Cash and Cash Equivalents

Cash and cash equivalents (CCE) are assets that are immediately available as cash, meaning they can be converted into cash within fewer than 90 days.

Cash and cash equivalents are calculated by adding up these assets, like so:

Cash and cash equivalents = cash + current bank accounts + short-term, liquid securities

This number helps companies and investors see how much cash a business has on hand, indicating whether it can cover short-term cash needs.

Below is an overview of CCE, including examples, uses, and limitations.

What are cash and cash equivalents?

Cash and cash equivalents (CCE) are any assets that are highly liquid, meaning they are either already cash or can be converted into cash within 90 days.

Examples of CCE include:

- Cash

- Bank accounts

- Short-term, liquid securities

Examples of short-term, liquid securities include:

- Commercial paper

- Short-term government bonds

- Treasury bills

- Money market funds

Short-term, liquid assets like commercial paper and short-term government bonds, including Treasury bills and money market funds, would need to mature within 90 days.

For the most part, cash and cash equivalents do not include equity or stock holdings because the price of those assets can fluctuate significantly in value.

This means they can't necessarily be converted into cash at a dependable price, so a company would not want to be in a position where they were relying on equity or stock holdings for cash, as they may have to sell them at a less-than-ideal price.

This is different from the short-term assets included in cash and cash equivalents, whose value doesn't tend to vary very much and is more predictable.

CCE is an important financial number for a business, as the total helps investors and companies determine how well a company is positioned to handle short-term cash needs.

However, this number also should not be excessive. For example, companies can sometimes park excess cash in balance sheet items like “strategic reserves” or “restructuring reserves,” which could be put to better use generating revenue.

Overall, it's a balance. A company should have enough cash and cash equivalents on hand to cover short-term needs, but not too much that could be put to better use elsewhere.

Additionally, CCE contributes to working capital, in that net working capital is the difference between current assets, which includes CCE, and current liabilities.

Working capital is used as an indicator of a company's short-term financial health, whereas CCE tells you whether a company actually has the money available now, or within 90 days, to pay for an expense.

SummaryCash and cash equivalents (CCE) are highly liquid assets, meaning they can be converted into cash within 90 days. Examples include cash, bank accounts, and short-term, liquid securities.

How are cash and cash equivalents calculated?

Cash and cash equivalents are calculated simply by adding up all of a company's current assets that can reasonably be converted into cash within a period of 90 or fewer days.

Here is the formula:

Cash and cash equivalents = cash + current bank accounts + short-term, liquid securities

As for which assets to include, there are generally accepted accounting rules about this.

And though the above calculation does include some assets that are traded in markets, such assets are very short-term and therefore their actual value is unlikely to vary much from their expected value.

This is because these assets' prices are restricted by the short-term interest rates set by centralized banks like The Federal Reserve in the U.S. So, as money market assets get closer to their maturity date, market forces will guide their prices toward set rates.

This is very different from other markets, like the stock market, where there is no guaranteed end price for an asset.

For this reason, companies can rely on their short-term assets being liquid enough to convert into cash within a short period.

SummaryThe cash and cash equivalent number is calculated by adding up a company's cash, current bank accounts, and short-term, liquid assets.

Where can you find cash and cash equivalents?

Cash and cash equivalents are listed on a company's balance sheet, under current assets.

They are listed at the top because they are very liquid or “current,” meaning they're available for use as cash “immediately,” or within 90 days.

However, it's important to note that not all current assets are cash and cash equivalents, as entries like accounts receivable will also be there.

Examples

Below are two examples of CCE.

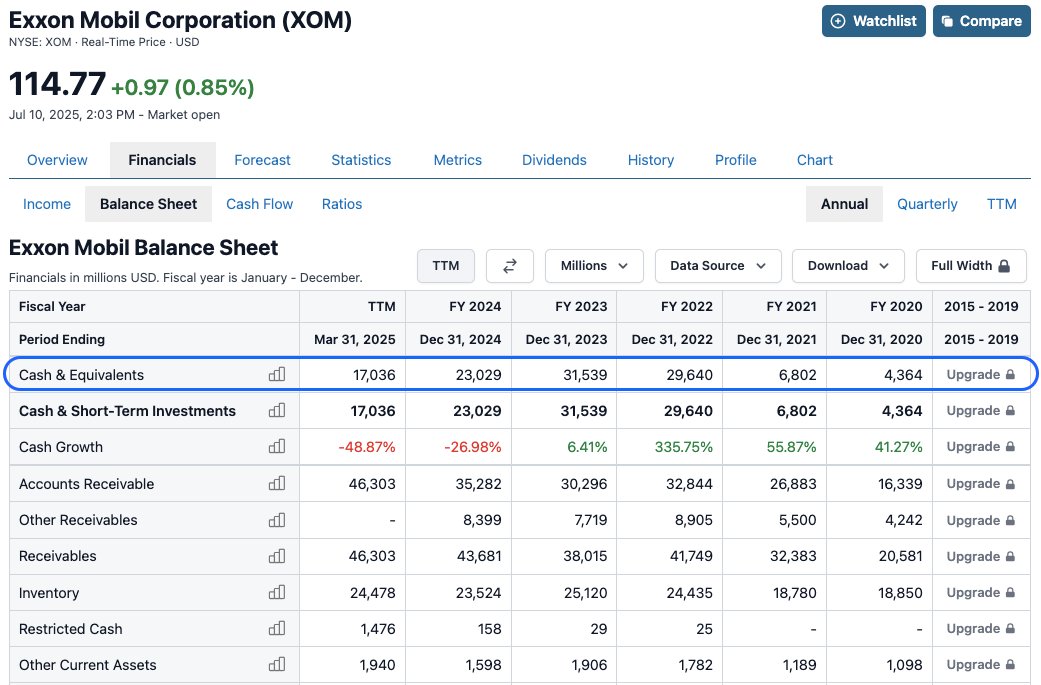

Exxon (XOM), the oil and gas giant, is an example of a cyclical and capital-intensive industry.

You can see on the top line of the balance sheet that the value of CCE fluctuates as these two factors play out in terms of higher oil and gas prices and periods of high capital expenditure.

Source: Exxon's Balance Sheet

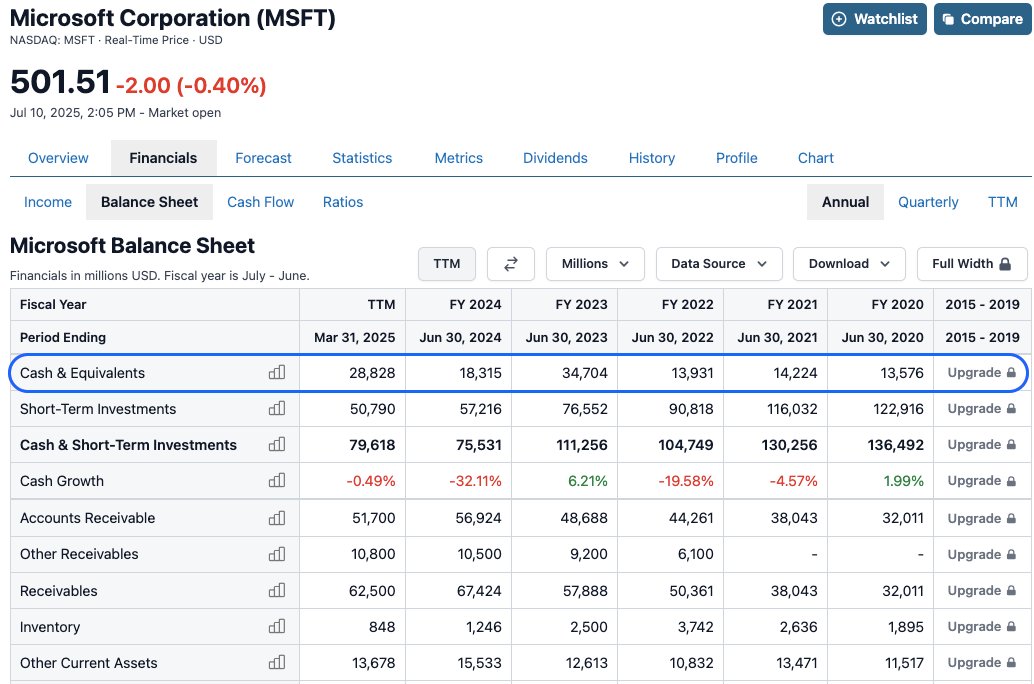

Compare this to computing powerhouse Microsoft (MSFT), which has a steadier cash position since it has fewer capital requirements and is not in a strongly cyclical industry.

Source: Microsoft's Balance Sheet

SummaryCash and cash equivalents are found at the top of a company's balance sheet, under current assets.

Why cash and cash equivalents is a useful number

Cash and cash equivalents is a useful measure for investors to consider when understanding how well a company is positioned to deal with short-term cash needs.

A company could need cash quickly in order to cover slowing sales or another, urgent unexpected need for cash.

However, companies need to balance being prepared for short-term cash needs with using their resources wisely, to generate earnings. Successful companies get this balance right.

Investors will need to decide whether they think a company is managing this process well, paying close attention to cash trends over time on the balance sheet.

A build-up of cash may indicate that a company is enjoying strong performance; however, if too much cash is accumulating rather than being put to use generating revenue, it could show a lack of growth opportunities for the company to invest in.

Building a very strong cash position can also create pressure from shareholders to pay dividends or issue stock buybacks, which are ways of returning capital to shareholders.

Investors generally look to industry norms to get a sense of whether a company is taking a reasonable approach. This is because different industries will have different cash pressures and potential short-term liabilities that companies will need to be prepared to account for.

SummaryCCE helps investors understand how well-prepared a company is to pay its short-term liabilities, or debts. However, this has to be balanced with operational efficiency.

Industry considerations for CCE

Cash and cash equivalent needs can vary greatly by industry.

For example, CCE is a particularly useful number when looking into industries where cash requirements are either higher or lower than in other industries.

Industries that are not capital-intensive, such as entertainment, media, or software firms, do not have the same spending needs as capital-intensive industries like oil, gas, or steel.

Cyclical industries also face challenges during down cycles.

Therefore, companies in these industries need to ensure that they stockpile cash in good times, in order to be able to cover any expensive capital investments or down times.

SummaryWhat's considered a reasonable number of cash and cash equivalents to have on hand varies greatly from industry to industry. Looking at CCE can be very useful in industries that have more extreme cash requirements.

What are the limitations of CCE?

Investigating a company's cash position is a good way to understand whether they are well prepared to deal with short-term cash needs.

However, this needs to be viewed in the context of the recent history and short-term future expectations for the company.

CCE is, after all, a measure of a short-term position, since the assets all have life spans of 90 or fewer days.

Therefore, looking into a company's cash position should be done alongside the examination of its recent past and expected shorter-term future, as well as industry norms.

An example of this would be if a company is showing a higher-than-normal cash position at a particular point in time, it could lead investors to think that the company is being sloppy with its use of resources.

Nevertheless, the full-context view may reveal that this is actually a short-term situation brought about, for example, by a recent, large influx of sales or a cyclical upsurge of cash into the business, which is actually a sign of healthy performance.

For this reason, it's important to investigate further and try to find the cause of any large surges in CCE, as well as to keep an eye on the cash position and see what management does next.

Additionally, analyzing the cash flow statement by quarter is a good opportunity for investors to better understand how the business works by learning about its sources and uses of cash.

SummaryThe major limitation of CCE is that it may fail to reveal the larger context of the situation. Therefore, it's important to always look at recent history and future expectations.

The takeaway

Cash and cash equivalents is a useful number that can help investors understand whether a company is liquid enough to cope with larger or unexpected short-term cash needs.

Yet while it's reassuring for companies to have healthy CCE reserves, it's also important to ensure the number is not excessive, which could be put to better use generating revenue.

Getting to know company and industry norms can be enormously helpful when evaluating CCE. As always, it's important to understand the larger context of the number.