How to Invest in Flexport Stock in 2026

Flexport is making waves in global logistics.

The company provides an end-to-end platform, simplifying the entire supply chain management process. From a single hub, businesses can coordinate with suppliers, shippers, customs, ports, and more.

This makes shipping and tracking orders much more efficient, which makes it easier for businesses to sell more and scale faster.

To date, over 10,000 businesses are using Flexport.

However, the company is unlikely to have its initial public offering until 2026 or later. More on this below.

Regardless, you don't need to wait for its IPO — there's a way to buy Flexport stock right now.

How to invest in Flexport before its IPO

Flexport is a private company. There is no Flexport stock symbol to look up and buy in your traditional brokerage account.

That said, shares of the company are trading on Hiive, a secondary marketplace.

Secondary marketplaces are platforms where accredited investors can buy shares of private companies from current shareholders.

A note on accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional.

If you meet one of these criteria, you can buy Flexport stock on Hiive:

As of this writing, there are 42 unique listings for Flexport stock.

This means there are 42 different shareholders — which may be employees, venture capital firms, or angel investors — with varying asking prices and volume available for purchase.

On Hiive, buyers can either accept the listing price offered or place bids and negotiate directly with sellers.

In addition to Flexport, some of the other most actively traded companies on Hiive are SpaceX and Databricks.

Start investing in private, VC-backed companies on Hiive:

Alternative options for non-accredited investors

If you don't qualify as an accredited investor, there's no way to invest directly in Flexport stock right now. The best way to invest in Flexport is to wait for its IPO.

Nevertheless, if you really want to invest in the company today, there are a few roundabout ways of doing so.

The vast majority of Flexport's external funding has come from private equity and VC firms, but there are several publicly traded companies that have invested.

Both SoftBank and Shopify have stakes in Flexport.

SoftBank (SFTBY), an investment holding company, has invested in three separate funding rounds:

| Round | Date | Amount raised | Valuation |

| Series D | February 2019 | $1 billion | $3.2 billion |

| Late VC | July 2021 | $10 million | Undisclosed |

| Series E | February 2022 | $935 million | $8 billion |

Given the size and number of investors in each round, it's possible SoftBank has a $500 million stake in Flexport. If it does, that would represent ~1% of SoftBank's total market capitalization.

Shopify (SHOP) participated in two of the same rounds as SoftBank, the Late VC and Series E rounds listed above.

In May 2023, Shopify sold its logistics unit to Flexport. Shopify received a roughly 13% equity interest in Flexport, which brought its total ownership to the "high-teens."

Additionally, the company also lent Flexport $260 million in the form of a convertible note in early 2024. This may give Shopify an option to buy more equity at a predetermined price, though the specifics of the deal are not publicly available.

Altogether, Shopify may have the rights to up to 20% of Flexport. Still, this stake represents a small fraction of Shopify's $105 billion market capitalization.

Flexport struggles and potential IPO

Flexport began a restructuring process to regain profitability and reshape its business in October 2023.

Since founder Ryan Peterson returned as CEO in September, he has reduced the workforce by 20%, made changes to the leadership team, and set the goal of reaching profitability by the end of 2024. Drastic times call for drastic measures.

The company's revenue has fallen dramatically in recent years. After growing from $650 million in 2019, to $1.3 billion in 2020, to $3 billion in 2021, and $5 billion in 2022, revenue fell by nearly 70% in the first half of 2023 to $700 million.

Even worse, in December 2023, Peterson said they were targeting just $330 million in net revenue in 2024 — a 90% reduction since 2022 — primarily due to an industry-wide collapse in freight markets.

Though Peterson remains committed to taking the company public, his goal for Flexport is to become a “profitable public company that throws off lots of cash that can be a darling of Wall Street."

Based on its current trajectory, this is likely several years away. I'd be surprised if the Flexport IPO happened before 2026.

When it does go public, you'll need a brokerage account to buy shares. If you're looking for a brokerage, we recommend Public, where you can open an account for free.

On the platform, you can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles, all from the same account.

Who owns Flexport?

Flexport was founded by Ryan Peterson, who has once again stepped in as CEO. He likely owns a sizable portion of the company.

Additionally, employees and members of the C-suite were also likely granted stock options as part of their compensation packages.

The company has also raised $2.7 billion from 97 external investors.

In addition to Shopify and SoftBank, other notable investors include Andreessen Horowitz, Founders Fund, Winklevoss Capital, and Kevin Kwok.

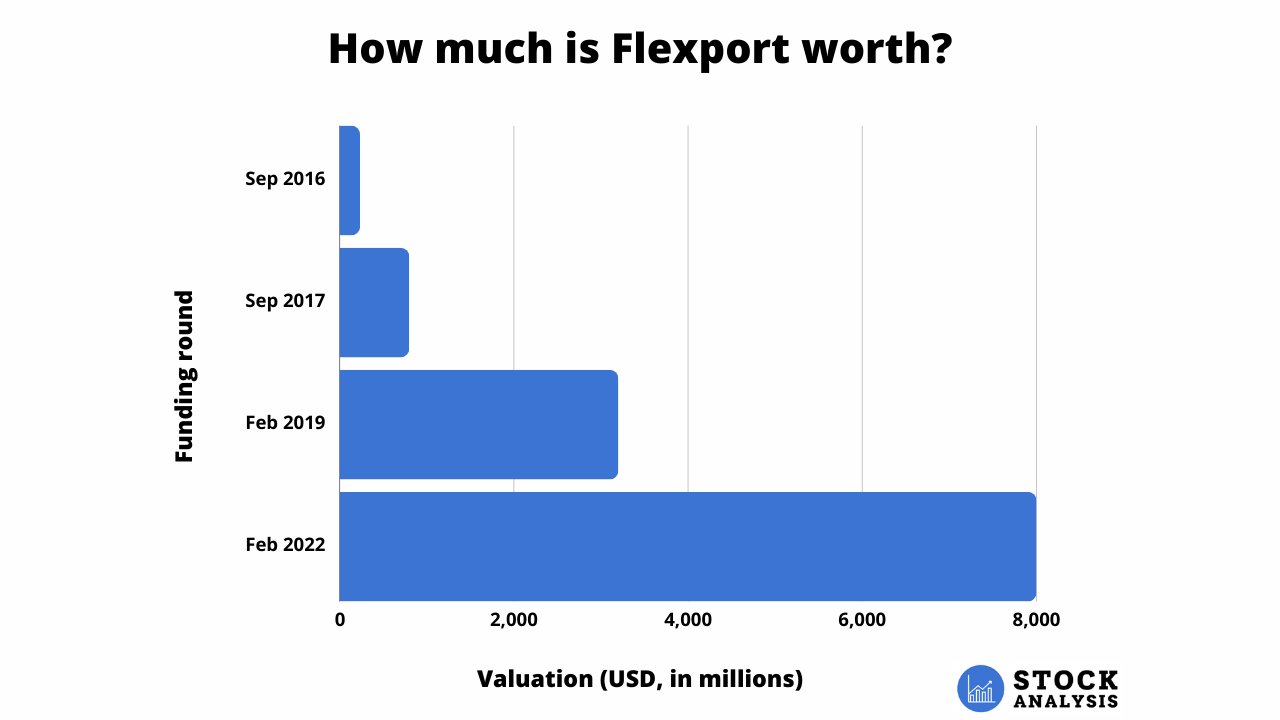

Flexport valuation chart

Flexport most recent valuation figure was the $8 billion it raised money at in its Series E in February 2022.

Here's a look at the valuation history:

Source: Crunchbase

However, as mentioned above, Flexport's annual revenue is down ~90% since 2022.

Because of this, it's estimated Flexport is currently worth between $1.4 billion to $1.6 billion.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)