How to Buy Mercury Stock in 2026

Mercury is a financial technology company that provides banking services to startups and small businesses.

Instead of using different tools for invoicing, accounting, cash management, bill pay, and employee credit cards, companies can use Mercury's platform and manage their entire financial operations from a single dashboard.

Mercury has grown rapidly since being founded in 2017. The company grew its customer count by 40% in 2024 alone and posted $500 million in revenue for the year. It's also profitable.

The company raised $300 million at a $3.5 billion valuation in March 2025 — more than double the $1.62 billion valuation it received back in July 2021.

And, if you qualify, you can invest in it too.

Here's how to buy Mercury stock in 2026, before its IPO.

Can you buy Mercury stock?

Mercury is still a private company, which means there is no Mercury stock symbol and its shares aren't available on public stock exchanges.

However, its shares do trade on secondary marketplaces like Hiive.

Hiive is an investment platform where accredited investors can invest in more than 2,000 venture-backed companies like SpaceX, Anthropic, and xAI.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

As of the time of writing, there are 7 live orders of Mercury stock available. The shares have an average price of $123.68:

Each of these listings was created by an existing shareholder. Shareholders remain anonymous but are typically employees, venture capital firms, or angel investors.

After creating an account, as well as verifying their identity and share ownership, each seller creates their own listing by setting their asking price and the quantity of shares for sale.

Once a listing is posted, buyers can accept a seller's asking price as listed or place bids on the shares.

To stay updated on a company, buyers can also add companies to their watchlists and receive notifications of any new listings or completed transactions.

Once a buyer and seller agree on a price, Hiive's team facilitates the transaction — the buyer gets the shares, while the seller gets the cash.

To see all of the current listings and bids, as well as recent transactions for Mercury (and every other company on Hiive), create an account for free with the button below:

Can retail investors buy Mercury?

Unfortunately, since Mercury is still a private company and Hiive is only available to accredited investors, there's no way for retail investors to buy its stock.

And since Mercury has only received investments from venture capital firms and not from any publicly traded companies, there's also no way to get indirect exposure.

Retail investors will have to wait until Mercury's IPO to invest in it.

Though Mercury is the main company offering a full-stack financial operations platform, it's not the only company working on providing banking solutions to startups and small businesses.

You may also be interested in:

Block

Block (XYZ) is a fintech company that provides banking, payments, and financial services to small businesses.

Although Block is primarily focused on point-of-sale technology, its Square ecosystem includes business checking, invoicing, payroll, and lending — directly competing with Mercury's suite of startup-focused financial tools.

Intuit

Intuit (INTU) is the parent company of QuickBooks, a dominant payroll and accounting software platform used by millions of small businesses.

While QuickBooks isn't a direct competitor of Mercury's, it serves the same audience, and its recent addition of lending and cash flow tools may be the start of the product becoming a more complete financial hub.

Fintech ETFs

You could also invest in fintech ETFs like the Ark Fintech Innovation Fund (ARKF) and the Global X FinTech fund (FINX) to gain general exposure to the industry.

You can invest in stocks and ETFs from your regular brokerage account. If you don't have a brokerage account, we recommend Public.

What does Mercury do?

Mercury is an all-in-one banking platform built for startups and tech-forward small businesses.

Using only its platform, businesses can do all the following:

- Conduct banking

- Invest cash in Treasury accounts

- Invoice

- Manage expenses

- Issue employee credit cards,

- Send and receive payments via API

- Raise short-term funding

All in all, Mercury is a full financial operations stack.

However, it's not technically a bank.* Mercury partners with FDIC-insured institutions that actually hold the customer deposits. Mercury sits as the tech layer on top, making it easier to oversee and manage every aspect of a business's finances.

*Mercury is what's known as a neobank.

A neobank is a digital-only bank that offers financial services through a mobile app or website. These banks typically focus on low fees, fast service, and modern tech features. However, they may also face some regulatory hurdles.

Mercury benefited greatly from Silicon Valley Bank's implosion in 2023. The company gained more than $2 billion in customer deposits in the first five days after SVB's collapse.

To attract SVB customers, Mercury worked with its partners to up its FDIC insurance from $1 million to $5 million and released Vault, an account that invests customers' cash into a money market fund predominantly composed of U.S. Treasury Bills.

While it was already growing, SVB's collapse marked an inflection point for Mercury. Revenue jumped nearly 20% and the company's growth has since accelerated.

Who founded Mercury?

Mercury was founded in 2017 by Immad Akhund, Max Tagher, and Jason Zhang.

Before founding Mercury, Akhund founded three other companies and served as a part-time partner at Y-combinator.

The new company started simply, by offering an online bank account with some basic features. It slowly added more advanced features over time, including invoicing and employee credit cards with built-in expense tracking.

By the end of 2021, its customer base had grown to 45,000 businesses. Less than a year later, the figure stood at 80,000.

The company now has more than 200,000 customers and conducted more than $156 billion in payment volume in 2024.

Mercury is backed by Sequoia Capital, Andreessen Horowitz (a16z), Coatue, CRV, Spark Capital, Marathon, Sapphire Ventures, and more.

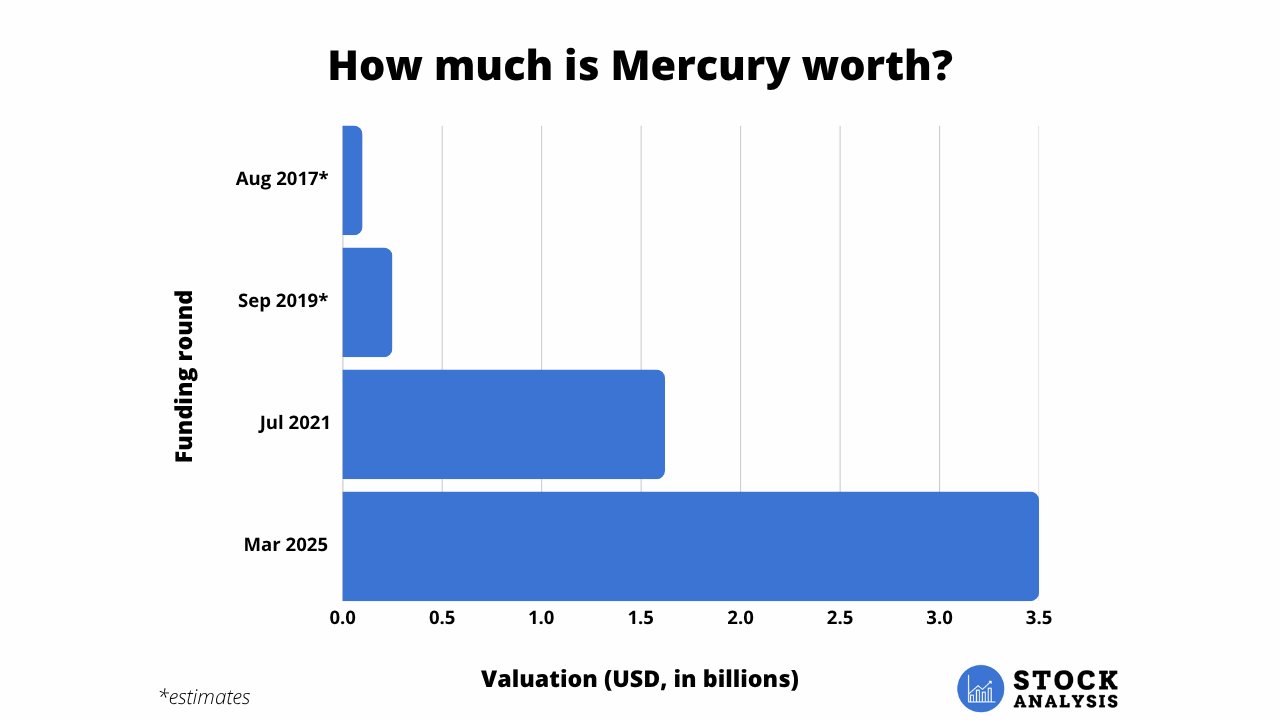

How much is Mercury worth?

Mercury has raised a total of $500 million in primary and secondary funding, $446 million of which came from four rounds:

- Seed funding: In August 2017, Mercury raised $6 million at an undisclosed valuation.

- Series A: In September 2019, Mercury raised $20 million at an undisclosed valuation.

- Series B: In July 2021, Mercury raised $120 million at a $1.62 billion valuation.

- Series C: In March 2025, Mercury raised $300 million at a $3.5 billion valuation.

Here's a look at how Mercury's valuation has changed over time (estimates mine):

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.