Research and Development (R&D)

Research and development, also known as R&D, represents a company's efforts to create new products or improve its existing offerings.

R&D costs are generally considered operating expenses and are reported on the income statement. As an expense, they have a big impact on the bottom line and may be considered a company's most essential — though sometimes risky — investment.

Through R&D, a company can remain competitive in the market and work to generate patents, trademarks, and new revenue streams.

Below is everything you need to know about R&D, including why it's important, the different types, accounting for it, and how the R&D tax credit works.

What is R&D?

Research and development is a company's investment in itself. The aim of R&D is to create or improve products, which will hopefully generate more income in the future.

R&D is a long-term investment — companies don't invest in research and development for instant profit. Instead, R&D expenses are long-term costs meant to help a company anticipate trends and stay ahead of its peers.

Most companies have some sort of R&D program, but those in sectors dependent on innovation, such as pharmaceuticals, semiconductors, and tech, tend to spend the most on research and development.

In the U.S., there's an R&D tax credit, which provides a 6–14% payroll tax credit to companies conducting “qualifying” R&D activities. The cap recently doubled from $250,000 to $500,000 following the signing of the Inflation Reduction Act (1, 2).

SummaryR&D represents a company's efforts to create new products or improve its existing ones. The goal is to generate more income in the long term, as well as remain competitive in the market.

Why is R&D important?

R&D is how a company focuses on the future and stays ahead in the market. For this reason, R&D programs are an important component of long-term company success.

A successful R&D program is how a company thrives and survives as a standalone enterprise. On the other hand, a company struggling with R&D may have to outsource parts of its business or explore mergers and acquisitions (M&A) or partnerships.

Operationally, R&D is unique because it's an expense focused on the long term. Immediate profit is not an expectation, and neither is a rapid return on investment (ROI).

Instead, R&D expenses are expected to contribute to long-term profitability and innovation.

In addition to new goods and services, companies invest in R&D hoping it could lead to breakthrough discoveries, which are usually protected by patents, copyrights, or trademarks.

R&D investments are high risk for companies but also potentially high reward, focusing on the long term rather than an immediate profit.

SummaryCompanies invest in R&D to innovate, develop new products, improve existing ones, and remain competitive. Many companies also invest in R&D to find breakthrough discoveries protected by patents, copyrights, or trademarks.

What are the types of R&D?

There are three main types of R&D: basic research, applied research, and experimental development.

- Basic research: The goal of basic research is to acquire new knowledge and observable facts. In other words, it's the groundwork companies put in from a theoretical or experimental perspective, even if there's no particular application just yet.

- Applied research: Applied research is similar to basic research in that the goal is to acquire new knowledge. However, this time, there's an original framework and investigation directed toward a specific purpose or objective.

- Experimental development: Experimental development draws on the knowledge gained from basic and applied research. By this point, companies direct their R&D towards producing new products or improving existing offerings.

SummaryThe three types of R&D are basic research, applied research, and experimental development. These cover a company's entire R&D lifecycle, from acquiring and using knowledge to formulating a plan to develop this information into a final product.

Examples of R&D

Even though research and development spending may vary by industry, you can find examples of R&D across most companies.

Take companies that make popular everyday products, such as Unilever (UL) or Procter and Gamble (PG). Unilever is the parent company of Axe, while P&G is the parent company of Old Spice. A lot of R&D goes into creating these products and marketing them to consumers.

Some companies spend so significantly on R&D, however, that they stand out from the rest. One example of this is Pfizer (PFE) and the COVID vaccine.

While Pfizer didn't initially have the R&D for mRNA vaccines, it outsourced this by paying BioNTech USD $185 million upfront in April 2020 (2).

In the second quarter of 2022 alone, the vaccine brought in USD $8.8 billion in sales. Pfizer's total revenue also grew 47% year-over-year to $27.7 billion, a company record. That's a pretty good return on investment (3).

This is a classic example of how R&D benefits a company's long-term profitability.

SummaryR&D examples range from consumer goods to pharmaceuticals. One stand-out example is Pfizer's $185 million upfront payment for BioNTech's mRNA R&D, which resulted in the COVID vaccine and record sales for Pfizer.

Which companies spend the most on R&D?

Regardless of industry, most companies typically invest in R&D programs.

However, a construction company will probably spend less on R&D than a company operating in pharmaceuticals, semiconductors, or software/technology.

Companies with innovation as their foundation will generally invest heavily in R&D to bolster their intellectual property and give them a leg up in developing the next big thing.

For example, consider the companies that spent the most on R&D in 2020 (4):

- Amazon: $42.7 billion

- Alphabet: $27.6 billion

- Huawei: $22.0 billion

- Microsoft: $19.3 billion

- Apple: $18.8 billion

- Samsung: $18.8 billion

- Meta Platforms: $18.5 billion

Incredibly, Amazon (AMZN) spent over $15 billion more on R&D than its second-closest competitor, and spent 11% of its total revenue on R&D expenses.

But perhaps Amazon knew what it was doing, considering it received 2,244 new patents in 2020 focused on artificial intelligence, machine learning, and cloud computing.

Additionally, consider the pharmaceutical industry in 2021.

While patents on vaccines and COVID treatments were the primary focus in 2020, 2021 was all about maintaining competitiveness and the previous year's unprecedented revenue surge.

Unsurprisingly, Pfizer spent the most on R&D in 2021, with a whopping 17% of its revenue dedicated to R&D. As you can tell from the table below, the pharmaceutical industry takes research and development very seriously (5).

| Company | R&D spend | % of revenue |

| 1. Pfizer | $13,829,000,000 | 17.0% |

| 2. Roche Pharmaceuticals | $13,342,082,240 | 27.1% |

| 3. Merck & Co. | $12,245,000,000 | 25.1% |

| 4. Janssen (Johnson & Johnson) | $11,882,000,000 | 22.8% |

| 5. Bristol Myers Squibb | $11,354,000,000 | 24.5% |

SummaryMost companies have some sort of R&D program, though companies in high-innovation sectors tend to spend the most on research and development. In 2020, Amazon spent 11% of its revenue on R&D. In 2021, Pfizer spent 17% of its revenue on R&D.

How is R&D accounted for?

The U.S. Generally Accepted Accounting Principles (GAAP) require research and development costs to be expensed.

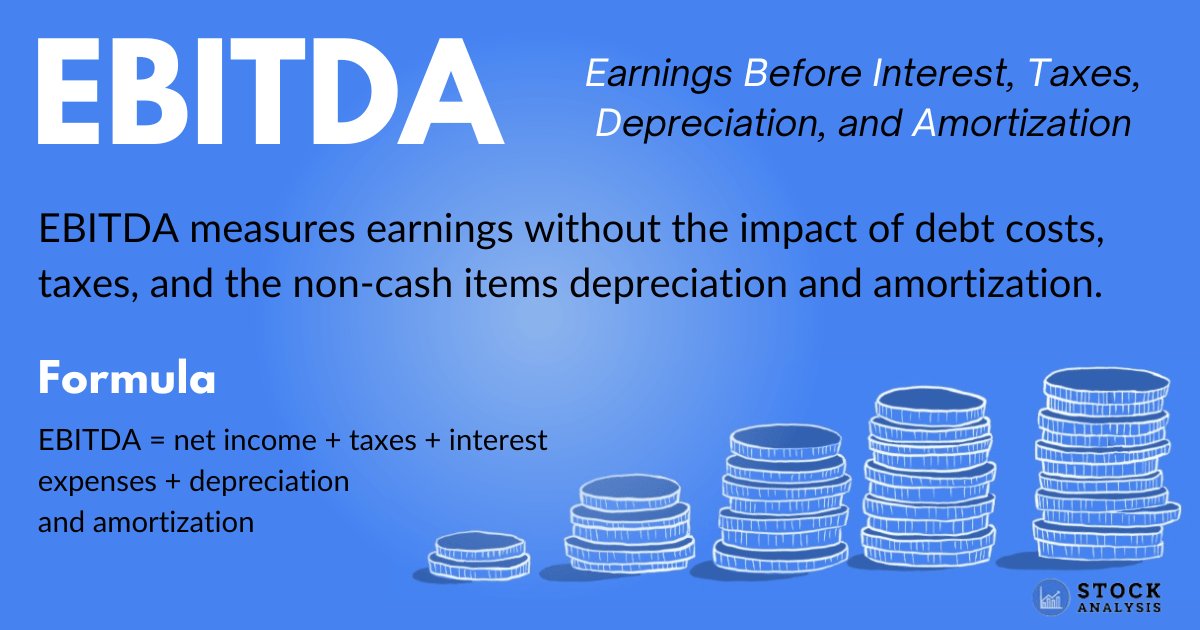

R&D costs are thus considered operating expenses and are reported on the income statement. As an expense, they can considerably impact a company's bottom line.

In some instances, R&D expenses can be reported on the balance sheet, provided they have an alternative future use and can be depreciated or amortized over time.

Examples of R&D costs that may be capitalized include software development expenses, patents, trademarks, and other intangible assets. Capitalizing R&D costs in the year they are incurred reduces operating expenses and, in turn, boosts a company's profitability.

SummaryR&D costs are usually considered operating expenses and are accounted for on the income statement. However, once a company determines future use of R&D activities, the cost may be capitalized and reported on the balance sheet.

R&D tax credit

The R&D tax credit is likely the most critical tax credit for U.S. businesses, especially those in early stages that aren't yet profitable.

Depending on the industry and type of expense, companies can claim tax credits through incentives, such as the regular research credit (RRC), alternative simplified credit (ASC), credit for basic research, or energy research credit.

Through the alternative simplified credit (ASC) incentive, the U.S. federal research and experimentation tax credit provides a 6–14% payroll withholding tax credit to companies conducting qualifying R&D activities (1, 2).

The purpose of the tax credits is to reduce the payroll tax burden, improve cash flow, promote and encourage investments in qualified R&D activities, and incentivize innovation and growth.

To be considered a qualifying R&D activity by the Internal Revenue Service (IRS), a research and development expense must meet all the following requirements (6):

- Qualified purpose: the research must aim to improve defined, specific aspects.

- Eliminated uncertainty: capabilities, methods, and designs must be established.

- Experimental: a scientific method or specific process must be followed.

- Technological: must focus on the hard sciences, like physics or engineering.

Research after commercial production, studies, surveys, and reverse engineering does not qualify.

Recently, the maximum tax credit threshold doubled from USD $250,000 to $500,000 following the signing of the Inflation Reduction Act.

To put it simply, companies that reach the maximum threshold can now reduce their payroll taxes by half a million dollars.

SummaryThe R&D tax credit provides a 6–14% payroll tax credit to U.S. companies conducting qualifying research activities. The upper limit of the credit recently doubled from $250,000 to $500,000 following the signing of the Inflation Reduction Act.

The takeaway

With business and tech continuing to advance at breakneck speed, innovation is critical.

This is why research and development investments play an increasingly important role as companies work to stay one step ahead.

Consider the example of Pfizer, which following a global pandemic set revenue records due to hundreds of millions of dollars spent on R&D expenses.

Companies with a long-term focus on growth tend to see R&D as a significant priority, especially if they want to create unique products that are difficult to imitate.

R&D doesn't usually result in an instant payoff — it's a long-term investment that, over time, can lead to improved productivity, profitability, and unique proprietary assets.

In other words, investing in R&D helps companies stay ahead of the curve while positioning themselves at the top of their sector for investors and consumers.