Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA)

Earnings Before Interest, Taxes, Depreciation, and Amortization — or EBITDA, for short — is a measure of a company's earnings without the impact of these four expenses.

It's one of several ways to look at a company's profitability, and indicates how well the business is generating cash from its operating activities.

Here is a detailed look at EBITDA, including how to calculate EBITDA, why it matters, how to use it, related terms, and limitations of this metric.

What is EBITDA?

EBITDA measures earnings without the impact of interest, taxes, debt costs, and the non-cash items depreciation and amortization.

In a nutshell, depreciation and amortization are ways to calculate the value of business assets, though the type of asset they account for differs.

- Depreciation: Depreciation represents a tangible, or physical, asset's loss in value over time. Examples of tangible assets include equipment or furnishings.

- Amortization: Amortization is about gradually distributing an intangible, or non-physical, asset's cost over time. Examples of intangible assets are patents or copyrights.

Analyzing earnings before removing these items helps provide a clear indication of the company's ability to generate cash from its operating activities.

This calculation also provides an apples-to-apples comparison of the income-generating capabilities of two different businesses within the same industry.

SummaryEBITDA is a measure of a company's earnings before interest, taxes, depreciation, and amortization expenses are deducted. It's a useful indication of core business profitability, and helpful when comparing two businesses within the same industry.

Why is EBITDA important?

EBITDA is a way to measure a company's core profitability. Along with other earnings measurements, it can provide key information about a company's operations.

Consider, for example, a mining company that requires the heavy use of property, plant, and equipment (PP&E). This company is likely to have high depreciation costs because the operation requires so much machinery.

In this case, the EBITDA calculation can more relevantly indicate the company's underlying earning power. In fact, many industries rely on large quantities of PP&E, including oil and gas, paper and packaging, and commercial real estate.

EBITDA also adds amortization costs back in, which expenses intangible assets like patents, service contracts, software, licensing agreements, and copyrights.

A company may have particularly high amortization expenses if their core business is intellectual property. In such cases, EBITDA prevents these expenses from obscuring overall profitability.

Finally, EBITDA adds tax and interest expenses back in. This can be useful because these numbers indicate how the operation is financed, but are not directly relevant to the company's ability to generate revenue through sales of their products or services.

Measuring earnings before interest and taxes can also be useful when comparing the operating efficiencies of companies within different tax jurisdictions.

SummaryEBITDA is an important measure of earnings because it accounts for costs that might distort the true picture of a company's ability to generate profits from its core operations.

How is EBITDA calculated?

EBITDA can be calculated in two ways. With either method, you'll need the company's income statement and cash flow statement.

Importantly, know that these two EBITDA calculations can differ. This is because net income sometimes includes numbers not included in operating income. For example, a one-time expense or non-operating income like gains on investment are not part of operating income.

Below are the formulas for both methods.

EBITDA formula: the net income method

The first method, the net income calculation, uses the following formula:

EBITDA = net income + taxes + interest expense + depreciation and amortization

Here, taxes and interest are added to net income to determine the operating income, or the profit gained from core business operations. Net income, taxes, and interest expenses are located on the income statement.

Next, depreciation and amortization are added. These are usually found on the cash flow statement.

EBITDA formula: the operating income method

The second method, the operating income calculation, uses the following formula.

EBITDA = operating income + depreciation and amortization

This calculation is more concise because operating income is calculated before taxes and interest are removed. Operating income is the company's profit after subtracting expenses associated with normal operating activities.

Next, depreciation and amortization are added back in from the statement of cash flow.

SummaryEBITDA can be calculated using either the net income method or the operating income method. In some cases, the formulas can generate two different EBITDA figures for the same company, as net income and operating income are calculated differently.

An example of an EBITDA calculation

Below is a sample calculation of the EBITDA for Target, using both formula methods. The financials you see here can be found on the company's 10-K filing with the SEC.

The net income method

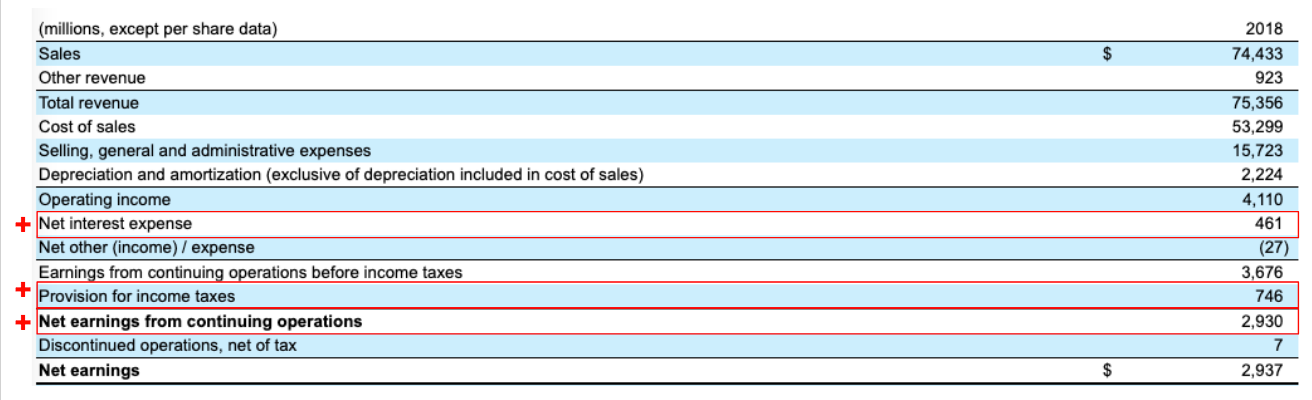

Target's income statement:

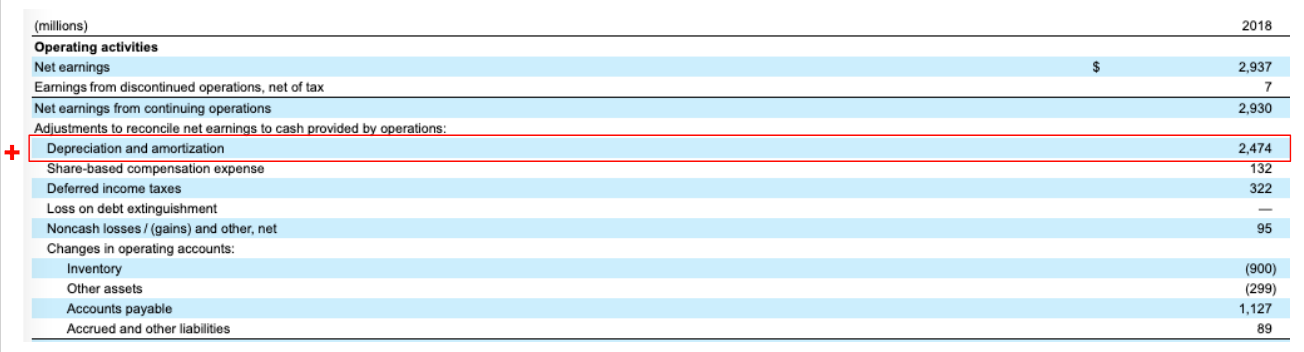

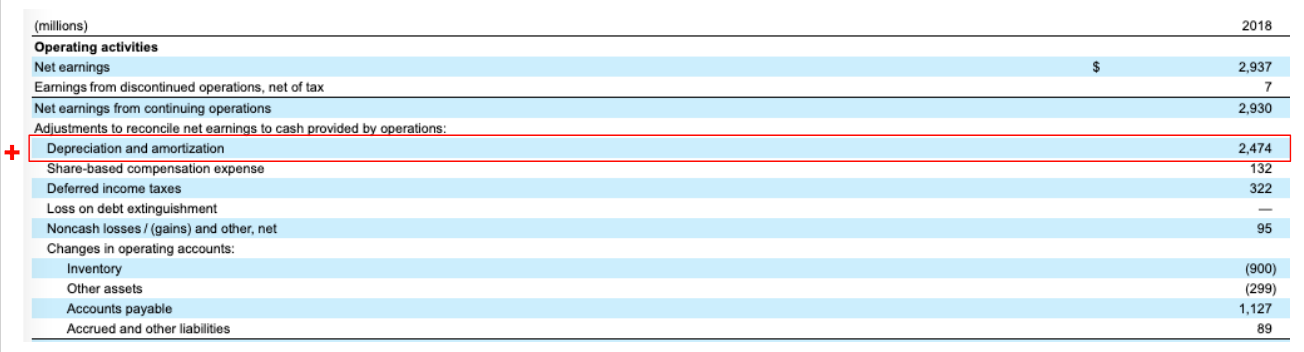

Target's cash flow statement:

Calculation (in USD millions):

| Net earnings | = $2,930M |

| + taxes | = $746M |

| + interest | = $461M |

| + depreciation and amortization | = $2,474M |

| EBITDA | = $6,611M |

The operating income method

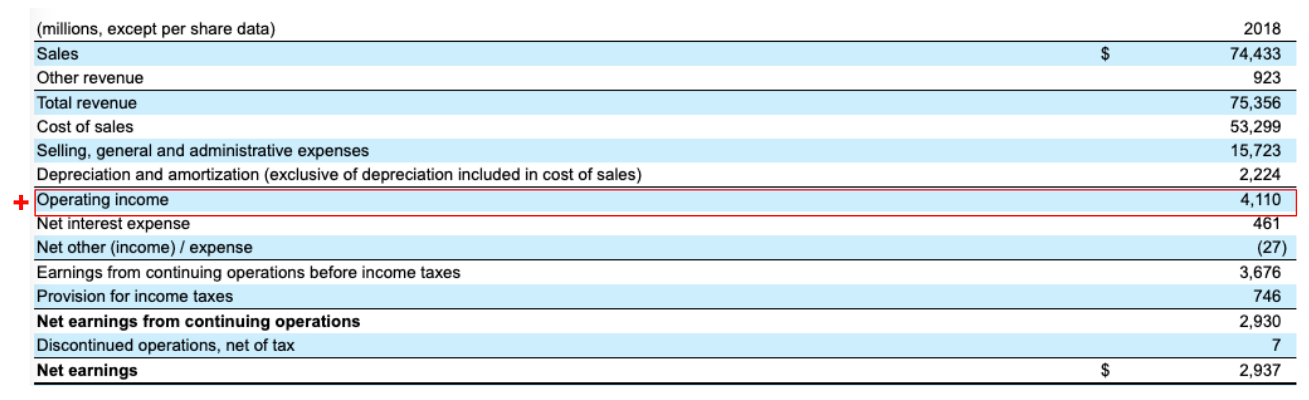

Target's income statement:

Target's cash flow statement:

Calculation (in USD millions):

| Operating income | = $4,110M |

| + depreciation and amortization | = $2,474M |

| EBITDA | = $6,584 |

In this calculation, you can see that the EBITDA differs slightly from what's above. This is because net income includes “net other (income) / expenses.” This number represents the difference between the EBITDA figure in both calculations.

SummaryThe example above shows how to calculate EBITDA with both the net income approach and the operating income approach, using an income statement and cash flow statement from Target.

Uses of EBITDA

Many people use EBITDA as a way to gauge the cash flow of a business.

It can also be used in cases where a company has no reported net profit. In these instances, EBITDA can allow an individual to assess the company's value without that figure.

Owners and investors also occasionally use EBITDA as a tool for comparing their business to competitors. This is often seen as a fair comparison because EBITDA does not make a company look better or worse due to how it's funded.

SummaryEBITDA is often used as a quick way to determine a company's profitability, as it excludes financing and other expenses.

Limitations of EBITDA

There are four key limitations to EBITDA.

1. Inconsistent numbers

As seen in the example above, EBITDA calculations can result in two different numbers for the same company. Additionally, EBITDA is not a figure U.S. companies are required to report.

When analyzing companies' earnings, it's important to be consistent in your approach.

2. Missing costs

One key criticism of EBITDA is that it does not account for the costs of assets and debt, which have a major impact on a company's ability to generate cash.

3. Distorted valuations

Sometimes EBITDA can make a stock look like a better deal than it actually is.

EBITDA is a part of other calculations, such as the EBITDA/EV multiple. Using EBITDA in this formula can result in a low multiple, signaling a buying opportunity, while in truth the multiple is low because EBITDA doesn't represent the bottom-line earnings.

Relying only on this number can therefore be misleading.

4. Non-GAAP measurement

Generally accepted accounting principles (GAAP) are standardized rules that publicly traded companies in the U.S. are required to follow when reporting their financial performance.

EBITDA is a non-GAAP measurement, meaning it can be calculated without regard for any formal rules from the Financial Accounting Standards Board (FASB), which developed GAAP principles.

SummaryEBITDA, while useful, should not be the only earnings measurement you use. It excludes capital expenditures, which can have major implications on the business's operations. It's also a non-GAAP measurement, so doesn't have to follow formal rules.

What is EBITDA margin?

The calculation for EBITDA margin is as follows:

EBITDA margin = EBITDA / total revenue

A rising EBITDA margin can signify that a company is getting better at minimizing the degree to which operating expenses cut into earnings. The result is a more profitable operation.

When the EBITDA margin is high, it means the company is operating leanly. For example, a company might see this figure rise after making cost cuts that save money without impacting their ability to sell the services or products they offer.

This measurement is particularly useful when comparing the relative profitability of two companies of different sizes within the same industry.

In some cases, the calculation can be misleading because it ignores debt, and a company that has built up debt to finance its operations might look healthier than it truly is. Companies may also choose to highlight this figure when reporting earnings to investors.

SummaryEBITDA margin is a calculation used to determine a company's profitability from operations, illustrating efficiency and the company's ability to maximize profits. However, there are some upsides and downsides to keep in mind.

What's a “good” EBITDA?

To understand whether the EBITDA of a company is good or bad, you'll need to analyze the EBITDA history by calculating it on a quarterly or annual basis.

A rising EBITDA over time may indicate that the company is improving and growing, while a decreasing EBITDA could indicate that the company is struggling.

However, these conclusions are not certain.

A rising EBITDA will not reveal the big capital expenditures a company may have made. EBITDA also excludes certain expenses, which could affect trends over time.

SummaryIn the case of EBITDA, "good" is a relative term. You should analyze EBITDA trends over time, rather than relying on a sole figure. It's also important not to overly rely on EBITDA or look at it in a silo. Instead, consider a more comprehensive analysis of the company.

Other calculations that use EBITDA

There are several other calculations that use EBITDA, including adjusted EBITDA, the EBITDA/EV multiple, and the debt-to-EBITDA ratio.

Adjusted EBITDA

Adjusted EBITDA removes one-off items that could distort EBITDA.

To calculate it, you first calculate EBITDA, and then take the additional step of removing all other irregular, one-time, and non-recurring items. Examples include things like litigation expenses, a one-time donation, and asset write-downs.

The purpose of this measurement is to avoid the financial anomalies that would otherwise skew EBITDA.

EV/EBITDA multiple

Below is the formula for the EV/EBITDA multiple:

EV/EBITDA multiple = market capitalization + total debt - total cash / EBITDA

The purpose of this calculation is to provide a more complete picture of a company's value by including cash levels, debt, and stock price related to the business's operating profitability.

When compared to another company in the same industry, the business with the lower multiple is likely undervalued while the company with the higher multiple is likely overvalued.

The EV/EBITDA multiple is useful when comparing the performance of one company to the others in its industry.

For example, an investor could simply compare the multiple of Boeing (BA) to the average enterprise multiple for the aerospace industry.

These widely available industry EV/EBITDA multiples make it easy to get a quick idea of how competitive a company is compared to other businesses.

Debt-to-EBITDA ratio

Here's how to calculate the debt-to-EBITDA ratio:

Debt-to-EBITDA ratio = debt / EBITDA

In this formula, debt represents the company's short- and long-term debt obligations. Overall, the calculation measures a company's ability to pay off incurred debt.

This measure is useful to creditors making a decision about the risk involved when providing a loan to the company. As a company becomes burdened with more debt, the debt-to-EBITDA ratio increases.

SummarySeveral other measurements use EBITDA in their formula, including adjusted EBITDA, the EV/EBITDA multiple, and the debt-to-EBITDA ratio. These calculations can help evaluate business operations and be used to draw comparisons between companies.

Frequently asked questions

Below are some frequently asked questions about EBITDA, including how it compares to other earnings metrics.

EBIT vs EBITDA: what's the difference?

Both EBIT and EBITDA measure a company's profitability with certain, but different, types of expenses added back in.

EBIT stands for Earnings Before Interest and Taxes. As the name indicates, EBIT represents earnings minus the impact of interest and taxes. It's very similar to EBITDA, but doesn't add depreciation and amortization costs back to earnings.

Because EBITDA adds more types of expenses back in, it will be larger than EBIT.

Here is the formula for EBIT:

EBIT = revenue - costs of goods sold (COGS) - operating expenses

Which is better, EBIT or EBITDA?

There's not a clear answer to this question, and the preference may vary by industry or investor.

For example, depreciation costs are lower in industries that aren't capital-intensive, so there's less difference between EBITDA and EBIT. But in industries requiring more capital, such as oil or mining, there's a larger difference between EBIT and EBITDA.

Depending on how you want to account for these expenses in earnings, you may develop a preference for either EBIT or EBITDA.

Overall, it's valuable to calculate both EBIT and EBITDA, and compare the two. Then you can note the differences and decide for yourself which number is most useful.

Finally, as is the case with EBITDA, be sure to look at EBIT trends over time and not rely on singular calculations.

Is EBITDA the same as gross profit?

In short, no. Gross profit ignores operating expenses, while EBITDA ignores non-cash items related to financing decisions. Gross profit is calculated as follows:

Gross profit = revenue - cost of goods sold

Overall, gross profit is a simple calculation for examining how well a company can make a profit from their direct materials and labor, while EBITDA is a more comprehensive look at operating earnings.

However, both can be used to gauge profitability and compare companies.

Which external factors impact EBITDA margin?

Inflation can increase the prices the company pays for the materials used to produce their goods. If the company can't increase their prices accordingly, their EBITDA margin will fall.

On the other hand, if deflation occurs, then the company might be able to purchase materials for less, thereby increasing their EBITDA margin.

Additionally, the cost of labor, the rise of competing companies, and shifting consumer demand for the company's goods can all impact the EBITDA margin.

Is EBITDA helpful to investors?

Yes, EBITDA is helpful to investors because it reflects how operationally efficient a business is, as well as how that efficiency compares to that of other companies, or potential investments.

However, EBITDA alone does not provide enough information to make an investment decision. Other factors, such as dividends, P/E ratio, EPS, and more must also be considered.

Does a relatively high EBITDA indicate future share price growth?

There is no definitive answer to this question. A relatively high EBITDA likely reflects management's ability to drive profitability, which tends to promote share price growth.

That said, there are no verified studies linking EBITDA numbers to stock outperformance.

The takeaway

EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization.

This calculation indicates the profitability of a company's core operations, and can be calculated using basic information from the company's income and cash flow statements.

By measuring earnings before interest, taxes, depreciation, and amortization, EBITDA provides a clear indication of the company's ability to generate cash from its operating activities.

It is also useful when comparing competing businesses within the same industry.

However, EBITDA is just one of several measurements that should be considered when assessing the value of a company.