Revenue

Revenue is the amount of money a company receives from its primary business activities, such as sales of products and services. It is also called sales.

A company's revenue does not take any expenses into account. After you subtract all the expenses from the revenue figure, what is left is profits.

It is possible for a company to have a lot of revenue but still not make any profits if expenses are very high. Profits are also called earnings or net income.

Revenue example

Let's imagine a hypothetical motorcycle company that produces and sells 100 motorcycles in a year. The average selling price is $10,000 per bike.

This company's revenue can be calculated as 100 x $10,000 = $1 million dollars.

However, each bike costs $8,000 to produce because the company needs to pay for parts, employee salaries, taxes, etc.

When you extract all expenses from the revenue number, the company's profit is only $200,000. This amounts to a profit margin of 20%.

Revenue formula and calculation

Companies get revenue in many different ways, but the most straightforward one to understand is the sales of products or services.

For a company that makes its money from sales, you can calculate revenue by multiplying the number of units sold by the average price of each unit.

Formula: Revenue = Price Per Unit * Number of Units Sold

The calculation is similar for companies with subscription revenue. You simply multiply the average subscription revenue per user by the number of paying users.

Of course, this isn't quite so simple in the real world. Most companies have many different products at different price points.

Revenue in accounting

Although revenue may seem easy to understand, it is not always so simple when it comes to accounting.

In accrual-based accounting, revenue gets recorded as soon as the product or service is provided. The company may not have received any cash payment yet.

For example, a company may record the revenue as soon as a product has shipped, but the customer may not need to pay the bill until 30 days later.

In this case, you should also look at the cash flow statement to see how effective the company is at collecting the money owned as cash.

On the other hand, cash accounting only records revenue when the cash is received.

In the U.S., companies that trade publicly on a stock exchange use accrual-based accounting when reporting revenue.

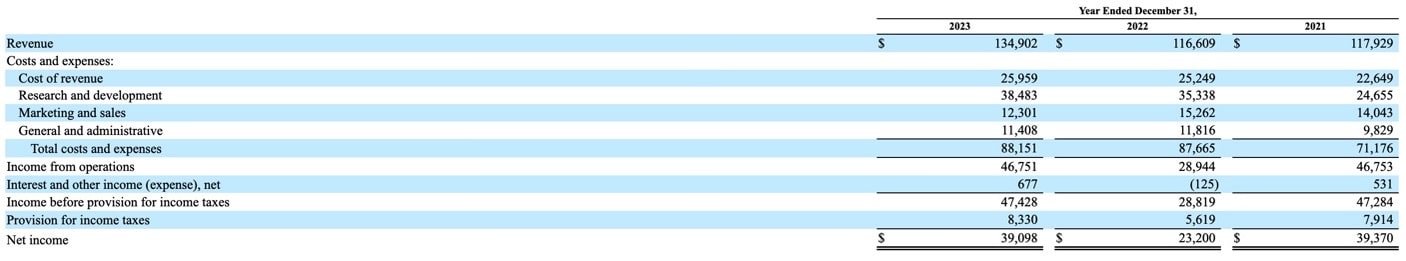

Revenue is at the top of the income statement

Publicly traded companies report their financials four times a year when they release their quarterly reports.

Revenue is often referred to as the "top-line" because it is the first number listed on the income statement of the financial report.

Net income, or profits, is referred to as the "bottom-line" because it's closer to the bottom after you have subtracted all expenses.

Here's a screenshot of Facebook's (META) income statement from its 2023 annual report that highlights revenue (top-line) and net income (bottom-line):

Source: EDGAR

Net income (profit) is what's left after you subtract all expenses.

Formula: Net Income = Revenue - Cost of Revenue - Operating Expenses - Interest - Taxes

Then earnings per share (EPS) is calculated by dividing the net income with the number of shares outstanding.

Types of revenue

Many different types of revenue have been defined, including:

- Sales revenue: When a company makes its money from the sales of products and services.

- Recurring revenue: Companies that get money regularly via subscriptions have recurring revenue.

- Interest revenue: Some companies get a lot of their revenue from interest on loans, such as banks.

- Tax revenue: The government gets most of its income from taxes.

- Non-profits: Non-profits get money in different ways, such as donations or membership fees. Their revenue is often termed gross receipts.

- Operating revenue: This is money earned from a company's regular business activities.

- Non-operating revenue: This money is seen as a one-time thing, such as a payment from a lawsuit.

Real-world examples

Here are some examples of revenue for well-known companies:

- Apple (AAPL) makes money selling physical products like iPhones and Macs. But it also makes money from services, which includes recurring subscription revenue.

- Tesla (TSLA) makes money primarily by selling cars, but they also get some revenue via leases and selling batteries and solar panels.

- Amazon (AMZN) gets a lot of revenue from its online store, but they also sell advertising and get recurring revenues via the Amazon Web Services (AWS) cloud division.

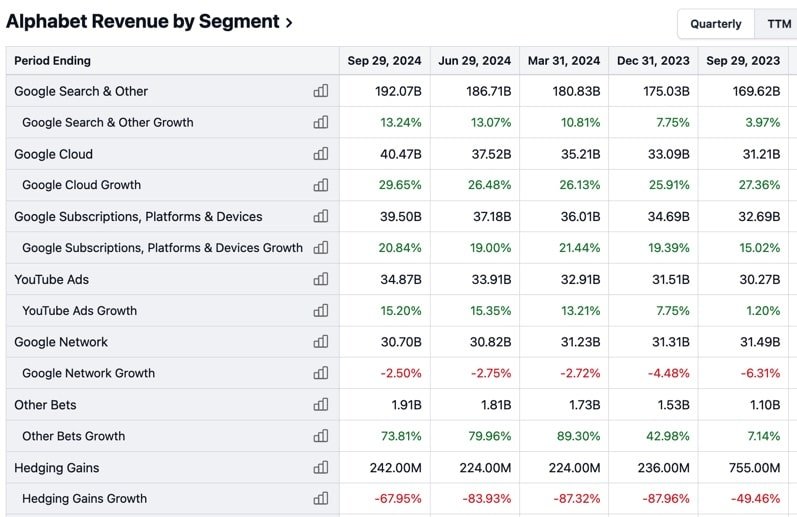

- Alphabet (GOOGL) gets most of its revenue from ads on its internet properties, such as Google search and YouTube. But they also sell physical products like phones and get recurring revenue via cloud computing.

This screenshot shows how Google-parent Alphabet separates its revenue into different categories:

Source: Stock Analysis

Having many different sources of revenue is seen as a strength for a company and often leads to a higher stock price.

For example, Apple used to rely heavily on iPhone sales to drive growth. As they managed to diversify their revenue sources and make more money from services, the stock price went up a lot despite revenue and profits not growing much.

Revenue, growth, and stock prices

The two financial numbers most closely followed by stock analysts and investors are revenue and EPS (earnings per share).

When a company releases its financials for each quarter, the financial media report whether revenue and EPS are above or below expectations.

If the numbers are higher than expected, it is termed a "beat" and often leads to a jump in the stock price. When the numbers are lower, it is called a "miss" and often causes the stock price to drop heavily in a matter of minutes.

However, revenue growth can be even more important than the revenue number itself.

When revenue is growing year-over-year, it implies that the company is expanding by gaining market share or improving its operations.

Companies that have consistent revenue growth tend to have much higher stock prices. But when growth slows down, the stock price often drops significantly.

Investing in stocks with strong revenue growth is often termed growth investing, while value investing tends to favor cheaper stocks with more stable financials.

Many growth stocks with rapid revenue growth don't have any profits because expenses are still very high. But investors still buy them because they may become profitable in the future.

Financial metrics and ratios that use revenue

Many commonly used financial metrics and ratios use revenue. These include:

- P/S ratio: The price to sales ratio is calculated by dividing the company's market cap by its revenue in the last 4 quarters.

- EV/sales ratio: This ratio is similar to the P/S ratio, but uses [enterprise value](/term/enterprise-value/) instead of market cap.

- Gross margin: This is a measure of profitability that is calculated by dividing gross profit by revenue.

- Operating margin: Another profitability measure that also accounts for operating expenses. You calculate it by dividing operating income by revenue.

- Profit margin: How much money is left as profit after subtracting all expenses. It is calculated by dividing net income by revenue.

Revenue and revenue growth are also used in more advanced types of financial analyses, such as financial modeling and discounted cash flow valuation.