How to Buy Rubrik Stock in 2024

Rubrik is a data security company with a unique approach.

While working as a cybersecurity engineer, founder and CEO Bipul Sinha noticed a gap in the market: companies were hyper-focused on preventing cyberattacks, but were completely exposed once those walls came down.

Instead of focusing only on preventing cyberattacks — which Sinha says is like trying to prevent the unpreventable — Rubrik focuses on cyber resilience.

Rubrik designs and implements data resilience plans, adding extra layers of protection to prevent breaches and providing solutions in the case of a successful attack.

The company caters to enterprise clients and sells high-margin, recurring revenue products and services.

Moreover, the company invented the cyber resilience category and is poised to be a major disruptor to the $222 billion cybersecurity industry.

Rubrik recently went public. Here's how you can buy stock today.

How to buy Rubrik stock

Rubrik is a public company, trading on the NYSE under the ticker symbol RBRK.

To buy Rubrik stock, you need a brokerage account.

Here is our list of the 7 Best Brokerage Accounts in 2024, with options for short-term traders and long-term investors, as well as new investors and experienced pros alike.

Our top spot on the list goes to Public, where you can invest in stocks, ETFs, Treasuries, cryptocurrencies, and more, all on a sleek, easy-to-use interface:

Other ways to invest in cybersecurity

In addition to Rubrik, there are also a handful of publicly traded cybersecurity companies you may be interested in:

-

CrowdStrike Holdings (CRWD) is a cloud-based cybersecurity company that focuses on advanced threats. Its $2.9 billion in TTM sales give it a market capitalization of $71 billion, a 24.5x P/S.

-

Palo Alto Networks (PANW) provides firewall appliances and software, as well as a dashboard for global control of the network's security. It generated $7.2 billion in revenue in the last 12 months and is valued at $107 billion.

-

Fortinet (FTNT) sells hardware and software licenses that include firewalls, intrusion prevention, anti-malware, VPNs, and more. It generated $5.2 billion in TTM revenue and is valued at $51 billion.

You may also consider investing in ETFs like CIBR or BUG, which hold a diversified group of cybersecurity companies.

Rubrik's IPO: April 25, 2024

On April 1, 2024, Rubrik filed to go public on the New York Stock Exchange under the ticker symbol RBRK. You can read the full S-1 filing here.

On April 25, 2024, Rubrik made its debut.

Rubrik stock opened at $38 per share. The company had initially set its share price at $32 each on the day before its IPO, slightly above its target range of $29 to $31, after raising $752 million.

This valued Rubrik at $6.6 billion on a fully diluted basis, marking an 88% increase from its previous primary valuation of $3.5 billion in 2019.

By the end of the opening day's trading session, the stock had settled at $37 per share.

Who owns Rubrik?

Rubrik was founded by CEO Bipul Sinha, a former cybersecurity engineer turned venture capitalist, in 2014, alongside Arvind Jain, Soham Mazumdar, and Arvind Nithrakashyap.

Prior to its IPO, Rubrik raised $553 million over seven rounds, primarily from VC firms.

Some notable investors include MicroVentures, Greylock Partners, Lightspeed Venture Partners, Microsoft, and NBA star Kevin Durant.

Here are their known stakes in the company:

- Lightspeed and affiliates: 23.9%

- Greylock: 12.2%

- Bipul Sinha: 7.6%

- Arvind Jain: 7%

- Arvind Nithrakashyap: 6.7%

Other large VC firms have also been involved in funding rounds, including Khosla Ventures and Bain Capital Ventures.

Their exact stakes are unknown, but are likely to be under 5%, as they were not listed in the company's S-1 filing prior to its IPO.

Rubrik's revenue growth

In its IPO filing, Rubrik reported that revenue for the fiscal year ending in January increased by approximately 5%, reaching $627.9 million.

However, the company experienced a wider net loss, totaling $354.2 million compared to $277.7 million the previous year. Over three-quarters of Rubrik's revenue was allocated to sales and marketing.

Prior to this, in January 2023, the company disclosed it had crossed $500 million in annual recurring revenue (ARR). By July, this number had increased to $600 million.

These figures are up significantly from a few years ago. In August 2022, the company announced it had crossed $400 million in ARR, which was up 100% YoY.

Notably, in the last few years, the company has shifted its business model away from expensive one-off consultations to less-expensive recurring subscriptions.

Rubrik's S-1 filing revealed the company had more than 1,700 paying customers with an overall annual contract value of $100,000, as well as almost 100 clients who paid more than $1 million per year.

From fiscal 2023 to fiscal 2024, the company's revenue increased from $599.8 million to $627.9 million, or nearly 5%, though subscription revenue grew by 40%.

Rubrik reported that subscription revenue comprised 91% of its total revenue by January 2024, up from 73% the previous year.

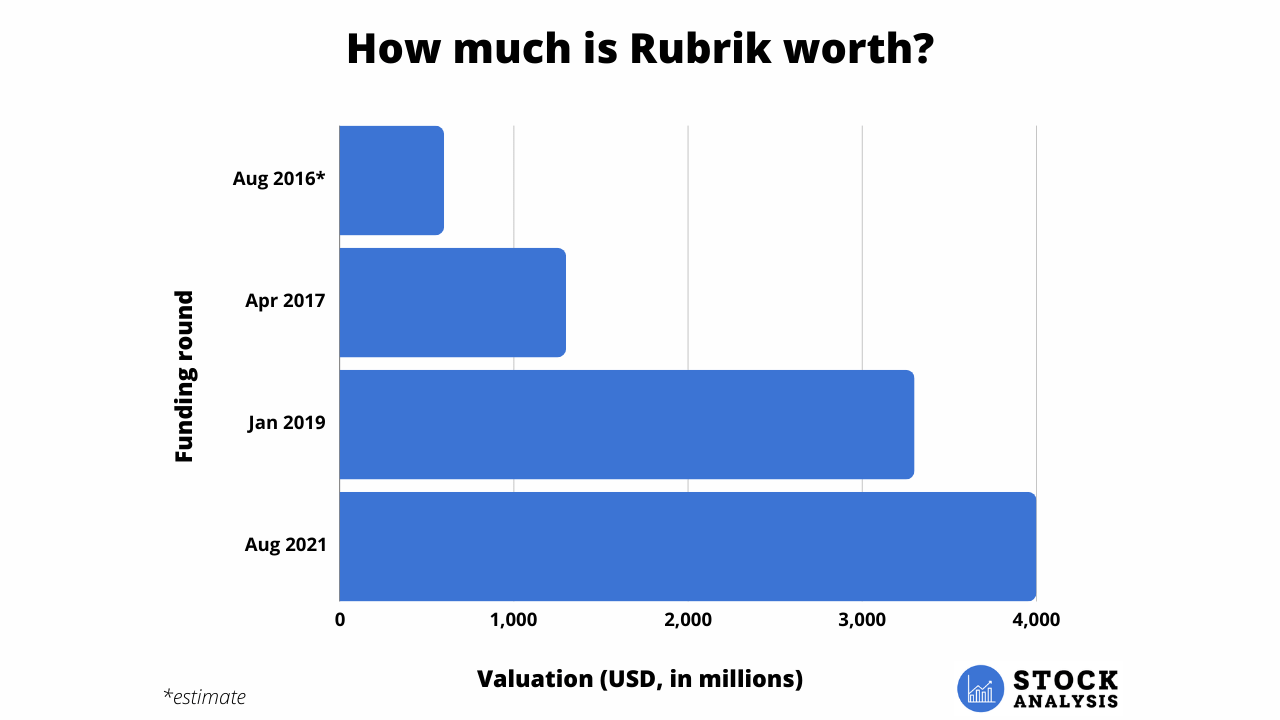

Rubrik's valuation history

Below is Rubrik's valuation history prior to its IPO.

Source: Crunchbase

As of April 26, 2024, it has a market cap of $6.51 billion. You can check here to get current market cap data.