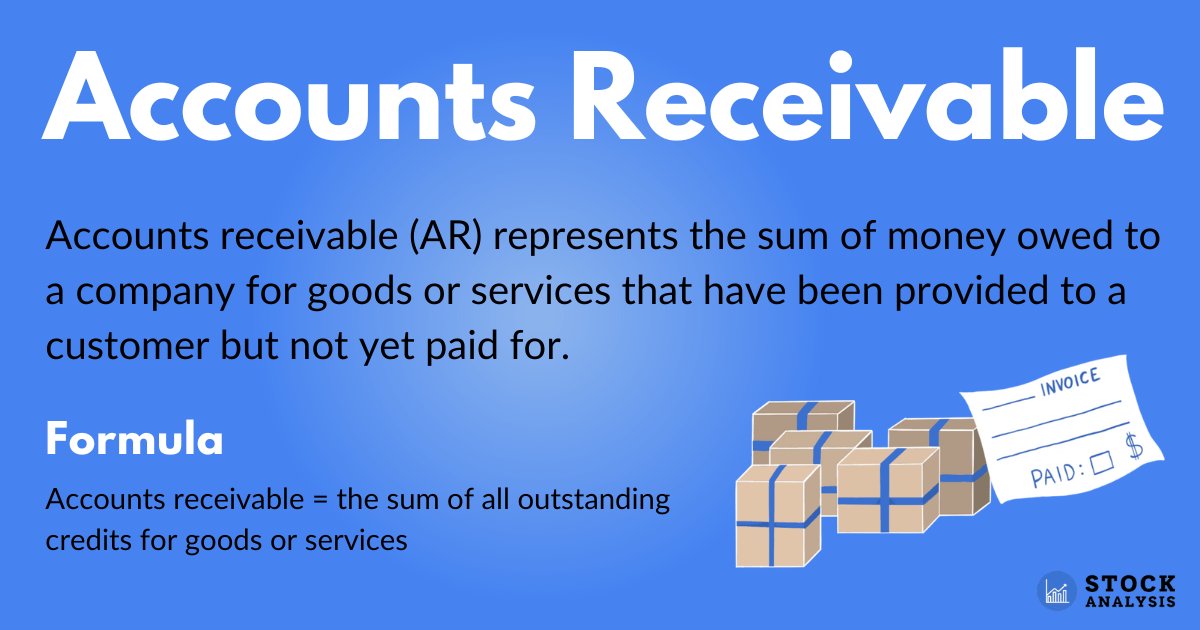

Accounts Receivable (AR)

Accounts receivable (AR) represent the sum of money owed to a company for goods or services that have been provided to a customer but not yet paid for.

They are calculated by adding up all the outstanding credits for goods and services, like so:

Accounts receivable = the sum of all outstanding credits for goods or services

AR are a useful number when analyzing how a company is managing payments for its sales. They are also used in the AR turnover ratio, which provides further insights.

Below is an overview of AR, including how the number is used, how AR compares to accounts payable (AP), and how to find or calculate the number.

What are accounts receivable?

Accounts receivable (AR) are the sum of money a company is owed by customers for purchases made on credit. The goods and services have been provided but not yet paid for.

AR are considered a current asset since they will be cash within one year or less. However, the conversion will normally happen much faster than that, usually within 90 or fewer days.

AR are also considered to be a liquid asset, as they have a short lifespan before cash conversion happens. This is why AR can be used as collateral for a short-term loan.

Customers, in essence, are the debtors of the company since they owe money for goods and services that they have already received. The time period of this credit is called “the term.” Terms for AR are generally 30, 60, or 90 days.

However, it's important to understand that there's an element of risk with AR because a customer might not pay. Therefore, it's important for companies to be discerning when offering credit, and not expose themselves to unnecessary risk.

When analyzing a business, looking at AR is an important part of assessing the company's assets and how it's managing payments for sales.

SummaryAccounts receivable (AR) are the total amount of money owed to a company for goods or services that have been provided but not yet paid for by the customer.

How are accounts receivable calculated?

AR are calculated with the following formula:

Accounts receivable = the sum of all outstanding credits for goods or services

However, they're usually listed for you under current assets on a company's balance sheet.

When a company sells goods to a customer on credit, the company's inventory will decrease by the amount of the sale. This amount will then be added to AR.

After the credit period has finished and the customer pays the company, AR will decrease by the sale amount and the cash of the company will increase by this same amount.

In other words, the value of the sale moves from inventory to AR to cash as the transaction is processed through the different payment stages.

Thus, AR makes up an important part of a company's working capital.

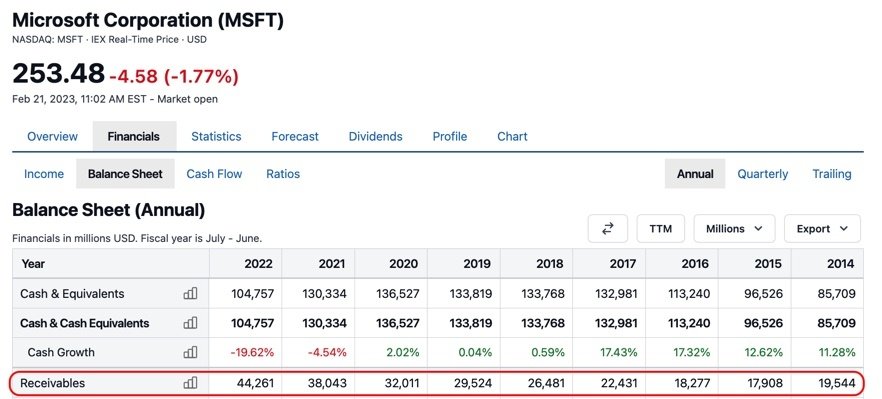

As an example, below is the balance sheet for Microsoft (MSFT). AR can be seen in the current assets section, which is at the top of the sheet.

Source: Microsoft's Balance Sheet

SummaryAccounts receivable are calculated by adding up all outstanding credits for goods and services. They are then listed on a company's balance sheet, under current assets.

Are accounts receivable an asset?

In short, yes. AR are listed under assets on a company's balance sheet. As such, AR are generally viewed as a positive component of a company's finances.

This is because, as a short-term credit, AR are lower risk than a longer-term credit. Taking this risk allows the company to make sales more attractive to customers.

In many cases, since competitors would be offering credit, it would not really be feasible to not also offer this option.

However, if a company has excessive AR compared to its own history, or the norm for the sector, this is worth looking into further.

For starters, it indicates that the company is more exposed to the credit risk of its customers, the risk if they don't pay. This could affect the operations of the company, such as making it unable to pay its own creditors as well as impacting profits.

Ultimately, if a customer doesn't pay, the company will have to write off the unpaid debt on its balance sheet. For this reason, companies should consider the reliability of customers when offering credit.

The other issue is that when a company's AR looks high, it could mean the company is not putting enough effort into being paid or managing its collection of payments.

Such mismanagement of working capital would then put the company at risk and demonstrate poor leadership.

On the other hand, if AR is low, then the company may be missing out on business because its payment terms may be too tight, putting off potential customers.

SummaryGenerally, AR are a positive part of a company's balance sheet, though factors to consider include the overall amount and the likelihood of payment, as well as industry and company norms.

How investors use AR: the AR turnover ratio

Investors want to understand how well a company is managing the credit it gives customers.

This is done by calculating the AR turnover ratio, which tells you how frequently the company has realized its AR during the accounting period — that is, how quickly the payments with credit risk are being covered by net sales.

The formula for the AR turnover ratio is:

AR turnover ratio = net sales on credit / average AR

Here's how to calculate net sales on credit:

Net sales on credit = gross sales on credit – sales returns – sales discount

A higher frequency and shorter periods of credit exposure suggest that the risk the company is taking is lower because the company is generating sales into cash more quickly.

A lower frequency means it takes the company longer to cover AR credit risk exposures with new net sales coming in. This is riskier because if customers don't pay, it will take the company longer to make up the difference from net sales.

In the meantime, they are more vulnerable, as they may need that cash to pay suppliers.

As an investor, you would consider the AR turnover number in the context of previous years or other companies, especially those with similar capital structures, within the same sector. If the number was very different, you'd want to find out what had changed.

Additionally, there's one more component to credit risk exposure, which is the likelihood of the customer paying their debt. Companies need to manage this as part of their risk as well by being discerning about which customers they offer credit to.

A/R turnover ratio example

Consider the following numbers for a building supply company (in USD millions):

| Net sales on credit | $12M |

| Average AR | $5M |

| AR turnover | 12/5 = 2.4 |

This means the company collects fully on its receivables 2.4 times per year.

You would then want to compare this to the industry norm or previous years for the same company, keeping an eye out for any significant discrepancies.

SummaryThe AR turnover ratio reveals how quickly a company can cover its AR with sales. This provides insight into the risk the company is taking, which can then be compared to previous periods or industry norms.

What are the limitations of the AR turnover ratio?

Sometimes, when the AR turnover ratio is calculated, total sales rather than net sales is used.

This makes comparisons tricky because companies using total sales will end up with a higher AR turnover ratio. This generally makes them look better since they end up with a higher frequency of times they've collected on AR during an accounting period.

Companies sometimes do this if they are struggling with collecting AR and want to hide that.

Of course, if a company was not adequately using credit to encourage customers to make sales, using total sales rather than net sales, this would make their turnover ratio even higher.

This would draw attention to a low AR and might discourage investors, who could be concerned about the company's overly cautious approach to credit.

As an investor, when you make comparisons between companies, you need to ensure you're comparing on level ground and dig deeper if companies have chosen to use this less common method.

Additionally, for some industries, like oil and gas producers, auto leasings, or engineering companies, normal credit periods can be longer. On the other hand, for retailers or hotels, credit periods are generally fairly short. So the industry does play a part.

For example, consider a company buying a commercial engine. They might expect to get substantial time to settle the invoice, compared to a shopper buying groceries who, even if they use a credit card, are unlikely to expect more than 30 days to pay.

This means that an engineering firm is likely to have a lower AR turnover ratio than a store.

SummaryAs an investor making comparisons between companies, it's important to ensure both entities are using the same components. Additionally, when evaluating AR turnover ratios, industry-specific norms play a significant role.

Accounts receivable vs accounts payable

Accounts payable (AP) is the opposite of accounts receivable. AP is the money owed by a company to its suppliers for goods or services purchased on credit.

So, the AP of the company makes up a component of the AR of their suppliers. In this case, it is the company that is the debtor to its supplier.

Examples of AP would be software subscriptions, office supplies, logistics, leases, etc.

AP is another important metric when assessing the finances of a business. It will also be listed on a company's balance sheet.

SummaryAccounts payable (AP) are the debts owed by a company to its suppliers for goods or services purchased on credit.

The takeaway

Accounts receivable, or AR, represent money owed to a company for goods and services it has provided to customers but has not yet received payment for.

As such, AR is considered a current asset and is listed on the balance sheet.

Analyzing AR is helpful for investors because it shows how efficiently a company is managing payment for these goods and services, which is calculated with the AR turnover ratio.

Companies with high AR turnover are generally seen as having stronger liquidity than those with a lower ratio. However, this is not always the case and depends in part on the industry.

It's also worth noting that this is a balance, as companies that have significantly less AR than their peers may be missing out on sales opportunities.

AR turnovers, if significantly higher or lower compared to previous periods for the company or peers, need to be investigated further.