How to Invest in Klarna Stock in 2025

Klarna is a Swedish company specializing in buy now, pay later (BNPL) consumer loans.

Here's an example of how it works: instead of making one payment of $280 for a new jacket, Klarna allows shoppers to break it down into four interest-free payments of $70 each, paid every two weeks.

From there, Klarna essentially works like a credit card company — customers who pay on time incur no additional costs, while those who miss payments are charged interest.

On March 14, 2025, Klarna filed for its IPO and will trade under the ticker symbol "KLAR" on the NYSE. The IPO date, number of shares offered, and expected price range are still unknown.

But you don't need to wait for Klarna stock to go public. There's a way to invest in it now.

How to invest in Klarna before its IPO

Klarna is still a private company, which means there is no Klarna stock symbol and no way to buy it in your regular brokerage account.

Interestingly, the SEC has regulations that allow certain types of investors, called accredited investors, to invest in riskier asset classes than retail investors. This includes private companies.

Accreditation requirements

You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional.

If you meet at least one of these criteria, the next section is for you.

If you don't qualify as an accredited investor, I cover a few ways to gain indirect exposure to Klarna or invest in the BNPL industry in the second section below.

1. How to invest in Klarna as an accredited investor

You can invest in shares of Klarna on Hiive. Hiive is a secondary marketplace for private, VC-backed companies and their shareholders.

Registering for Hiive will give you access to hundreds of private companies, including Klarna:

There are currently 10 live orders (asking prices and volume offered) of Klarna stock on Hiive.

On Hiive, you can buy shares directly from Klarna shareholders. This includes employees, venture capital funds, or angel investors. You can either accept the asking price as listed or place bids and negotiate with the sellers.

Get started on Hiive with the button below:

2. How to invest in Klarna as a retail investor

For retail investors, there are ways to get indirect exposure to Klarna itself, but you're probably better off investing in one of its competitors or waiting for its IPO.

I cover all three below.

a) Invest in Klarna's investors

You can get indirect exposure to Klarna by investing in its publicly traded partners:

- Visa: In June 2017, Visa (V) partnered with and invested in the company, though the size of the investment is not publicly known. Klarna was valued around $2 billion at the time of the investment.

- Macy's: In October 2020, Macy's (M) partnered with Klarna to offer its BNPL services in its department stores. The company also invested an undisclosed amount, likely at a valuation of ~$10 billion.

Although the size of each investment is unknown, I would speculate that both companies invested less than $100 million in Klarna. Given Visa is a $528 billion company, its stake represents a fraction of its total business.

Macy's, however, is a $4.3 billion company. A $50 million stake in Klarna would make up 1.2% of its market capitalization. But if you're considering investing in Macy's to get exposure to Klarna, make sure you like the other 98.8% of its business, too.

SoftBank (SFTBY) has also invested in Klarna. The Japanese company led a funding round that valued Klarna at over $45.6 billion. SoftBank may have invested $150 million, an investment that is now worth closer to $50 million, or 0.17% of SoftBank's market cap.

b) Invest in its publicly traded competitors

Klarna isn't the only company offering BNPL services.

Affirm Holdings (AFRM) is Klarna's most direct publicly traded competitor.

Unlike Klarna, Affirm does not charge late fees — customers can either pay in four interest-free installments or choose monthly payment plans that do charge interest.

Affirm processed $7.2 in transaction volume last quarter and is valued at $22 billion.

Block (SQ) and PayPal (PYPL) also have their own BNPL solutions, though these are just segments of their bigger businesses.

Altogether, Block generated $23.9 billion in revenue over the past 12 months and is valued at $56 billion, while PayPal's $31 billion in TTM sales are valued at $88 billion.

c) Wait for the Klarna IPO

If you're a retail investor who is set on investing in Klarna directly, you should wait for the company's IPO.

As mentioned above, Klarna is very close to having its IPO. However, the number of shares, pricing, and timeline have yet to be announced.

Klarna was previously seeking a valuation of about $20 billion when it was considering its public debut in early 2024. This would have been a step up from the $6.7 billion valuation it received in July 2022, but less than half its peak valuation of $45.6 billion it received in June 2021.

When Klarna does have its initial public offering, you'll need a brokerage account to buy its shares. If you're in the market, we recommend Public, where you can open an account for free.

On the platform, you can invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles, all from the same account.

Is Klarna profitable?

Klarna has 93 million active users who are currently making payments via its BNPL checkout service. The company generated $2.8 billion in revenue in 2024, an increase of 24%.

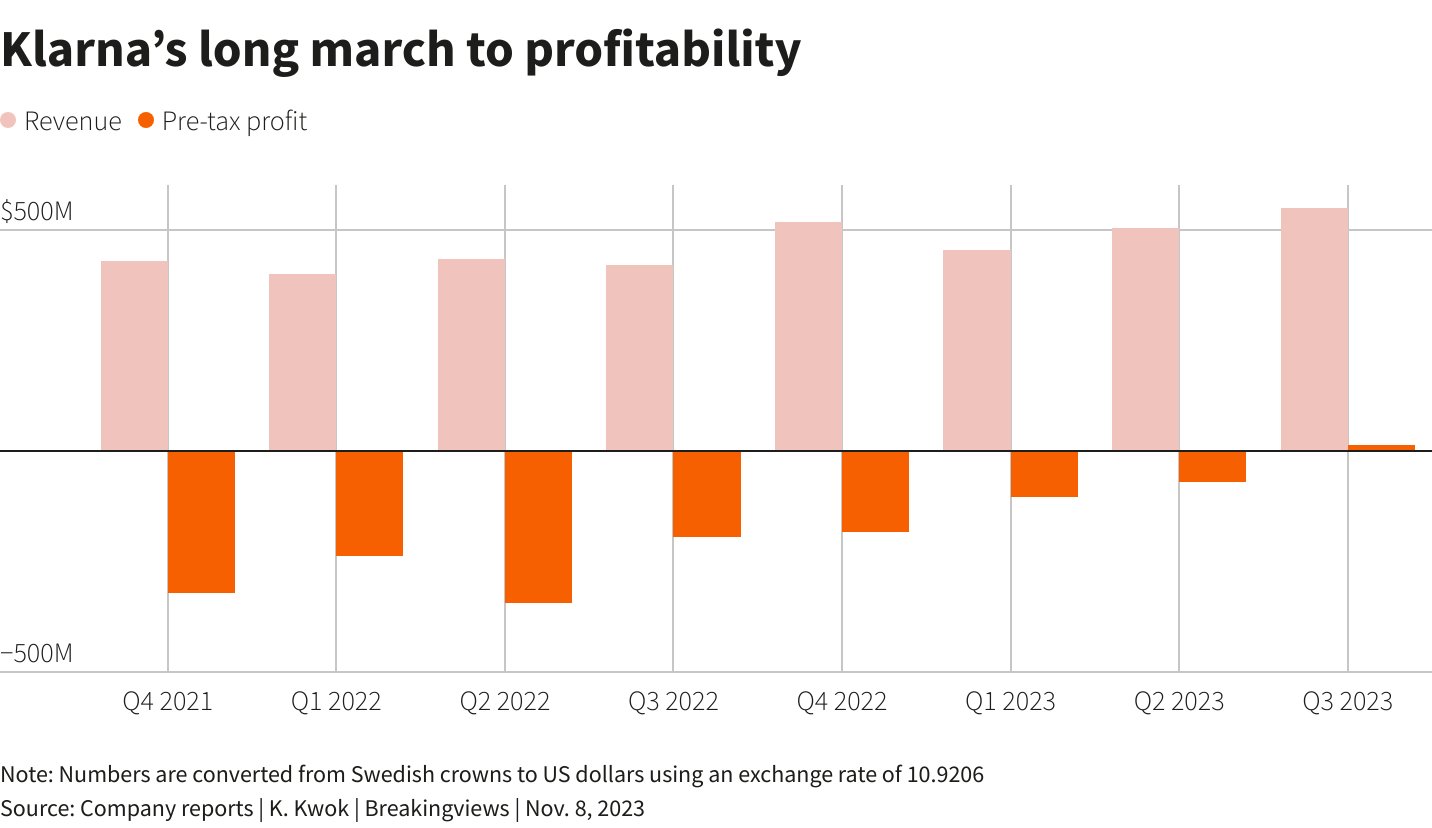

Regarding its profitability, CEO Sebastian Siemiatkowski said Klarna generated a pre-tax profit of $12 million on about $550 million in revenue in Q3 2023, a significant improvement from the company's $200 million loss in the same quarter a year prior.

Source: Reuters

Over the years, Klarna has significantly increased the requirements a user must pass to be approved for its BNPL loans. These changes have resulted in a much higher collection rate and fewer losses from loan write-offs.

In addition to charging customers interest and fees on late payments, Klarna charges merchants fees ranging from 3.29–5.99% per transaction. According to Apptunix, this is where the majority of the company's revenue comes from.

Who owns Klarna?

Klarna was co-founded by CEO Sebastian Siemiatkowski, Niklas Adalberth, and Victor Jacobsson in 2005. I suspect these three still own sizable portions of the company.

That said, the company has raised $4.2 billion over the last 19 years. To raise this amount of money, venture capital firms, hedge funds, other corporations, and angel investors likely now own the majority of the company.

Additionally, former and current employees own some portion of the company through stock options and other equity incentive programs.

Klarna valuation chart

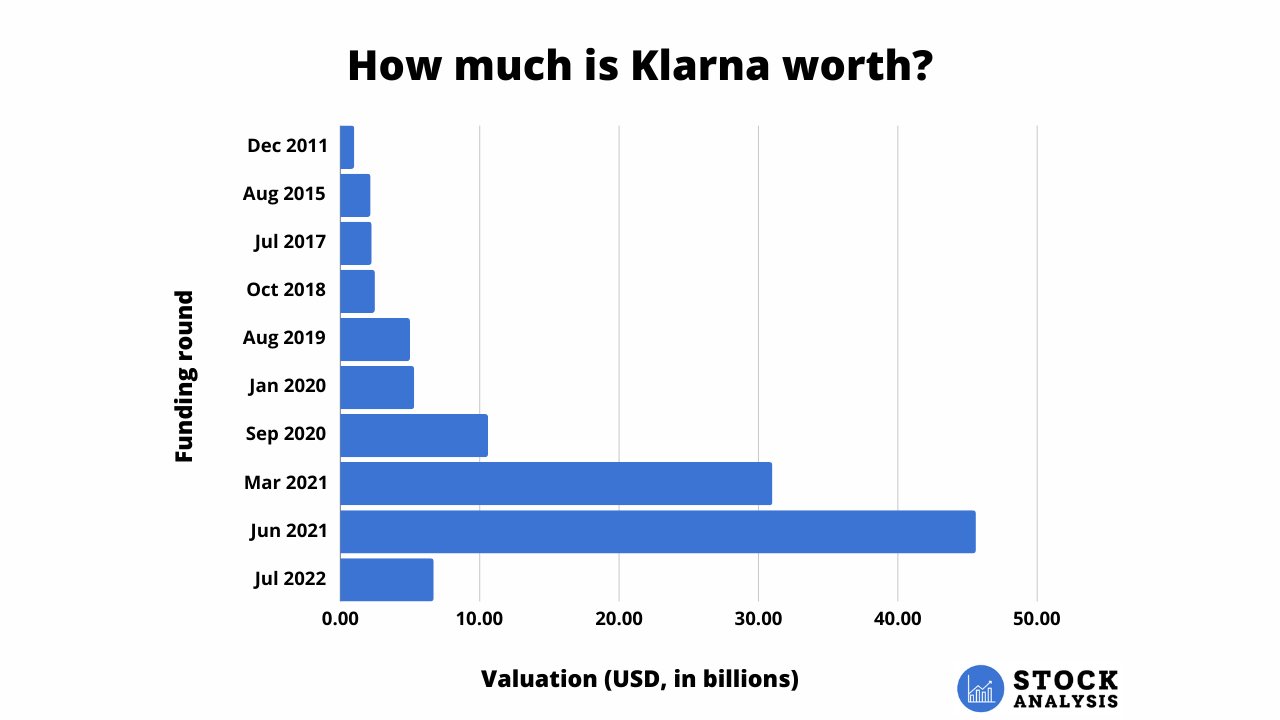

After peaking at a valuation of $45.6 billion in June 2021, Klarna's valuation was slashed to $6.7 billion 13 months later, a decrease of 85%.

Here's a look at its valuation history:

Source: Crunchbase

I expect Klarna will be seeking a valuation of ~$20 billion in its public offering.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited (“Hiive”) or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.