Private Market Investing: A Complete Guide

Money has been pouring into private markets.

On average, institutional investors are now allocating 11.5% of their portfolios to private market assets.

The appeal? Risk-adjusted returns.

Private markets have historically delivered higher returns than traditional stocks and bonds, while also offering diversification outside of public markets.

For institutional investors like pensions and endowments, this combination of strong performance and reduced volatility has made private markets an increasingly important part of their portfolios.

But what about individual investors? What role should private market investments play in your portfolio, and what should you know before investing?

In this article, you'll learn what private market investing is, the unique risks it carries, and how you can start investing in assets like private equity, private credit, real estate, and more.

What is private market investing?

Any equity- or debt-based investment that is not bought and sold on a public exchange is a “private market” investment.

This includes private equity, private credit, private real estate, and infrastructure.

Note: Private market investments are a subset of alternative investments — they are not the same thing. "Alternatives" refer to any asset class outside of stocks, bonds, and cash, including private markets, hedge funds, commodities, collectibles, crypto, and other niche assets.

For something to qualify as a private market investment, it must involve raising and allocating capital through structured investment vehicles (like funds, partnerships, or direct financing) outside of public markets.

Private markets are a distinct corner of the investment universe, separate from both traditional markets and other alternatives.

Public markets vs private markets

| Public markets | Private markets | |

| Who can access? | Anyone | Primarily accredited* and institutional investors |

| Example asset classes | Stocks, bonds, ETFs, mutual funds | Private equity, private credit, real estate, infrastructure |

| Minimum investment size | No minimum | $500 to $10,000+ |

| Regulatory standards | Very high | Medium |

| Liquidity | High | Low-medium |

*You can qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly.

- Your net worth exceeds $1,000,000, excluding your primary residence.

- You are a qualifying financial professional with a Series 7, 65, or 82 license.

With that foundation in place, here are the core assets that make up private markets.

Private market investments

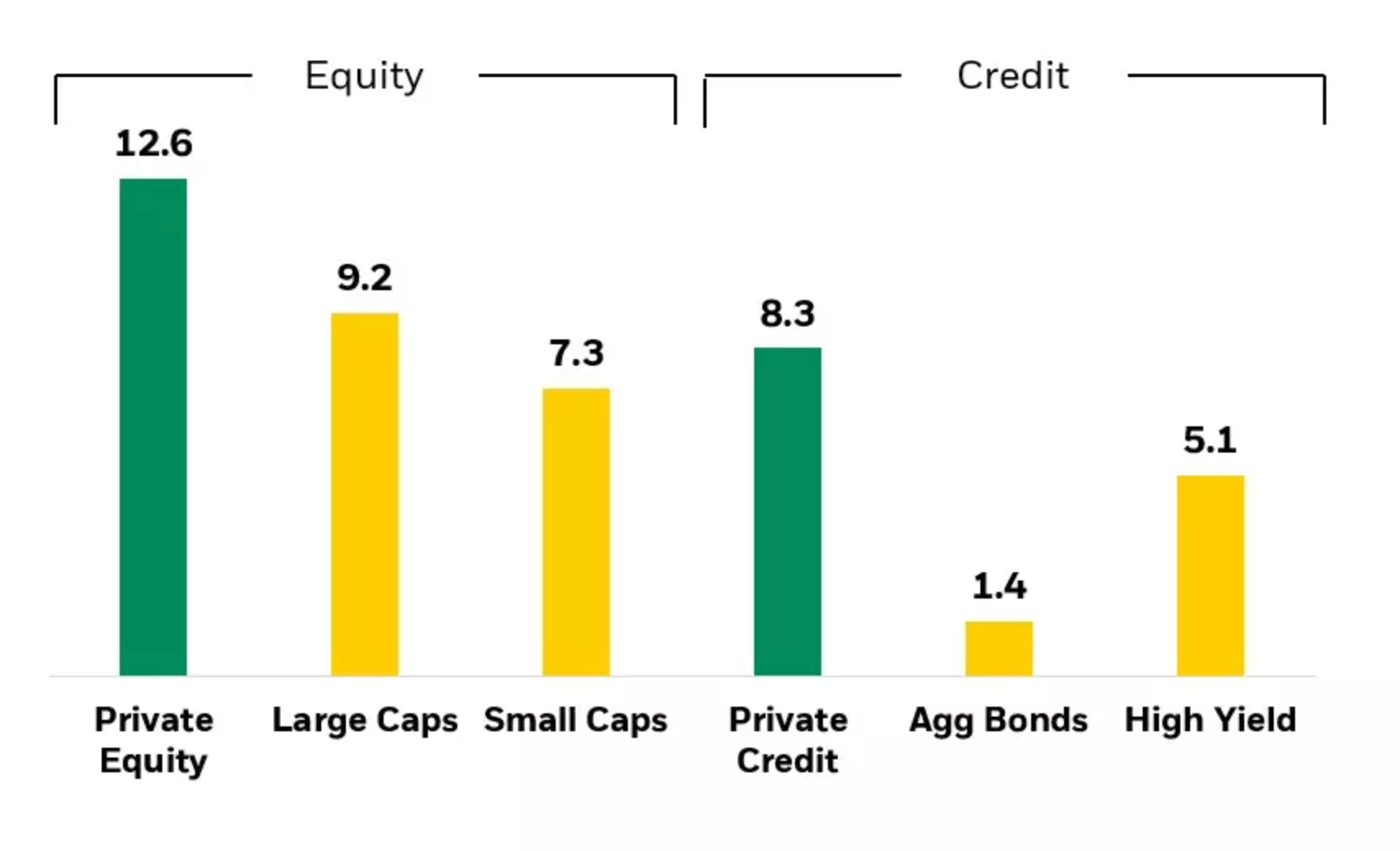

Private equity and private credit are two of the most popular private market assets, and both have outperformed their public-market counterparts over the past decade (as of Dec 2024):

Source: Bloomberg, MPI

Real estate and infrastructure* are the two other most common private market investments, and typically offer a blend of capital appreciation and regular income.

Additionally, certain real estate investments may come with tax benefits, such as pass-through depreciation deductions or the ability to defer capital gains through 1031 exchanges.

*Infrastructure investing means putting money into the development of essential systems societies rely on, such as roads, airports, utilities, data centers, and energy.

Investors earn returns through steady cash flows from user fees (tolls), utility payments, leases, and contracts, and may also benefit from capital gains if the underlying asset appreciates.

Why invest in private markets?

There are two main benefits of investing in private markets: higher potential returns and diversification outside of public markets.

1. Higher potential returns

As shown in the image above, private equity and private credit outperformed their traditional equivalents from 2014–2024.

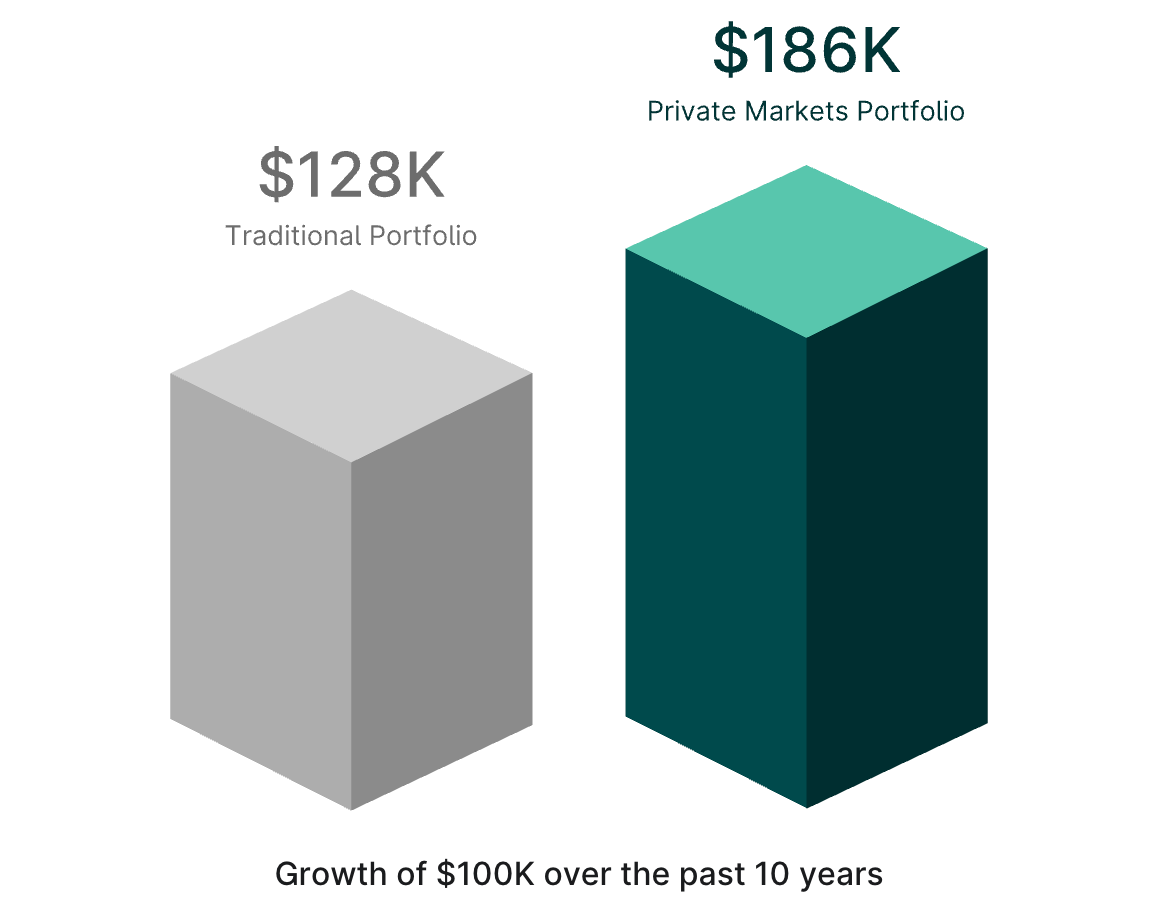

Over that same period, a portfolio of 40% private equity, 30% private credit, and 30% private real estate outperformed a traditional 60/40 stock-bond portfolio by a wide margin:

Source: Willow Wealth

While this performance isn't guaranteed to continue in the future, it illustrates the main advantage of including private market assets in traditional portfolios.

Because the investments are harder to access, less liquid, more speculative, and overall entail more risk, in theory, it would make sense for private markets to outperform public markets over the long term.*

*This is known as “risk premium,” which is a financial theory that states that the riskier an asset is, the higher its expected returns should be.

2. Diversification

Beyond offering higher returns, private markets don't move in lockstep with stocks and bonds, making them a powerful diversification tool.

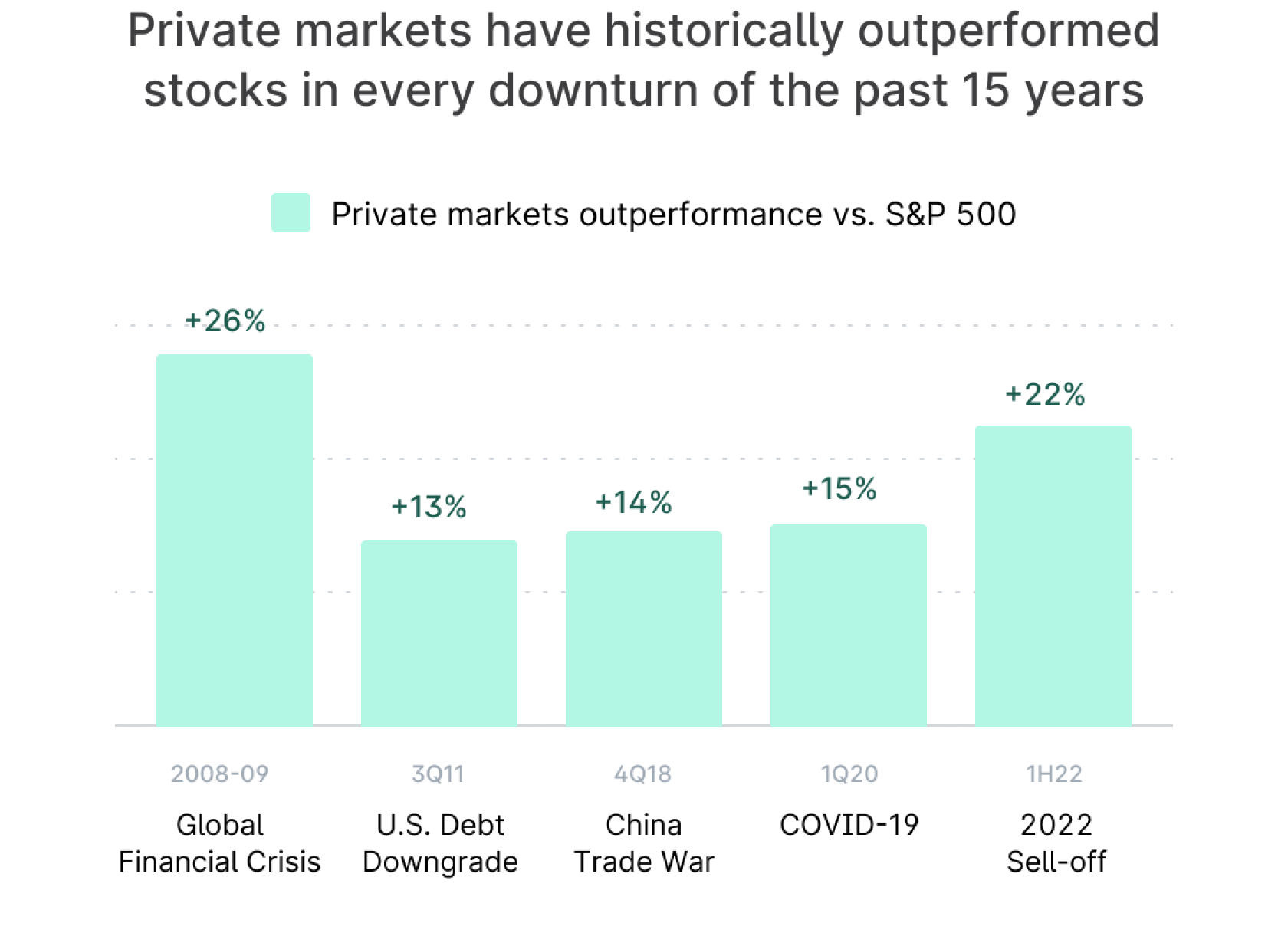

This is especially important during bear markets, when stocks are struggling.

Here's a graph of the largest quarterly drawdowns of the S&P since 2008 and how a basket of private market investments performed relative to the stock market:

Source: Willow Wealth

In these periods especially, having exposure to assets that don't follow the stock market can make portfolios more resilient.

While there are benefits to adding private market investments to a portfolio, they come with additional layers of complexity and risk.

Drawbacks to investing in private markets

While private markets can enhance returns and diversification, they also come with some important trade-offs investors should understand:

- Low liquidity: Because there are no secondary marketplaces, most private market investments are locked up for the duration of the investment. These periods can range from 10 months (private credit) to 7–12 years (private equity) or longer, making it difficult to access your money quickly.

- Lack of transparency: Private investments don't have the same reporting standards as public companies, so performance and valuations can be harder to track.

- Complexity: Deals often involve sophisticated structures, fees, and legal terms that are not easy for everyday investors to evaluate.

- Limited access: Most private market investments are limited to institutions and accredited investors.

- High minimums: Even if you qualify as an accredited investor, many platforms have minimum investments of $10,000 or more (many private funds require $250,000 or more), which may preclude you from investing.

- High default risk: Many private market investments have higher failure rates than traditional investments.*

*For example, four of Willow Wealth's real estate deals were recently declared total losses, underscoring both the risks of private markets and the importance of diversification.

Despite these drawbacks, many institutional investors continue to increase their allocations to private markets.

Next, I break down the three steps you can take to add them to your own portfolio.

How to invest in private markets

1. Determine how much to allocate

Most professionals recommend allocating just a portion of your total portfolio into private markets, leaving the bulk in traditional investments like stocks and bonds.

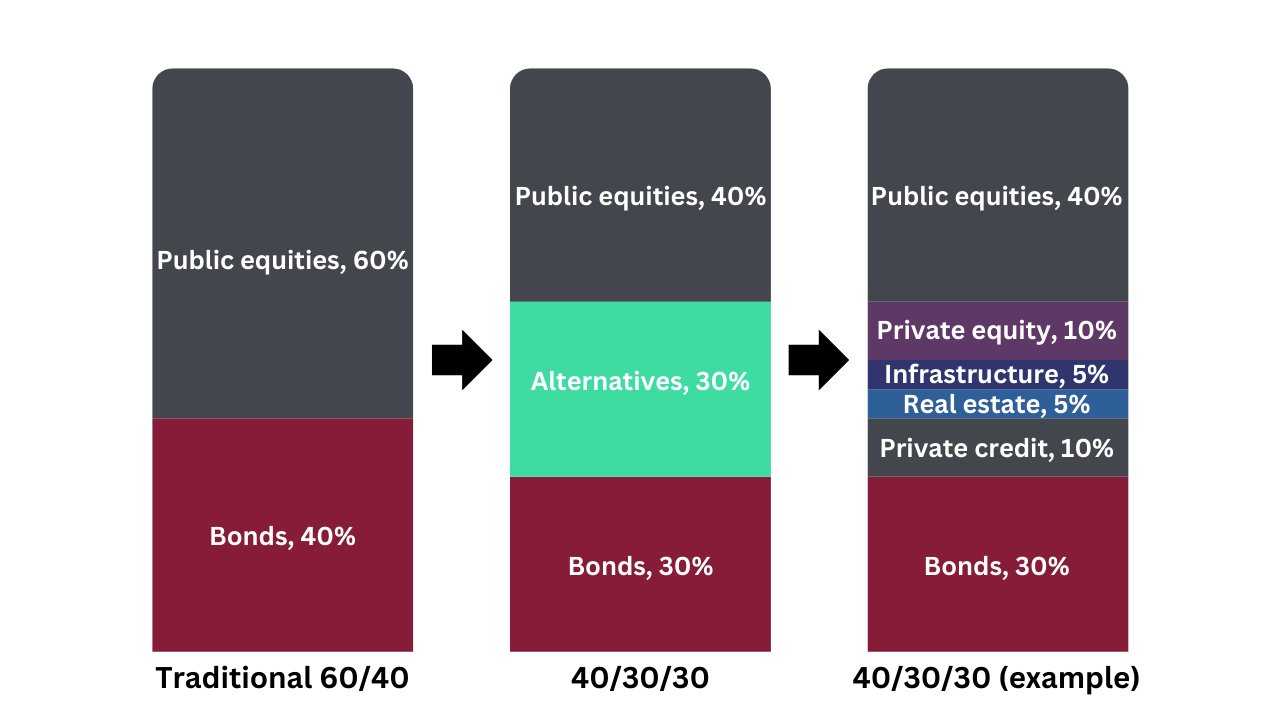

For example, KKR suggests investors with a 60/40 stock-bond portfolio may want to transition to a 40/30/30 stock-bond-alternatives portfolio.

Their research suggests this adjustment may improve risk-adjusted returns, increase inflation protection, and lower volatility in a portfolio.

KKR provides the following as an example of how you could allocate the alternatives portion of your portfolio across various private markets:

Disclaimer: This is an example allocation. You should determine the right allocation for yourself based on your age, risk tolerance, and financial goals.

If you're just getting started in private investing, you may want to consider something closer to a 55/35/10 portfolio, in which just 10% of your capital is allocated to private markets (or other alternatives).

2. Decide which investment(s) are right for you

There are many private market investments to choose from, some of which may be more suitable for your portfolio than others.

Below are a few of the most popular private market investments.

Each of these asset classes has its own risk/reward profile as well as benefits and drawbacks. Be sure to carefully research each of them and perform your due diligence before making an investment.

a) Private equity

Private equity investments are investments in companies that aren't publicly traded.

Today, more and more companies are staying private longer, and an increasing amount of the returns are accruing to private investors before companies become publicly traded.

While private equity as a whole has performed well over the last 30 years, the asset class is known for its heightened risk of loss of capital. Distributions vary widely.

It's also more illiquid and requires more upfront capital than public equities.

b) Private credit

When private companies need to borrow money and don't have access or don't want to use traditional banking channels, they turn to the private credit market.

The average default rates fall between investment-grade and non-investment-grade bonds, but the market's double-digit average returns and short-term durations make it a very attractive investment for income-seeking investors.

c) Real estate & infrastructure

Since these are real, physical assets, real estate and infrastructure investments are known for being strong hedges against inflation. Plus, most of these deals come with regular cash flow and steady returns.

However, they also often come with higher investment minimums.

3. Choose an investment platform

After determining how much money you have to invest and what private markets you're interested in, you'll need to create accounts with different investment platforms.

Similar to how a brokerage account allows you to access public markets, accounts with these platforms give you access to one or more private market investments.

Unlike brokerage accounts, every private market investment platform has its own set of deals and opportunities. Partnering with the right platform(s), even if the fees are higher, will help give you access to the best selection of investments.

A few private market platforms you should know about are:

a) Hiive — best for private equity

Hiive is a secondary marketplace platform that allows accredited investors to buy shares of private companies.

Some of the most actively traded securities on Hiive are Perplexity, Databricks, and SpaceX.

Hiive connects sellers (employees, venture capitalists, angel investors, etc.) who want to sell their shares with buyers.

Sellers create listings, which include asking prices and share volume. Buyers can either accept the asking price as listed or place bids and negotiate directly with the sellers.

For more information, check out my Hiive review.

You may also be interested in the Fundrise Innovation Fund.

b) Percent — best for private credit

Private credit has been rapidly increasing in popularity, especially among income-seeking investors.

Private credit is known for its high yields (13%+) and short-term durations (usually around 9-10 months). These are the average figures from Percent, a platform that specializes in private credit.

While you can invest in private credit on Willow Wealth (next), there usually seems to be more deals available on Percent. Plus, Percent's minimum investment is just $500.

For more information, check out my Percent review.

c) Willow Wealth — best for real estate and infrastructure

Willow Wealth (formerly Yieldstreet) is one of the largest investment platforms for alternative investing.

More than 500,000 members have invested over $6 billion on Willow Wealth since 2015.

While most other platforms specialize in a particular asset class, Willow Wealth offers 10 alternative asset classes. These include real estate, infrastructure, art, private equity, private credit, and more.

If you're overwhelmed by all of the alternative investment options available to you, the Alternative Income Fund may be a good option.

The fund includes 20+ investments spanning a variety of asset classes, and is likely the easiest way to diversify into alternatives.

Plus, the Alternative Income Fund is available for everyone, not just accredited investors.

Final thoughts

Adding private markets to your portfolio can enhance diversification, provide access to unique investments, and potentially deliver higher returns.

However, they come with their own set of challenges and risks.

If you're considering investing in private equity, private credit, real estate, or infrastructure, be sure to perform as much due diligence as possible.

Additionally, only allocate as much capital as you're willing to lose. And remember, your money is likely to be tied up for the duration of the investment.

My opinion? Go slow, and approach with caution.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.