State Street Industrial Select Sector SPDR ETF (XLI)

| Assets | $29.56B |

| Expense Ratio | 0.08% |

| PE Ratio | 30.41 |

| Shares Out | 155.03M |

| Dividend (ttm) | $2.00 |

| Dividend Yield | 1.17% |

| Ex-Dividend Date | Dec 22, 2025 |

| Payout Frequency | Quarterly |

| Payout Ratio | 35.54% |

| Volume | 19,478,646 |

| Open | 168.14 |

| Previous Close | 169.94 |

| Day's Range | 166.17 - 171.40 |

| 52-Week Low | 112.75 |

| 52-Week High | 179.31 |

| Beta | 1.02 |

| Holdings | 82 |

| Inception Date | Dec 16, 1998 |

About XLI

Fund Home PageThe State Street Industrial Select Sector SPDR ETF (XLI) is an exchange-traded fund that is based on the S&P Industrial Select Sector index. The fund tracks a market cap-weighted index of industrial-sector stocks drawn from the S&P 500. XLI was launched on Dec 16, 1998 and is issued by State Street.

Top 10 Holdings

39.84% of assets| Name | Symbol | Weight |

|---|---|---|

| GE Aerospace | GE | 6.53% |

| Caterpillar Inc. | CAT | 6.11% |

| RTX Corporation | RTX | 5.40% |

| GE Vernova Inc. | GEV | 4.11% |

| The Boeing Company | BA | 3.47% |

| Uber Technologies, Inc. | UBER | 3.00% |

| Union Pacific Corporation | UNP | 2.89% |

| Honeywell International Inc. | HON | 2.87% |

| Deere & Company | DE | 2.85% |

| Lockheed Martin Corporation | LMT | 2.62% |

Dividend History

| Ex-Dividend | Amount | Pay Date |

|---|---|---|

| Dec 22, 2025 | $0.5316 | Dec 24, 2025 |

| Sep 22, 2025 | $0.62983 | Sep 24, 2025 |

| Jun 23, 2025 | $0.43167 | Jun 25, 2025 |

| Mar 24, 2025 | $0.40474 | Mar 26, 2025 |

| Dec 23, 2024 | $0.67013 | Dec 26, 2024 |

| Sep 23, 2024 | $0.43102 | Sep 25, 2024 |

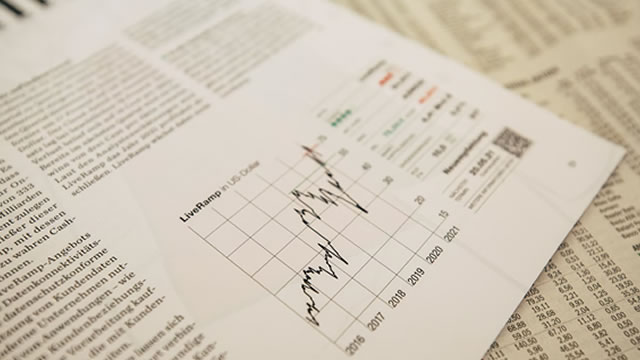

Performance

XLI had a total return of 29.08% in the past year, including dividends. Since the fund's inception, the average annual return has been 9.52%.

News

Health care and industrials are the sectors to put money to work: Crossmark's Victoria Fernandez

Victoria Fernandez, Crossmark Global Investments, joins 'Closing Bell' to discuss the recent price action in oil, the strength in tech stocks and more.

The #1 Rule For Retiring On Dividends (3 Stocks That Prove It)

Most dividend investors focus on the wrong metric, and it quietly destroys retirement plans. A simple rule separates sustainable dividend income from ticking time bombs. I discuss three income machine...

Do More for Your Core: A Tactical Roadmap for Sector Investing

Sector investing — it's a typical strategy for advisors if their clients are looking beyond broad market exposure by targeting a specific sector. The concept is fairly straightforward, but implementin...

FXR: Sophisticated Strategy With A High Fee Lagging XLI, A Hold

FXR: Sophisticated Strategy With A High Fee Lagging XLI, A Hold

Undisruptable: How Dividend Stocks Became Market Leaders - And Why That Scares Me

Dividend stocks and defensive sectors have dramatically outperformed as investors flee AI-vulnerable and AI-spending industries, but valuations now appear stretched. Consumer staples and energy sector...

Energy Leads S&P Sectors in January

Three of the smallest sectors in the S&P 500 delivered the index's strongest performance in January, while the two largest sectors weighed on returns. The broad market index gained modest ground last ...

Industrials are our favorite sector now, says Manulife John Hancock's Matt Miskin

Matt Miskin, Manulife John Hancock Investments, joins 'The Exchange' to discuss the investment mistakes to avoid, which are set to benefit from policy this year and much more.

Global industrial stocks feel the benefit of the biggest hedge fund buying in ten years

Improved forecasts for global growth, a decent IP print and the rearmament in Europe are all encouraging hedge funds to overweight the industrial sector.

My Ultimate Dividend ETF Combo For 5%+ Yield And 10%+ Annual Growth

A golden yield-and-growth combo is something most investors assume they'll rarely find. Defensive income machines keep quietly compounding at double-digit rates. This trio could change how you think a...

Industrial Stocks Are Flying Despite Lousy Data. Here's Why.

Key industrial data showed more pain for U.S. manufacturers on Monday. Stocks shrugged it off.

JPMorgan's Steve Tusa talks industrials outlook for 2026

JPMorgan analyst Steve Tusa joins 'Closing Bell Overtime' to talk what he expects out of the Industrials trade in 2026.

XLI: High Quality Growth At A Reasonable Price

The Industrial Select Sector SPDR® Fund ETF offers diversified exposure to the industrial sector, spanning defense, aerospace, transportation, and heavy machinery. XLI presents a 12% consensus upside ...

'Green light' away from AI trade: Two ETF executives see a key market shift underway

A key rotation away from artificial intelligence stocks may be underway in the market. According to Astoria Portfolio Advisors' John Davi, a broader range of stocks are getting a “green light” because...

XLI: 3 Reasons To Consider Buying This ETF

The Industrials Select Sector SPDR Fund (XLI) offers diversified exposure to leading U.S. industrial companies. XLI stands out for its strong historical performance, featuring high-quality holdings wi...

Industrial Stocks Enjoyed Earnings Season. Which Ones to Buy.

Industrial companies like Caterpillar and Rockwell Automation looked promising this earnings season.

Schwab IMPACT 2025: Record $13T in ETFs & What's Next for ETF Assets

Matt Camuso, Head of ETF Solutions at BNY Investments, says there are $13 trillion of assets in ETFs. That's compared to $5 trillion a year prior.

State Street's Anna Paglia on why the firm is shifting from ETFs to mutual funds

Anna Paglia, State Street Investment Research CBO and chief business officer, joins CNBC's Dom Chu on the type of assets and ETFs State Street is seeing the flows into. She also shares why the firm is...

Industrials Post Positive Earnings. 3 Stocks Whose Charts Say ‘Buy.

An equipment manufacturer, an industrial machinery play, and a safety science company with constructive technical indicators.

XLI: Quiet Lately, But Expecting Year-End Industrials Strength

Reiterate a buy rating on Industrial Select Sector SPDR® Fund ETF despite recent underperformance versus the S&P 500. XLI offers diverse exposure to industrials, including AI-adjacent aerospace and de...

Industrials are our top pick of the year, says Morgan Stanley's Katerina Simonetti

Katerina Simonetti, Morgan Stanley Private Wealth Management, joins 'The Exchange' to discuss market catalysts and concerns she sees.

Final Trades: Apple, PG&E, MercadoLibre and XLI

The Investment Committee give you their top stocks to watch for the second half.

Industrials, Banks to Drive M&A: Morgan Stanley's Miles

Dealmakers are raking in billions in M&A despite lingering fears about trade wars and geopolitics. Transaction values are up almost a fifth this year at $2.2 trillion, according to data compiled by Bl...

Key ETF Asset Class Performance

The market ended the month of July on a down note, but the S&P 500 still ended the month with a gain of 2.3%. While domestic equities posted small gains in July, there was quite a bit of disparity amo...

The Big 3: SMH, XLK, XLI

The @brownreport's Jason Brown turns to ETFs on today's Big 3. He points to the Technology Select Sector SPDR ETF (XLK) as a way investors can capitalize on tech's broad bull run.

XLI: Benefits From Aerospace And Defense Allocation Are Yet To Emerge

XLI ETF commands the most attractive portfolio allocation amid broad industrials ETFs thanks to the shift towards aerospace and defense players. The unstable geopolitical situation provides solid fund...

Trade Tracker: Steve Weiss buys Caterpillar and the XLI

Steve Weiss, founder and managing partner of Short Hills Capital Partners, joins CNBC's “Halftime Report” to detail his latest buys.

Buy America, says John Hancock's Matthew Miskin

Matthew Miskin, John Hancock Investment Management, joins 'The Exchange' to discuss markets, small and mid-caps and the industrial sector.

Defensive Sectors Continue To Lead U.S. Stock Market This Year

President Trump announced a US-UK trade deal yesterday, which may be an early sign of a thaw in the global trade war. Although the broad US stock market has rebounded sharply in recent weeks, the reco...

XLI: The Pick If You Are Bullish On U.S. Manufacturing

Manufacturing activity in the U.S. could be rebounding. Government spending coupled with tariffs could represent a potential powerboost to U.S.-based industrials. XLI offers the opportunity to be expo...

XLI: Now A Premium P/E, But The Bear Market May Be Done

The Industrials Select Sector SPDR ETF (XLI) is down 4% YTD, slightly outperforming the S&P 500, with GE Aerospace showing strong performance. Despite mixed sector performance and a concerning P/E rat...

8 Stocks And 1 ETF I'm Buying As Trade Wars Roil The Market

Free trade benefits economies by allowing market participants to voluntarily exchange goods and services, leading to higher living standards and economic growth. Tariffs increase costs for consumers a...

Industrial Stocks Have Taken It on the Chin. 6 to Buy on the Dip.

President Trump's tariffs on trading partners and proposed tax incentivizes for U.S. companies will spur more domestic projects.

Don't Get Left Behind - The Great Rotation Into Dividend Stocks Is Here

Despite significant market events, industrial and tech stocks have had similar returns since 2020, indicating a potential long-term rotation favoring value stocks. Higher inflation and interest rates ...

XLI: Industrials Sector's Earnings Growth Power Is Likely To Drive Healthy Returns

The industrials sector is expected to deliver strong returns in 2025, driven by double-digit earnings growth in the aerospace, defense, airlines, services, and transportation industries. XLI ETF is re...

Investors can find opportunity in a trade war, advisor says

More Fed officials warn tariffs will cause price hikes, hitting consumers. VettaFi's Todd Rosenbluth warns investors are not prepared.

Healthcare and industrials are two underperforming sectors to watch, says Trivariate's Adam Parker

Trivariate's Adam Parker and Robinhood's Stephanie Guild, join 'Closing Bell' to discuss hyperscalers CapEx numbers and AI spending.

Why Wells Fargo favors industrial stocks despite new tariffs as S&P 500 stumbles

The industrial sector is one area of the U.S. stock market that looks favorable to Wells Fargo Investment Institute after new tariffs on Canada, Mexico and China.

ETF inflows top $1 trillion in 2024. What comes next in 2025?

Investors poured over $1 trillion into exchange-traded funds (ETF) in 2024, with single-stock ETFs showing some of the highest annual returns. Clough Capital President and CEO Vince Lorusso — whose fi...

XLI: Industrials Sector Continues Its Quiet Leadership

XLI is a well-diversified ETF within the industrials sector, avoiding heavy reliance on a few stocks unlike other S&P 500 sectors. Despite the high-risk environment, XLI's diversified holdings and sta...