How to Invest in Mercor Stock in 2026

Mercor is a company that connects AI labs with domain experts who help train AI models.

Companies like OpenAI, Perplexity, Anthropic, Google, and Amazon pay Mercor to match them with scientists, lawyers, doctors, consultants, and other specialists who perform the highly specific data-labeling tasks that LLMs depend on.

What is data labeling?

Data labeling is the process of tagging or categorizing raw information — like text, images, audio, or video — so AI models can better understand it.

For example, a labeler might identify all of the cars in a photo or note whether a sentence sounds positive or negative. These examples teach AI models how to interpret context, nuance, and meaning, thereby improving their output.

AI models are only as good as the data they're trained on.

And as competition has intensified among model developers, the demand for high-quality labeled data has exploded — making Mercor's role in the ecosystem increasingly critical.

That growing dependence has translated into strong business momentum: Mercor is reportedly on pace to hit $500 million in annual recurring revenue (ARR) and raised $350 million at a $10 billion valuation in October 2025, up fivefold since February 2025.

And you may be able to invest in it.

Can you buy Mercor stock?

Mercor is a private company. There is no Mercor stock symbol and no way for retail investors to buy shares.

However, there are shares available on Hiive, a pre-IPO marketplace where accredited investors can buy shares of privately held companies.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

There are four live orders of Mercor stock available on Hiive right now:

Each listing on Hiive is created by a unique seller who sets their own asking price and quantity of shares available. Sellers are typically employees, venture capitalists, or angel investors.

After a seller creates a listing, buyers can place bids on the shares or accept the asking price as listed. Buyers can also add companies to their watchlist and get notified of any new listings or transactions.

Check out Mercor and the 3,000+ other startups listed on Hiive with the button below:

Can retail investors buy Mercor?

There is no way for retail investors to gain exposure to Mercor at this time.

Additionally, Mercor's primary competitors are also private companies (like Scale AI, Surge AI, and Labelbox), so there aren't any good ways for retail investors to get exposure to the data-labeling segment.

That said, there are many publicly traded companies working in the broader AI ecosystem — including the companies building the models, powering the infrastructure, and managing the data those models rely on.

Here are some key categories and examples:

- Model providers: Alphabet (GOOGL) and Meta (META).

- Hardware: NVIDIA (NVDA), Advanced Micro Devices (AMD), TSMC (TSM), Broadcom (AVGO), and Micron (MU).

- Network infrastructure: Arista Networks (ANET) and Broadcom (AVGO).

- Cloud and data platforms: Amazon (AMZN), Microsoft (MSFT), Alphabet (GOOGL), Snowflake (SNOW), Oracle (ORCL).

Additionally, Microsoft has a deep strategic partnership with OpenAI (read more), and both Alphabet and Amazon have taken large equity stakes in Anthropic to strengthen their positions in generative AI (details here).

You may also be interested in a few AI-related ETFs like AIQ and WISE.

For even more information about how to invest in the AI industry, check out our article 28 Ways to Invest in Artificial Intelligence.

Unfortunately, none of these are operating in the same part of the data-labeling market as Mercor. If you're only interested in investing in Mercor, you'll have to wait until its IPO.

When will Mercor go public?

Mercor's recent $350 million likely means its IPO won't be coming until 2027 at the earliest.

With fresh capital, strong revenue growth, and a capital-light business model, it can wait to go public until the timing — and valuation — are right.

CEO and cofounder Brendan Foody has described an IPO as “potentially on the horizon,” but didn't mention any specific details or timeline.

For now, the company appears focused on scaling operations and expanding partnerships with major AI labs before making the jump.

When it does go public, you'll need a brokerage account to buy stock. If you don't have one, we recommend Public.

Who founded Mercor?

Mercor was founded in January 2023 by Brendan Foody (CEO), Adarsh Hiremath (CTO), and Surya Midha (COO).

The company began as a hiring startup that used AI to assess and vet candidates based on their résumés, interviews, and portfolios.

In the process, Mercor amassed a network of specialized experts, which would later serve as the foundation of its new business model.

As AI labs began searching for domain experts to help refine and train their AI models, Mercor shifted its focus to connecting those labs with highly skilled professionals.

Mercor's business received a significant boost in early 2025 after Scale AI — the previous market leader in data labeling — sold a 49% stake to Meta.

The deal raised questions about Scale AI's neutrality and prompted both Google and OpenAI to cut ties and look for alternatives.

Mercor, which already had contracts with the top five AI labs, was perfectly positioned to capture the resulting demand. It still serves all five leading AI labs, along with six of the Magnificent 7 tech giants.

The company now manages more than 55,000 contractors who collectively earn $1.5 million each day. Its most popular categories are software engineering, finance, law, and medicine.

The company is headquartered in San Francisco, California.

Mercor's unique position

As mentioned above, data labeling plays a critical role in the training of LLMs, and providers like Mercor sit in a unique position.

Rather than competing to build the next frontier model, data-labeling companies supply the foundational inputs every model relies on — high-quality, human-verified training data.

That makes Mercor a classic “picks-and-shovels” play in the AI boom. As model training becomes even more important, demand for precise, domain-specific data labeling will only increase.

If Mercor maintains its lead in this niche, it stands to benefit no matter which AI lab ultimately dominates the space.

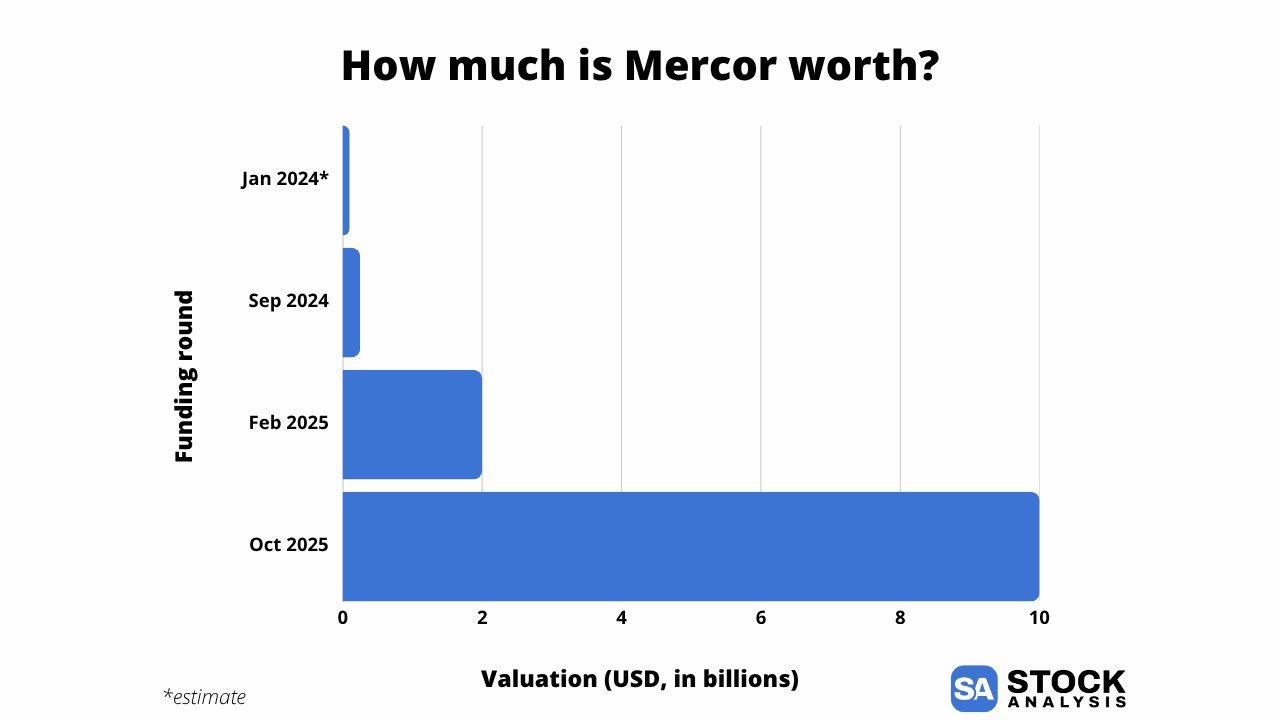

How much is Mercor worth?

Mercor most recently raised $350 million at a $10 billion valuation in October 2025, up 5x from the $2 billion it received just eight months earlier.

The company has raised a little over $485 million over four founding rounds. Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.