The 6 Best Real Estate Crowdfunding Platforms

Real estate has long been one of the most dependable ways to build wealth.

However, the high upfront costs, complexity, and ongoing management often meant only serious — and wealthy — investors could participate.

But that's changed.

Real estate crowdfunding platforms now make it possible for everyday investors to own fractional shares of income-generating properties, without becoming landlords.

These platforms pool capital from thousands of investors, and then handle everything from deal sourcing to tenant management.

You can get started with as little as $10 and invest across multiple properties and markets at once. It's never been easier to build a diversified real estate portfolio.

Still, not all platforms are built the same. Each one has different strategies, minimums, fees, and risk profiles, which can make it hard to determine the right option for you.

After testing dozens of them, here are the six best real estate crowdfunding platforms, websites, and apps in 2026.

A note on accreditation requirements

Some of these platforms are only available to accredited investors. You qualify as an accredited investor if you meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000 (excluding your main residence).

- Are a qualifying financial professional (with a Series 7, 65, or 82 license).

Each platform's accreditation requirements are noted in the table below.

A quick look at the best real estate crowdfunding platforms

| Platform | Our rating | Asset type | Minimum investment | Accessibility |

| Arrived | Single-family homes | $100 | Any investor | |

| Fundrise | Residential and commercial properties | $10 | Any investor | |

| EquityMultiple | Commercial real estate debt | $5,000 | Accredited only | |

| RealtyMogul | Private REITs | $5,000 | Primarily accredited | |

| Groundfloor | Short-term loans | $100 | Any investor | |

| 1031 Crowdfunding | DSTs | $25,000 | Accredited only |

Disclaimer: Ratings are my opinion.

Keep reading for more detailed breakdowns of why each platform got the above ranking and rating.

1. Arrived: best real estate crowdfunding platform overall

- Our rating:

- Asset: Single-family homes

- Minimum investment: $100

- Accessibility: Any investor

Arrived is my top pick for the best real estate platform because it's:

- Available to all investors

- Has a $100 minimum investment

- Is generating consistently strong returns

Unlike other platforms, Arrived only focuses on one type of property: single-family homes. It buys them for both long-term rentals and short-term (vacation) rentals.

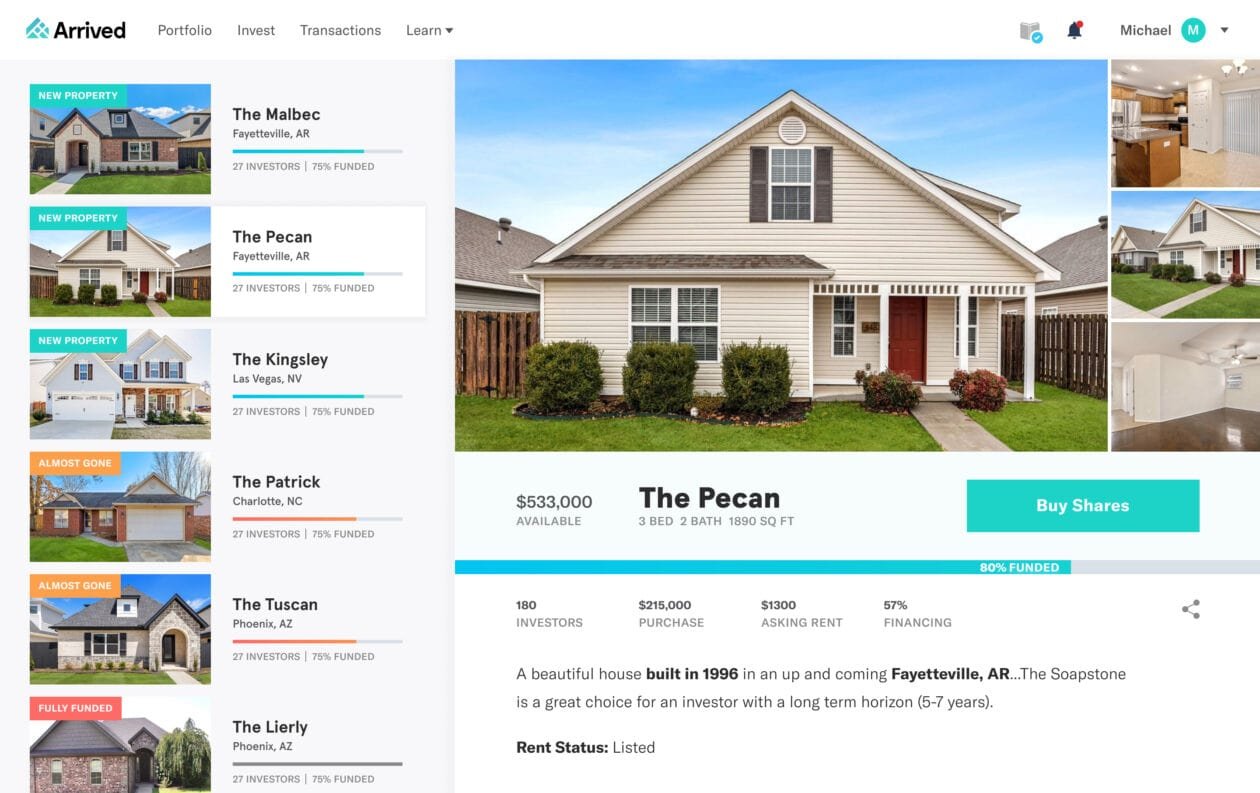

Source: Arrived

As mentioned above, Arrived has both long- and short-term rentals.

In Q3 2025, long-term rentals paid an annualized dividend of 0.4–10.4%, with a 4% average, while short-term rentals paid an annualized dividend of 0.4–9.3%, with an average of 2.4%.

Properties also experienced varying levels of price appreciation.

Arrived expects to hold most long-term rentals for 5–7 years and short-term rentals for up to 15 years.

Although the platform recently launched a secondary marketplace where investors can sell their shares to one another, I wouldn't count on it for liquidity — assume your money will be locked up for the full investment period.

If that holding period is a problem, you can invest in one of Arrived's funds, including:

- The Single Family Residential Fund, which lets you invest in a growing, diversified portfolio of rental homes with a single investment. So far, it has averaged an annual dividend income of 4% and price appreciation of 3–5% per year.

- The Private Credit Fund, which owns a portfolio of short-term loans secured by residential real estate, has generated an 8.1%+ annualized yield for investors since its launch.

Each of these funds allows investors to request redemption at any time after six months.

Altogether, Arrived is the fastest, easiest way to build a diversified real estate portfolio. That's why more than 900,000 investors have funded the purchase of $300+ million in real estate assets on the platform since its launch in 2019.

Primary benefit: With just $100, anyone can start building a diversified real estate portfolio.

2. Fundrise: best real estate investing app

- Our rating:

- Asset(s): Residential and commercial real estate

- Investment minimum: $10

- Accessibility: Any investor

Fundrise is one of the biggest players in the crowdfunding real estate space, and for good reason.

Like Arrived, it's extremely easy to sign up and start investing, and it has an even lower minimum investment (just $10). But its mobile app is where it really shines — it's clean, fast, and easy to navigate.

Fundrise's current real estate portfolio is worth more than $7 billion, fueled by 385,000+ investors. It invests in single-family homes, multi-family apartment buildings, and industrial properties.

Across those property types, Fundrise segments investments into four categories:

Source: Fundrise

Each individual deal is given one of these labels, allowing you to more easily build a portfolio tailored to your goals and risk appetite.

If you don't want to construct your own portfolio, you can invest in its Flagship Real Estate Fund. The fund owns build-for-rent housing communities, multifamily units, and industrial properties. It has delivered a 4.1% annualized yield since inception.

Fundrise is a great option, especially for new real estate investors or those with limited capital.

Primary benefit: The easiest platform for creating a diversified residential and commercial real estate portfolio.

While it's best known for its real estate offerings, Fundrise also has a venture capital fund, the Fundrise Innovation Fund, which buys stakes in private, high-growth technology companies.

3. EquityMultiple: best for investing in CRE debt

- Our rating:

- Asset(s): Commercial real estate projects

- Investment minimum: $5,000

- Accessibility: Accredited only

EquityMultiple specializes in commercial real estate and is available only to accredited investors.

Most of its deals are in mid-market commercial real estate, often focused on multi-tenant properties like office buildings, industrial spaces, and apartment complexes.

EquityMultiple offers three types of investments, each with a different risk and return profile:

- Keep: Lower-risk senior debt investments designed to preserve capital while generating steady monthly income. Ideal for investors who want to park cash with minimal volatility.

- Earn: Preferred equity offerings that offer a balance of income and downside protection. These are mid-risk investments with fixed return targets and shorter hold periods.

- Grow: Common equity deals with higher return potential, typically tied to value-add or development projects. These come with more risk and longer timelines but offer the greatest upside.

While most platforms lean heavily on equity deals, EquityMultiple stands out for its strong lineup in the Keep and Earn categories.

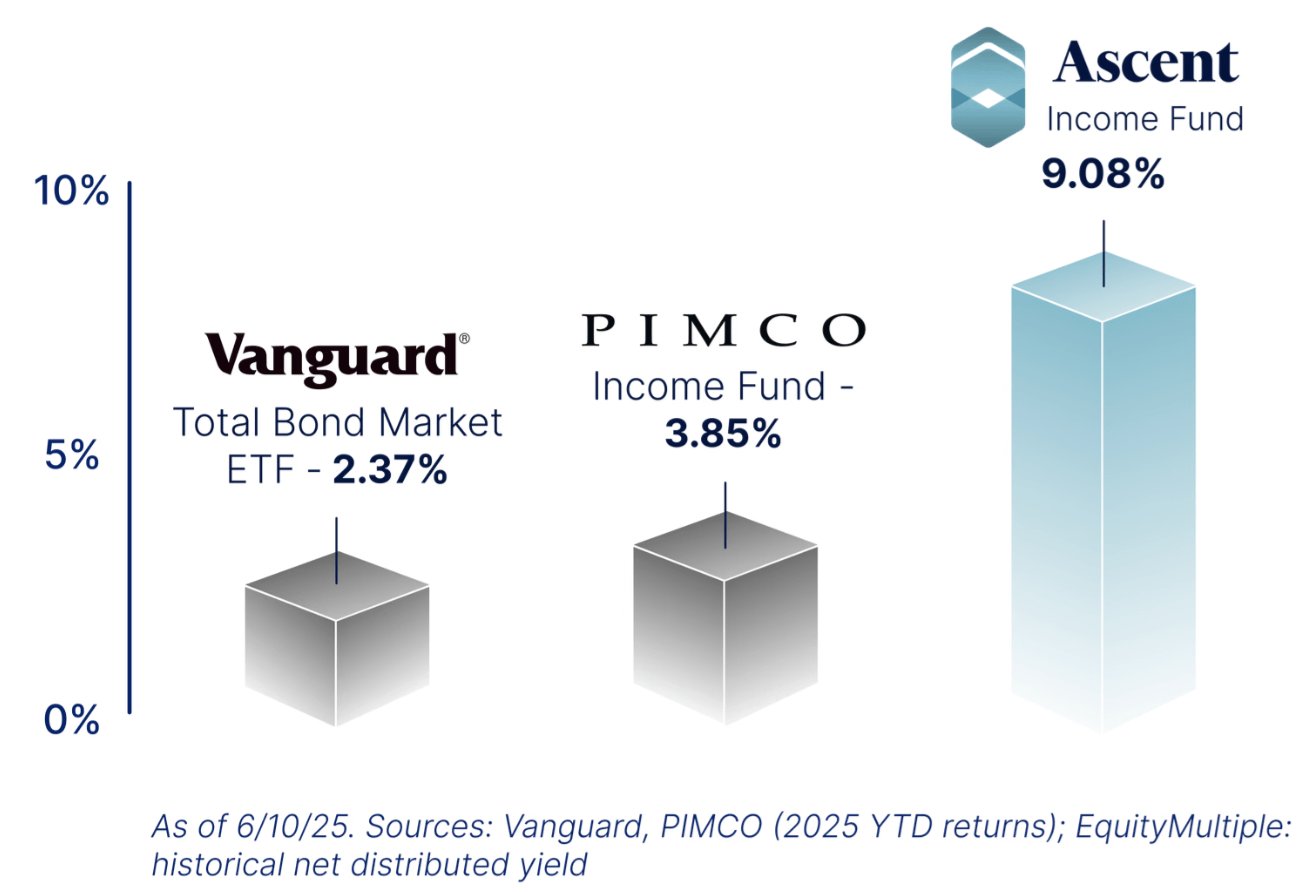

One standout is the Ascent Income Fund, which invests in senior debt positions and has delivered a 9.08% annualized return since inception.

Source: EquityMultiple

Another is the Alpine Note, a series of short-term notes with 3-, 6-, or 9-month term lengths, paying fixed APYs of 6%, 7%, and 7.35%, respectively.

These unique income-focused offerings have helped EquityMultiple grow to more than 48,000 investors nationwide.

Primary benefit: A flexible way to invest in commercial real estate through equity or debt offerings.

4. RealtyMogul: best for investing via private REITs

- Our rating:

- Asset(s): Commercial and multi-family real estate

- Investment minimum: $5,000

- Accessibility: Primarily accredited

RealtyMogul is another commercial real estate investing platform. It invests in apartments, office buildings, industrial properties, and mixed-use developments.

What sets it apart is its focus on private REITs, which offer a simple way to get diversified exposure to commercial real estate without having to pick individual deals.

These REITs are open to non-accredited investors, have relatively low minimums ($5,000), and pay monthly distributions.

Private REITs operate like traditional REITs but aren't publicly traded, which can lead to less day-to-day volatility and more stable income.

They're also professionally managed, meaning the RealtyMogul team handles property selection, due diligence, and ongoing operations on your behalf.

RealtyMogul currently offers two private REITs:

- Income REIT: Designed for investors seeking passive income. It focuses on stabilized, cash-flowing properties like apartments, office space, and retail centers, with the goal of delivering consistent monthly distributions. Since its inception in 2016, it has distributed $45 million to its investors and has paid monthly dividends of 6% (net of fees) for 109 consecutive months.

- Growth REIT: Built for long-term appreciation. It invests in value-add and opportunistic real estate projects, aiming for higher returns over time with less emphasis on immediate cash flow.

Together, these REITs give investors a streamlined way to build a diversified commercial real estate portfolio — whether you're focused on income, growth, or both.

Primary benefit: Simple, tax-efficient, and expertly managed private REIT investing.

5. Groundfloor: best for short-term real estate lending

- Our rating:

- Asset(s): Short-term loans

- Investment minimum: $100

- Accessibility: Any investor

Groundfloor allows you to invest in real estate-backed loans — typically short-term financing for residential fix-and-flip or renovation projects — with minimums as low as $100 per note.

Most loans on the platform have durations of 6 to 12 months and target annualized returns in the 9–11% range. Each loan is graded by Groundfloor's underwriting team (A through G), giving investors a quick view of the risk/return tradeoff.

You can hand-pick individual loans or invest passively through its Flywheel Portfolio, which pools investor funds into 200–400 loans, pays weekly interest, and makes automatic reinvestments.

There are no investor fees on individual loans, but there is a 1% fee on disbursements from the Flywheel Portfolio.

To date, more than 270,000 investors have funded over $2.2 billion through the platform.

Primary benefit: Earn passive income from real estate-backed loans with short durations and low minimums.

6. 1031 Crowdfunding: best for investors with 1031 exchanges

- Our rating:

- Asset(s): DSTs

- Investment minimum: $25,000

- Accessibility: Accredited only

1031 Crowdfunding is built specifically for real estate investors looking to reinvest proceeds from a 1031 exchange.

If you're not familiar, a 1031 exchange allows you to sell an investment property and use the proceeds to buy another — deferring capital gains taxes in the process.

This keeps more capital working for you, allowing you to move into larger or higher-quality properties without triggering an immediate tax bill.

The platform focuses on Delaware Statutory Trusts (DSTs), a legal structure that enables fractional ownership of institutional-grade real estate.

DSTs are commonly used in 1031 exchanges to satisfy the IRS requirements while offering a more passive, hands-off investing experience.

The most common complaint about 1031 Crowdfunding is the relatively high fees (5–7%), which are built into the property contracts rather than charged directly to investors. That said, this fee structure is standard for DST-based 1031 investments.

For many investors, the ability to defer taxes and access quality properties through a turnkey structure more than offsets the higher costs.

Primary benefit: A streamlined way to complete a 1031 exchange using professionally managed, crowdsourced real estate deals.

What is a real estate crowdfunding platform?

Before you sign up and make your first investment, it's important to understand how these platforms actually work.

Real estate crowdfunding platforms pool money from thousands of investors to fund real estate projects — everything from single-family rentals to large commercial developments.

Some platforms act as the direct sponsor and operator, handling everything from deal sourcing to property management. Others function more like marketplaces, connecting individual investors to real estate developers or institutional partners.

In either case, the platform typically vets each project through a due diligence process. Once approved, investors can buy in and earn a share of the rental income and potential profits when the property is sold.

This model allows anyone to invest in real estate (one of the most popular appreciating assets) without the upfront costs, financing headaches, or landlord duties. In many cases, all you need is an account and as little as $10 to get started.

The risks of real estate investing apps

While these platforms make real estate more accessible, they also come with their own risks.

Here are a few to keep in mind:

- Platform risk: You're not just investing in real estate — you're relying on the platform's team to underwrite deals, manage properties, and stay in business for the next 5–10 years. If the platform fails, your investment could be affected.

- Fees and transparency: Many platforms charge sourcing fees, management fees, and profit splits, but they're not always clearly disclosed. These fees can eat into your returns, especially if performance lags.

- Limited liquidity: Most investments are locked up for 5–7 years or more. Even if a secondary marketplace exists, there's no guarantee you will be able to sell, even at a discount.

These aren't reasons to avoid investing entirely, but they are important to understand before committing your capital.

What are the best real estate investor websites?

Real estate investor websites and apps fall into three main categories:

-

Crowdfunding/investing: The best way for investors to get exposure to the real estate market without all of the hassle and with easier diversification.

-

Educational: Best for those who are studying to become independent real estate investors or increase their knowledge.

-

Listing: Best for investors who want to quickly find and evaluate individual property listings in any zip code.

This article is about the best real estate crowdfunding platforms, not educational or listing websites. If those are what you're interested in, here are a few recommendations:

| Educational | Listing |

| BiggerPockets | Zillow |

| Stessa | Redfin |

| YouTube | Roofstock |

| Roofstock Academy | Mashvisor |

| REtipster | FSBO.com |

How we chose the best real estate platforms

When evaluating investment products and services, we consider the following:

- Core offering: How good the product or service is.

- Credibility: Quality of information and data, as well as company and brand reputation.

- Fees: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

Real estate investing used to be a full-time job — one that required serious capital, deep expertise, and a lot of hands-on work. Today, crowdfunding platforms have made it possible for anyone to invest in real estate with just a few clicks.

Whether you're looking for income, long-term growth, or a mix of both, there's a platform tailored to your goals. Just be sure to understand the risks, fees, and time horizon before jumping in.

Used wisely, real estate crowdfunding can be a powerful way to diversify your portfolio and tap into one of the most time-tested paths to building wealth, without needing to become a landlord.

.png)