How to Buy Natron Energy Stock in 2026

Clean, sustainable energy solutions — like wind and solar — do have some downsides.

One of the primary drawbacks is that they don't produce power consistently throughout the day.

However, energy storage systems solve this issue.

With these systems, excess energy can be stored during periods of high production (i.e., when it's windy or sunny) and released during periods where production is low. This ability is critical for providing a steady and reliable energy supply.

While many energy storage system solutions currently use lithium-ion batteries, Natron Energy specializes in sodium-ion batteries.

Keep reading to learn why this is important and how you can invest in Natron Energy.

What does Natron Energy do?

Unlike lithium — which is rare, expensive, and difficult to mine — sodium is abundant.

However, sodium-ion batteries have lower energy density than lithium, making them less suitable for applications where space and weight are critical (like electric vehicles and portable electronics).

That's why Natron Energy primarily sells its products to data centers, energy grids, and other industrial applications where the size and weight of the batteries are less of a concern.

For these uses, sodium-ion batteries are cheaper, safer, more easily recycled, and have longer lifespans than lithium batteries.

Given the recent rise in energy demand and the continuing shift for grids to use more renewable energy, Natron Energy may be in a prime position to capture a large portion of this market.

And despite it being a private company, you may be able to buy its stock.

Here's how.

Can you buy Natron Energy stock?

As mentioned above, Natron Energy is a private company.

It is not publicly traded and it does not have a stock symbol that you can look up and buy in your traditional brokerage account.

Still, if you qualify as an accredited investor, you can buy shares of its stock on Hiive.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment marketplace where accredited investors can buy shares of pre-IPO companies.

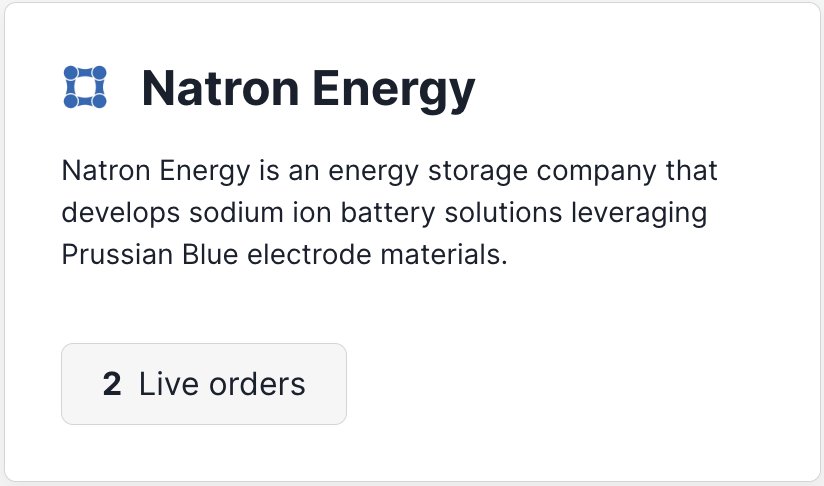

Thousands of the most popular VC-backed companies (like SpaceX, OpenAI, and Stripe) are available on the platform, including Natron Energy:

At the time of writing, there are two listings of Natron Energy stock available for purchase.

On Hiive, each listing is created by a unique seller who sets their asking price and quantity of shares available. Sellers may be current or former employees, venture capital firms, or angel investors.

After a listing is created, buyers can view the listing, accept the seller's asking price as listed, or place bids. Buyers can also add companies to their watchlist and get notified of any new listings or transactions.

To see the current listings of Natron Energy, including the current share price and implied valuation, create a free account on Hiive with the button below:

Can retail investors buy Natron Energy stock?

Because of SEC regulations, Hiive is only available to accredited investors. Since Natron Energy is still a private company, there's no way for retail investors to invest in it.

That said, some public companies have invested in Natron Energy. Technically, by investing in these companies, you could get (very) indirect exposure to Natron Energy.

- Chevron (CVX) invested an undisclosed amount in January 2019 to support the development of electric vehicle charging stations.

- United Airlines (UAL) invested an undisclosed amount in November 2022 with hopes of electrifying its airport ground equipment (like pushback tractors) and other gate operations.

- Liberty Energy (LBRT), which provides hydraulic fracturing services for oil and natural gas exploration, invested an undisclosed amount in September 2022.

- Nabors Industries (NBR) invested $7 million in July 2022. Nabors provides drilling and drilling-related services for land-based and offshore oil and natural gas wells in the U.S. and internationally.

Other public investors include ABB Ltd (STO: ABB), a Swiss electrical equipment provider, and Mercuria (TYO: 7347), a Japanese fund manager.

Natron Energy has made no indication of a potential IPO. Still, if you're a retail investor, you're likely better off waiting for its public offering to invest.

You may also be interested in battery-focused ETFs like:

- Global X Lithium & Battery Tech ETF (LIT)

- Amplify Lithium & Battery Technology ETF (BATT)

- iShares Global Clean Energy ETF (ICLN)

Each of these funds will give you broad exposure to the battery technology industry, though these ETFs are largely invested in companies focused on lithium.

Who founded Natron Energy?

Natron Energy was founded in 2012 by Colin Wessels (who serves as co-CEO), expanding on the work he had been doing for his PhD thesis at Stanford.

In 2020, the company achieved a UL 1973 listing for its sodium-ion battery, allowing it to begin commercial shipments to customers.

In 2024, the company began operations at its first mass-scale factory in Holland, Michigan.

Four months later, in August, it announced the construction of a $1.4 billion gigafactory in North Carolina. The new factory will allow it to 40x its production capacity.

How much is Natron Energy worth?

Natron Energy has raised $308 million over 12 funding rounds.

The company's most recent rounds were the $35 million it raised in its Series D in July 2020 and the $189.33 million it raised in its Series F in January 2021.

Natron Energy has taken a non-traditional approach to raising capital, opting to receive funding sporadically from companies that also want to form strategic partnerships (like those listed above).

For this reason, there is no publicly available valuation figure for Natron Energy. Some estimate the company is worth ~$1 billion.

However, it has also received capital from traditional sources like venture capital firms, including NanoDimension, Khosla Ventures, Prelude Ventures, Catalus Capital, Fluxus Ventures, and Volta.

Additionally, the company has received support from government agencies like the U.S. Department of Energy's Advanced Research Projects Agency–Energy (ARPA-E) in 2020 and the California Energy Commission in 2019.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.