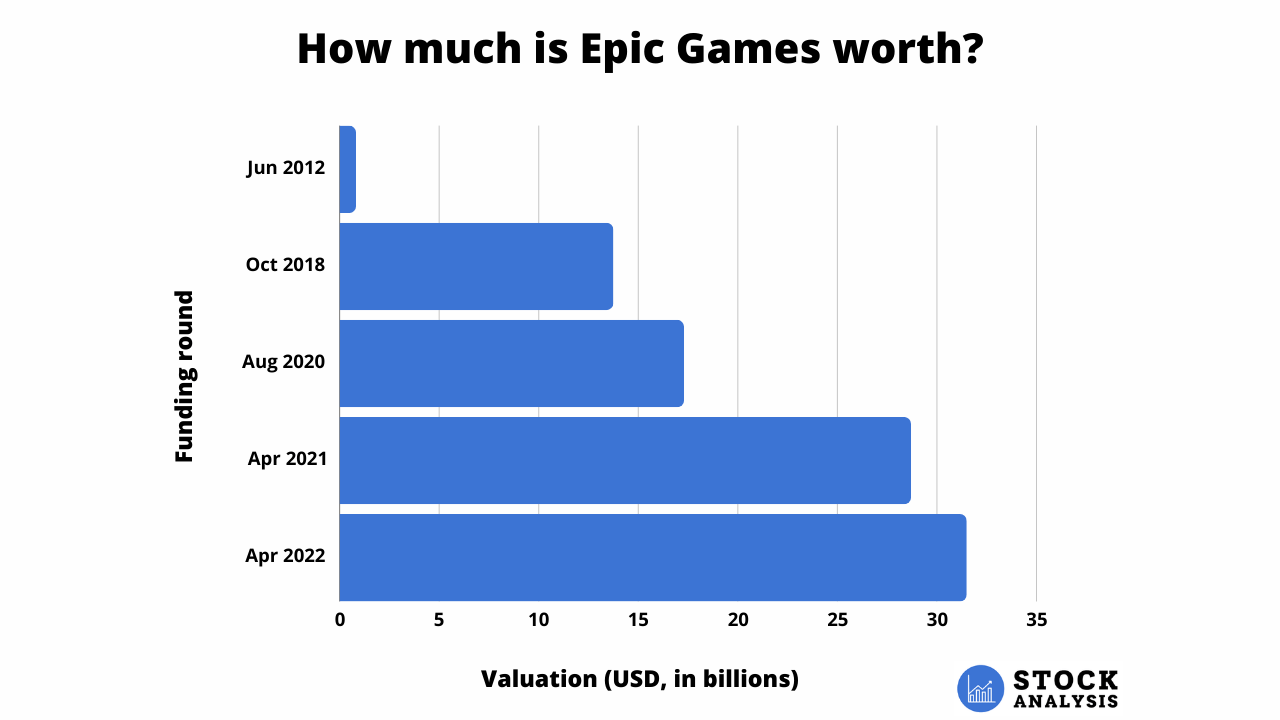

Epic Games valuation chart

Epic Games' most recent funding round came in August 2022. It raised $2 billion at a valuation of $31.5 billion.

Here's a look at the valuation history:

Source: Crunchbase