The 8 Best Real Estate Crowdfunding Platforms

Historically, real estate has been one of the most reliable ways to build wealth.

Unfortunately, due to the upfront costs, skill, knowledge, and time required, this asset class was only available to affluent investors.

But now, thanks to real estate crowdfunding, anyone can start investing in real estate.

Crowdfunding real estate platforms raise capital from many investors, pool the funds together, then use it to invest in rental properties or commercial buildings. After collecting money from investors, the platforms' teams do all the work — evaluating deals, buying properties, managing tenants, and maintaining properties.

Investors can get started with as little as $10 (depending on the platform) and invest in multiple properties at once. It's never been easier to build a diversified real estate portfolio.

However, every platform has its own unique style of investing as well as different minimum investment amounts, fees, and requirements, which can make it hard to determine which one is right for you.

After reviewing dozens of these myself, here's my list of the eight best real estate investment platforms, websites and apps in 2025.

A note on accreditation requirements

Some of these platforms are only available to accredited investors. You qualify as an accredited investor if:

- You have an annual income of $200,000 individually or $300,000 jointly

- Your net worth exceeds $1,000,000, excluding your primary residence

- You are a qualifying financial professional

Each platform's accreditation requirements are noted in the table below.

A quick look at the best real estate crowdfunding platforms

| Platform | Our rating | Asset type | Minimum investment | Accreditation requirement |

| Arrived | Single-family homes | $100 | Any investor | |

| Yieldstreet | Multiple alternative investments | $10,000 | Primarily accredited | |

| Fundrise | Residential and commercial properties | $10 | Any investor | |

| EquityMultiple | Commercial real estate debt | $5,000 | Accredited only | |

| RealtyMogul | Private REITs | $5,000 | Primarily accredited | |

| CrowdStreet | Commercial real estate | $25,000 | Accredited only | |

| Streitwise | Private REITs | $1,000 | Any investor | |

| 1031 Crowdfunding | DSTs | $25,000 | Accredited only |

Disclaimer: Ratings are my opinion.

Keep reading for more detailed breakdowns of why each platform got the above ranking and rating.

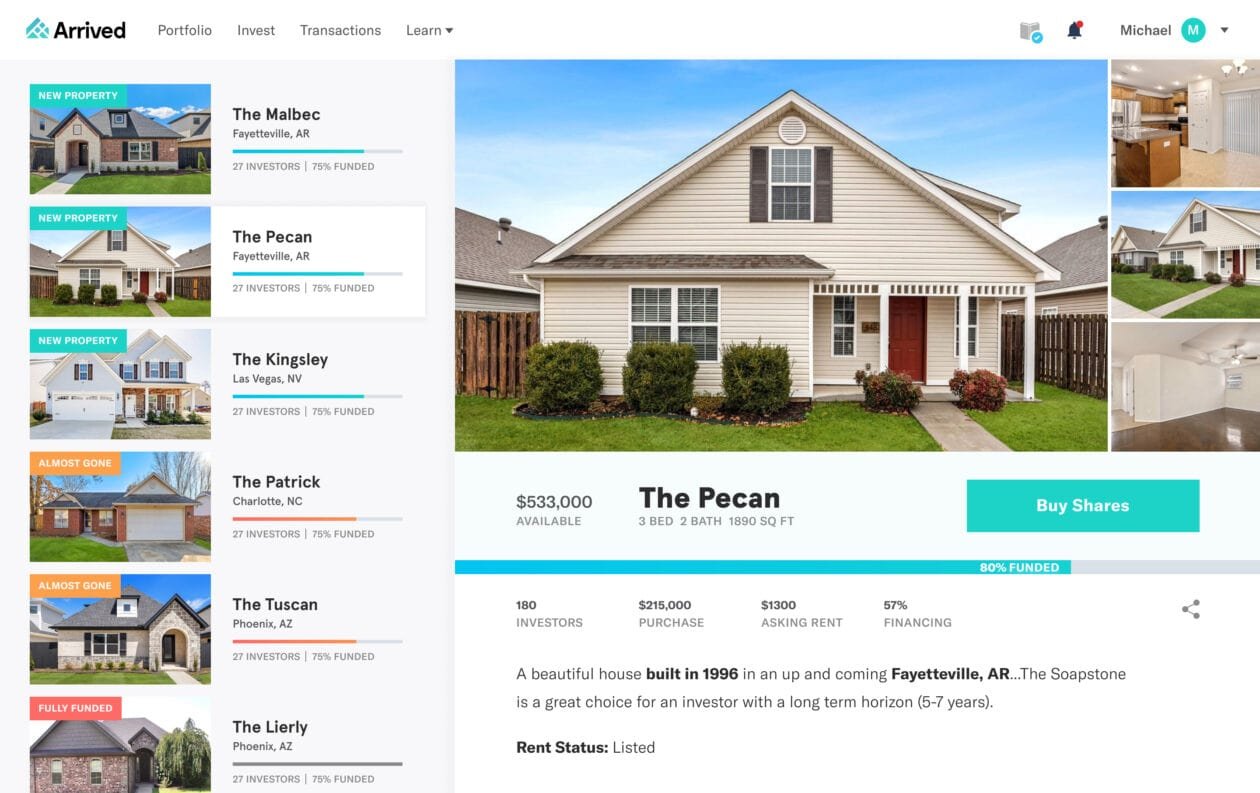

1. Arrived: best real estate crowdfunding platform overall

- Our rating:

- Asset: Single-family homes

- Minimum investment: $100

- Accreditation requirement: Any investor

Arrived is my top pick for the best real estate platform because it is:

- Available to any investor

- Extremely easy to get started

- Has a low minimum investment

- Is generating consistent returns

- Is hyper-focused on one type of real estate

The company only invests in single-family homes — it doesn't invest in multifamily buildings, apartments, or commercial properties. It buys them for both long-term rentals and short-term (vacation) rentals.

Source: Arrived

After purchasing a new property, the company will “securitize” it with the SEC, which allows Arrived to sell individual shares.

When you purchase shares of a property, you directly buy ownership in the individual Series of a Series LLC that owns that home asset.

So if you purchase 1% of the shares in a single home offering, you will be entitled to 1% of the economic interests of the asset over time, including rental income and value appreciation.

While Arrived has mentioned potentially launching a secondary marketplace where investors could sell their shares to one another, currently there is no way to sell your shares until Arrived sells the house.

Most properties listed have a 5- to 7-year target investment horizon, so expect your money to be locked up for at least that long.

A note on holding periods

It's worth mentioning that 7 years is a common minimum holding period for real estate investing, and holding periods should be taken into account when considering an investment.

Investing on Arrived is a simple, 4-step process. Here's how to do it:

- Browse properties: Browse available listings (there are 400+ at the time of this writing).

- Select a property: Choose an investment property.

- Buy shares: Determine an investment amount and buy shares.

- Earn: Collect rental income and watch your price appreciation as Arrived manages your properties.

Primary benefit: With just $100, anyone can start building a real estate portfolio.

2. Yieldstreet: best for investing in multiple alternative assets

- Our rating:

- Asset(s): Real estate and 11 others, including art, private credit, cryptocurrencies, VC, private equity, notes, infrastructure, and a multi-asset class fund

- Minimum investment: $10,000

- Accreditation requirement: Primarily accredited

Yieldstreet is the best overall platform for alternative asset investing, offering 11 assets under one login.

Source: Yieldstreet

More than $6 billion has been invested by 450,000+ investors since the platform's inception in 2015.

Since then, Yieldstreet has generated 9.7% net annualized returns across all of its investments, while a traditional 60/40 stock/bond portfolio returned just 6.5% annualized returns over the same period.

There are two reasons for investing in alternative assets:

- Diversification outside of public markets

- A potentially increased risk/reward ratio

Real estate has repeatedly demonstrated those two characteristics, which is why it's one of Yieldstreet's most popular assets. To date, Yieldstreet has raised over $900M across 100+ real estate offerings and has repaid more than $350M in principal to investors.

Yieldstreet offers every type of real estate deal: commercial, residential, and industrial.

Its real estate offerings are only available to accredited investors, however, and have a minimum investment requirement of $10,000.

Yieldstreet's most popular investment for retail investors is the Yieldstreet Alternative Income Fund. The fund focuses on generating income from a variety of asset classes and is professionally managed, so you get all the benefits of private market diversification without all the work.

Primary benefit: A wide variety of investment options.

3. Fundrise: best real estate investing app

- Our rating:

- Asset(s): Residential and commercial real estate

- Investment minimum: $10

- Accreditation requirement: Any investor

Fundrise is the easiest real estate investing app to get started on. It has a sleek, easy-to-use interface and a minimum investment of just $10.

The company invests in single-family homes, multi-family apartment buildings, and industrial properties. Its current real estate portfolio is worth more than $7 billion, fueled by its 2,100,000+ investors.

Fundrise takes a unique approach to real estate investing by using four strategies to promote well-balanced diversification for its clients, mixing opportunity with reliable income:

Source: Fundrise

Currently, Fundrise's investment team is focused on two trends in the U.S. market: (1) the increased demand for residential space across the Sunbelt and (2) eCommerce-driven industrial spaces.

While it's best known for its real estate offerings, Fundrise also has a venture capital fund, the Fundrise Innovation Fund, which buys stakes in private, high-growth technology companies.

There are 223 active projects currently available on Fundrise. You can invest in REITs, individual deals, and funds. Some of these will be focused on generating income while others are targeting ROE.

Primary benefit: The easiest platform for creating a diversified residential and commercial real estate portfolio.

4. EquityMultiple: best for investing in CRE debt

- Our rating:

- Asset(s): Commercial real estate projects

- Investment minimum: $5,000

- Accreditation requirement: Accredited only

EquityMultiple is focused on just one asset class: commercial real estate.

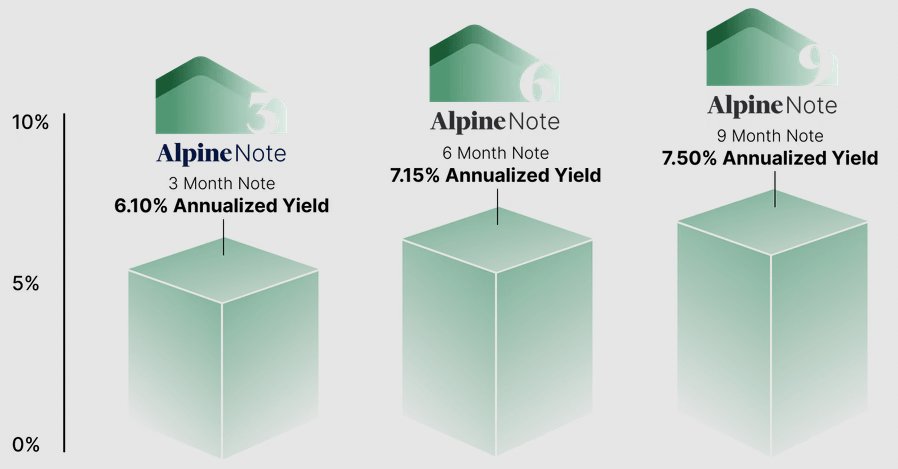

While it has opportunistic and value-add equity offerings, its most popular investments are the Ascent Income Fund and the Alpine Note.

The Ascent Income Fund, which has a $5,000 minimum investment, invests in senior debt positions and has generated 8.4% annualized returns since its inception.

Each investment is backed by commercial real estate assets, making it a great way for yield-focused investors to gain exposure to real estate via debt.

The Alpine Note is EquityMultiple's most popular investment. You can invest with 3-, 6-, or 9-month term lengths which, as of the time of writing, have fixed APYs of 6.10%, 7.15%, and 7.50%, respectively.

Source: EquityMultiple

These two unique offerings have helped the platform grow to more than 48,000 investors across the U.S.

Primary benefit: Easily invest in CRE debt via the Ascent Income Fund or the Alpine Note.

5. RealtyMogul: best for investing via private REITs

- Our rating:

- Asset(s): Commercial, multi-family, and single-family real estate

- Investment minimum: $5,000

- Accreditation requirement: Primarily accredited

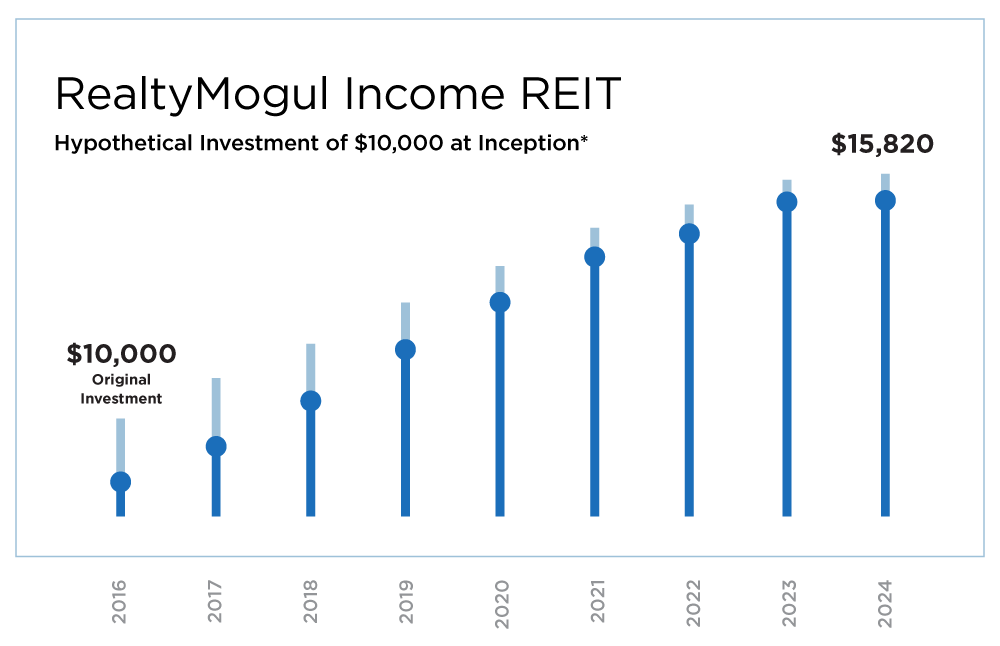

While several other platforms offer real estate investing via REITs, no one is more focused on these investments than RealtyMogul.

REITs provide stable cash flow (via dividends), tax efficiencies, liquidity, and easy diversification. Because of these characteristics, they're a popular investment for retirees.

RealtyMogul has 2 REITs: Income and Growth.

Since its inception in 2016, the Income REIT has distributed $41 million to its investors and has paid monthly dividends of 6% (net of fees) for 100 consecutive months.

Source: RealtyMogul

The Growth REIT is more heavily focused on capital appreciation. It has paid a distribution rate of 4.5% since its inception and has distributed $14.3 million to investors.

Both REITs have $5,000 minimum investments and are available to all investors, accredited or otherwise.

Primary benefit: Simple, tax-efficient, and expertly managed private REIT investing.

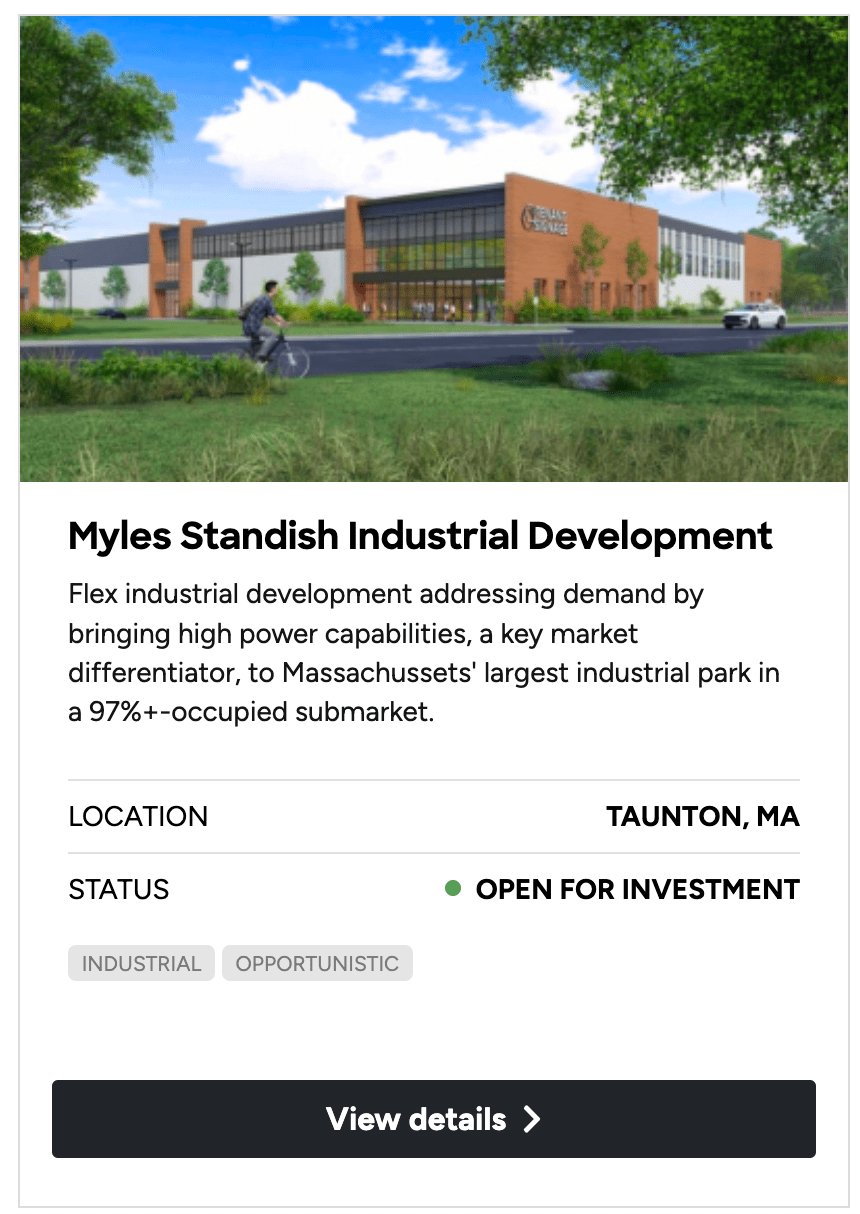

6. CrowdStreet: best for traditional CRE investing

- Our rating:

- Asset(s): Commercial real estate

- Investment minimum: $25,000

- Accreditation requirement: Accredited only

CrowdStreet has invested more than $4.4 billion into commercial real estate, making it one of the largest crowdfunding platforms in the world.

Over the last 11 years, CrowdStreet has funded nearly 800 deals, 216 of which have been sold. Of those 197, the company has generated a 11.2% internal rate of return with an average holding period of just 3.5 years.

CrowdStreet's team of experts — perhaps the company's greatest asset and differentiator — works directly with top real estate developers to bring exclusive projects to its investors.

These projects include hotels, multi-family apartment complexes, storage facilities, industrial parks, and more.

You can invest in individual deals or buy into one of CrowdStreet's Diversified Funds.

Source: CrowdStreet

Given CrowdStreet's track record and team of real estate professionals, you may be wondering why it's not higher on the list.

CrowdStreet's minimum investment of $25,000 is restrictive for many investors, and it's only available for accredited investors. If you're an accredited investor and aren't inhibited by the high minimum, CrowdStreet could be your best option.

Primary benefit: A team of real estate professionals with a track record of high performance.

7. Streitwise: best non-accredited REIT investing platform

- Our rating:

- Asset(s): Private REITs

- Investment minimum: $1,000

- Accreditation requirement: Any investor

Streitwise is another investing platform that is available to both accredited and non-accredited investors alike. Of all the websites on this list, Streitwise doesn't seem to be as popular as it should be and is flying under the radar just a little bit.

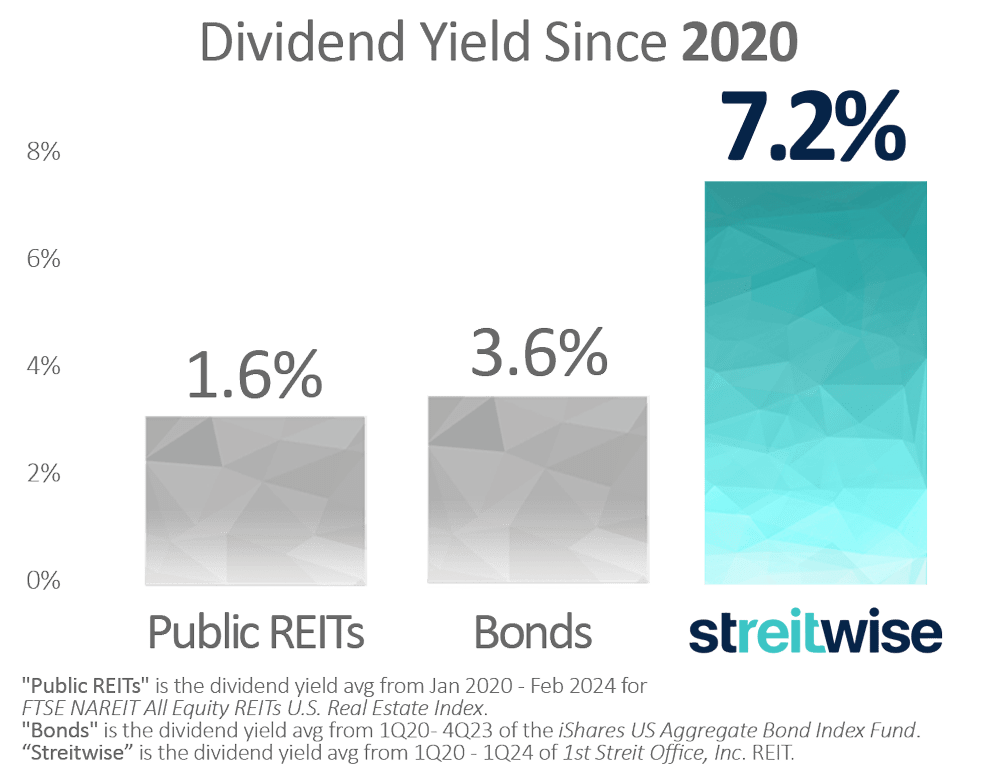

You can invest in individual deals or the Streitwise REIT, which has averaged a 7.2% dividend since 2020:

Source: Streitwise

There are a few things about Streitwise that stand out to me, which is why I feel it deserves a place on this list:

- Jeffrey Karsh, the founder and CEO, has $20 million of his own money in the REIT.

- Streitwise's sponsor — Tryperion Holdings — has generated an annualized 25.4% IRR on all realized investments (as of Q4 2023) since 2013, which is not a bad track record.

- The platform is easy to navigate and there are the right number of offerings, to where you can choose which one is best for you without being overwhelmed by options.

- Streitwise is available to both U.S. and foreign investors.

Primary benefit: An excellent track record over the last 10 years and has the potential to become very popular over the next few years.

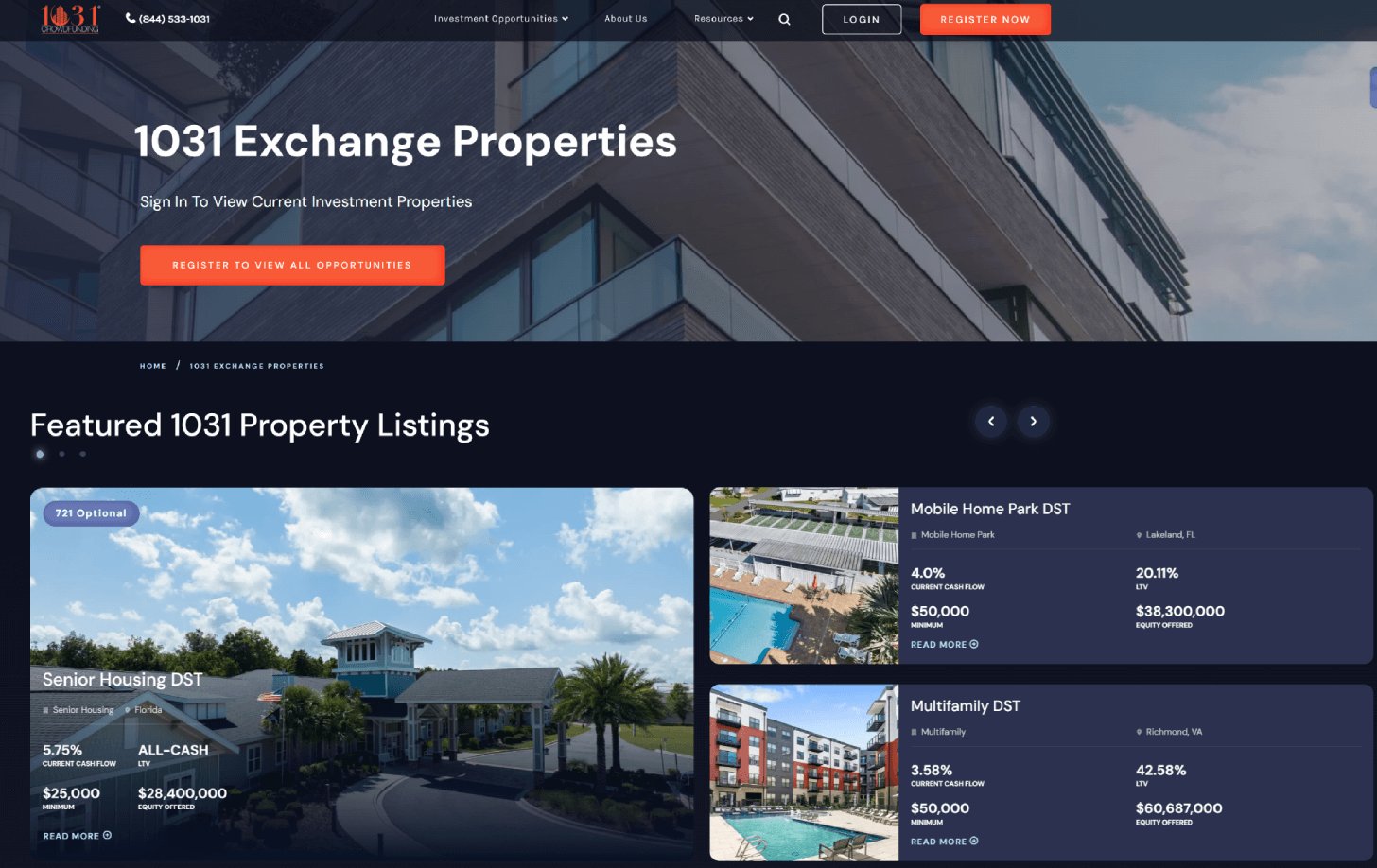

8. 1031 Crowdfunding: best for investors with 1031 exchanges

- Our rating:

- Asset(s): DSTs

- Investment minimum: $25,000

- Accreditation requirement: Accredited only

If you're reinvesting real estate funds through a 1031 exchange, this is the platform for you.

1031 Crowdfunding specializes in providing real estate investors with funds from 1031 exchanges access to crowdsourced real estate investments.

If you don't know, a 1031 exchange allows real estate investors to sell an investment property and use the proceeds to buy another investment property with no immediate tax consequences.

By deferring the taxes owed from the sale, more capital is freed up for investments in bigger, more expensive properties.

A Delaware Statutory Trust (DST) is the type of legal entity used to enable crowdfunded 1031 exchanges.

Source: 1031 Crowdfunding

The most common complaint about 1031 Crowdfunding is the relatively high fees (5–7%), which are built into the property contracts and not explicitly paid by investors. This is a typical fee structure for this type of tax-deferred investing.

For many investors, the value received from the tax savings and the quality of available investments more than offset the fees charged.

Primary benefit: Crowdsourced real estate investments that meet the obligations required for investors who are deferring taxes through a 1031 exchange.

What is a real estate crowdfunding platform?

Before creating an account and making your first investment, it's important to know the details of how these platforms work.

Real estate crowdfunding platforms work by pooling funds from thousands of investors to invest in real estate projects and properties.

These platforms either serve as the investors and managers themselves or act as the middlemen, connecting individual investors with real estate developers.

The platforms may evaluate deals, make offers, buy properties, renovate, or develop, and then list the properties for rent or sale.

After a project passes the due diligence process, investors can buy in and will then collect their portion of rental income and, when the deal is closed, any capital appreciation.

In this way, you can invest in real estate (one of the most popular types of appreciating assets to invest in) with nothing more than an account and as little as $10, leveraging the years of transaction experience and skills of the professionals working on the platforms.

What are the best real estate investor websites?

Real estate investor websites and apps fall into three main categories:

-

Crowdfunding/investing: The best way for investors to get exposure to the real estate market without all of the hassle and with easier diversification.

-

Educational: Best for those who are studying to become independent real estate investors or increase their knowledge.

-

Listing: Best for investors who want to quickly find and evaluate individual property listings in any zip code.

This article is about the best real estate crowdfunding platforms, not educational or listing websites. If those are what you're interested in, here are a few recommendations:

| Educational | Listing |

|

|

|

|

|

|

|

|

|

|

How we chose the best platforms

When evaluating investment products and services, we consider the following:

- Core offering: How good the product or service is.

- Cost: Overall price, value for money, average cost per month, and any hidden fees.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of information and data as well as company and brand reputation.

- Audience: Who the product is for, the range of uses and applications, whether it actually works for its target audience, if it's the best option available, and any limitations therein.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

With daily volatility in the stock and bond markets, the draw to real estate investing is clear — everybody could use some stable capital appreciation and reliable cash flow.

While there are a number of real estate investment websites to choose from, all of them have slightly different offerings and strategies.

Now you should have a better understanding of which one is right for you based on your investment objectives, time horizon, and financial goals.

Regardless of your exact personal situation, it's never been easier to build a diversified real estate portfolio.

.png)