How to Buy Polymarket Stock in 2026

Polymarket is a cryptocurrency-based prediction market where users can place bets on real-world events.

Participants buy and sell “shares” tied to the outcomes of political elections, sports games, economic data releases, and other trending topics.

While Polymarket had been gaining traction beforehand, it exploded in popularity during the 2024 U.S. elections, with more than $3.3 billion wagered on the presidential race between Donald Trump and Kamala Harris alone.

Trading activity has remained elevated ever since, with more than $3 billion in volume executed on Polymarket in October 2025 — a 55x jump from January 2024.

That kind of growth has caught investors' attention. The Intercontinental Exchange, the owner of the New York Stock Exchange, invested $2 billion at a pre-money valuation of $8 billion in October 2025.*

*Just weeks later, news broke that Polymarket was in early discussions to raise money at a valuation between $12 billion and $15 billion.

And while it remains a private company, there may be a way for you to invest in it too.

Can you buy Polymarket stock?

Polymarket is still a private company, which means there's no Polymarket stock symbol and no way for you to buy it in your typical brokerage account.

But there is a way for you to invest in it if you're an accredited investor.

Accreditation requirements

It's easy to see if you qualify as an accredited investor. You only need to meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Be a qualifying financial professional (have a Series 7, 65, or 82 license).

If any of these apply, you qualify. Just register with the platform below, and Hiive will verify your status.

Hiive is an investment platform where accredited investors can buy shares of pre-IPO companies.

There are over 3,000 companies listed on Hiive, including SpaceX, Kraken, and Polymarket:

Each of these 25 live orders was created by a unique seller who may be a current or former employee, an angel investor, or a VC firm.

After a current shareholder creates a listing, buyers on Hiive can place bids on the shares or accept the asking price as listed, similar to a typical stock exchange.

Once a buyer and seller agree on a price, Hiive's team facilitates the transaction.

See the full order book — all bids, asks, and recent transactions — for Polymarket and every other company on Hiive by creating an account today:

Forge is another major pre-IPO marketplace where accredited investors may find Polymarket shares, and pricing or availability may differ from Hiive. Serious private market investors often check both platforms before purchasing shares to make sure they're getting the best possible deal.

Can retail investors buy Polymarket stock?

Since Polymarket is still privately owned, there is no way for retail investors to invest in it directly.

However, the Intercontinental Exchange (ICE), the owner of the New York Stock Exchange, recently invested $2 billion in Polymarket for a 25% stake.

So, by investing in ICE stock, you could get indirect exposure to Polymarket.

That said, the Intercontinental Exchange has an $85 billion market capitalization, so its investment in Polymarket represents just ~2.4% of its total business.

Unless Polymarket becomes significantly larger, this stake is unlikely to have much of an impact on ICE's stock.

You may also be interested in investing in Robinhood (HOOD), which started offering event contracts through a partnership with Kalshi (Polymarket's largest competitor) in late 2024.

In Q3 2025, more than 2.3 billion event contracts were traded on Robinhood, and its prediction markets business passed $100 million in annualized revenue. Its trading volume jumped to 2.5 billion contracts in October alone.

Prediction markets like Polymarket and Kalshi are now competing with much larger sports-betting platforms like DraftKings (DKNG) and FanDuel (owned by Flutter Entertainment, FLUT).

Unsurprisingly, the sportsbooks are taking notice and making moves of their own.

In August, FanDuel partnered with CME Group (CME) to develop a regulated exchange for prediction markets, signaling plans to expand beyond sports.

While all of these will give you some exposure to the prediction markets space in general, none of them is the same as investing in Polymarket. If you're only interested in investing in it, you'll have to wait for its IPO.

When will Polymarket go public?

Polymarket founder and CEO Shayne Coplan hasn't indicated any plans for an IPO.

Beyond the typical startup challenges of revenue growth and profitability, the company's biggest obstacle has been — and continues to be — regulation.

In 2022, Polymarket agreed to ban U.S. users and paid a $1.4 million penalty to settle charges from the Commodity Futures Trading Commission (CFTC) for operating an unregistered trading platform.

Two years later, in 2024, FBI agents raided Coplan's apartment amid allegations that the site was still accessible to Americans.

Since then, however, Polymarket has made significant regulatory progress.

In July 2025, investigations by both the CFTC and the Justice Department were dropped. Less than a week later, the company acquired QCEX, a licensed exchange and clearinghouse, in a move expected to pave the way for a U.S. relaunch.

That breakthrough came in September 2025, when Polymarket received CFTC approval to operate legally in the U.S.

That milestone triggered a surge in investor confidence, pushing the company's valuation from around $1.2 billion to $8 billion initially, and now up to $15 billion.

Still, prediction markets remain a legal grey area.

While the CFTC treats event contracts as financial derivatives, many others argue they're simply thinly veiled gambling.

The only real distinction is regulatory: one falls under federal oversight as a financial product, while the other is governed by state gambling laws.

Given the lingering regulatory uncertainty around prediction markets, an IPO within the next year or two seems unlikely.

Who founded Polymarket?

Shayne Coplan founded Polymarket in his New York apartment in June 2020.

Coplan, an NYU dropout with a background in computer science and crypto, became interested in prediction markets after reading a whitepaper by economist Robin Hanson.

Hanson originally proposed the concept as a way to harness collective intelligence for decision-making.

During the Covid-19 lockdown, Coplan turned his bathroom into a makeshift office and began coding what would become Polymarket, a decentralized platform where people could bet on real-world events using cryptocurrency.

It gained initial traction inside the crypto community because of its clean interface, transparent markets, and real-time odds.

Five years later, at just 27, he became the youngest self-made billionaire after Intercontinental Exchange (ICE) invested $2 billion in his company. The deal gave Polymarket a pre-money valuation of $8 billion.

How does Polymarket work?

On the platform, users can buy and sell "shares" predicting what will happen in elections, data releases, sports games, and more.

Each market functions like a binary stock, with “Yes” and “No” shares that rise or fall in price based on the perceived probability of the event happening.

Shares typically pay $1 if the user is correct and $0 if the user is incorrect, and the prices fluctuate based on collective trading.

How does Polymarket make money?

Unlike its competitors, Polymarket does not charge trading fees, which allows it to maximize user growth and liquidity.

Instead, its primary source of revenue is data monetization — selling anonymized data on user predictions and trading activity to financial institutions and media outlets, providing insights into public sentiment and event probabilities.

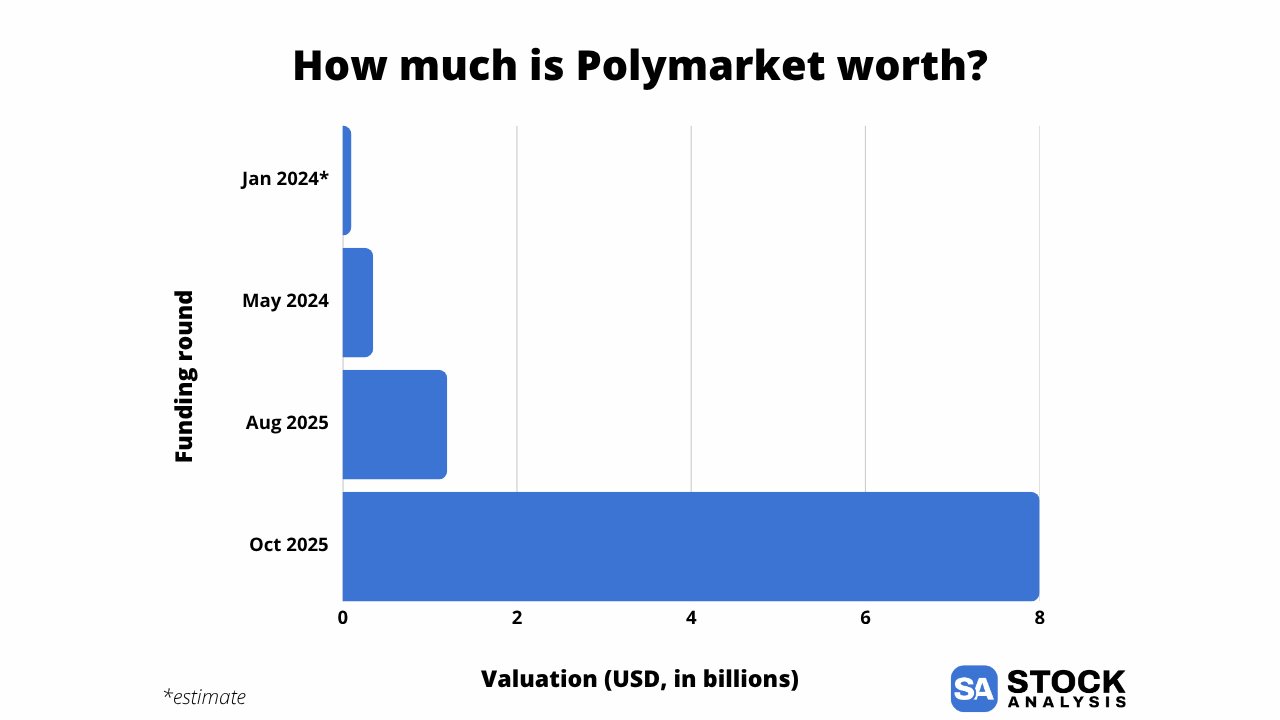

Polymarket valuation chart

In late October 2025, Polymarket announced it was in early discussions with investors to raise money at a valuation between $12 billion and $15 billion.

This news came just weeks after the company raised money at a pre-money valuation of $8 billion, which itself was up almost 8x from the $1.2 billion valuation it received just two months earlier.

To date, Polymarket has raised roughly $2.3 billion. Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.