What Is Private Credit? Pros, Cons, and How to Invest

Private credit is a form of lending provided by non-bank institutions to businesses that can't (or don't want to) borrow from traditional banks.

Most private credit borrowers are mid-sized companies that generate between $10 and $150 million per year of EBITDA, making them too large to borrow from traditional banks.

But because they're privately held, they can't issue bonds on the public markets, so they turn to the private credit market instead.

The private credit market is made up of non-bank lenders like pension funds, endowments, credit funds, insurance companies, and institutional asset managers.

These firms negotiate directly with borrowers to structure customized loans, often at higher interest rates and with stricter terms than traditional bank financing.

While private credit existed before the 2008–2009 Global Financial Crisis, post-crisis banking regulations made it harder for traditional lenders to serve this segment of the market.

As a result, major institutions — like Blackstone, KKR, and Apollo — have poured hundreds of billions into private credit, making it an increasingly important part of their portfolios.

And while private credit used to be exclusively available to institutional investors, that's no longer the case — individual investors can also now invest in the asset class.

Here's everything you need to know about private credit and how to invest in it.

Where to invest

Our favorite platform for investing in private credit is Percent. More on it below, and in our Percent review.

The market for private credit

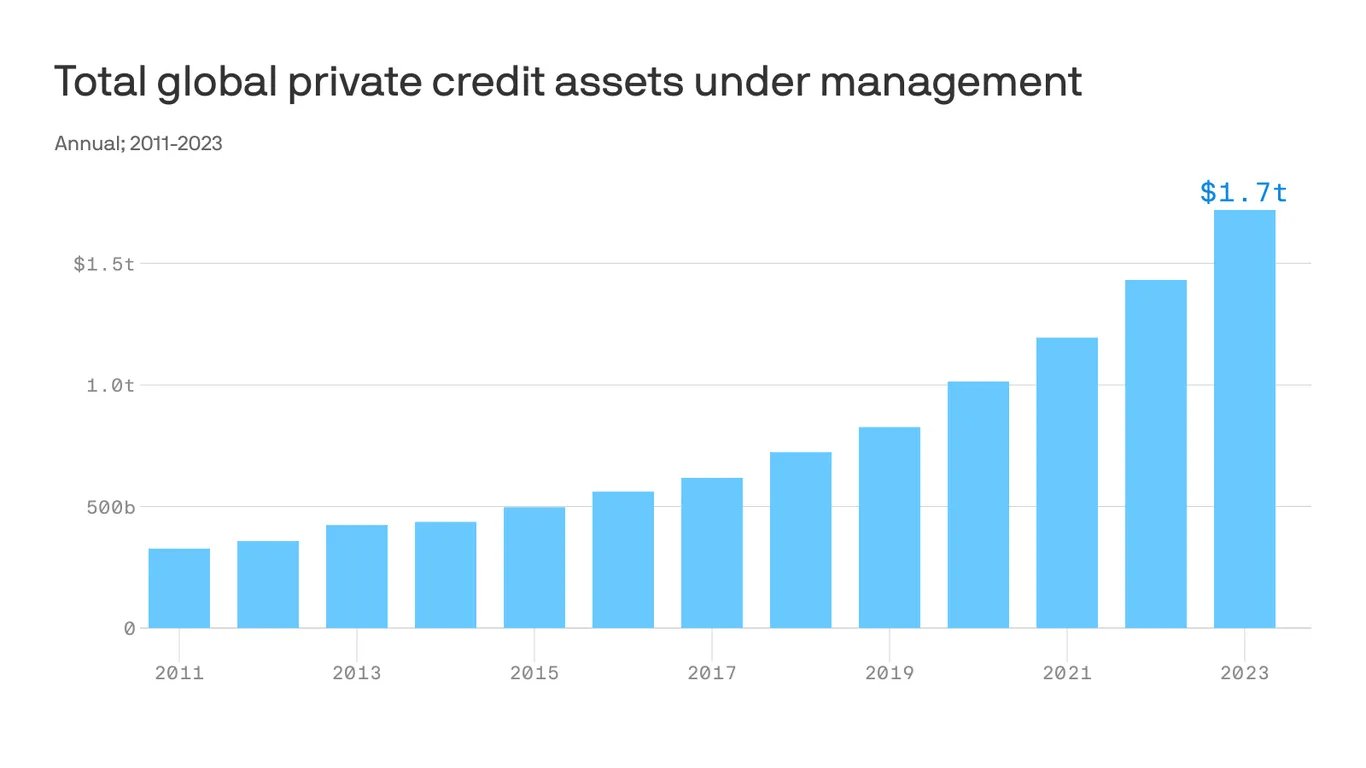

Following the Global Financial Crisis, the private credit market swelled from roughly $375 billion in assets to over $1.7 trillion by 2023.

Source: Axios

BlackRock projects private credit will exceed $3.5 trillion by 2028.

The growth is coming from both sides: businesses needing flexible capital and investors chasing yield in a low-rate environment.

On the borrower side, companies have increasingly turned to private credit for speed, certainty, and customization.

Unlike traditional bank loans, these deals are often negotiated directly and tailored to the borrower's specific needs — two benefits that have scaled alongside the market, giving borrowers more leverage and optionality than ever before.

On the investor side, private credit's double-digit yields, low default rates, and short durations have made it an attractive alternative to traditional fixed income.

The risk-adjusted returns are hard to ignore, which is why Blackstone has amassed over $500 billion in private credit, making it one of the firm's largest and fastest-growing strategies.

Now, let's take a closer look at the typical terms in a private credit deal.

Why invest in private credit?

To secure funding, private credit borrowers must offer lenders better terms than what's available in public markets.

Most deals are unique, but they tend to share four key traits:

- Higher yields

- Low default rates

- Short-term durations

- Low correlation to public markets

Here's a closer look at each, along with some data from Percent — a leading private credit platform for individual investors.

1. Higher yields

The most obvious thing for private credit borrowers to offer lenders to attract capital is a higher yield. But how much higher?

On Percent, the historical weighted average APY (annual return) has been 14.47% on matured deals since its inception in 2018.

For perspective, junk bonds (high-yield bonds that have a credit rating of BBB or lower) are currently paying 6.68%.

2. Low default rates

Your next question should be, “Yes, but what are the default rates?”

Since 2018, Percent has had a 3.00% default rate, roughly the same as the 2–3% of junk bonds that defaulted in 2023.

These favorable risk-adjusted returns (higher yields at lower default rates) are the main draw for private credit investors.

3. Short-term durations

As of 2025, the average term length for deals on Percent is 16.6 months.

Short-term durations allow for greater portfolio flexibility, enhanced liquidity, lower interest rate risk, and lower default risk.

Interest rate risk

Interest rate risk is the risk of losing value on an investment due to changes in the interest rate, and is especially applicable to longer-term bonds losing value in a rising interest rate environment.

In a rising interest rate environment, newly issued bonds will have higher yields than older bonds, which drives the prices of the older bonds lower.

The shorter the maturity date on the bonds you hold, the less exposure you have to this risk.

While private credit investing does require more maintenance than buying 10-year Treasury bonds (more frequent purchases), most income-seeking investors appreciate this added layer of flexibility.

4. Low correlation to public markets

Like other alternative investments, private credit allows investors to diversify their portfolios outside of traditional public markets (stocks and bonds).

While stocks and bonds are supposed to move in opposite directions, they have become increasingly correlated over the years, oftentimes moving in total lockstep with one another.

Private credit investments, on the other hand, are not actively traded on any secondary exchange, so investors are not subject to the daily volatility seen in publicly traded fixed-income markets.

By allocating some money to private credit, investors may increase the stability of their portfolios.

Private credit vs public bonds

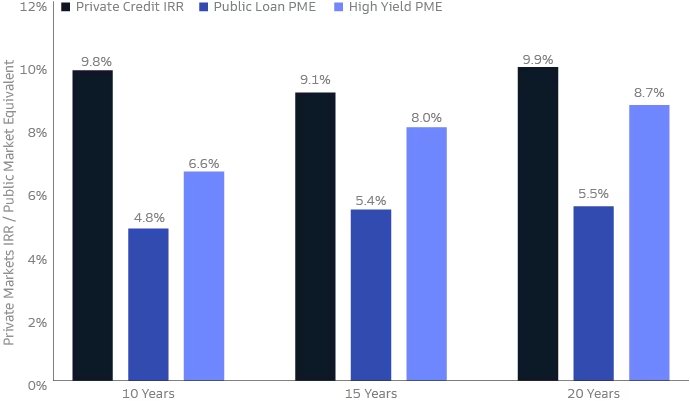

In the 10-, 15-, and 20-year periods ending December 2021, private credit outperformed the total public bond and the junk bond markets by solid margins:

Source: Goldman Sachs Asset Management

This strong performance, especially relative to its risk, has led to private credit being one of Wall Street's favorite asset classes. Many of the largest asset managers have raised hundreds of billions of dollars for their private credit funds.

Drawbacks to investing in private credit

While there are obvious benefits to investing in private credit, this asset class does come with its own set of drawbacks.

- Lack of liquidity: It's often difficult or even impossible to sell private credit investments on the secondary market. When you invest in a deal, you should expect your cash to be locked up for the duration of the loan.

- Limited transparency: Unlike in the public markets, there isn't much public information about the companies you're lending money to, making you much more reliant on the due diligence process of the platform you're investing through.

- Complex structures: Each deal has its own set of terms and conditions. These may include covenants, securities arrangements, and other contractual provisions. You will either need to sort through these details on your own or trust that your investing platform is offering high-quality investments.

- Concentration risk: Private credit offerings are usually sold to only a few investors in relatively large sums. Depending on the minimum investment and the size of your portfolio, this may cause you to be over-concentrated in one or a few positions. That said, many of Percent's deals have minimum investment amounts of just $500.

If you're considering investing in private credit, you should be aware of and comfortable with these risks. While its historical performance has been great, private credit is still considered a new and somewhat speculative asset class.

Private credit isn't the only private market asset class. For more, see our article on private market investing.

How to invest in private credit

Assuming you've weighed the pros and cons and decided to add private credit to your portfolio, here are the steps you should take:

- Confirm your accreditation status: To invest in private credit, you must be an accredited investor.* You qualify as an accredited investor if a) you have annual income of $200,000 (or $300,000 jointly) or b) your net worth excluding your primary residence exceeds $1 million.

- Register with an investment platform: You'll need to sign up for an investment platform that allows individual investors to invest in private credit. We like Percent. Percent is the only platform dedicated to private credit investing.

- Define your allocation amount: Next, you need to determine how much of your portfolio to allocate to private credit. KKR suggests high net worth households should invest up to 30% in alternative assets, with 10% going to private credit, although this is likely to be on the high end for most investors.

- Research investments: After you've created an investment account, you need to research and decide which investments to make based on their available listings and your financial goals.

- Make a purchase: Invest in your first private credit deal.

*If you're not an accredited investor but want to invest in income-focused alternative investments, check out Willow Wealth's Alternative Income Fund. The fund invests in multiple alternative asset classes, including private credit.

Final verdict

Private credit has grown into a multi-trillion-dollar asset class and a favorite of institutional investors.

But now, accredited investors can also access the private credit market. With strong risk-adjusted returns, low correlation to public markets, and short-term durations, it's worth considering as part of a diversified portfolio.

Frequently asked questions

Below are a few more questions you may have about private credit.

Public credit vs private credit: what's the difference?

The main difference between the public and private credit markets is who the borrowers are.

- Public credit: In the public credit market, the borrowers are government entities (local, state, and federal) and publicly traded companies.

- Private credit: The private credit market serves non-public entities (everybody else).

There are several other secondary differences.

The public market is easier to access, has more liquidity, has a higher degree of transparency, is more heavily regulated, has more investors, and is much larger than the private market.

What is a private credit fund?

A private credit fund is an investment that pools money from multiple investors and invests in private credit deals. These funds are managed by professional investors who source, analyze, and manage all of the investments on behalf of their investors.

Different funds will have different investment objectives. If you're considering investing in one, be sure it matches the risk/reward profile you're looking for before investing your capital.

Are private debt and private credit the same?

Yes, private debt and private credit are the same.

.png)