Top 7 High-Yield Investments in 2026

While there are many good investment options, not all of them generate real cash flow.

For example, while stocks are the highest returning asset class, most of their returns come in the form of appreciation, which means you'll have to sell some of your investment to actually create income.

That's not what you want to do. You want your portfolio to produce cash on its own, without you needing to manage it.

The investments on this list will do that.

Whether you're retired or just looking to create some additional income, here are the seven highest-yielding investments in 2026.

Summary of the best high-yield investments

| Investment | Average yield* | Timeframe |

| 1. Private credit | 9–18% | Short |

| 2. Bonds | 3–8% | Short-to-long |

| 3. Dividend stocks & ETFs | 2–7% | Long |

| 4. Covered call ETFs | 8–13% | Medium-to-long |

| 5. REITs | 3–15% | Long |

| 6. High yield savings accounts (HYSAs) | 4–5% | Short-to-long |

| 7. CLO ETFs | 6–7% | Medium-to-long |

Disclaimer: Average yield is a general figure based on current data (detailed below). Actual results may vary. Content is for educational purposes only; it is not investment advice.

For more details on each of these investments, keep reading.

1. Private credit

- Average yield: 9–18%

- Timeframe: Short

- Availability: Accredited investors only

Many private companies are too big to qualify for loans from banks.

Instead, these companies borrow money from non-bank lenders — typically large institutions like Goldman Sachs, Morgan Stanley, and AIG — in the “private credit” market.

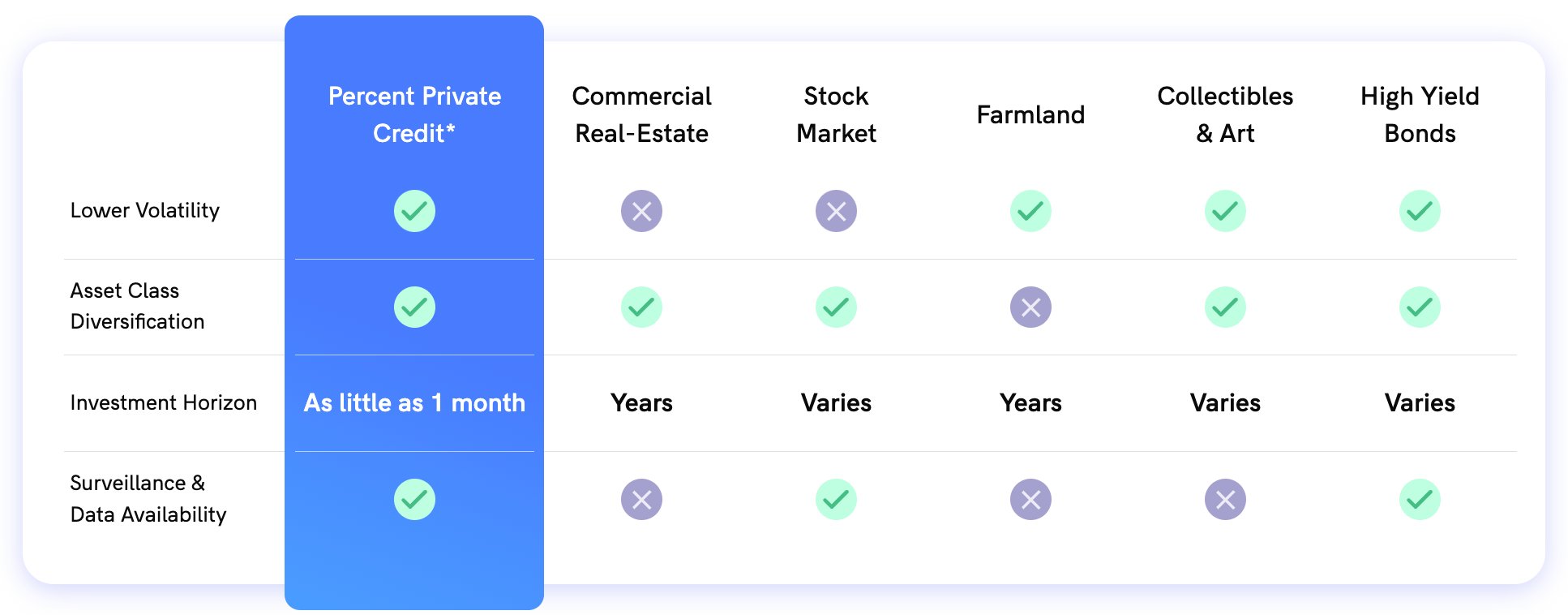

Because the funding is harder to come by, the terms are often very favorable for the lenders. Private credit is known for its high yields, low volatility, and short-term investment horizons.

While the private credit market used to be only available to institutional investors, individual investors can now participate in the market through Percent, a private credit investment platform.

As of April 2025, deals on Percent have averaged:

- Yields of 13.71%

- Default rates of 2.64%

- Investment terms of 10.4 months

In total, more than $1.45 billion has been invested through Percent — and more than 89% of investors reinvest after their first deal.

Unfortunately, Percent is only available to accredited investors.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

But if you qualify as an accredited investor, you can start investing in private credit on Percent today (and get a bonus of up to $500 for registering through our links).

2. Bonds

- Average yield: 3–8%

- Timeframe: Short-to-long

- Availability: Any investor

Bonds are debt securities sold by corporations and governments to investors.

Each bond has a predetermined maturity date for when the borrowed amount (plus interest) must be repaid.

Many bonds also come with periodic payments (known as “coupon payments”), which are paid in regular installments, typically semiannually, throughout the life of the loan.

The two most common types of bonds are corporate bonds — which are issued by public companies, like Microsoft — and government bonds — which are issued by government agencies, like the U.S. Treasury.

A bond's yield is inversely related to how likely the bond is to be repaid — the higher the yield, the riskier the bond. Since there is an extremely low chance the U.S. government will ever default on its debt, its debt typically pays the lowest yields.

You can purchase individual bonds or bond funds (here's the difference).

I personally prefer investing in bond ETFs because they have lower investment minimums ($1 vs $1,000) and offer instant diversification.

Here are a few popular bond ETFs:

- SGOV, a short-term U.S. Treasury bond ETF, currently yielding 4.70%

- EDV, a long-term U.S. Treasury bond ETF, currently yielding 4.95%

- VCIT, an intermediate-term investment-grade bond ETF, currently yielding 4.49%

- USHY, an intermediate-term junk-bond ETF, currently yielding 6.77%

Any investor can purchase bonds in their regular brokerage account. If you don't have one, we recommend Public.

3. Dividend stocks & ETFs

- Average yield: 2–7%

- Timeframe: Long

- Availability: Any investor

Dividend stocks are the most popular investment for investors who want regular cash flow while also giving their principal a chance to appreciate.

A common misconception among new dividend investors is that the companies paying the highest dividend yields are the best.

However, higher dividend yields are often the result of a depressed stock price (due to underlying issues at the company), and are often a sign of a weakness rather than a strength.

Instead, most dividend investors try to own high-quality companies that not only pay dividends, but have also been regularly increasing their dividend payouts due to higher revenue and profit.

You can invest in dividends stocks and ETFs in your brokerage account. If you need a brokerage account, check out Public.

Many dividend investors reinvest their dividends into the company that paid them. Each reinvestment then results in slightly more shares. With slightly more shares, your next dividend payment is slightly higher.

This, combined with the underlying company regularly increasing its dividend, creates a snowball effect that can result in extremely large dividends when given enough time.

Some of the most popular dividend growth stocks (and their current yields) are:

| Johnson & Johnson (JNJ): 3.38% | McDonald's (MCD): 2.21% |

| Procter & Gamble (PG): 2.55% | Kimberly-Clark (KMB): 3.56% |

| Coca-Cola (KO): 2.85% | Pfizer (PFE): 7.31% |

| PepsiCo (PEP): 4.32% | ExxonMobil (XOM): 3.77% |

| Realty Income (O): 5.66% | Chevron (CVX): 4.98% |

| Altria Group (MO): 6.81% | Verizon Communications (VZ): 6.13% |

There are also some very popular dividend growth ETFs, including SCHD, VIG, and DVY.

You may also be interested in Dividend Aristocrats and Dividend Kings (companies in the S&P that have raised their dividends every year for 25+ and 50+ years, respectively).

To learn more about dividend growth investing, and how to evaluate dividend stocks, check out the r/dividends subreddit.

4. Covered call ETFs

- Average yield: 8–13%

- Timeframe: Medium-to-long

- Availability: Any investor

Another option for investors who have the bulk of their portfolio invested in stocks but want to generate some income is to sell covered calls.

If you own 100 shares of a stock, you can sell a call option on those shares, which gives the buyer the right to buy your shares at the “strike price” within a certain timeframe.

In exchange, the buyer pays you a “premium” that is added to your account balance like income.

If the stock stays below the strike price, you keep both your shares and the premium. If it rises above the strike price, your shares will be called away from you, but you still keep the premium and any gains up to the strike price.

While selling covered calls can be an effective way to generate extra income, managing covered calls manually can be time-consuming and complex.

Instead of doing all this work yourself*, you can invest in a covered call ETF.

*If you want to learn how to do this yourself, check out my course Selling Options for Income.

These ETFs own portfolios of stocks and then sell call options on those stocks. The proceeds are passed on to investors in the form of monthly dividends.

Some of the most popular covered call ETFs are:

- JPMorgan Equity Premium Income ETF (JEPI) has a yield of 7.98% and is one of the largest and most well-known covered call ETFs. It uses a mix of blue-chip stocks and equity-linked notes (ELNs) to generate income.

- Global X Nasdaq 100 Covered Call ETF (QYLD) has a yield of 13.85% and writes calls on the Nasdaq-100. It's high yield, but has limited upside due to writing calls on the entire index every month.

- Global X S&P 500 Covered Call ETF (XYLD) has a yield of 13.37% and is like QYLD but performs it on the S&P 500. It offers monthly income with broad market exposure.

The primary tradeoff of selling covered calls is that it caps some of the upside potential which may lead the portfolio to underperform the broader market during big rallies.

That said, they tend to outperform during sideways or down markets, while also generating a steady stream of income.

Covered call ETFs are available to any investor with a brokerage account and can be bought just like any stock or ETF.

5. REITs

- Average yield: 3–15%

- Timeframe: Long

- Availability: Any investor

Real estate is a common investment for people looking to generate income, but finding investment properties, screening tenants, and everything else that comes with being a landlord isn't a viable option for many people.

Fortunately, you can earn passive income from real estate without owning your own properties.

Real estate investment trusts (REITs) are companies that own real estate such as apartments, shopping centers, office buildings, warehouses, cell towers, and data centers.

There are several types, including equity REITs, mortgage REITs, hybrid REITs, and others.

In exchange for favorable tax treatment, REITs are legally required to distribute at least 90% of their taxable earnings to shareholders as dividends — which makes them a natural fit for yield-focused investors.

And, you can purchase them in your regular brokerage account.

Some popular publicly traded REITs are:

- Realty Income (O) has a yield of 5.66% and owns a diversified portfolio of retail and commercial properties.

- Public Storage (PSA) has a yield of 3.90% and is a leading self-storage REIT with a strong track record of dividend growth.

- Digital Realty Trust (DLR) has a yield of 2.87% and owns and operates data centers — a segment benefiting from the growing demand for cloud infrastructure and AI.

- Agree Realty (ADC) has a yield of 4.00% and focuses on retail properties where it can negotiate long-term leases with major national tenants.

- AGNC Investment Corp. (AGNC) has a yield of 15.67% and invests in agency-backed mortgage securities. While mortgage-backed REITs generate higher income, they also come with substantially more volatility and risk.

You can also invest in REIT ETFs, which own baskets of REITs, like VNQ and SCHH.

REITs can be bought and sold just like stocks in any brokerage account, and many investors hold them in tax-advantaged accounts like IRAs to defer taxes on dividends.

If you like the idea of owning real estate without all the hassle, you may want to check out our article on real estate crowdfunding platforms.

6. High-yield savings accounts (HYSAs)

- Average yield: 4–5%

- Timeframe: Short-to-long

- Availability: Any investor

In the last few years, it has become substantially easier to earn interest rates of up to 5% in certain savings accounts.

High-yield savings accounts (HYSAs) work just like traditional savings accounts — your money is FDIC-insured and you can withdraw it at any time.

If you have cash set aside in an emergency fund or if you have a short-term savings goal, HYSAs are a great way to earn some extra interest in the meantime.

Public has a high-yield savings account offering 4.1% interest. Every client who opens a brokerage account on Public also gains access to a HYSA.

SoFi offers a 3.80% interest rate on their HYSAs, while Marcus offers 3.75%.

While a high-yield savings account won't make you rich, it offers solid, risk-free returns — though it's worth noting that rates can fluctuate. But in today's high-interest-rate environment, this is one of the smartest places to keep idle cash.

7. Collateralized loan obligation (CLO) ETFs

- Average yield: 6–7%

- Timeframe: Medium-to-long

- Availability: Any investor

Collateralized loan obligations (CLOs) are bundles of loans made to companies with low credit ratings. The loans are pooled together and then sliced into tranches with varying levels of risk and return.

Traditionally, due to their complexity and large capital requirements, CLOs were only available to institutional investors. But regular investors can now gain exposure via CLO ETFs.

These ETFs are made up of baskets of CLO tranches and typically pay monthly or quarterly dividends.

Most CLO ETFs hold the highest-rated CLO tranches, which tend to have lower default risk than traditional junk bonds (though the underlying assets are still more complex and less liquid than junk bonds).

As a bonus, most CLOs have floating interest rates, which means CLO ETFs can benefit from rising interest rates while providing attractive monthly or quarterly income.

Two of the most popular CLO ETFs are:

- VanEck CLO ETF (CLOI), which has a yield of 6.34% and offers diversified exposure to investment-grade CLO tranches with relatively low duration risk.

- Janus Henderson AAA CLO ETF (JAAA), which has a yield of 6.04% and focuses exclusively on AAA-rated CLO tranches, offering stability with solid returns.

CLOs are a solid option for yield-focused investors looking to diversify outside of typical assets and, because of their floating rates, will respond quickly to any changes in interest rates.

How we chose the best high-yield investments

When evaluating investments, we considered the following:

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time or is it relatively new?

- Accessibility: Who is eligible to purchase the investment and how accessible is it? How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

Final verdict

Accessibility was a key factor when constructing this list.

Other than investing in private credit on Percent, all of the options on this list are available to any investor. All you need is a traditional brokerage account (like Public).

Whether you're only interested in generating yield or you want your portfolio to provide some income while also giving your principal a chance to appreciate, hopefully you found an investment that fits your goals.