How to Invest in Stripe Stock in 2026

Stripe processed $1.4 trillion in payments in 2024, up 38% from 2023.

For the sake of comparison, PayPal, a $66-billion company, processed $1.7 trillion worth of payments in 2024.

Maybe more important is what's causing this growth.

Stripe is now used by more than half of the Fortune 100, a major shift from its early days of only serving other startups.

At the same time, it remains the default choice for next-generation companies. More than 700 AI startups launched on Stripe last year.

Unsurprisingly, this steady growth has translated into a swelling valuation.

In February 2025, the company was valued at $91.5 billion in a secondary transaction, up from $70 billion less than a year earlier.

Given these figures and its list of backers, it's easy to see why you're interested in investing in Stripe.

Here's how you can, even before it goes public.

Can you buy Stripe stock in your brokerage account?

Stripe is a private company, which means there is no Stripe stock symbol and you can't buy it in your brokerage account.

Although the company was weighing an IPO in 2023, those plans have been set aside for the time being.

Stripe generated $100 million in EBITDA in 2023. Given this level of profitability, the company is in no rush to go public. More on that below.

Still, there's a way to buy Stripe stock right now — if you qualify.

How to invest in Stripe

Are you an accredited or retail investor?

You qualify as an accredited investor if you meet one of the following criteria:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000 (excluding your primary residence)

If you're an accredited investor, the next chapter is for you. If you don't qualify as an accredited investor, skip to the following chapter, which is for retail investors.

1. How to buy Stripe stock as an accredited investor

Hiive is an investment marketplace that gives accredited investors access to high-growth, VC-backed startups and private companies like Stripe:

Right now, there are 46 live orders of Stripe stock on Hiive.

Each listing on Hiive is created by a seller (usually an employee, VC firm, or angel investor) who lists the number of shares they have for sale and their asking price.

From there, accredited buyers can accept an asking price as listed or place bids and negotiate directly with the sellers.

You can see all of the live orders and recent transactions for Stripe by creating an account with the button below:

2. How to buy Stripe stock as a retail investor

If you are not an accredited investor, there are still a few other ways to get indirect exposure to Stripe.

Invest in its publicly traded investors

While the vast majority of Stripe's backers are private equity and venture capital firms, there are a few publicly traded companies that have invested in Stripe.

Both Visa (V) and American Express (AXP) participated in Stripe's Series C, which raised around $100 million at a $5 billion valuation in July 2015.

Assuming $20 million investments, each of their stakes would now be worth $366 million at Stripe's latest $91.5 billion valuation.

While the ROI is excellent (~1,730%), these investments represent just .05% and 0.17% of Visa's and American Express's total businesses.

As you can see, these stakes are inconsequential given the market capitalizations of these businesses, so investing in either of these companies is a very diluted means of gaining exposure to Stripe.

Invest in Stripe's competitors

While you may not be able to buy Stripe stock, you can still invest in the rapidly growing payment processing industry by buying one of its competitors' stocks.

-

PayPal (PYPL): PayPal, which owns PayPal, Venmo, Braintree, and other payment solutions, processed $1.7 trillion in payment volume and generated $31.8 billion in revenue, $6.2 billion in EBITDA, and $6.8 billion in free cash flow in 2024. The company has a $66 billion market capitalization, though this is 82% lower than at its peak in 2021.

-

Block (XYZ): Block, the $46-billion company behind payment processor Square and the Cash app, generated $24 billion in revenue and $1.3 billion in EBITDA on $241 billion in total payment volume in 2024.

-

Adyen (ADYEY): Adyen is a Dutch company that operates a payments platform in Europe, the Middle East, Africa, North America, the Asia Pacific, and Latin America. It generated $2 billion in revenue, $955 million in EBITDA, and $1.6 billion in free cash flow in 2024. The company is currently valued at $52 billion.

It's worth noting that the level of competition and size of the opportunity have made payment processing and other "fintech" stocks incredibly volatile over the last few years.

If none of these options are appealing to you, your best bet is to wait for Stripe's IPO.

When will Stripe IPO?

In 2023, Stripe set a 12-month deadline for itself to go public or pursue a private market transaction.

While it opted for the latter, raising $6.5 billion to provide liquidity for existing shareholders, it was clearly considering an IPO at that time.

Since then, however, the company has shown little sign of moving toward an IPO.

In February 2025, co-founders Patrick and John Collison said they believe Stripe is better off staying private for now.

They pointed to its profitability, ability to raise capital easily in private markets, and that many financial services firms have waited decades to go public or remained private indefinitely (Fidelity, for example).

In another interview around the same time, when asked about the Stripe IPO, John Collison said, “We are not dogmatic on the public vs. private question,” and that they “have no near-term IPO plans.”

When Stripe does go public, you'll be able to look up its stock symbol and buy it in your brokerage account. If you don't have a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies, all on one of the most modern investing platforms.

Who owns Stripe?

Stripe has 120 investors.

These include angel investors like Elon Musk, Peter Thiel, and Aaron Levie, as well as institutional investors like Sequoia Capital, Andreessen Horowitz (a16z), Tiger Global Management, General Catalyst, Silver Lake, Visa, American Express, and others.

In addition to these investors, co-founders and brothers Patrick (CEO) and John (president) Collison likely own billion-dollar stakes, though the exact equity breakdown is not public information.

Additionally, C-suite executives and employees — both current and former — likely own some percentage of the company.

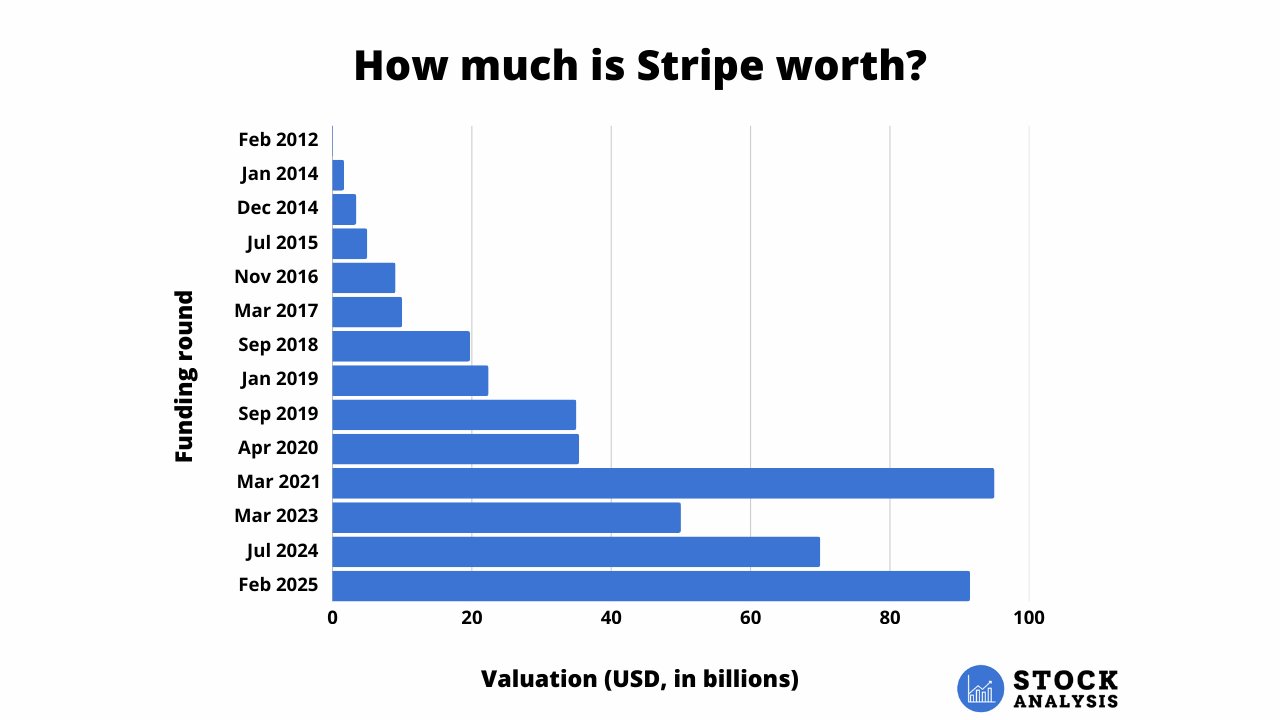

Stripe valuation chart

After peaking at $95 billion in March 2021, Stripe's valuation took a step backward.

In March 2023, Stripe raised $6.5 billion at a valuation of $50 billion in its Series I, down 47% from its valuation just two years earlier.

However, its valuation picked back up in July 2024 when Sequoia Capital, one of Stripe's biggest backers, made an offer to purchase up to $861 million worth of shares at a $70 billion valuation.

Then, in February 2025, the company finalized a secondary transaction that valued it at $91.5 billion, just shy of its peak.

Here's a look at how Stripe's valuation has changed over time:

Source: Crunchbase

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)