How to Invest in Perplexity AI in 2026

If you haven't heard, Google has a challenger.

Perplexity is an AI-based search engine company aiming to offer accurate, reliable, and real-time answers to users' queries. And it's exploding in popularity.

Perplexity answered 780 million queries in May 2025 alone, well over the 500 million it answered in all of 2023 combined.

Revenue has been growing at a similar clip. In August 2025, Perplexity's annual recurring revenue (ARR) crossed $150 million, up 30x since January 2024.

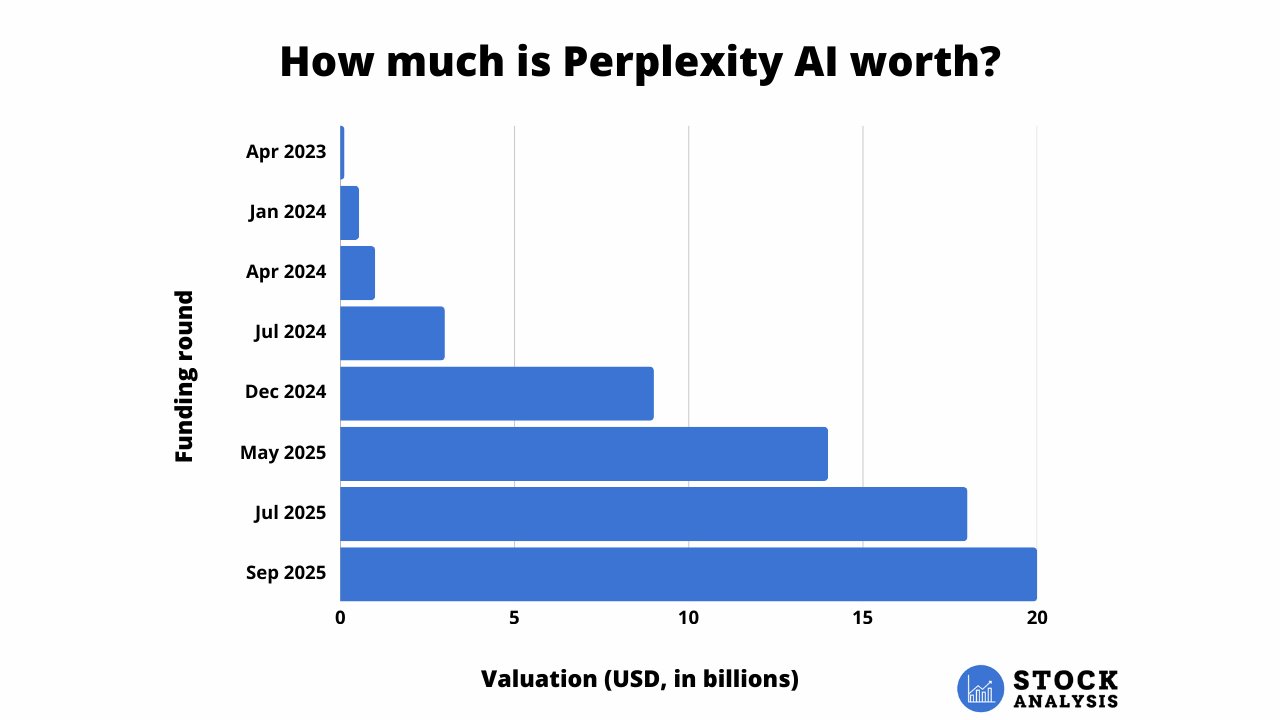

This growth has attracted investment from many notable investors, including Accel, Institutional Venture Partners, and Nvidia. In September 2025, Perplexity raised $200 million at a $20 billion valuation, its third round of the year.

Did you know there's a way for you to invest in Perplexity AI, too?

Can you buy Perplexity AI stock?

Perplexity AI is a private company, which means it doesn't trade on a public stock exchange, and there's no Perplexity AI stock symbol.

However, its stock does trade on Hiive, an investment platform where shareholders of private companies can sell their shares to accredited investors.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are more than 2,000 private companies with shares available on Hiive, including OpenAI, Figure AI, and SpaceX.

As of the time of this writing, there are 67 listings of Perplexity AI stock available:

Every listing on Hiive is created by a unique seller. Sellers are typically current or former employees, venture capitalists, or angel investors.

Each seller enters the number of shares they want to sell and sets their asking price. After a listing is created, buyers can either accept the asking price as listed or place bids and negotiate directly with sellers.

Buyers can also add companies to their watchlist and get notifications of any new listings or completed transactions.

To see the order book for Perplexity AI, including all bids, asks, and recent transactions, create an account on Hiive with the button below:

Can retail investors buy Perplexity AI stock?

In short, no. Since Perplexity AI is still a private company, retail investors cannot buy its shares. Non-accredited investors will have to wait for the company to IPO before they're able to invest.

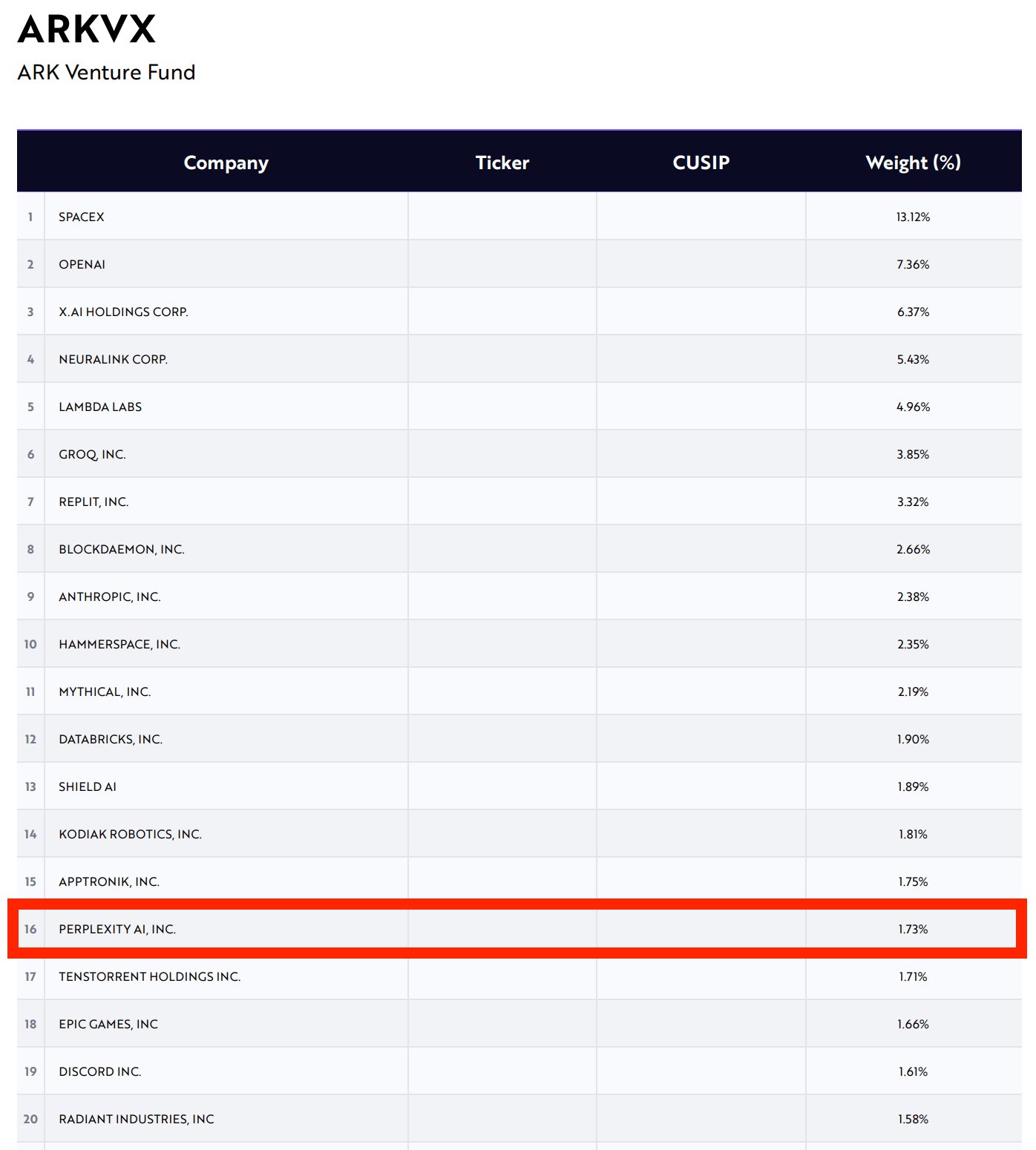

However, retail investors can gain exposure via the ARK Venture Fund.

ARK Venture Fund

The ARK Venture Fund is a venture capital fund that invests in both public and private technology companies.

The fund's top 10 holdings include SpaceX, OpenAI, xAI, and Anthropic. It also owns a stake in Perplexity, though it makes up just 1.73% of the fund's holdings (as of August 31, 2025):

Given the size of its stake, buying the ARK Venture Fund will give you very indirect exposure to Perplexity. However, if you're interested in private tech investing, the fund is a way to gain exposure to many of the world's hottest startups.

The fund is available to all investors and has a 2.90% annual management fee. You can learn more about the fund and how to invest in it on the ARK website.

For retail investors to gain direct exposure to Perplexity, however, they'll need to wait for its IPO.

When will Perplexity AI have its IPO?

In March 2025, when asked about his IPO plans, Perplexity CEO Aravind Srinivas said the company has all the funding it needs and has “no plans of IPOing before 2028.”

If Perplexity can continue to attract funding from the private markets (which I expect it will), there's no reason for it to become publicly traded in the immediate future.

By keeping a company private, founders are able to retain more control, keep their financials private, and not have to deal with the regulatory complexities of being a public company.

Plus, they might make a lot more money.

Other investment opportunities

Although you may not be able to invest in Perplexity, you can invest in other AI-powered search companies that are publicly traded, such as Google and Microsoft.

Buying either one of these stocks isn't the same as investing in Perplexity, but until its IPO, these are the best available options for retail investors.

Alphabet

Alphabet (GOOGL), the parent company of Google, still dominates search.

According to some estimates, Google currently processes 16.4 billion search queries per day, or nearly 200 billion per month, absolutely dwarfing (by about 256x) Perplexity's 780 million per month.

If you're bullish on the future of AI-powered search, it's hard to imagine a world where Google isn't a big beneficiary.

Microsoft

Microsoft (MSFT) runs its own AI-powered search engine — Bing — and has a close partnership with OpenAI.

OpenAI's SearchGPT is an AI-powered search engine similar to Perplexity's, though it's just one of OpenAI's products.

Microsoft's partnership also gives it access to OpenAI's technology, which it has been integrating into many of its core products.

Other options

Additionally, Nvidia (NVDA) and SoftBank (SFTBY) also own stakes in Perplexity, so buying either of these stocks would give you some exposure to Perplexity.

However, both of their investments are extremely small relative to their total market capitalizations of $4.3 trillion and $176.4 billion, respectively.

Who founded Perplexity AI?

Perplexity was founded in 2022 by:

- Aravind Srinivas: The company's CEO, who was formerly an AI research scientist at OpenAI and a research intern at both Google and DeepMind.

- Denis Yarats: The CTO, who was formerly an AI research scientist at Meta.

- Johnny Ho: Perplexity's Chief Strategy Officer, who was formerly an engineer at Quora as well as a quantitative trader.

- Andy Konwinski: The co-founder of Databricks.

This founding team has a singular mission statement for Perplexity: everyone in the world should have the information they need, as fast as possible.

Perplexity's business model

Perplexity operates on a freemium model, where users get its core features for free but can upgrade to a paid subscription for image uploads and other features.

In July 2025, Perplexity launched a $200 monthly subscription plan. The new plan, called Max, gives users unlimited access to all of the lab's products and priority access to new features and its latest models.

Alongside its new Max plan, Perplexity offers a consumer Pro plan for $20/month and an Enterprise Pro plan for $40/month.

Perplexity generated $34 million in revenue in 2024, largely driven by subscriptions to its $20/month Pro plan.

While the company hasn't disclosed the breakdown of its $150+ million ARR, I suspect over 85% comes from subscriptions.

How much is Perplexity worth?

In September 2025, Perplexity raised $200 million at a $20 billion valuation, up from the $18 billion valuation it had received just two months earlier.

Altogether, Perplexity has raised $1.615 billion.

Perplexity's investors include:

- Jeff Bezos (Amazon)

- Tobi Lutke (Shopify)

- Yann LeCun (Meta)

- Andrej Karpathy (OpenAI)

- Susan Wojcicki (Alphabet)

- Elad Gil

- Nat Friedman

- Naval Ravikant

A few of its institutional investors are:

- Accel

- Bessemer Venture Partners

- New Enterprise Associates

- Sequoia Capital

- Laude Capital

- AIX Ventures

- Nvidia (NVDA)

- Databricks

- SoftBank (SFTBY)

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.