Marketable Securities

Marketable securities are short-term assets that companies can quickly convert into cash.

Examples include stock, treasury bills, commercial paper, and bonds.

These are useful assets for a company to own because they can be easily sold when the business needs to get cash quickly. Marketable securities are also used when calculating liquidity ratios like the cash ratio, current ratio, and quick ratio.

Below is a guide to marketable securities, including examples, where to find a company's marketable securities listed, and how they're used in liquidity ratios.

What are marketable securities?

Marketable securities are short-term assets that can easily be converted into cash, as they are simple to buy or sell and generally mature quickly.

In fact, the defining characteristic of marketable securities is their liquidity — meaning they can be bought and sold quickly. Here are some examples:

- Common or preferred stock

- Treasury bills

- Commercial paper

- Derivatives

- Bonds

- Exchange-traded funds (ETF)

- Money market instruments

- Hedge fund investments

Marketable securities are useful assets for a company to have if they need to raise funds quickly, such as for an acquisition opportunity or to meet a short-term obligation.

In general, marketable securities are purchased as short-term investments with the intent to sell them later on. The benefit of these assets over cash is that they may also earn a return, though keep in mind that assets like stock can also lose value over time.

Marketable securities are found on a company's balance sheet and are considered current assets. They're also a key component of liquidity ratio calculations.

SummaryMarketable securities are short-term assets that can easily be sold if a company needs to raise funds quickly. Examples include stocks, bonds, ETFs, and others.

Types of marketable securities

Marketable securities can come in the form of equity, debt, or derivatives.

- Equity securities: Equity securities are those that represent ownership shares in another company. Examples include common stock, shares with voting rights, or preferred shares with the first claim on profit.

- Debt securities: Debt securities are financial assets created between two parties that have basic terms defined. They are considered fixed-income because they earn interest. Examples include commercial paper and treasury bills.

- Derivatives: In finance, a derivative asset is one whose value is dependent on another, underlying asset. Many derivatives, such as futures, options, and warrants, can also be marketable securities.

Of note, money market funds typically hold debt securities, as well.

SummaryMarketable securities come in three forms: (1) equity securities, which represent ownership shares in another company, (2) debt securities, which are fixed-income assets, and (3) derivatives, assets whose value depends on another asset.

Where to find a company's marketable securities

As an asset, you can find a company's marketable securities listed on its balance sheet.

Because marketable securities are a company's most liquid asset, they will be listed toward the top of the balance sheet, close to cash and cash equivalents.

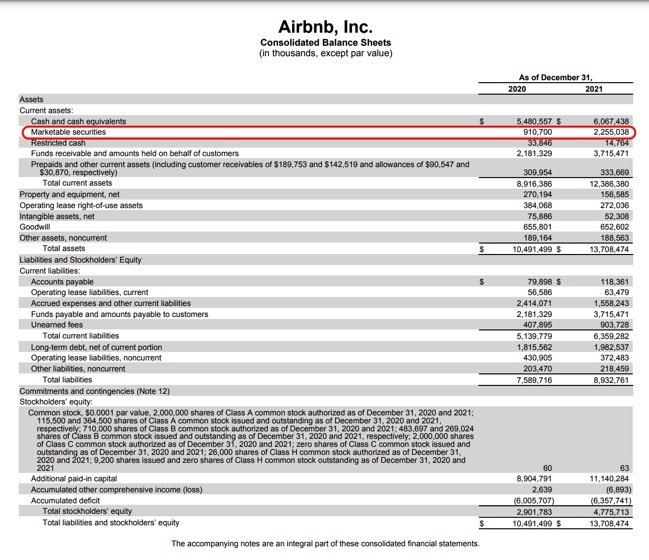

As an example, here is Airbnb, Inc.'s (ABNB) balance sheet from its 2021 10-K filing.

Source: Airbnb's 10-K

SummaryMarketable securities can be found on a company's balance sheet. As a highly liquid asset, they're generally located near the top.

How marketable securities are used in liquidity ratios

Marketable securities are used when calculating a company's liquidity ratios.

Liquidity ratios determine a company's ability to meet short-term obligations, evaluating whether it has enough liquid assets to pay off short-term liabilities.

These ratios include the cash ratio, the current ratio, and the quick ratio.

The cash ratio

This ratio takes a company's cash and marketable securities and then divides this number by the total current liabilities.

Here is the formula:

Cash ratio = (cash + marketable securities) / current liabilities

What this ratio reveals is how much of a company's current liabilities can be covered by its current cash and short-term assets.

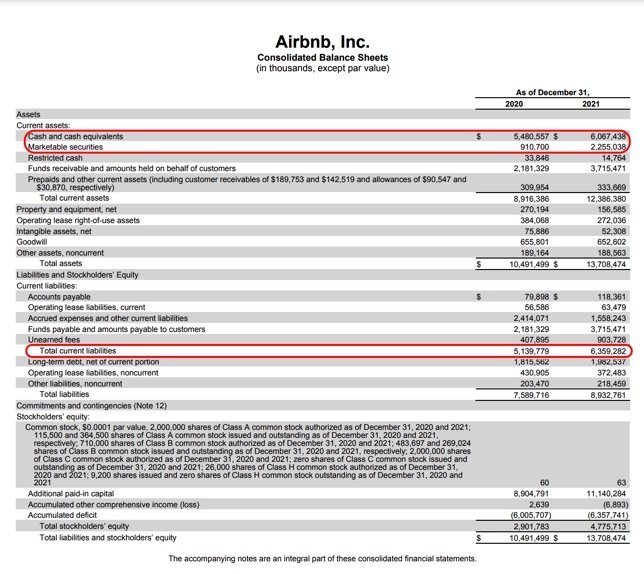

Below is an example calculation using Airbnb's 10-K. Note that all numbers are in thousands.

Source: Airbnb's 10-K

For 2021, Airbnb had USD $6,067,438 in cash and cash equivalents, $2,255,038 in marketable securities, and its total current liabilities were $6,359,282.

Therefore, you can calculate its cash ratio like so:

($6,067,438 + $2,255,038) / $6,359,282 = 1.3

A number larger than one means a company's cash and short-term assets are greater than its debt, while a figure below one means a company's short-term debt is greater than its assets. As Airbnb's cash ratio is 1.3, its short-term assets are greater than its debt.

The current ratio

The current ratio depicts how well a company can pay off its short-term obligations with its current assets.

The formula is as follows:

Current ratio = current assets / current liabilities

It reveals how well a company can meet its debt and other obligations, and can be used to make comparisons between peers. Of note, it's also called the working capital ratio.

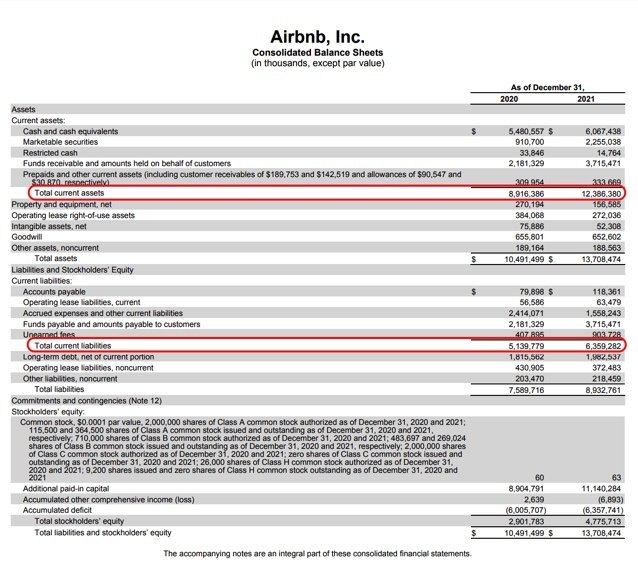

Below is an example calculation using Airbnb's data, again in thousands.

Source: Airbnb's 10-K

In 2021, Airbnb had $12,386,380 in current assets and USD $6,359,282 in current liabilities.

Here's the calculation:

$12,386,380 / $6,359,282 = 1.9

The same rule of one applies here, where a ratio under one would indicate the debt is greater than the assets. A ratio above one indicates the assets are greater than the liabilities.

The quick ratio

The quick ratio is a more conservative liquidity measurement of a company, as it only factors in assets that can be easily converted into cash.

Thus, the formula is as follows:

Quick ratio = quick assets / current liabilities

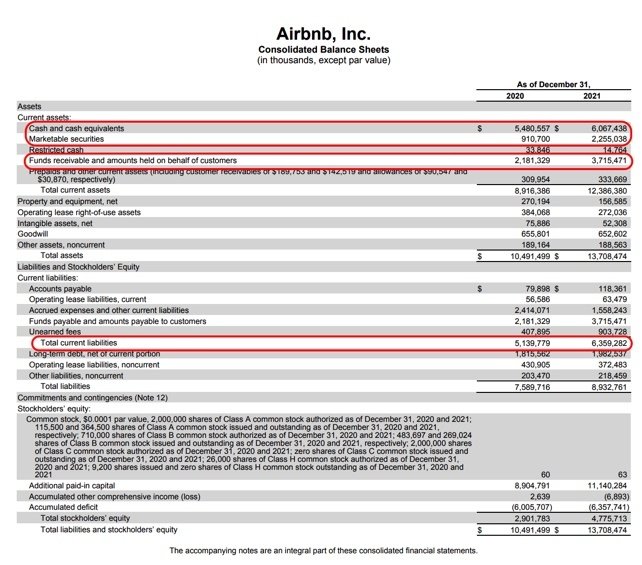

And below is an example using Airbnb, in thousands.

Source: Airbnb's 10-K

Airbnb's quick assets include cash and cash equivalents, marketable securities, and funds receivable. Restricted cash, prepaids, and other assets are not easily converted into cash, so would not be used when calculating the quick ratio.

In 2021, Airbnb had $6,067,438 in cash and cash equivalents, $2,255,038 in marketable securities, and $3,715,471 in funds receivable. Its total current liabilities were $6,359,282.

Here is the calculation:

($6,067,438 + $2,255,038 + $3,715,471) / $6,359,282 = 1.9

Again, this means Airbnb's assets are greater than its liabilities.

SummaryMarketable securities are considered current and quick assets. As such, they are part of the three liquidity ratios: the cash ratio, the current ratio, and the quick ratio. These are all used to assess short-term funds in relation to obligations.

What are non-marketable securities?

Where marketable securities are highly liquid and easily converted into cash, non-marketable securities are the exact opposite.

These assets are highly illiquid because they do not trade on prominent secondary exchanges.

Such securities include savings bonds, limited partnership or private company shares, and complex derivatives.

Typically, these non-marketable securities must be transacted privately or over the counter.

SummaryNon-marketable securities are highly illiquid assets that do not trade on prominent secondary exchanges. Examples include savings bonds, limited partnership or private company shares, and complex derivatives.

The takeaway

Marketable securities are short-term assets that can be sold quickly and converted into cash. They serve several purposes for the companies who acquire them.

For one thing, these securities are short-term liquid investments that can be quickly converted to cash when the business is in need of fast funds.

Additionally, marketable securities can be more advantageous than cash since they may generate a positive return, though this is not always the case.

You can find marketable securities listed on a company's balance sheet.

They are also used in several liquidity ratios, including the cash ratio, current ratio, and quick ratio. These are used to provide insights into a company's ability to cover its short-term obligations, which is an important consideration when evaluating a company.