Grupo Financiero Galicia S.A. (BCBA:GGAL)

Argentina · Delayed Price · Currency is ARS

Argentina · Delayed Price · Currency is ARS | Market Cap | 10.22T -20.4% |

| Revenue (ttm) | 4.98T -52.7% |

| Net Income | 756.27B -51.6% |

| EPS | 478.75 -54.8% |

| Shares Out | 1.61B |

| PE Ratio | 13.28 |

| Forward PE | 12.96 |

| Dividend | 236.21 (3.71%) |

| Ex-Dividend Date | Feb 6, 2026 |

| Volume | 3,721,376 |

| Average Volume | 3,683,663 |

| Open | 6,405.00 |

| Previous Close | 6,545.00 |

| Day's Range | 6,320.00 - 6,680.00 |

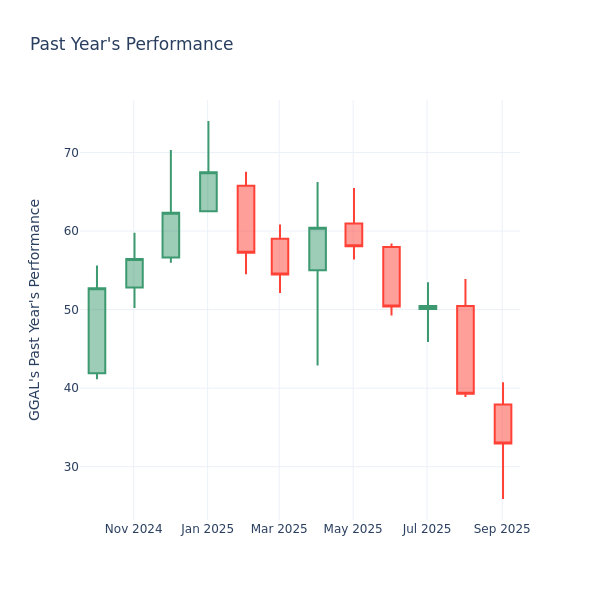

| 52-Week Range | 3,990.00 - 9,395.00 |

| Beta | 0.76 |

| RSI | 32.01 |

| Earnings Date | Mar 6, 2026 |

About Grupo Financiero Galicia

Grupo Financiero Galicia S.A., a financial service holding company, provides various financial products and services to individuals and companies in Argentina. The company operates through Bank, Naranja X, Insurance, and Other Businesses segments. It offers savings, checking, and time deposits; personal loans; express and mortgage loans; overdrafts; pledge and credit card loans; credit and debit cards; and online banking services. In addition, the company offers financing products; mutual funds; asset management services; consumer finance and d... [Read more]

Financial Performance

In 2024, Grupo Financiero Galicia's revenue was 7.50 trillion, a decrease of -4.29% compared to the previous year's 7.83 trillion. Earnings were 1.76 trillion, an increase of 121.28%.

Financial StatementsNews

Grupo Financiero Galicia S.A. declares $0.1541 dividend

Grupo Financiero Galicia SA (GGAL) Stock Price Down 3.72% on Feb 17

Grupo Financiero Galicia SA (GGAL) Stock Price Down 3.72% on Feb 17

Grupo Financiero Galicia (GGAL) Shares Cross Below 200 DMA

In trading on Thursday, shares of Grupo Financiero Galicia SA (Symbol: GGAL) crossed below their 200 day moving average of $49.15, changing hands as low as $48.08 per share. Grupo Financiero Galicia S...

Grupo Financiero Galicia (GGAL) Leads Weekly Financial Movers

Grupo Financiero Galicia (GGAL) Leads Weekly Financial Movers

Crypto-tied stocks slide, Argentine banks rise: week's financials wrap

This week's biggest financials movers mainly comprised crypto-related firms and Argentine lenders, with CleanSpark (CLSK) falling the most and Grupo Financiero Galicia (GGAL) leading the gainers.

Grupo Financiero Galicia S.A. 2025 Q3 - Results - Earnings Call Presentation

Grupo Financiero Galicia: Not The Best Option For Betting On Argentine Growth

Grupo Financiero Galicia is a leading Argentine financial holding company, but I rate it HOLD due to limited near-term sector upside. GGAL's recent rebound follows Milei's election victory, yet macro ...

Grupo Financiero Galicia S.A. (GGAL) Q3 2025 Earnings Call Transcript

Grupo Financiero Galicia S.A. ( GGAL) Q3 2025 Earnings Call November 26, 2025 11:00 AM EST Company Participants Pablo Firvida - Investor Relations Officer Gonzalo Covaro - Chief Financial Officer Con...

Grupo Financiero Galicia S.A. FQ3 2025 Earnings Preview

GGAL Crosses Below Key Moving Average Level

In trading on Tuesday, shares of Grupo Financiero Galicia SA (Symbol: GGAL) crossed below their 200 day moving average of $50.48, changing hands as low as $49.59 per share. Grupo Financiero Galicia SA...

Grupo Financiero Galicia (GGAL) Announces Quarterly Dividend

Grupo Financiero Galicia (GGAL) Announces Quarterly Dividend

Grupo Financiero Galicia S.A. declares $0.1349 dividend

Grupo Financiero Galicia (GGAL) Surges 67% Amid Argentine Political Optimism

Grupo Financiero Galicia (GGAL) Surges 67% Amid Argentine Political Optimism

Why Avidity Biosciences Shares Are Trading Higher By Around 42%; Here Are 20 Stocks Moving Premarket

Shares of Avidity Biosciences Inc (NASDAQ: RNA) rose sharply in pre-market trading after the company agreed to be acquired by Novartis AG (NYSE: NVS). Holders of Avidity common stock will receive $7...

Grupo Financiero Galicia (GGAL) Surges After U.S.-Argentina Currency Deal

Grupo Financiero Galicia (GGAL) Surges After U.S.-Argentina Currency Deal

HSBC Resumes Buy Rating on Grupo Financiero Galicia (GGAL)

HSBC Resumes Buy Rating on Grupo Financiero Galicia (GGAL)

A Look Into Grupo Financiero Galicia Inc's Price Over Earnings

In the current market session, Grupo Financiero Galicia Inc. (NASDAQ: GGAL) price is at $33.00, after a 4.73% increase. However, over the past month, the stock fell by 17.28% , and in the past year, ...

Grupo Financiero Galicia (GGAL) Sees Significant Stock Increase

Grupo Financiero Galicia (GGAL) Sees Significant Stock Increase

Monday's ETF Movers: ARGT, PXH

In trading on Monday, the Global X MSCI Argentina ETF is outperforming other ETFs, up about 5.6% on the day. Components of that ETF showing particular strength include shares of Grupo Financiero Galic...

Grupo Financiero Galicia (GGAL) Surges Nearly 14% Amid Market Activity

Grupo Financiero Galicia (GGAL) Surges Nearly 14% Amid Market Activity

Grupo Financiero Galicia: Prepare For Volatility As Argentina Faces Political Turmoil

Argentine banks face a difficult year after an auspicious 2024 amid a sector paradigm shift after several decades financing public sector. Galicia reported a 63% Y/Y drop in profits in the first quart...

Galicia: The Sell-Off Created A Buying Opportunity As The Long-Term Prospects Remain Strong

Argentina's credit penetration is far below its LATAM peers due to chronic inflation. If Argentina achieves catching up to its peers, credit could grow between three and seven times. Milei's administr...

Grupo Financiero Galicia (GGAL) Receives Downgrade to Neutral by Citigroup | GGAL Stock News

Grupo Financiero Galicia (GGAL) Receives Downgrade to Neutral by Citigroup | GGAL Stock News

Grupo Financiero Galicia S.A. (GGAL) Q2 2025 Earnings Conference Call Transcript

Grupo Financiero Galicia S.A. (NASDAQ:GGAL) Q2 2025 Earnings Call August 27, 2025 11:00 AM ET Company Participants Gonzalo Fernandez Covaro - Chief Financial Officer Pablo Eduardo Firvida - Investor ...

Grupo Financiero Galicia: Buy The Dip To Play Argentina's Recovery

Argentina's market pullback offers a second chance, with GGAL trading at compelling valuations and poised for outsized gains if reforms hold. Galicia stands out due to its strong management, dominant ...