Is The Motley Fool Epic Service Worth It?

The Motley Fool recently overhauled its entire product lineup.

Previously, the company offered over 40 separate services, which created thousands of possible product and renewal combinations. This made the site challenging to navigate and created a messy experience for both potential customers and existing members.

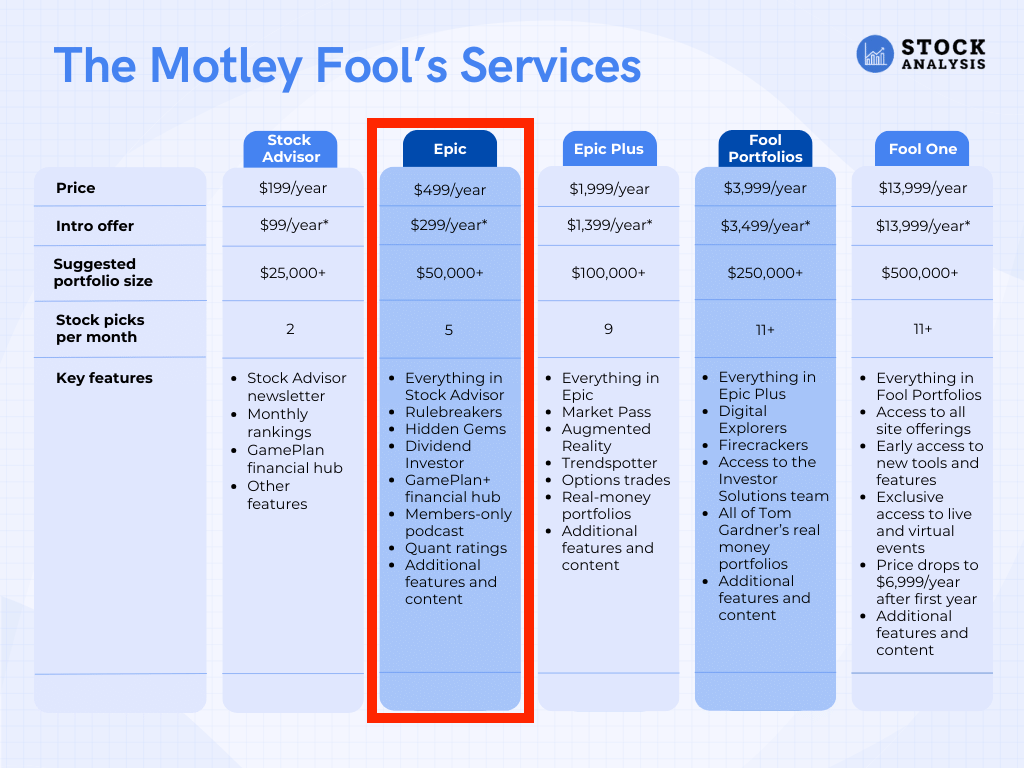

Today, The Motley Fool offers just 5 services — each one (except the first) containing several of its former products.

Its new Epic service instantly became one of the most popular, and for good reason: It combined several of their most popular stock-picking services into one bundle, all for a fraction of the cost.

I've been subscribed to a couple of The Motley Fool's products for the last few years, so I was very interested to try out the new Epic product for myself.

Here's my review of what's included in the subscription, who it's best for, and who might be better off choosing another service.

Motley Fool Epic review summary

- Overall rating:

- Service type: Stock recommendation service

- Best for: Long-term investors with portfolios of $50,000+

- Cost: $499/year (new members can save $200 on their first year with our links)

In my opinion, Epic is the best value out of the five services The Motley Fool now offers.

One step above The Motley Fool's entry-level service (Stock Advisor), Epic delivers five new stock recommendations each month. These are a mixture of growth, emerging technology, and dividend stocks.

But Epic isn't for everyone.

The main drawbacks of Epic are its cost and the recommended portfolio size ($50,000) The Motley Fool suggests you have before subscribing.

However, I think you can use the service with a slightly smaller portfolio if you can add at least $1,000 per month to invest in the new recommendations.

If the subscription is too expensive or if your portfolio isn't big enough yet, you may be better off with a Stock Advisor subscription. You can read more about that service in my Stock Advisor Review.

An overview of Motley Fool's new products

Before jumping further into what's included in Epic, let's back up and see where it fits into The Motley Fool's new product stack.

*These are special introductory offers for new members only. Click on the following links to get the discount and learn more about the service: Stock Advisor, Epic, Epic Plus, Fool Portfolios, Fool One.

TMF's membership-fee-back guarantee

Many of The Motley Fool's products come with a 30-day, membership-fee-back guarantee.

Now that you've seen the snapshot of The Motley Fool's offerings and how Epic fits into its lineup, let's dig into Epic's specific features.

What's included in Motley Fool Epic?

Before launching their new services, The Motley Fool's two most popular products were Stock Advisor and Rule Breakers.

These two products are the core of the new Epic service, though it also comes with a couple of other (previously standalone) products: Hidden Gems and Dividend Investor.

Altogether, an Epic subscription provides five stock recommendations per month:

- 2 from Stock Advisor

- 1 from Rule Breakers

- 1 from Hidden Gems (formerly “Everlasting Stocks”)

- 1 from Dividend Investor (which replaced “Real Estate Winners”)

In addition to the stock picks, an Epic subscription comes with several other features which I cover in more detail below.

But first, let's take a closer look at each of its stock recommendation services.

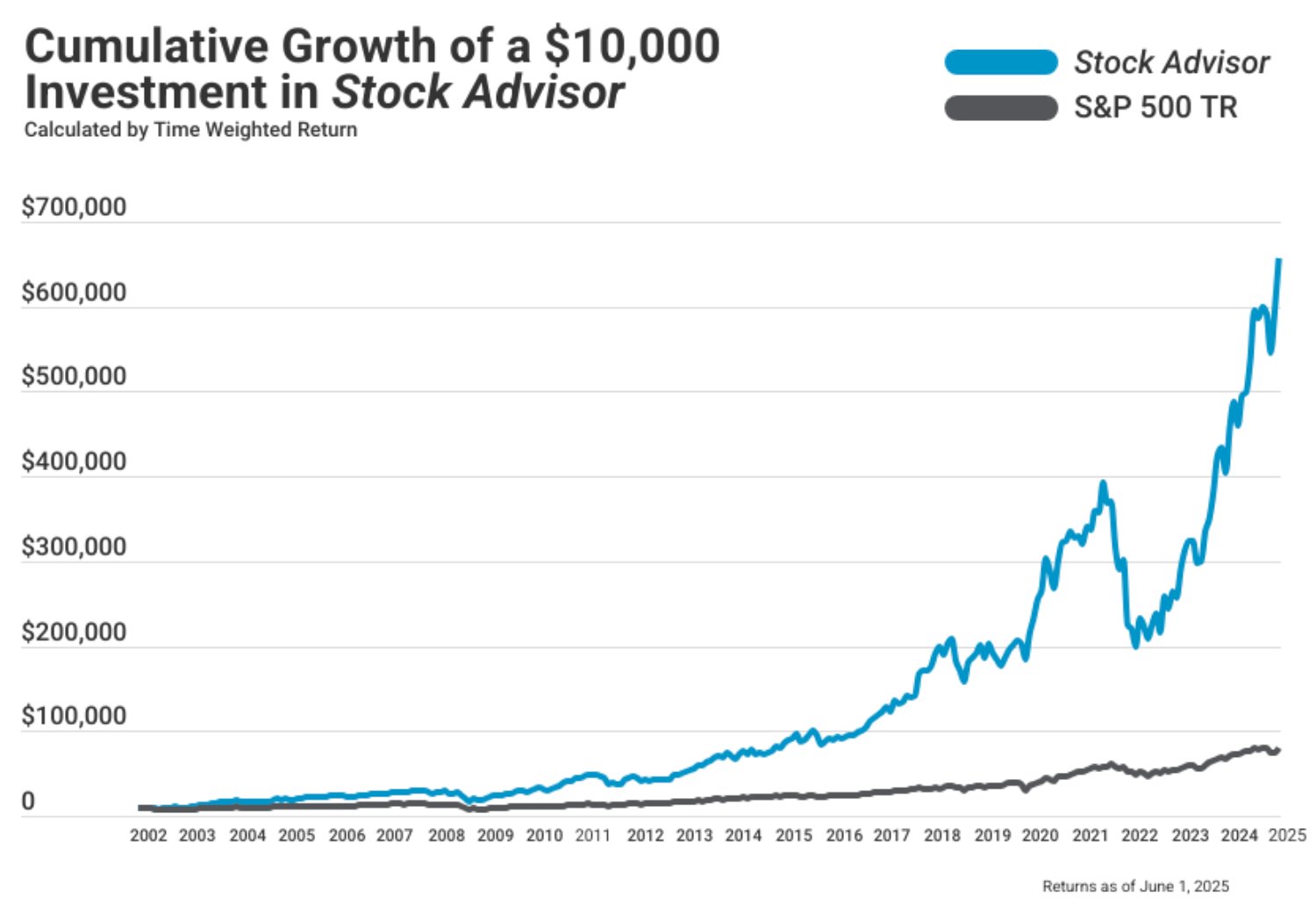

1. Stock Advisor

Stock Advisor is The Motley Fool's most popular product. It's a stock recommendation service that provides two new recommendations each month.

The Stock Advisor team primarily focuses on growth stocks — any company that is growing its revenue and earnings per share and has sustainable competitive advantages is a candidate for the portfolio.

Most of the recommendations are well-established companies such as Netflix (NFLX), Costco (COST), or Amazon (AMZN).

Stock Advisor was launched in 2002. Since its inception, it has more than 5.8x'd the S&P 500 (1,046% vs 178% as of July 2025):

Stock Advisor can still be purchased as a standalone service — it's Motley Fool's entry-level product. You can see my full Stock Advisor Review for more details.

But, if you want to bundle it with Rule Breakers, you'll need to go to the next product — Epic.

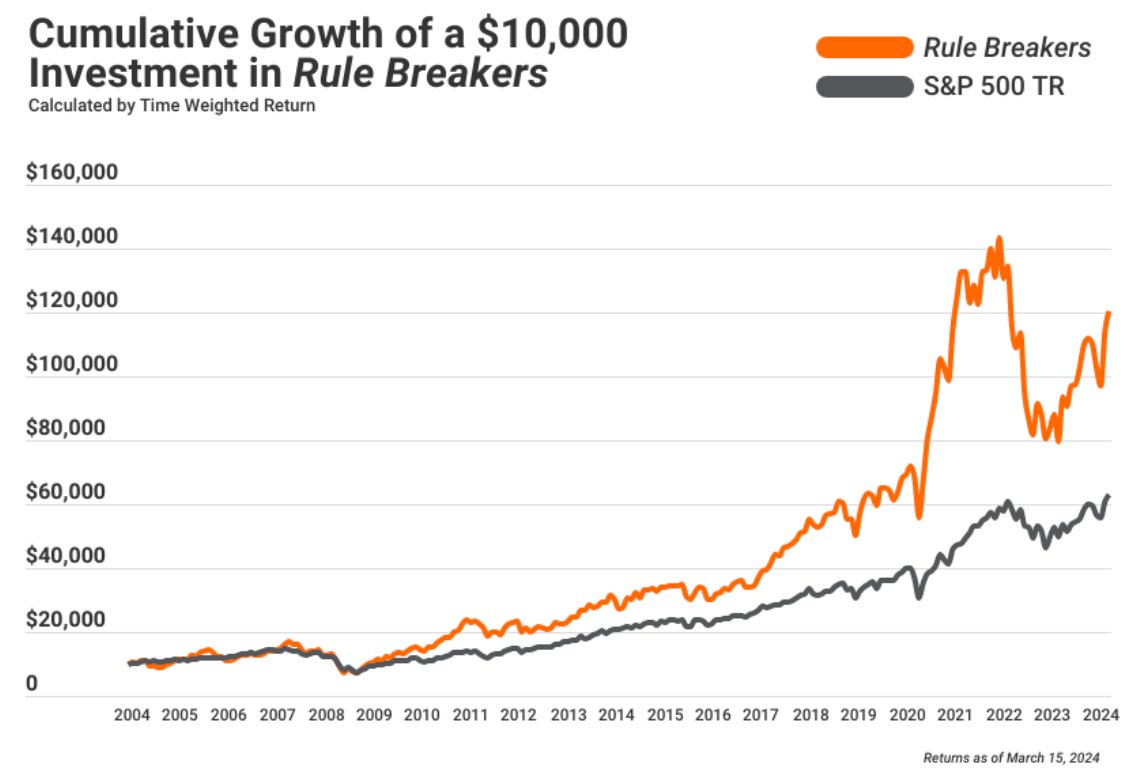

2. Rule Breakers

Launched in 2004, Rule Breakers is The Motley Fool's second-oldest product.

While Stock Advisor invests in primarily growth stocks, Rule Breakers has a more narrow focus. The service only invests in disruptive technology companies — companies that have the potential to change entire industries.

Oftentimes, this entails picking companies that are still (relatively) young and haven't totally established themselves. While investing in companies in their earlier innings may offer investors greater upside, there is also greater risk and volatility involved.

However, when they correctly spot a trend, they can pick some big winners. A few of their past picks are Shopify (SHOP), Tesla (TSLA), and MercadoLibre (MELI).

Its recommendations like these that have helped Rule Breakers generate an impressive track record:

As of July 2025, Rule Breakers has returned +338.09% vs +185.85% for the S&P 500 since the product was launched in 2004.

Personally, while it's nice to have Hidden Gems, Dividend Investor, and the other features I'm going to cover next, I find most of the value of Epic is in the subscriptions to Stock Advisor and Rule Breakers.

These were my favorite services before The Motley Fool changed its offerings, and the best way to get them both is with an Epic subscription.

3. Hidden Gems

Hidden Gems, which was formerly known as Everlasting Stocks, is another stock recommendation service that used to sell for $299/year.

In a lot of ways, the service resembles Stock Advisor, as the team focuses on finding well-established growth stocks.

But they took their stock selection process a step further by adding an additional layer of criteria: only invest in stocks that you can buy and hold forever.

Growth is still important, but there's an added emphasis on finding companies with robust moats and defendable competitive advantages. If a company doesn't also have those, the Hidden Gems team will pass on it.

Hidden Gems was launched in September 2018. Since then, it has slightly outpaced the S&P 500 (+55.23% vs +49.47% as of July 2025).

4. Dividend Investor

An Epic subscription also provides one new dividend stock recommendation per month through its new Dividend Investor product.

Dividend Investor was launched in February 2023 and, as far as I can tell, is the replacement for Real Estate Winners.

Real Estate Winners was a stock-recommendation newsletter that invested in real estate investment trusts (REITs), homebuilder stocks, or other companies in the industry.

It seems The Motley Fool team ditched their focus on the real estate industry specifically and opted for a more general, dividend-focused product that appeals to a broader audience.

Other features

Here's a list of all the other things that come with an Epic subscription:

- Recommendations and rankings: After subscribing, you don't have to wait for the regular schedule to get stock recommendations. If you're new to the service, new to investing, or just want to add some new stocks to your portfolio, an Epic subscription comes with several lists of stocks that are a great place to start.

- Portfolio strategies: Once you become a member, you can choose a strategy (cautious, moderate, or aggressive) that best suits you, and the service can outline which of its stock recommendations could be best based on the strategy you select.

- GamePlan+: The GamePlan+ tool will give you some resources to help you set up your portfolio. It makes sure you're aware of the Fool's Investing Principles, and gives monthly challenges to help members hit their financial goals.

- Epic Opportunities podcast: The Motley Fool's members-only podcast discusses different opportunities, personal finance, and how the team finds new stocks.

- Research tools: If you want to do your own stock research, you can use your subscription dashboard to access The Motley Fool's tools, information, and news articles.

As mentioned above, I personally find the bulk of Epic's value to be in the access to Stock Advisor and Rule Breakers.

That said, these additional features are all nice to have, especially if you're new to investing.

Is Motley Fool's Epic worth the money?

At $499/year — after an introductory price of $299 — the new Epic product is significantly cheaper than what The Motley Fool used to charge for all of these products individually.

Previously, Stock Advisor was $199/year and Rule Breakers, Everlasting Stocks (replaced by Hidden Gems), and Real Estate Winners (replaced by Dividend Investor) were $299/year each.

The Motley Fool also used to offer a bundle of Stock Advisor and Rule Breakers for $499/year.

With the new Epic service, for the same cost as the old bundle, subscribers also get access to Hidden Gems and Dividend Investor — which means two additional stock recommendations per month and two more complete portfolios of recommendations.

For this reason, I find Epic to be the best value for money out of all the new products offered by The Motley Fool.

Who should try Motley Fool's Epic?

Despite all the value provided, I don't think Epic is for everyone.

After the introductory year, the $499/year cost is not overly expensive. However, if your portfolio isn't large enough, the subscription will eat into your returns.

For example, if you have a $10,000 portfolio and the stock picks generate a 10% return, the $499 subscription cost will leave you with just a 5% net return, or $500.

Meanwhile, on a $50,000 portfolio, a 10% return will net you $4,500 after the cost of the subscription.

As you can see, the bigger your portfolio, the less of an impact the subscription will have on your net returns.

Furthermore, five new stock recommendations per month is quite a few.

If you wanted to invest $200 into each new recommendation, you would need to add $1,000 per month to your portfolio. To invest $500 into each new recommendation, you would need to add $2,500 per month to your account.

If you don't need five new recommendations per month or you aren't regularly contributing new money to your portfolio and/or starting with a decently sized account, you may be better off with a subscription to Stock Advisor or another stock-picking newsletter.

More about Stock Advisor

For more information on Stock Advisor, check out my full review.

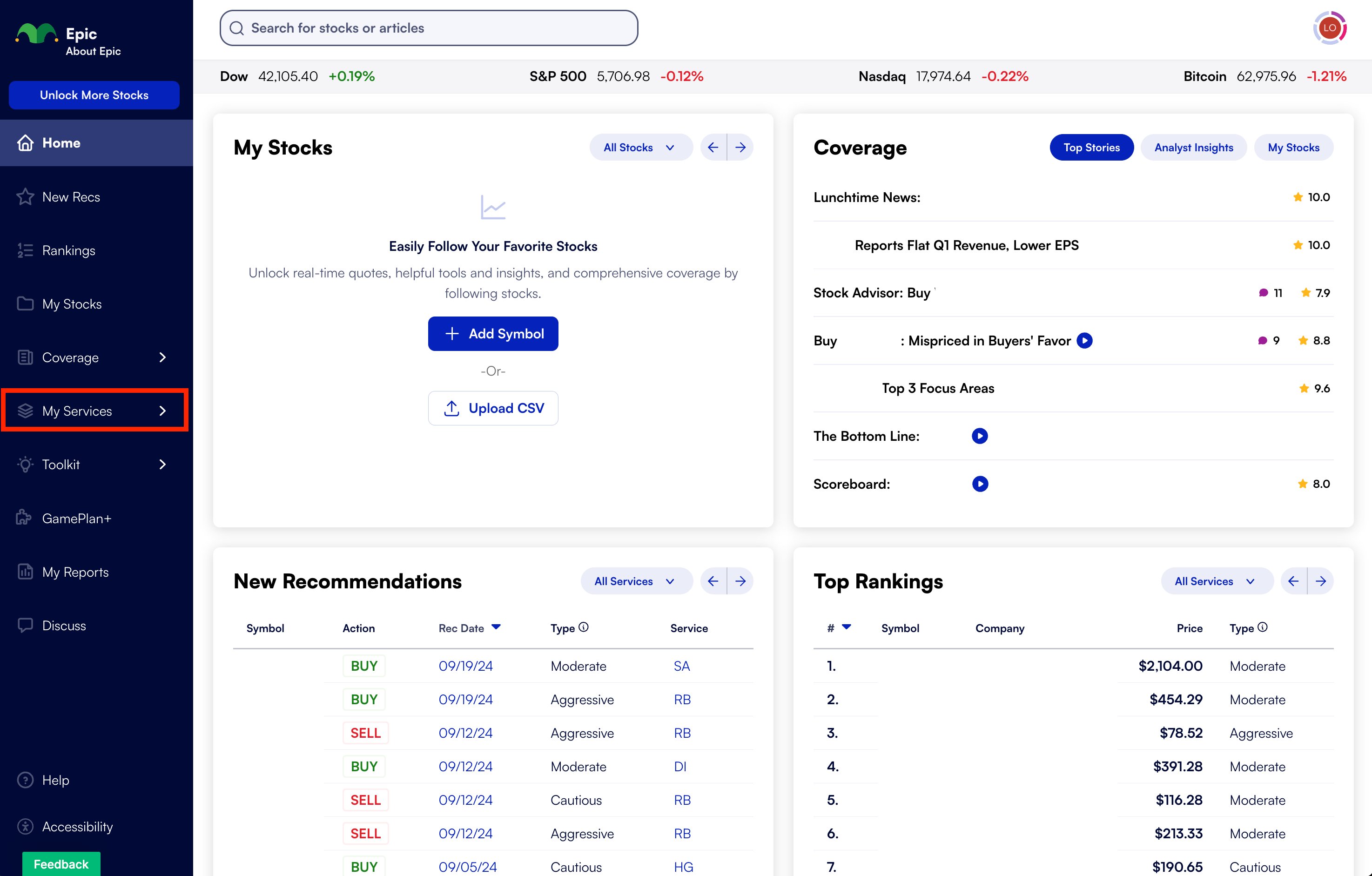

What does Epic look like?

The Motley Fool also changed how it displayed its products behind the paywall, making for a much simpler and more streamlined experience.

Remember, Epic is a bundle of several products, and that's how it's displayed for subscribers. Here's a look at the main dashboard (I've hidden the stock recs):

The dashboard shows you the aggregate view of all the stock recommendations and rankings across all of the products included with Epic.

You can filter each of the products individually by clicking on the My Services tab and selecting the one you're interested in (Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor).

Overall, the website design update makes for a much more cohesive experience for members who are subscribed to multiple products.

Final verdict

The Motley Fool's new Epic service provides members with a mix of growth, dividend, and under-the-radar stocks to build a well-rounded portfolio.

It also comes with member-only perks, analytics and research tools, and expert guidance on building a portfolio.

However, at the end of the day, you're buying access to their stock recs.

Epic is the best way to access both of The Motley Fool's oldest and historically best-performing services, Stock Advisor and Rule Breakers. It also comes with subscriptions to Hidden Gems and Dividend Investor.

In my opinion, it's the best value of any of their new services.