Why Stock Buybacks Are Good for Investors

There's been a lot of controversy about stock buybacks in recent years.

Some of the criticism is valid, but a lot of it seems to be based on a basic misunderstanding of what stock buybacks are and how they work.

A stock buyback involves a company buying its own shares on the open market, which leads to fewer shares outstanding. This causes each remaining share to become more valuable, so this is seen as a way to reward long-term shareholders.

Stock buybacks are also called share repurchases. The "back" part of the word comes from the fact that the company is buying back shares that it had previously created.

Here are several reasons why stock buybacks are good for investors.

Stock buybacks raise earnings per share

The single most important driver of stock prices is the earnings per share (EPS) number. When it goes up, the stock usually follows, and vice versa.

Earnings per share is calculated by dividing the company's total earnings with the total number of shares outstanding, like so:

EPS = earnings / outstanding shares

By reducing the number of shares outstanding, the denominator of the formula gets smaller, so the EPS increases.

In other words, when the number of outstanding shares goes down, each remaining share is entitled to a greater percentage of the company's profits, so each share becomes more valuable.

For example, if a company has $1 billion in yearly earnings and 100 million shares outstanding, the earnings per share is $1000/100 = $10.

But if the company buys back 10 million shares, leaving the number of shares outstanding at 90 million, the earnings per share will be $1000/90 = $11.1.

This leads to a reduced P/E ratio until the shares rise

The price-to-earnings ratio, or P/E ratio, is the most commonly used valuation metric to quickly determine if a stock is cheap or expensive.

The P/E ratio is calculated by dividing the stock price by the earnings per share number. So when EPS goes up due to share buybacks, the P/E ratio goes down.

When the P/E ratio goes down, investors may see that the stock seems cheap and start buying more of it. This leads the stock price to increase to reach its previous P/E ratio, now at a higher stock price than before.

Buying back shares can lower supply and raise demand, leading to a price increase

Companies that have big buyback programs can also affect the short-term movements of their stock prices by bidding up the shares on the open market.

Stock prices are determined by supply and demand. Stock buybacks affect both:

- Demand: When a company bids for its shares on the open market, it increases the demand for the shares.

- Supply: The company doesn't sell the shares after buying them, leading to a reduced supply of shares on the stock exchange.

This is one of the reasons why companies with a lot of cash available to repurchase shares may be more resilient during a stock market correction. Their bid for their own shares can help put a floor under the stock price.

In fact, stock market drops can be a good thing for companies that are actively buying back shares, because then they are able to buy back more shares for the same amount of money.

Share buybacks are a tax-friendly way to return cash to shareholders

The main purpose of share buybacks is simply to return cash to shareholders. Because the stock price usually goes up from share buybacks, shareholder wealth increases.

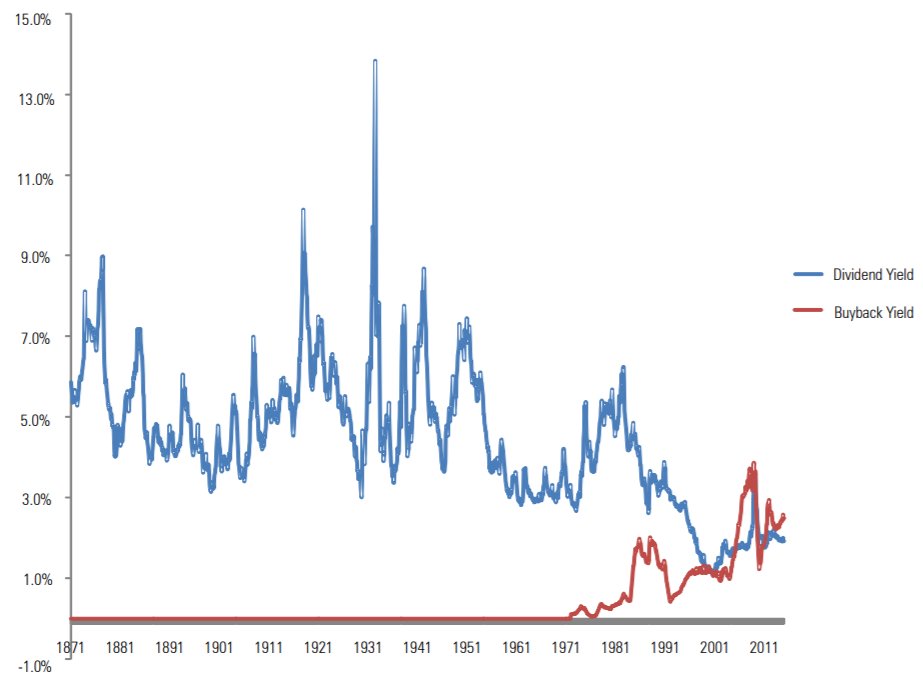

In the past, dividend payments used to be the main way for companies to return cash to shareholders. But new rules in 1982 made share buybacks more popular, and now they are considered more tax-friendly and flexible (1).

The following graph shows how share buybacks became the preferred method of returning cash to shareholders after 1982:

Most investors need to pay a tax on their dividend payments, which amounts to 0–40% in the US. On the other hand, investors don't need to pay a tax from the share price going up until they sell, when they will have to pay a capital gains tax.

For long-term holders, it can be better to have the shares gain value from buybacks instead of getting a dividend and having to pay a tax right away. In this way, the money stays in the investment and can gain compound interest over time.

Dividends are also subject to double taxation. First, the company pays a tax on its profits, but then you pay the second round of tax after getting the dividend.

With share buybacks, the profits are only taxed once at first, but then you don't get taxed until you sell your stock at a profit.

Buybacks are more flexible for companies

When most companies issue a dividend, it is expected that the dividend will grow over the long term, or at least stay the same.

When a company runs into financial troubles and is forced to cut the dividend, this is often punished severely by the market and can lead to an extreme drop in the price of the stock.

On the other hand, it is generally not seen as a very big deal when a company reduces its share buyback program.

So if a company has tons of excess cash that it wants to return to shareholders, then share buybacks may be a better choice if the company isn't sure that business will stay as good in the future.

If a recession hits, then the company can just pause the buyback program. But if they had committed to a dividend payment, it would be much harder to cut the dividend.

In this way, share buybacks are more flexible than dividend payments for the company's management. The share repurchase program can be increased, decreased, or paused, while the dividend is seen as more permanent.

Stock buybacks increase your ownership of the company

As a long-term investor, my favorite aspect of share buybacks is that they increase my percentage of ownership in the company.

When you really get back to the basics and think about what stocks represent, owning stock means that you are a part owner of the company.

For example, if a company has 1 million shares outstanding and you own a thousand shares, that means you own 0.1% of the company.

If the company were to buy back half a million shares, your ownership would increase to 0.2%. Now you own twice as much in the company as you did before.

Owning shares in a company that is growing, while your ownership percentage is increasing at the same time due to share buybacks, is a great way to make a lot of money if you hold the shares for a long time.

On the other hand, owning companies that are issuing shares each year means that your percentage of ownership is decreasing over time. This is called share dilution and is a bad thing, except when the company is growing so fast that it far exceeds the pace of share dilution.

Stock buybacks can be bad for investors, in some cases

Everything has its pros and cons. This is also true of stock buybacks, which can be bad for long-term investors in some cases.

For example, if company management is sacrificing investments in long-term growth in favor of share repurchases, this can have a negative effect as the company will be missing future revenue opportunities.

Company executives are often paid through stock options, or have their compensation tied to the EPS number or the stock price. This can give bad incentives to focus on short-term returns over long-term gains.

In addition, companies that are issuing debt in order to pay for share buybacks could get in trouble down the line. Eventually, the debt is going to have to be repaid and the interest payments will reduce earnings for many years or decades.

The best scenario for share buybacks is when a company is spending on growth and paying their employees well but is simply making so much money that it doesn't have anything else to do with it.

In these cases, a share buyback program can greatly increase shareholder value without any apparent negative effects.