Shares Outstanding

Shares outstanding is a financial number that represents all the shares of a company's stock that shareholders, including investors and employees, currently own.

For investors, knowing the shares outstanding is important for calculating financial metrics and understanding the stake in a company that a share represents.

An additional metric used alongside shares outstanding is a company's “float,” which refers to the shares available for investors to buy and sell on the open market.

Outstanding shares: meaning and types

When you buy stock in a company, you are buying an ownership stake, which is issued as a share of stock.

The shares companies issue are known as authorized shares, which are the maximum number of shares they are lawfully permitted to make available to investors.

There are two types of authorized shares: unissued shares and issued shares.

- Unissued shares: These are stocks that have never been issued or put up for sale by a company. They generally have no effect on outstanding shares.

- Issued shares: These include treasury stock and outstanding shares. Treasury stock refers to shares held by the company, which do not have exercisable rights.

Shares outstanding consists of unrestricted shares that can be traded on the market, shares held by institutional investors, and restricted shares owned by company insiders.

The first of these, unrestricted shares, is also known as “the float.” These are the shares that can be actively traded on the open market.

Importantly, the number of shares outstanding is dynamic and fluctuates over time.

SummaryShares outstanding are company-issued shares that can be traded on the market, held by investors, and owned by company insiders. Unrestricted shares, or those available on the market, are called the float.

Why shares outstanding matters

For investors, a company's outstanding share number has two main uses: it's a component of key financial metrics and reveals what your stake in the company is.

It's used to calculate financial metrics

The number of outstanding shares is used to calculate important financial metrics like market capitalization, earnings per share, and free cash flow per share:

- Market capitalization: Market capitalization is calculated by multiplying share price by shares outstanding. It's an integral measurement in understanding a company's actual value and size.

- Earnings per share: Earnings per share (EPS) is calculated by dividing earnings by outstanding shares. It shows how much profit is generated per share of stock.

- Free cash flow per share: Free cash flow (FCF) per share shows how much money remains after funding core business operations and paying for capital assets, calculated per share of stock. It provides insights into profitability and how that money is spent.

It shows what your stake in the company is

A company's number of outstanding shares is dynamic, changing over time.

Evaluating the trend of this number provides useful insights to investors. It also lets you know what portion of ownership your shares represent.

For example, when shares outstanding are going up, the ownership stake of shareholders is diluted. And when shares are bought back, investors end up owning more of the company.

SummaryKnowing a company's number of shares outstanding is key when calculating critical financial metrics and determining share value as a portion of ownership.

How to find shares outstanding

You can find shares outstanding at the top of a company's 10-Q or 10-K filing.

These statements are available on companies' investor relations pages or the SEC website. The information is also available on stock data websites like Stock Analysis.

Generally, the shares outstanding will be listed for you. But in case you want to know how to calculate it yourself, here is the formula:

Shares outstanding = shares issued - treasury stock

Example calculation

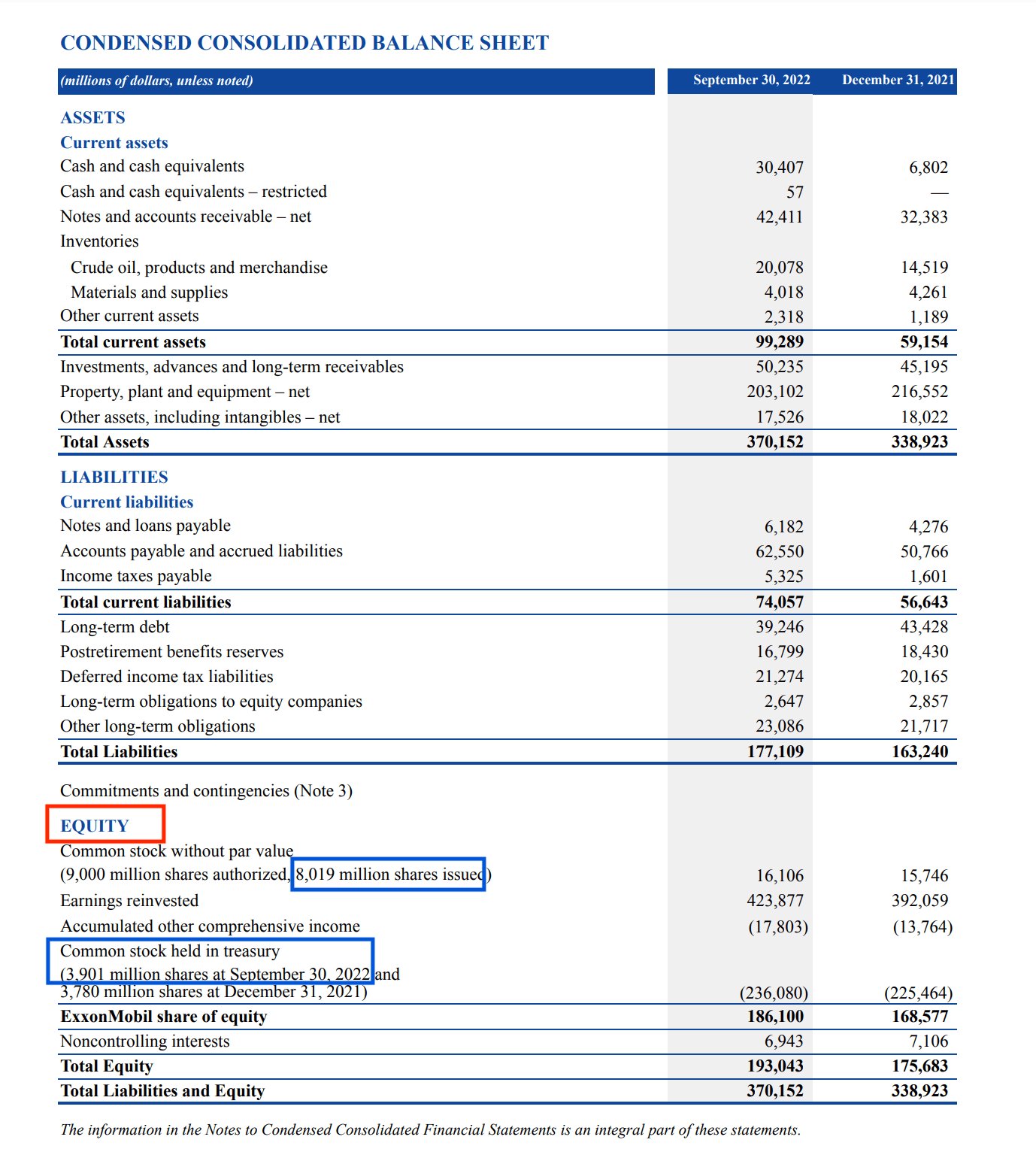

Below is an example calculation using Exxon Mobil's (XOM) Q3 2022 10-Q statement.

Source: Exxon Mobil's 10-Q

The inputs you'll need for this calculation are located on the balance sheet.

Here, the balance sheet reports 8,019 million shares issued and 3,901 million treasury shares, as of September 30, 2022.

You can then calculate the shares outstanding like so:

8,019 - 3,901 = 4,118 million outstanding shares

Other companies may explicitly list their outstanding shares as a line item in the equity section of their balance sheet.

SummaryThe number of outstanding shares is calculated by subtracting treasury stock from the shares issued. Generally, you won't need to calculate this number yourself and it will be listed for you on a company's 10-Q or 10-K filing.

Shares outstanding vs float

Shares outstanding is a metric that goes hand-in-hand with float.

The number of shares outstanding consists of shares held by institutions, restricted shares held by company insiders, and shares available for investors to buy and sell on the open market. The shares on the open market are called the float.

The float is the portion of outstanding shares that's most relevant for smaller investors.

Here is the formula to calculate float:

Float = outstanding shares - restricted shares

When investors research stocks, they often assess a company's float.

Generally speaking, stocks with smaller floats will experience more volatility than those with larger floats. With fewer available shares to trade, the fluctuations are larger.

Often, this is why day traders tend to prefer low-float stocks.

SummaryThe shares available to investors on the open market are commonly called the float. In general, stocks with low floats will experience more volatility than those with large floats.

How do stock splits affect shares outstanding?

Several factors can cause a company's number of outstanding shares to rise or fall, with one of the most common being stock splits.

A stock split occurs when a company increases the number of its outstanding shares without changing its overall market cap or value.

For instance, if a company goes through a 2-for-1 stock split, its stock price will go down by 50% but it will double the number of its outstanding shares.

Many companies decide to do a stock split to make their stock more affordable for a broader range of investors and to improve liquidity.

A recent example is Amazon (AMZN). In March of 2022, Amazon was trading at over $2,000 a share — considerably out of budget for many retail investors. So the board announced a 20-for-1 stock split, reducing the share price to just over $100.

Companies can also undergo a reverse stock split or share consolidation.

A reverse stock split exchanges existing shares for a proportionately smaller number of new shares. Companies may do this to increase their share price, such as if they need to satisfy exchange listing requirements or want to deter short sellers.

A recent example of a reverse stock split is General Electric's (GE) 1-for-8 reverse stock split during the summer of 2021.

At the time, GE discussed plans to split into three companies and to divest from many businesses. They determined that reducing their share count from nearly 8.8 billion to roughly 1.1 billion better aligned with this vision (1).

SummaryA stock split occurs when a company increases its shares outstanding without changing its market cap or value. This increases the number of shares but reduces the share price. Companies can also undergo reverse stock splits or consolidate shares.

The takeaway

The shares outstanding metric is foundational for investors.

It's a critical figure when calculating a company's market cap, EPS, and FCF per share.

Changes in shares outstanding over time also reveal how valuable shares are as a stake of ownership in the company, as the number of shares available directly affects this.

Moreover, the number of shares outstanding is extremely useful when monitoring how a company conducts its business, as things like stock splits also affect share numbers.

Overall, the number of shares outstanding, the metrics you can calculate from it, and related metrics — like the float — provide key insights to investors.