Seeking Alpha vs The Motley Fool vs Morningstar vs Zacks: Which Is Best?

Seeking Alpha, The Motley Fool, Morningstar, and Zacks are four of the most popular investment research websites for individual investors.

Although they may seem similar and share a few features, each was built with entirely different users in mind.

The key is knowing how they differ — after that, picking the right one is easy.

In this article, I cover what makes each of these websites popular, what products they offer, how much each of them costs, and what you'll get as a customer.

Here's everything you need to know to determine which one of these services is right for you.

A quick look

| Seeking Alpha | Motley Fool | Morningstar | Zacks | |

| Rating | ||||

| Best for | Premium investment research + momentum-based stock picking | Fundamental-based stock picking | Researching ETFs and mutual funds | Free stock rating system based on earnings estimate revisions |

| Type of service | Self-directed and done-for-you | Done-for-you | Self-directed | Self-directed |

| Type of investor | Beginner + Advanced | Any | Advanced | Advanced |

Seeking Alpha — Overview

Products: Seeking Alpha Premium, Alpha Picks

Seeking Alpha is an investment research website that provides fundamental data, news, stock screeners, portfolio tools, and a quantitative stock grading system — all the tools necessary for investors to perform their own due diligence.

But the website is best known for its comprehensive investment research.

Seeking Alpha crowdsources investment analysis from more than 18,000 experienced investors and analysts who collectively produce more than 10,000 research reports per month.

Each of these reports contains a detailed analysis of a stock and how the author expects it to perform in the future.

You can access a few of these articles per month for free, but beyond that, you will bump into a paywall for Seeking Alpha Premium.

Seeking Alpha also sells Alpha Picks, a momentum-based stock picking service fueled by the data on the website.

More on both of these products below.

Seeking Alpha Premium

- Service type: Stock research and opinionated analysis

- Rating:

- Cost: $299/year ($269 + 7-day free trial with this link)

As mentioned above, you will run into a paywall for Seeking Alpha Premium after getting a few analysis articles for free.

If your stock research process looks anything like mine, you'll hit that paywall rather quickly (which is why I've been a Premium user for 6+ years).

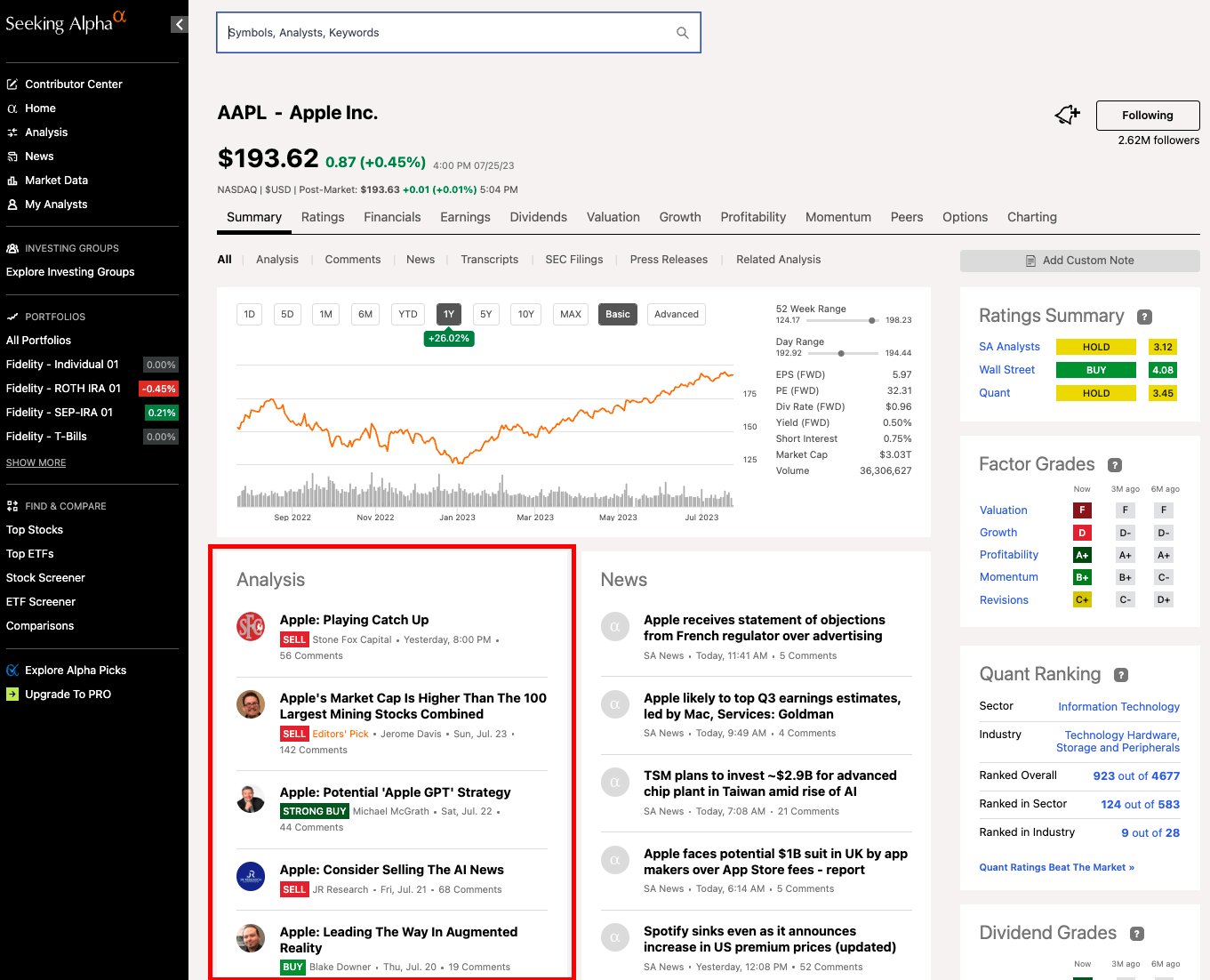

Seeking Alpha is typically where my research begins. For example, if I'm thinking about investing in Apple, I'll look it up and read the latest articles from different analysts and see whether they think it's a buy, sell, or hold.

These articles help me quickly get a feel for the narratives surrounding a company — what the bull case is, what the bear case is, and how investors think different macroeconomics will affect the stock.

This helps me conduct a much more thorough analysis (and find things I may have missed) in less time than it would take to do solely my own research.

I also use Seeking Alpha to evaluate my existing portfolio. About once per month, I look up all of the stocks I own and make sure I'm aware of any changes that may materially affect their businesses.

Since there are varied opinions (bulls and bears) all in one place, I can get a complete picture of each of my stocks in about 30 minutes.

A Premium subscription will unlock access to everything Seeking Alpha has to offer (except for Alpha Picks):

- Analysis: Read a seemingly unlimited amount of research on your favorite stocks. More than 10,000 stock reports are published every month.

- Ratings: See every stock's quantitative ratings, Wall Street analyst ratings, and contributor ratings.

- Financial data: Get full financial data (income, balance sheets, and cash flow statements), growth trends, and projections.

- Factor grades: Stocks are graded based on valuation, growth, profitability, momentum, and earnings revisions.

- Dividend grades: Companies' dividends are graded based on safety, growth, yield, and consistency.

- Other: News, stock screener, and portfolio tools.

I use the analysis section the most, but also reference the Quant Ratings, Factor & Dividend Grades.

Premium comes with a 7-day trial, so you can use it, see if you like it, and decide whether to pay for it based on your experience.

Alpha Picks

- Service type: Stock-picking newsletter

- Rating:

- Cost: $499/year ($449 introductory offer with this link)

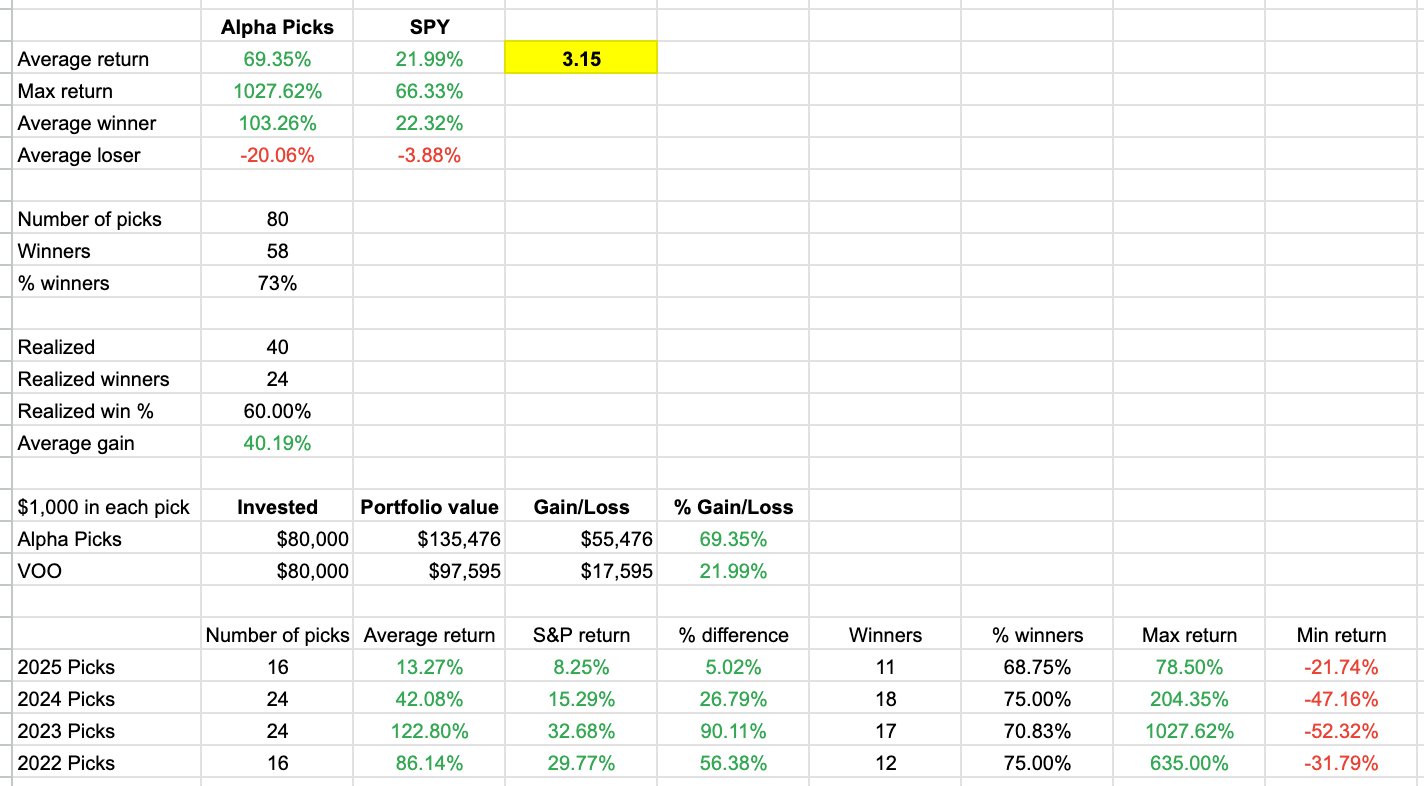

Seeking Alpha also offers Alpha Picks, a momentum-based stock-picking service that provides 2 new recommendations per month. The service was launched in July 2022, and the performance since then has been excellent.

The team analyzes stocks that have been outperforming their peers and then uses a number of quantitative tools to gauge which stocks are most likely to continue their streaks of outperformance.

If a stock's strong price action is supported by improving fundamentals, it becomes a candidate for the portfolio.

I've tracked the performance of every new recommendation since the service was launched. As of September 2025, Alpha Picks has returned 3.15x the S&P 500.

View this sheet | Disclaimer: Past performance does not guarantee future results.

If you're looking for a done-for-you investing service where all you need to do is follow a team's recommendations, Alpha Picks is an excellent option.

However, there are two main drawbacks to Alpha Picks:

- It's more expensive than The Motley Fool's Stock Advisor (more on it below).

- It's a relatively new service and has yet to be tested over multiple market cycles.

Still, the results through the first 3+ years are very strong.

The Motley Fool — Overview

Products: Stock Advisor, Epic

The Motley Fool is a financial services and media company that was founded in 1993 by brothers Tom and David Gardner.

While Seeking Alpha primarily provides the tools and information you need to perform your own investment research, The Motley Fool does the investment research for you via its stock-recommendation services.

Its two most popular products are Stock Advisor and Epic.

Stock Advisor

- Service type: Stock-picking newsletter

- Rating:

- Cost: $199/year ($99 introductory offer with this link)

Stock Advisor is The Motley Fool's flagship product and has over one million subscribers.

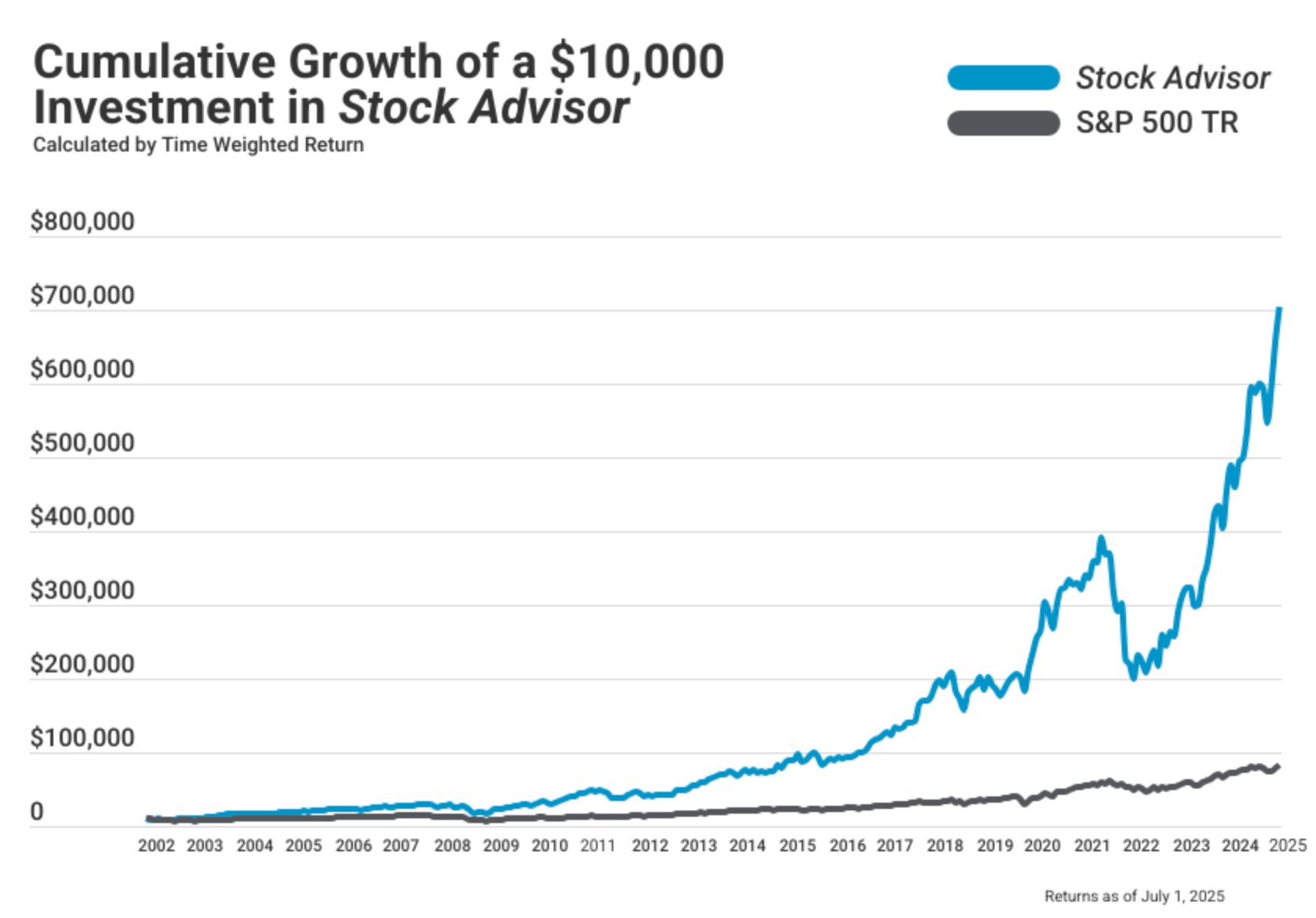

Since its inception in 2002, Stock Advisor has achieved impressive results, having outperformed the S&P by 5.7x (1,034% to 180%) as of July 2025.

Disclaimer: Past performance does not guarantee future results.

The Stock Advisor investment team is looking for companies with robust competitive advantages and strong growth potential. The team generally recommends stable, well-established businesses.

The Motley Fool is known for its long-term, buy-and-hold approach. Each of its stock recommendations is expected to be held for at least 5 years.

While the service has performed very well over the last 20+ years, you should still expect some volatility.

Even if the team recommends winning stocks over the long run, you will experience drawdowns, and you need to be ready to weather the inevitable downturns.

In addition to the two monthly stock picks and accompanying analysis, a subscription to Stock Advisor will come with access to a list of the team's best stocks to buy now, educational content, and an online community.

Epic

- Service type: Stock-picking newsletters

- Rating:

- Cost: $499/year ($299 introductory offer with this link)

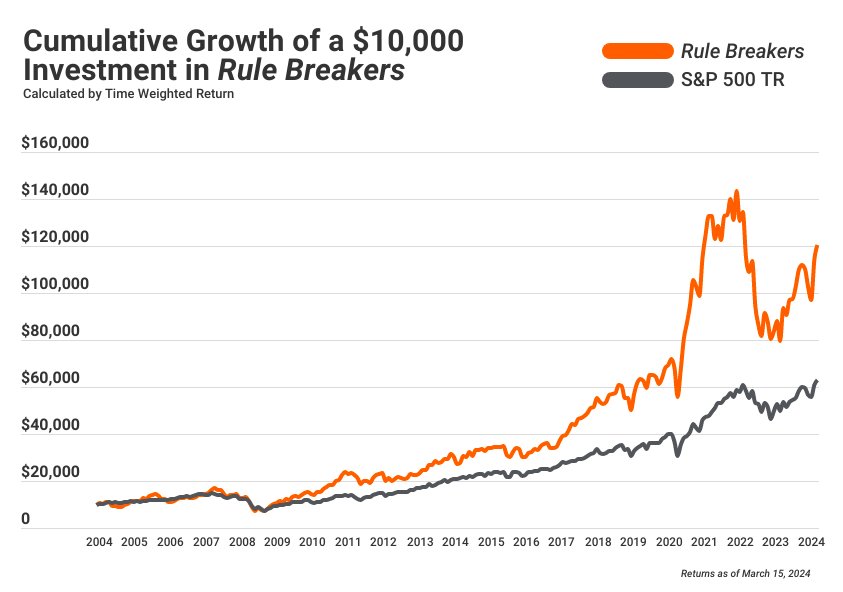

The Motley Fool recently combined several of its most popular products,* including Rule Breakers, into one subscription called Motley Fool Epic.

*Stock Advisor, Rule Breakers, Hidden Gems, and Dividend Investor are all included in Motley Fool's new Epic service.

Rule Breakers, like Stock Advisor, is a stock-picking newsletter that provides two new stock picks per month. Rule Breakers also gives subscribers a list of the best stocks to buy now, some educational material, and access to an online community.

It has also outperformed the market.

Disclaimer: Past performance does not guarantee future results.

While Stock Advisor tends to focus on well-established businesses, the Rule Breakers team invests in disruptive companies with the potential to reshape entire industries.

Because of this investment strategy, the Rule Breakers portfolio tends to be even more volatile than Stock Advisor's. The team regularly invests in stocks with very high or negative P/E ratios — it's a more speculative service overall.

Rule Breakers is only available through Motley Fool Epic, a subscription level that also comes with access to Stock Advisor and several other services. In total, Epic subscribers receive 5 new stock recommendations per month.

Morningstar — Overview

Product: Morningstar Investor

Morningstar is best known for its independent, objective research.

Unlike Seeking Alpha, which crowdsources its investment research from third-party contributors, all of Morningstar's analysis is written in-house by its team of professionals.

As such, it caters to a slightly more sophisticated investor and is frequently used by financial advisors and other professionals. Morningstar has an excellent reputation in the investment industry.

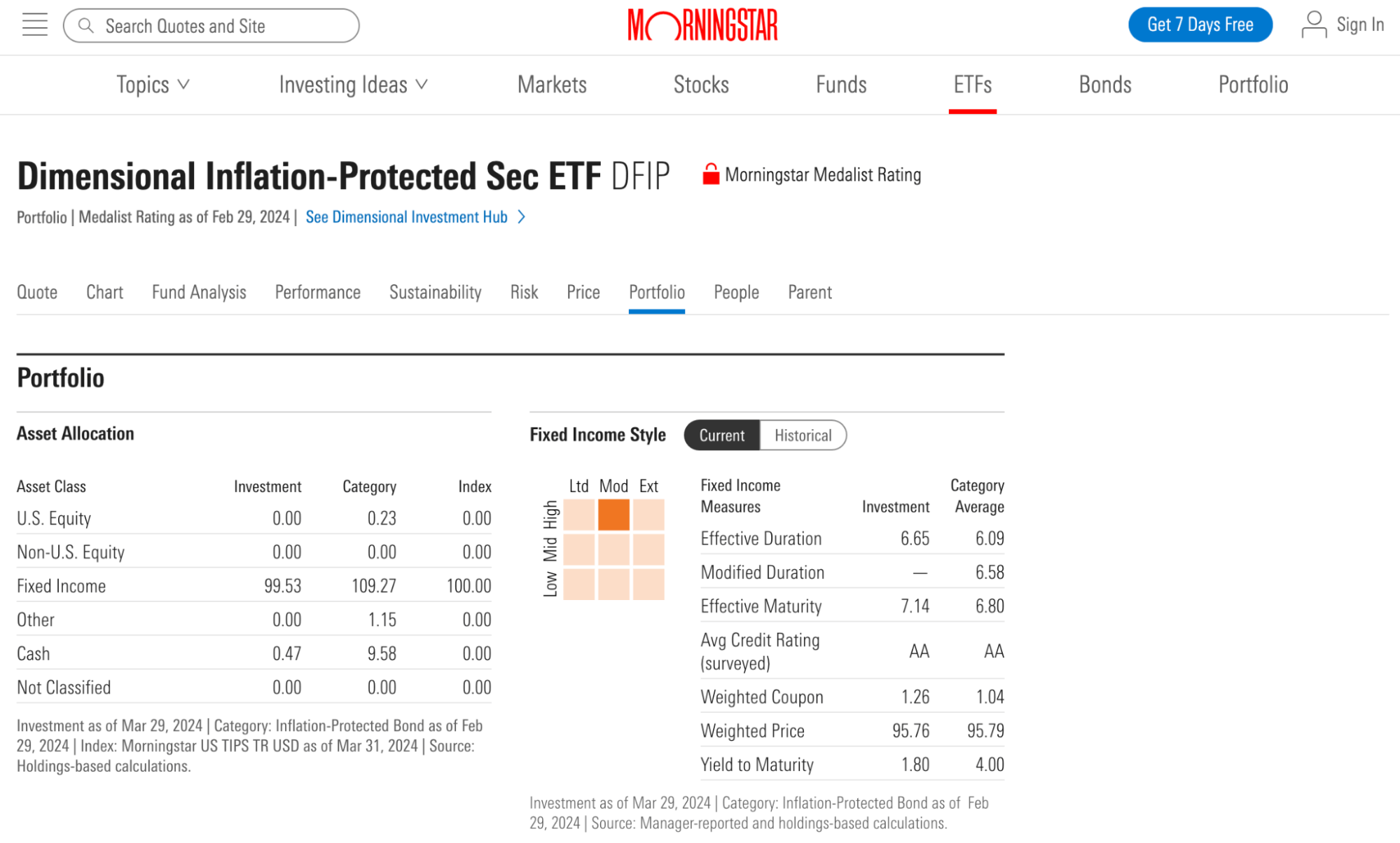

Out of the four websites on this list, Morningstar provides the most value for free, and it's especially useful for researching ETFs and mutual funds.

To unlock its ratings information and lists of investment ideas, however, you'll need to upgrade to Morningstar Investor.

Morningstar Investor

- Service type: Stock and fund research

- Rating:

- Cost: $249/year ($199 + 7-day free trial with this link)

A subscription to Morningstar Investor will unlock Morningstar Ratings for stocks and funds, which you can use to find or compare investments.

The rating system uses various valuation and performance metrics, which cover a broad range of data and focus on the factors that drive long-term value (like sales, earnings growth, and valuation).

You also get access to Morningstar's analysts' pre-filtered investment lists to get ideas straight from the team or set up your own screener utilizing more than 200 unique data points.

Plus, its newsfeed and continuous analysis will help you stay on top of why your stocks are moving. Unlike Seeking Alpha, this analysis is opinion-free, giving you the space to draw your own conclusions.

Morningstar Investor also comes with a number of portfolio analysis tools to measure your asset allocation across regions, industries, and valuations, so you always know exactly how concentrated you are in each area.

Your own system of ratings, investment ideas, objective analysis, and portfolio insights — that's what you'll get with Morningstar Investor.

Zacks — Overview

Product: Zacks Premium

Zacks was founded in 1978 by Len Zacks, an MIT researcher who discovered “the most powerful force impacting stock prices.”

What he discovered was that when Wall Street analysts adjusted their earnings estimates, stock prices tended to follow in the near- to medium-term.

Therefore, tracking these adjustments (which could be higher or lower) could be a leading indicator of movements in stock prices.

Based on these findings, the Zacks Rank system was built. It grades stocks on a scale from #1, “Strong Buy,” to #5, “Strong Sell.”

Zacks Premium

- Service type: Stock research and recommendations

- Rating:

- Cost: $249/year (30-day free trial with this link)

A Zacks Premium subscription will give you complete access to the ranking system.

You can look up any stock's Zacks Rank or look at all of the stocks on the #1 “Strong Buy” list (which you may want to buy) and the #5 “Strong Sell” list (which you may want to avoid).

However, as I cover in my Zacks Premium Review, there are a few problems with the service:

- The system is outdated: When the system was launched in the 1970s, Len Zacks uncovered a real market inefficiency. But now that everyone knows about it, that inefficiency no longer exists — investors know how analysts' estimate revisions impact stock prices and price stocks accordingly.

- Seeking Alpha also has the data point: To further the point made above, Seeking Alpha shows analysts' estimate revisions (alongside all of its other data points), so a subscription to Seeking Alpha also includes the Zacks Rank system.

- You don't actually need Zacks Premium: You can look up an unlimited number of stocks on Zacks and get their Zacks Rank without paying for Premium.

- Zacks performance reporting has limitations: Zacks spells out various disclosures about its performance data. Based on these disclosures, don't expect to get the same results its system advertises.

For these reasons, I personally don't find a subscription to Zacks Premium to be worth it.

Pro and con summary

Below is a summary of each service's main benefits and drawbacks.

Seeking Alpha

| Pros | Cons |

|

|

The Motley Fool

| Pros | Cons |

|

|

Morningstar

| Pros | Cons |

|

|

Zacks

| Pros | Cons |

|

|

How they compare head-to-head

If you're having a hard time deciding between two of these services, here are short head-to-head comparisons of each.

The Motley Fool vs Seeking Alpha

The Motley Fool provides stock recommendation services, whereas Seeking Alpha Premium is an investment research website where you can do your own analysis.

If you want to compare The Motley Fool's and Seeking Alpha's stock picking services, see my Stock Advisor vs Alpha Picks article.

The Motley Fool vs Zacks

Of these two, The Motley Fool provides done-for-you stock picking services, whereas Zacks provides stock ranks based on its proprietary system.

If you're considering Zacks Premium, I'd recommend Seeking Alpha Premium instead. You can see why in my Zacks Premium Review.

The Motley Fool vs Morningstar

If you're looking for stock picks, choose The Motley Fool. I cover its flagship service in detail in this Motley Fool Stock Advisor Review.

If you're looking for objective analysis and ratings on stocks, ETFs, and mutual funds, choose Morningstar.

Seeking Alpha vs Morningstar

Seeking Alpha's analysis is subjective, opinionated, and crowdsourced from thousands of contributors. It also has more ratings data and more tools for quantitative analysis.

Morningstar's analysis is more objective and professional, and the same is true about its ratings.

If you want opinions, choose Seeking Alpha. If you want objectivity, choose Morningstar.

Seeking Alpha vs Zacks

Seeking Alpha has earnings estimate revisions (which is what Zacks is built on) and so much more. Just choose Seeking Alpha.

Final verdict

Seeking Alpha Premium is my favorite service for premium investment research. Its robust set of tools, ratings, and stock market analysis makes it a great resource for many investors.

If you're new to the stock market, don't have time to do your own research, or would rather use a stock picking service, you'll want to check out Alpha Picks, Stock Advisor, or Rule Breakers.

For the best portfolio tools, objective analysis, and fund ratings, Morningstar is the service for you. It also has a lot of free information, so I'd encourage you to try using it for your fund research even if you aren't interested in Morningstar Investor.

Of the services on this list, Zacks Premium is the one I would definitely skip.