Intangible Assets

Intangible assets are the non-physical resources that a company owns.

Because they are non-physical and their future benefits can be difficult to determine, they can be harder to define or value than their tangible, or physical, counterparts.

Examples of intangible assets include intellectual property, brand equity, and patents.

Below is a comprehensive overview of intangible assets including examples, how they're used in accounting, and information on valuing them.

What is an intangible asset?

Intangible assets are those that are not physical in nature. They are typically used by a company over a long-term period and are often intellectual assets.

Because of their nature, intangible assets can be harder to define and value than physical assets. In fact, a good way to assess whether an asset is tangible or intangible is to consider its physicality.

Examples of intangible assets include:

- Goodwill

- Intellectual property

- Trademarks

- Patents

- Copyrights

- Franchises or licensing agreements

- Research and development

- Brand equity

- Customer lists

- Domain names

Although intellectual capital is becoming more and more important economically, valuing intangible assets from an investment standpoint can be tricky.

This is because their future benefits are often uncertain. Furthermore, some intangible assets have an undefined lifespan, making accounting for them even more complicated.

Nevertheless, intangible assets have great value to a business and can be a key piece of the company's success and financial valuation.

Intangible assets can be either acquired or created by a company. In accountancy terms, acquired assets are shown on the balance sheet, while those created by the company are treated as expenses, rather than as assets.

However, these expenses are important because they represent a future financial benefit for the company, as ultimately they add to earnings.

SummaryIntangible assets are those that are not physical, such as goodwill, domain names, or trademarks. Valuing these can be difficult, as their future benefits and lifespans may be undefined. However, they're an important piece of a business's finances.

Where do intangible assets come from?

Intangible assets can be created or acquired by a company.

An example of a created intangible asset would be the establishment of a new trademark for products, while an example of an acquired intangible asset would be a trademark purchased from another company.

You might ask why a company would decide to acquire, rather than create, its own trademark or other intangible asset.

This will fundamentally be a decision based on the bottom line — that is, is it more profitable to spend time creating an in-house trademark, with all the uncertainty of success that brings, or is it more worthwhile to pay to acquire a readymade, successful one from elsewhere?

Of course, since many intangible assets have long or undefined lifespans, evaluating which is better will ultimately be more of a business choice than an exact, calculable amount.

SummaryIntangible assets can be either created or acquired by a company. Sometimes there is a choice involved when a new asset is needed, which comes down to a business decision about which approach will be more valuable to the company long-term.

Why are intangible assets important?

Intangible assets can lead to increased revenue and profitability. They are simply another form of asset for a business to create or acquire to add value to the company.

Whether a company is building a new franchise, investing in research and development, or buying a copyright from another company, the idea is that this will bring growth.

To see the value of intangible assets, consider names like Starbucks or Christian Dior. These brands are extremely well-recognized, household names.

However, putting a price on this brand recognition can be tricky. Since intangible assets are by nature hard to define, their importance to a company can also be difficult to quantify.

This is especially true for assets with no fixed lifespan, like a brand name.

Intangible assets also have much to offer by way of competitive advantage since they help create perceived customer value. This comes into play when a business is bought or sold, as intangible assets add value beyond the book value of the tangible assets.

To put it simply, intangible assets add to a business's bottom line, although not necessarily in a direct or easily quantifiable manner.

As an investor, it's vital to take the time to get a better understanding of the potential value that an intangible asset is adding to future earnings.

On the flip side, when intangible assets are no longer contributing to cash flow or lose value, they can become an impairment in accounting.

SummaryIntangible assets add value to a business, with examples being brand recognition and perceived customer value. While hard to quantify, especially when the asset's lifespan is indefinite, these assets are important to revenue and profitability.

Identifiable vs non-identifiable intangible assets

Intangible assets are classified in terms of their useful lifespan as either identifiable, with a finite lifespan, or non-identifiable, with an indefinite lifespan.

Lifespan is important when valuing intangible assets because it helps a business understand how to evaluate their usefulness in terms of profitability.

Because identifiable assets have a finite lifespan, their value can be considered over this period. Non-identifiable assets, on the other hand, have an indefinite lifespan, which makes valuation even more tricky.

As with most aspects of intangible assets, these classifications are often more of a matter of opinion or business decision, rather than hard and fast rules.

Of course, for example, a contract or licensing agreement would tend to have a definite timespan, but assets like brand equity would be much harder to define.

Overall, a company's ability to give accurate valuations to its intangible assets is a good indicator of its ability to manage the business successfully.

SummaryIntangible assets are classified according to their lifespan as either identifiable, with a known lifespan, or non-identifiable, with an indefinite lifespan.

How intangible assets are valued

Intangible assets can be difficult to value since their future benefits are often uncertain.

However, it's important to consider their value in terms of accounting, and not just in terms of what they will generate for a business in the future — that is, from an investment point of view.

Accounting uses historic costs to calculate the value of a company, whereas market value comes from how investors perceive the future of the company.

Importantly, there's also a difference between how created versus acquired assets are valued.

Assets created by the company

If a company creates an intangible asset, the expenses from the process can be written off.

For example, if a company registers a patent, the legal costs, patent filing expenses, and others can all be written off. This is continued for any future expenses coming from the asset.

Since these costs have been treated as expenses, they will not appear as assets on the balance sheet and will therefore have no book value.

Thus, you will often see that when a company is bought by another company, the purchase price is greater than the book value of the assets on the company's balance sheet.

This is, in part, because the purchaser perceives value in the intangible assets of the company it's buying so is prepared to pay more than the cost of the physical assets.

However, keep in mind that perceived certainty in the present value of the company's future cash flows also contributes to price — intangible assets are just one element that goes into setting a purchase price.

Assets acquired by the company

In contrast, intangible assets that have been acquired are shown on the balance sheet.

When a company buys an asset from another company, such as a trademark or a patent for a new piece of technology, then the company will record this transaction on its balance sheet as an intangible asset, listed under long-term assets.

Over time, this asset would be amortized, or written off, in the same way as any other asset.

However, if the intangible asset is indefinite, such as a brand name or goodwill, then it will not be amortized. Instead, each year, it will be assessed to see whether its value recorded on the balance sheet is still fair. This is called assessing for impairment.

Balance sheet example

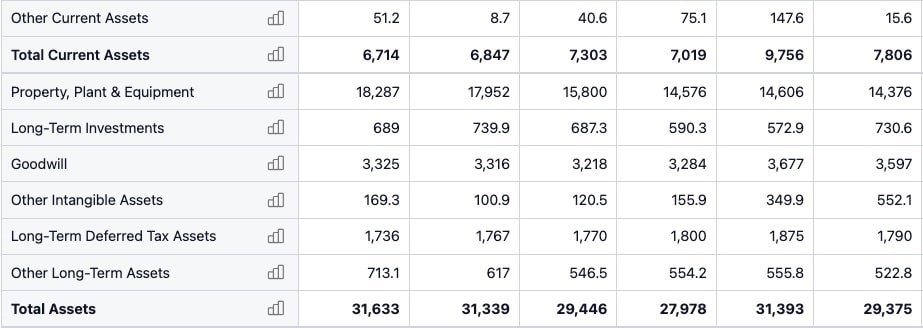

As an example, below is Starbucks Corporation's (SBUX) balance sheet with the entry for “goodwill and intangibles.” This is the annual overview, with 2025 (TTM, for the period ending March 30th) on the left.

Source: Starbucks Corporation's Balance Sheet

SummaryIntangible assets can be valued in terms of accounting and in terms of investing. They're also accounted for differently depending on whether they were created or acquired by a business, as only the acquired assets appear on the balance sheet.

Calculated intangible value

In investing terms, calculating value is often done using calculated intangible value (CIV) or by deducting book value from market value.

When a company is being sold, management will work to find a value for intangible assets. There are a couple of common ways to do this.

The simpler method is to simply deduct the book value from market value, but the issue here is that this constantly changes as the market value of the company fluctuates.

Therefore, companies often choose to use CIV since this method attempts to find a value for intangible assets in a way that isn't linked to market value.

CIV considers the company's average return on tangible assets alongside the industry average, as well as pre-tax earnings. It uses these to work out future likely excess earnings of the company versus its sector and attributes these to the intangible assets it has.

These are then valued “in today's money” by working out what money you'd have to pay now to get those future earnings.

SummaryCalculated intangible value is a way to determine value for intangible assets that isn't linked to a company's market value. It can be useful, for example, when a company is being sold.

The takeaway

Intangible assets can be confusing to value, especially as an investor.

But in a global economy where value increasingly comes from knowledge, and not just physical assets, understanding how companies use intangibles is key.

Importantly, intangible assets are valued differently from an accounting perspective versus an investment point of view, which is more focused on future performance.

Non-identifiable assets, or those without a definite lifespan, can be the trickiest to value.

However, properly valuing intangibles is critical, especially during the sale of a company, as these assets can be a big determiner of the purchase price above that of the tangible assets.

Companies that are being sold often prefer to use calculated intangible value, or CIV, rather than simply deducting book value from market value, since this gives a more robust valuation.