How to Invest in Plaid Stock in 2024

If you're under the age of 65, you've likely encountered Plaid's software.

According to the company's website, 1 in 3 U.S. adults have connected a financial account to an app with Plaid, which provides a number of products for banking and investment management customers.

Plaid's most popular tool is Plaid Link, which allows companies to seamlessly connect with their users' financial accounts. Link is powering apps like Venmo, SoFi, Rocket Money, Betterment, Chime, Acorns, and 8,000 others.

In other words, Plaid is integral to the onboarding process of the vast majority of emerging fintech companies.

While Plaid has yet to set specific IPO plans, there is a way for accredited investors to buy its stock right now.

Can you buy Plaid stock in your brokerage account?

No, you cannot buy Plaid stock in your brokerage account.

Plaid is still a private company, which means it does not have shares available for purchase on any stock exchange. Until its IPO, there is no Plaid stock symbol and no way for retail investors to invest in it directly.

That said, accredited investors can buy it before its IPO. Retail investors can also get exposure to Plaid, albeit much more indirectly.

How to invest in Plaid before its IPO

There are two ways to invest in Plaid, depending on which type of investor you are.

The SEC has set regulations that allow accredited investors to invest in riskier asset classes (including private companies) than retail investors.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly

- Have a net worth that exceeds $1,000,000, excluding your primary residence

If you meet one of these requirements, the first section is for you. If you don't qualify as an accredited investor, skip down to the section for retail investors below.

1. How to invest in Plaid as an accredited investor

Equitybee is an investment platform that gives U.S.-based accredited investors access to high-growth, VC-backed startups.

Private companies available for investment on Equitybee include Discord, Databricks, and Plaid:

By funding employee stock options, accredited investors can gain investment exposure to private companies at past valuations, meaning you can buy in at the same valuation as private equity firms paid at the last funding round.

In exchange for funding the options, you will receive a percentage of future proceeds from any successful liquidity events.

Equitybee is also offering accredited investors access to a data-driven, index-like venture fund.

The Equitybee Venture Portfolio Fund (VPF) provides access to a broadly diversified portfolio of 100+ late-stage, pre-IPO companies, invested at discounts to the last known common share price.

Hit the button below to register and view current offerings at Equitybee:

Disclaimer: Subject to availability. Investments involve risk; Equitybee Securities, member FINRA.

2. How to invest in Plaid as a retail investor

Unfortunately, to invest directly in Plaid at this time, you need to be an accredited investor.

However, here are a few ways retail investors can gain roundabout exposure to its upside.

Invest in Plaid's publicly traded investors

According to data from Crunchbase, Plaid has raised $734.3 million from 61 investors over 8 rounds.

Most of these investors are private equity firms, but several publicly traded companies have invested in Plaid:

- American Express (AXP) has invested twice, the first coming in the 2016 Series B round and the second coming in Plaid's most recent round, the Series D round in August 2021.

- Goldman Sachs (GS) participated in the Series B and Series C funding rounds, which raised $44 million in 2016 and $250 million in 2018.

- Mastercard (MA) and Visa (V) both invested during Plaid's Series C round in December 2018 and then re-invested in September 2019.

- J.P. Morgan (JPM) invested alongside American Express in the Series D round in August 2021.

While buying shares of any of these companies would give you exposure to Plaid, each of these companies' stakes are minor relative to the total size of their businesses.

For example, even if Goldman Sachs invested $150 million over the two rounds it participated in — and assuming the valuation rose from $2 billion to $20 billion — Goldman's investment would be worth $1.5 billion.

Despite being an excellent return, this stake makes up just 1.2% of its $125 billion market capitalization.

Invest in its industry

Most of Plaid's direct competitors are also private companies (like Stripe, MX Technologies, and Tink), but there are a few public companies in the fintech space you may be interested in.

- SoFi Technologies (SOFI): Sofi provides lending, investing, and banking services online and through its mobile app. It generated $2 billion in the last 12 months and has a market capitalization of $8 billion.

- Block (SQ): Block makes it easier for merchants to collect payments with its integrated system of technology solutions. It brought in $20.8 billion in sales over the last year and is worth $42.7 billion.

- PayPal Holdings (PYPL): PayPal offers several products that enable digital transactions between merchants, consumers, and friends. Over the last 12 months, PayPal has generated $29.1 billion in revenue and has a market capitalization of $65.8 billion.

- Affirm Holdings (AFRM): Affirm provides payment solutions via its pay-as-you-go lending terms. It generated $1.7 billion in the last year and is valued at $13.3 billion.

If none of these present themselves as compelling investment opportunities, you may decide to wait for the Plaid IPO. More on when this might be coming below.

What is Plaid?

Plaid's primary business is building application programming interfaces (APIs) for the financial industry.

Its technology makes it seamless for customers to interconnect their various financial institutions. Its customers offer banking, lending, and investing services.

For example, Seeking Alpha uses this feature to allow its users to connect their brokerage accounts to its portfolio tracker. This connection updates users' portfolios in real-time with all holdings and transactions.

Because of its speed, ease of use, and security, Plaid has quickly become a must-use platform in the fintech space.

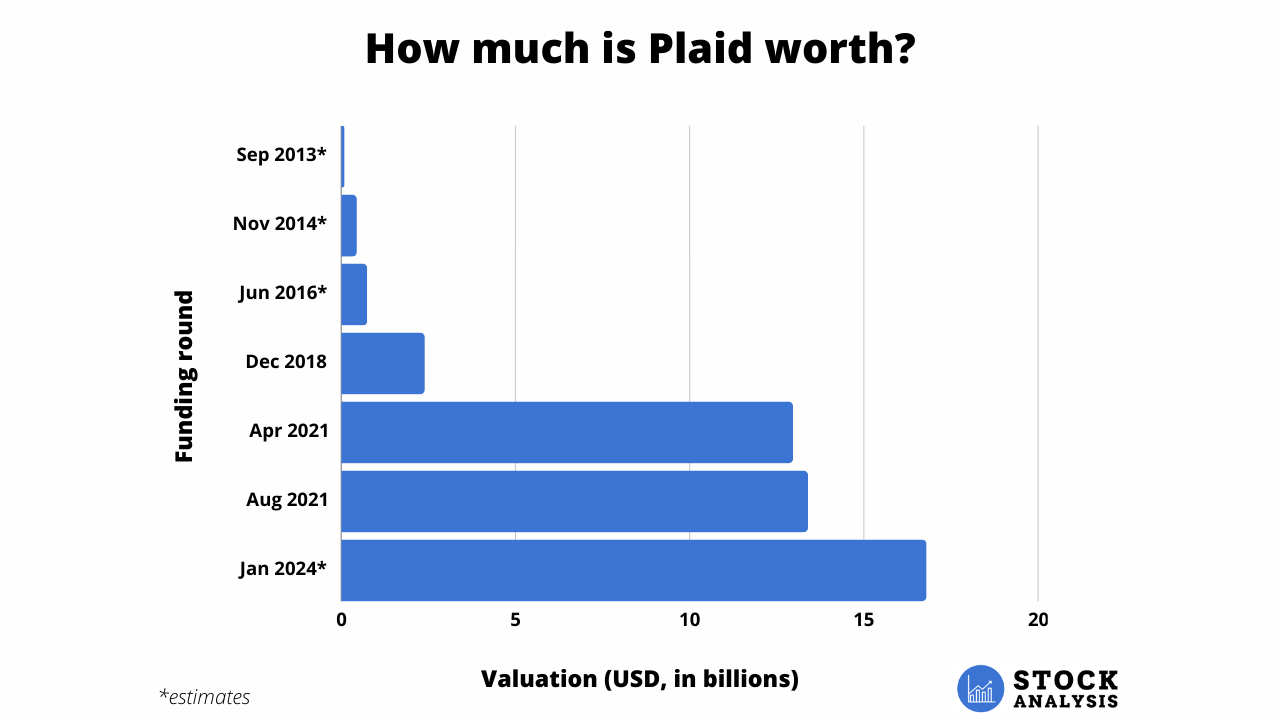

How much is Plaid worth?

Plaid generated $170 million in revenue in 2020, which is the most up-to-date information on the subject. It grew 60% from 2019 to 2020 and had 4,000 clients.

Assuming Plaid makes the same amount now from each client as it did in 2020 (a very conservative assumption), its 8,000 clients likely bring in at least $350 million per year in revenue.

Visa attempted to buy Plaid in early 2020 for $5.3 billion, but the deal fell through after failing to pass regulatory standards.

While the company finished 2020 with $170 million in revenue, revenue was likely closer to $110 million when Visa made its offer. Based on this figure, it was offering to pay about 48x revenue to acquire the company.

Using the same valuation and assuming $350 million in revenue, I would estimate Plaid is worth around $16.8 billion.

This is up slightly from its latest funding round in August 2021, when American Express and J.P. Morgan invested at a $13.4 billion valuation. This investment came near the peak of the fintech bubble.

When will Plaid IPO?

As mentioned above, Plaid had agreed to be acquired by Visa back in early 2020 before the deal was nixed by the Department of Justice.

Following the failed acquisition, Plaid went on to raise $425 million, made a few small acquisitions of its own, and has continued to grow its core business.

Additionally, the company laid off 20% of its staff in 2022, which should lengthen its runway before it needs to raise more money or IPO.

At this point, Plaid seems to be waiting for the IPO market to warm back up. In an interview with Axios in late 2022, Plaid CEO Zach Perret commented, “We don't have a specific IPO timeframe in mind. We're not in the market. We're not talking about it.”

When Plaid does have its initial public offering, you'll need a brokerage account to buy its shares. If you need a brokerage account, we recommend Public.

Invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and collectibles all from one account on Public.

Who owns Plaid?

Plaid was founded by Zack Perret (CEO) and William Hockey in 2013. These two likely still own much of the company, though the exact split is not publicly available.

Beyond the two co-founders, Plaid is owned by 61 external investors. Some of its most prominent investors are Andreessen Horowitz (a16z), Goldman Sachs, Altimeter Capital, J.P. Morgan, Visa, and Mastercard.

Additionally, some percentage of the company is owned by current and former employees who have received stock options as part of their compensation.

Plaid valuation chart

Here's a look at how Plaid's valuation has changed over time:

Source: Crunchbase

.png)