Top 8 Investment Opportunities for Accredited Investors

The investing landscape has broadened for accredited investors in the last five years.

Many investments that used to be reserved for the top 1% — like private credit, private equity, real estate funds, and high-end art — have opened up to a wider pool of investors.

While stocks and bonds are likely to remain the core of your portfolio, adding one or two of these alternative assets can meaningfully increase your portfolio's diversification, and may improve its returns.

You qualify as an accredited investor if you:

- Earn more per year than $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your primary residence.

- Are a qualifying financial professional.

To register as an accredited investor, simply create an account with the platform you'd like to invest on. After your account is created, the platform will reach out to verify your accreditation status.

Wondering where to start?

Whether you're looking to decrease your volatility, increase your income, or boost your returns, here are the 8 best investment opportunities for accredited investors in 2026.

Summary of the best investment platforms for accredited investors

| Platform | Our rating | Asset(s) | Risk-reward* | Minimum investment | Accreditation status |

|---|---|---|---|---|---|

| Percent | Private credit | Low-medium | $500 | Accredited only | |

| Willow Wealth | Real estate, short-term notes, private credit & more | Medium-high | $10,000 | Primarily accredited | |

| Hiive | Venture-backed companies | High | $25,000 | Accredited only | |

| EquityMultiple | Commercial real estate | Medium-high | $5,000 | Accredited only | |

| Arrived | Single-family homes | Medium-high | $100 | Any investor | |

| Masterworks | Art | Medium-high | $15,000 | Any investor | |

| RealtyMogul | Commercial, multifamily, and single-family real estate | Medium-high | $5,000 | Primarily accredited | |

| AcreTrader | Farmland | Low-medium | $15,000 | Accredited only |

*Disclaimer: Based on the assumption that the higher the risk, the higher the reward. Ratings are my opinion. Actual results may vary. All investors should do their own due diligence.

Keep reading for detailed breakdowns of each platform listed above.

1. Percent: Invest in private credit

- Our rating:

- Asset(s): Private credit

- Risk-reward*: Low-medium

- Minimum investment: $500

- Accreditation requirement: Accredited only

Percent gives you access to the $3.14 trillion private credit market, a market that was formerly only available to institutional investors.

Mid- to large-sized private companies (typically with revenue between $10 million and $1 billion) are too big to receive loans from banks and must turn to the private credit market for financing.

Because the money is harder to come by, most private credit deals come with more favorable terms for the lenders.

For instance, on Percent, the average deal has entailed (as of Aug 2025):

- High yields (>14%)

- Low default rates (<3%)

- Short durations (12.7 months)

Plus, private credit is largely uncorrelated with public markets, making it an excellent asset for diversifying a traditional stock/bond portfolio.

There's a lot to like about private credit, especially for high-net-worth and income-seeking investors, which is why it ranks #1 on our list of how to generate 10% returns.

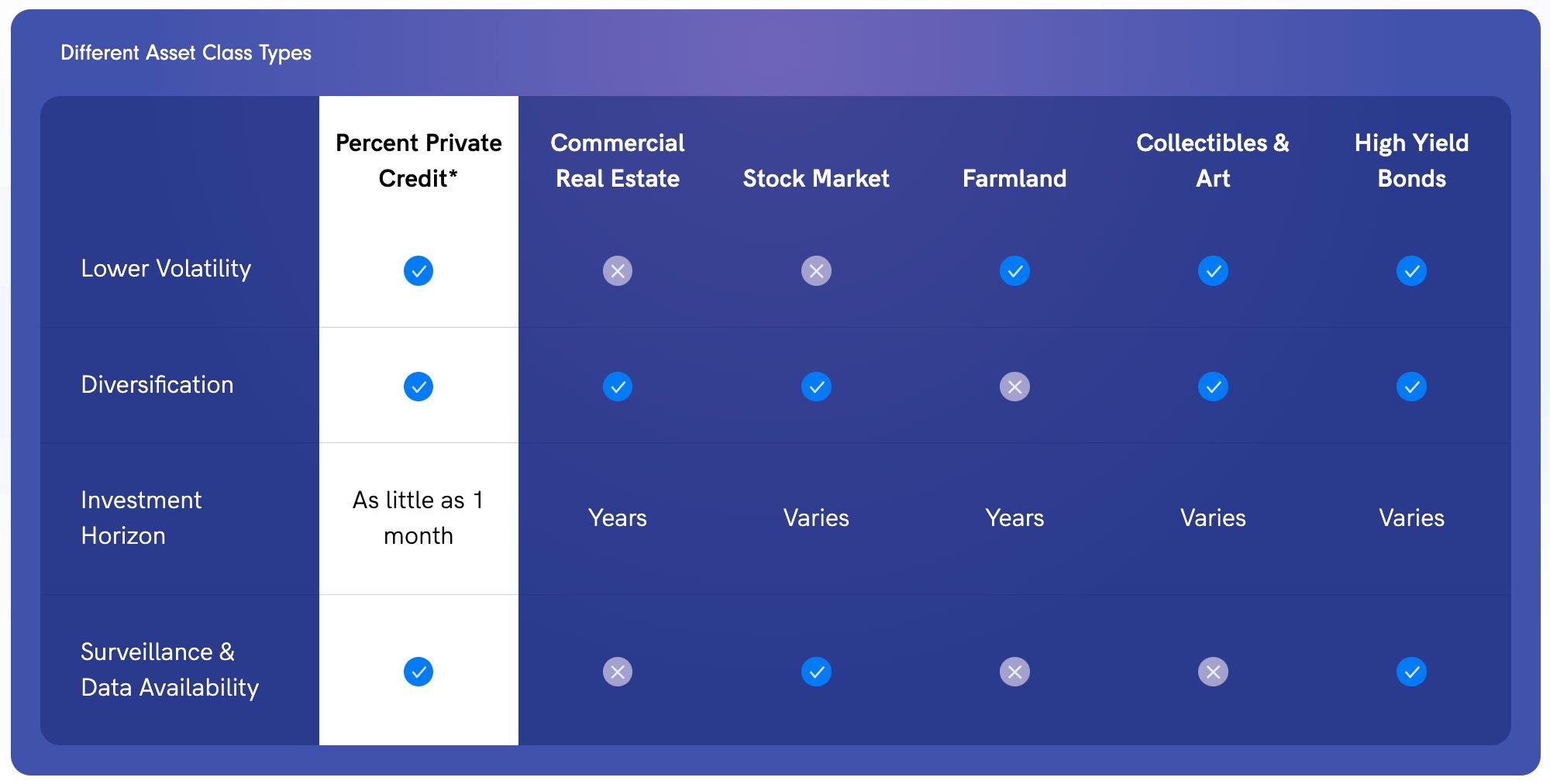

Here's how it stacks up against other asset classes:

Image source: Percent

For these reasons, private credit is our top recommendation for accredited investors looking to add an alternative investment to their portfolios, and Percent is the best platform for accessing private credit deals.

New investors can sign up using any of our links and receive a welcome bonus of up to $500 when making their first investment.

Quick facts

- Assets invested since inception: $1.73+ billion

- Number of investors: Not disclosed

- Primary benefit: Largest inventory of private credit deals

2. Willow Wealth: Real estate, art, private credit, & more

- Our rating:

- Asset(s): Real estate, art, private credit, cryptocurrencies, venture capital (VC), private equity, structured notes, transportation infrastructure, legal finance, and a multi-asset class fund

- Risk-reward*: Medium-high

- Minimum investment: $10,000

- Accreditation requirement: Primarily accredited

Willow Wealth (formerly Yieldstreet) gives accredited investors access to 10 alternative asset classes, making it the leading platform for private market investing.

Since 2015, Willow Wealth has distributed more than $3.8 billion to investors and has averaged 7.4% net annualized returns. For reference, a 60/40 stock/bond portfolio returned just 6.5% annualized over the same period.

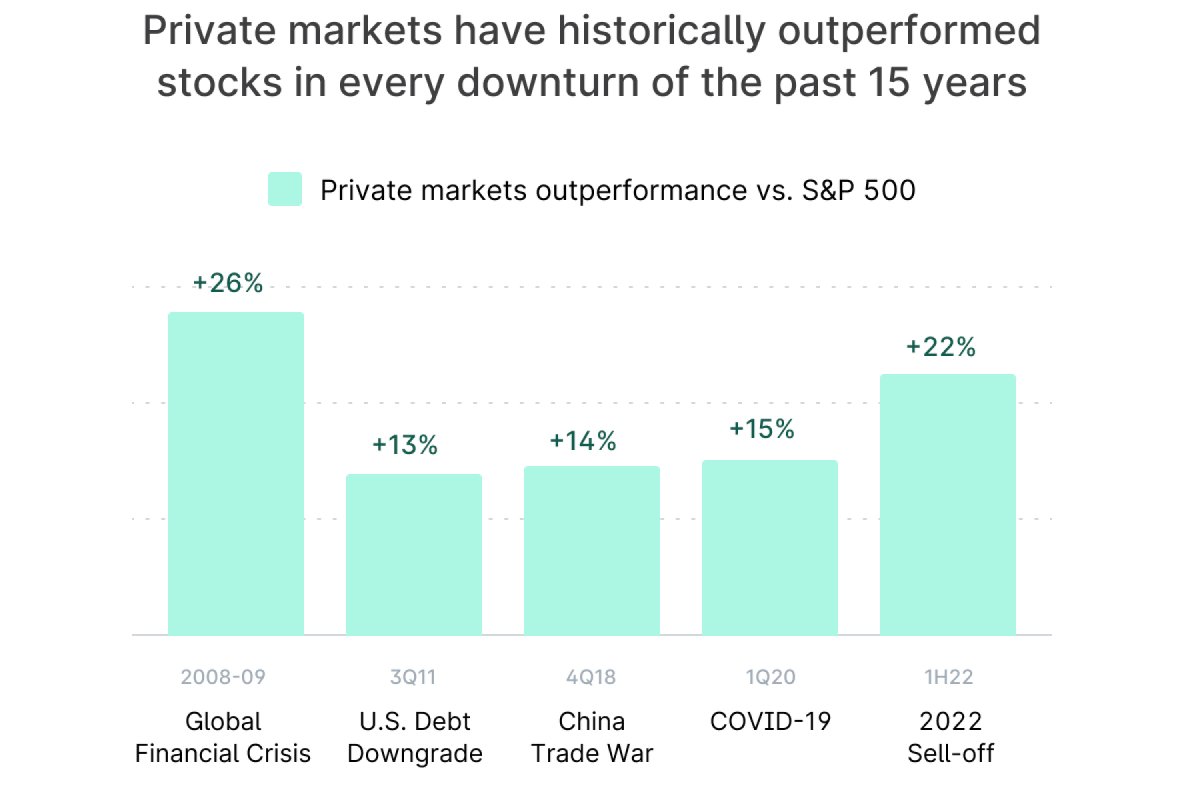

More importantly, one of the biggest benefits of investing in private markets is that they often outperform by the widest margins during public market downturns.

Image source: Willow Wealth

By mixing in a few alternative investments with a traditional stock/bond portfolio, investors may reduce their portfolio's volatility and increase their long-term returns.

While there are quite a few to choose from, the most popular assets on Willow Wealth are short-term notes, private credit, and real estate.

If you're not sure what alternatives you want to own, you can invest in the Alternative Income Fund.

The fund is professionally managed and owns 50+ income-focused investments spanning a wide range of assets. This way, you can get all the benefits of private market diversification without all the work.

Plus, the fund is available to all investors (not just accredited investors), pays quarterly dividends, and has a minimum investment of just $10,000.

The Alternative Income Fund is very popular — more than 50% of accredited investors on Willow Wealth currently own or have owned the fund.

If you're looking for one platform for diversifying outside of public markets, Willow Wealth is for you.

Quick facts

- Assets invested since inception: $6+ billion

- Number of investors: 500,000+

- Primary benefit: More private market asset classes than any other platform

3. Hiive: Buy shares of private, venture-backed companies

- Our rating:

- Asset(s): Private companies

- Risk-reward*: High

- Minimum investment: $25,000

- Accreditation requirement: Accredited only

Hiive is the best platform for investing in pre-IPO companies.

The platform gives you exclusive access to 3,000+ VC-backed startups, including Databricks, Stripe, SpaceX, ByteDance, Anthropic, and more.

Image source: Hiive

More than $110 million in transaction volume is conducted on Hiive each month, and there is more than $3 billion worth of stock currently available on the platform.

Hiive functions similarly to a stock exchange:

- Existing shareholders (who may be employees, venture capital firms, or angel investors) can create their own listings by setting their asking price and quantity of shares available.

- Buyers can accept a seller's asking price as listed or place a bid and negotiate directly with a seller.

- Once a buyer and seller agree on a price, Hiive helps facilitate the transaction, and the shares are transferred to the buyer.

After creating an account, you can see the complete set of active bids, asks, recent transactions, and current valuations for every company on the platform.

As venture capitalists and startup founders know, the real money is often made before a company's IPO, not after. Now, you can join the VCs by investing in many of the world's hottest startups (like Canva) right alongside them.

Quick facts

- Assets invested since inception: Not disclosed

- Number of investors: 50,000+

- Primary benefit: Invest in private, VC-backed companies

4. EquityMultiple: Commercial real estate projects

- Our rating:

- Asset(s): Commercial real estate projects

- Risk-reward*: Medium-high

- Minimum investment: $5,000

- Accreditation requirement: Accredited only

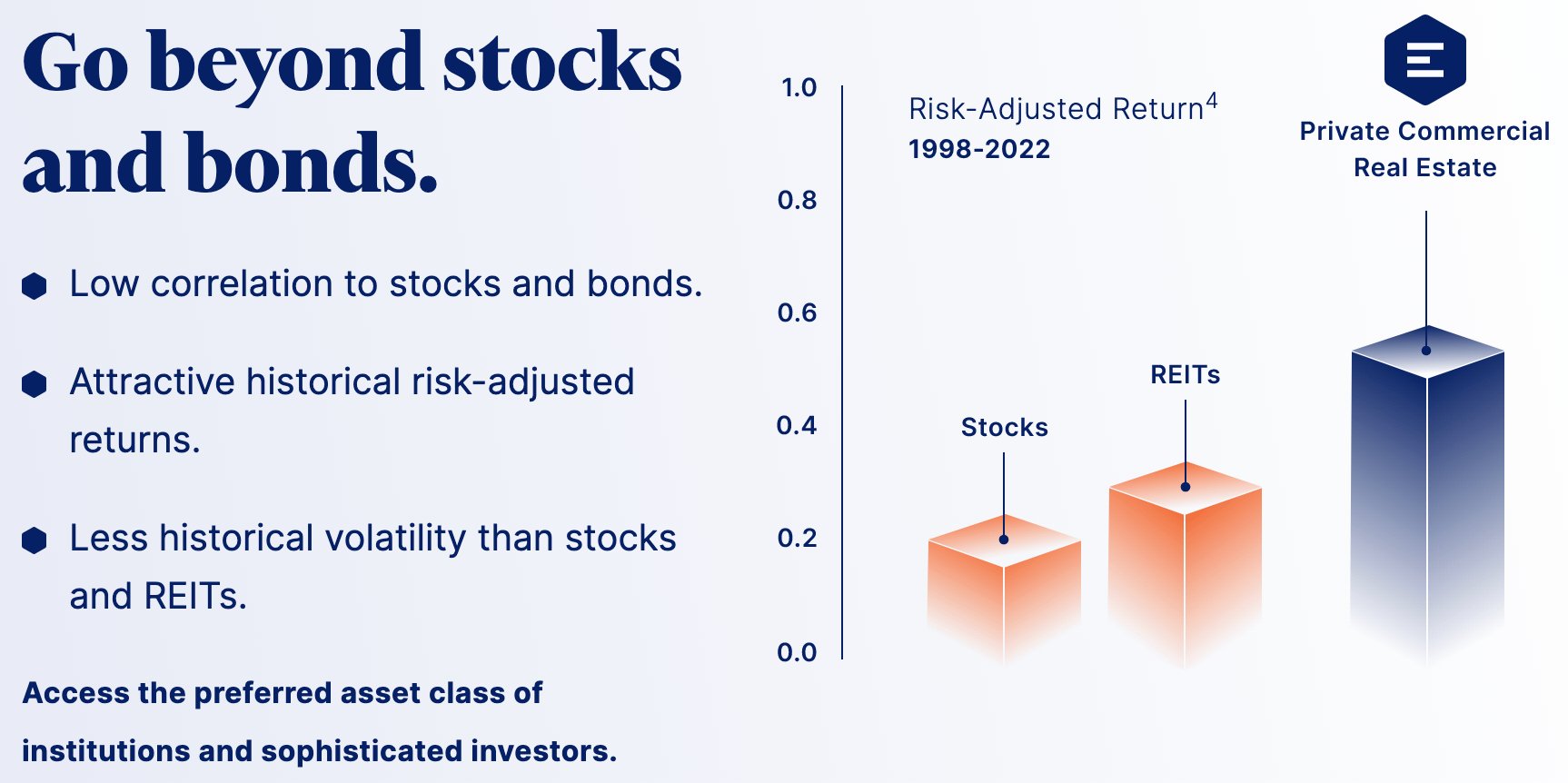

EquityMultiple is a crowdfunding real estate platform focused on commercial real estate, an asset class with one of the best risk-adjusted-return profiles:

Image source: EquityMultiple

EquityMultiple analyzes deals and, once a deal is approved*, lists it on its platform. Once listed, accredited investors can look at the deal and decide if they want to participate.

*Just 5% of the deals the team evaluates are approved.

The primary benefit of EquityMultiple over other crowdfunding real estate platforms is that, in addition to its equity investments, it also offers short-term notes ("Alpine Notes") and senior debt investments (via the Ascent Income Fund).

Both of those provide regular income for investors and much shorter (and pre-defined) investment time horizons.

Additionally, EquityMultiple offers a much lower minimum investment than almost every other CRE platform ($5,000 vs $25,000+).

Quick facts

- Assets invested since inception: $1+ billion

- Number of investors: Not disclosed

- Primary benefit: Invest in commercial real estate via short-term debt, funds, and equity

5. Arrived: Own single-family rentals

- Our rating:

- Asset(s): Single-family homes

- Risk-reward*: Medium-high

- Minimum investment: $100

- Accreditation requirement: Any investor

While other crowdfunding real estate platforms primarily target accredited investors, Arrived is available to all investors.

Arrived is solely focused on buying and renting single-family homes, for both long-term and short-term (vacation) rental markets. Its investors earn returns via rental income and price appreciation.

After purchasing a new property, the company will securitize and make shares available for purchase on its platform (similar to Masterworks).

Once a property starts generating rental income, the cash flow is paid out to the property's investors in the form of dividends.

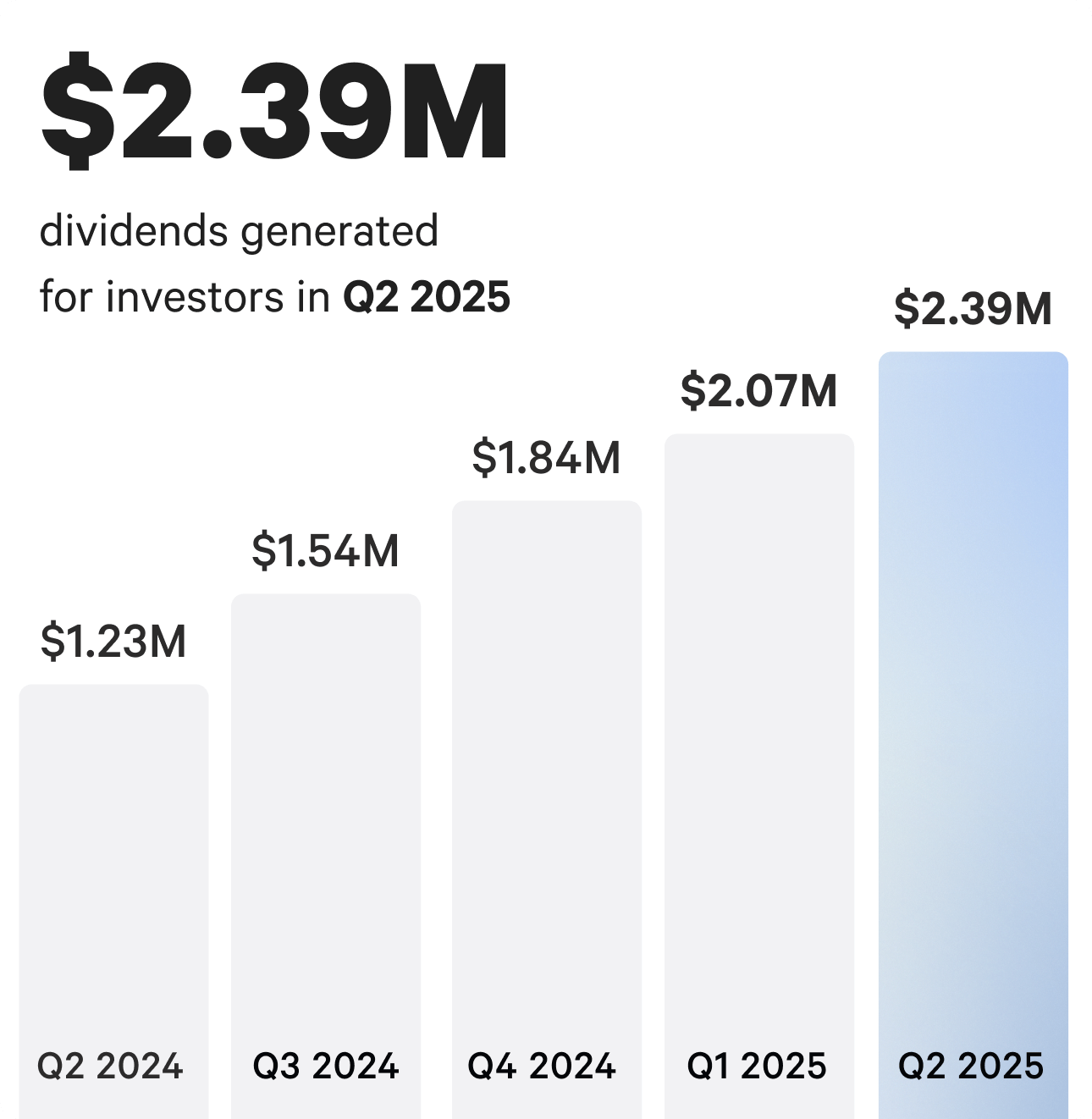

Arrived has paid out more than $17 million in dividends, including $2.39 million in Q2 2025 alone.

Image source: Arrived

Dividends vary by investment, but in Q2 2025, individual single-family residential properties paid an average annualized dividend of 3.7% and vacation rentals paid an average annualized dividend of 2.4%.

These figures do not include unrealized price appreciation.

For investors who don't want to hassle with analyzing and choosing between individual properties, Arrived also offers two funds: the Arrived Single Family Residential Fund and the Arrived Private Credit Fund.

The funds paid annualized dividends of 4% and 8.2%, respectively, in Q2 2025.

With Arrived, you can build an entire real estate portfolio on your computer or mobile device without ever leaving your couch.

Quick facts

- Property value funded since inception: $310+ million across 466 properties

- Number of investors: 858,000+

- Primary benefit: Build a real estate portfolio starting with just $100

6. Masterworks: Invest in shares of art

- Our rating:

- Asset(s): Art

- Risk-reward*: Medium-high

- Minimum investment: $15,000

- Accreditation requirement: Any investor

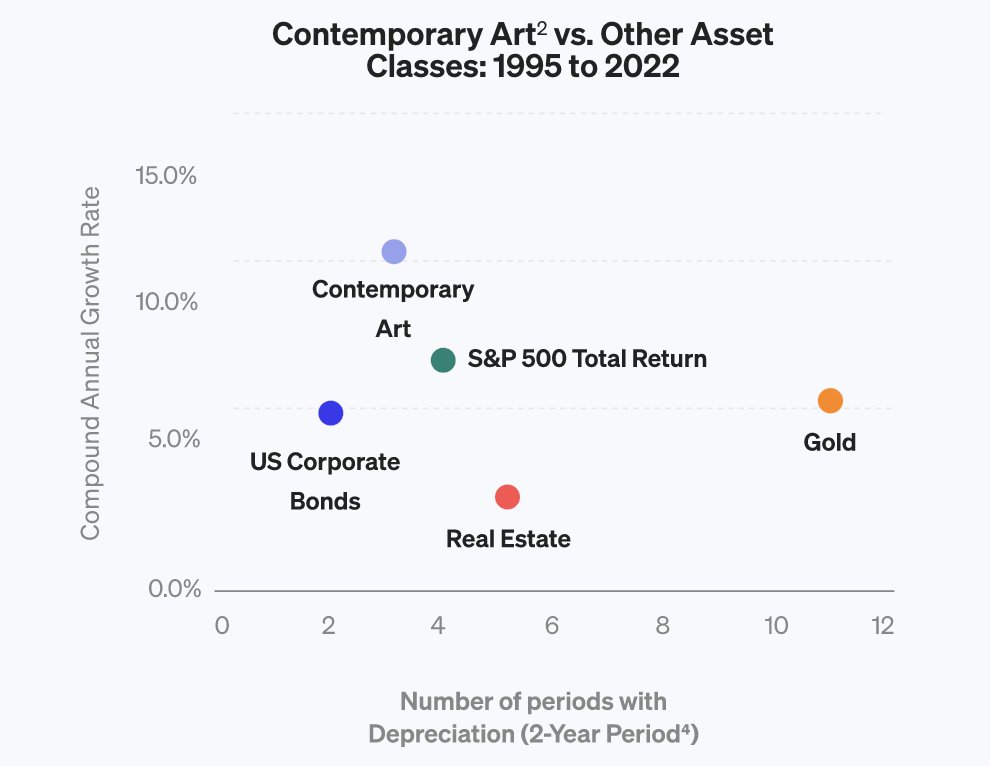

Masterworks is the best way to invest in high-end art, one of the most time-tested assets on this list.

Why invest in art? Two reasons: price appreciation and stability.

Image source: Masterworks

That's why millionaires have been investing in art for years. It's rare, can appreciate, and has historically been inflation- and recession-proof. But art investing requires time, skill, and a lot of money.

At least, it used to.

Today, Masterworks's research team scours the world for artists and paintings and purchases only those with the most momentum.

After purchasing the art, the company securitizes it with the SEC, which allows its users to invest in individual shares.

Investors can sell their shares to other users on the platform or wait until the Masterworks team sells the painting and the proceeds are distributed.

You can read our Masterworks Review for more details on this process.

Yes, you can invest in art on Willow Wealth, but if you're serious about art as an investment vehicle, then Masterworks (which has distributed over $61 million in proceeds back to its investors) is the obvious choice.

Quick facts

- Assets invested since inception: $1.2+ billion

- Number of investors: 1,000,000+

- Artworks purchased: 450

- Primary benefit: An unparalleled specialization in fine art investing

7. RealtyMogul: Invest in properties and REITs

- Our rating:

- Asset(s): Commercial, multifamily, and single-family real estate

- Risk-reward*: Medium-high

- Minimum investment: $5,000

- Accreditation requirement: Primarily accredited

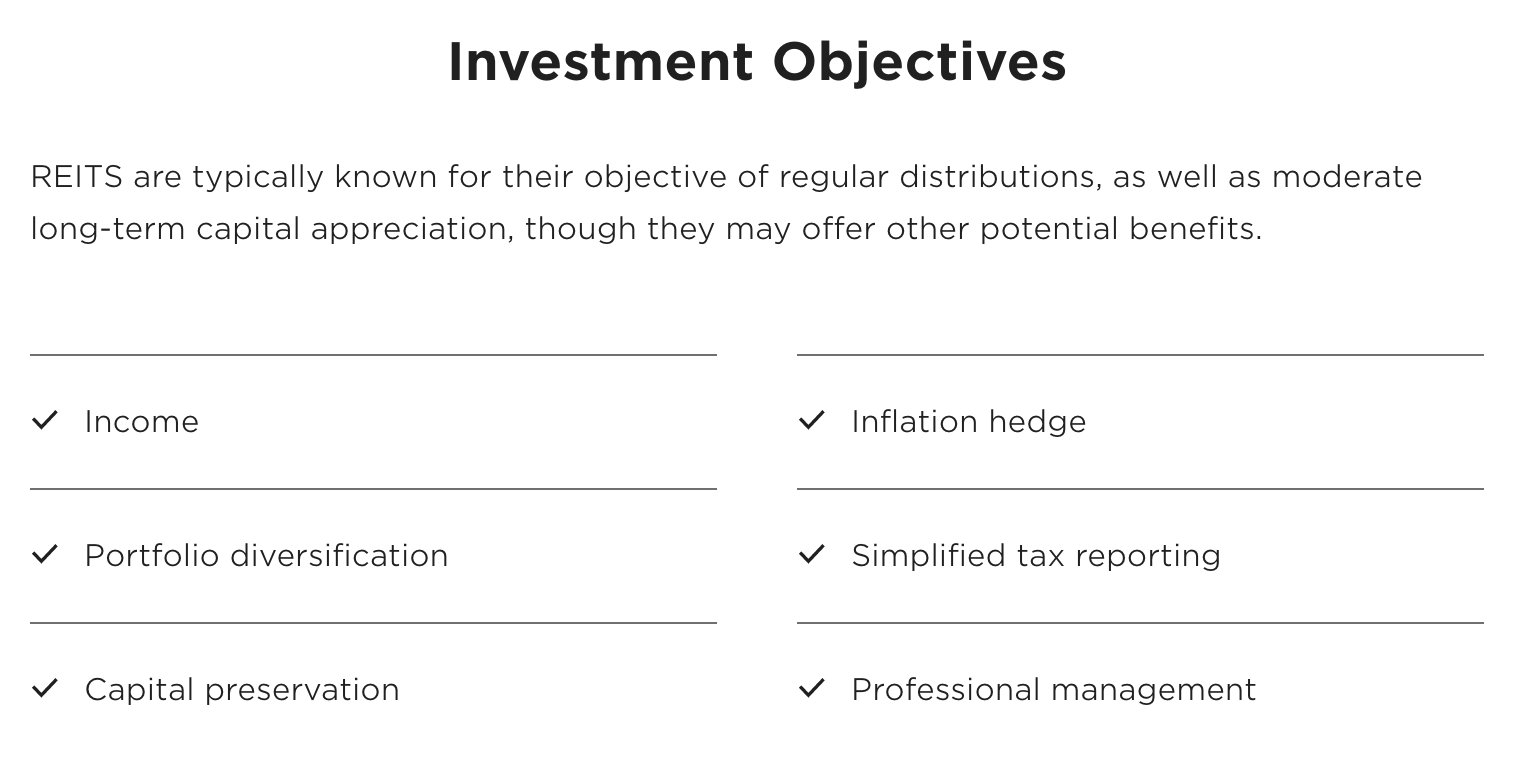

If you're looking for a platform that allows you to invest in private REITs, RealtyMogul is the best option.*

*A real estate investment trust (REIT) is a special type of entity that pools investor money to own or finance income-producing properties while avoiding corporate income taxes, provided it distributes most of its earnings as dividends.

Under this structure, investors can own professionally managed portfolios of assets (like office buildings, apartments, and shopping centers) and receive regular income via dividends with favorable tax treatment.

Like EquityMultiple, RealtyMogul connects investors to developers (sponsors) and takes care of the initial due diligence process for you.

Its most common offerings are for individual real estate projects like industrial parks, mixed-use facilities, and residential developments. These projects have a $25,000 to $35,000 minimum investment.

That said, RealtyMogul makes this list because of its REITs. It offers two REITs, an Income REIT and a Growth REIT, which have $5,000 minimum investments and are available to all investors.

Image source: RealtyMogul

Since the Income REIT's inception in 2016, it has distributed monthly dividends of at least 6% (net of fees) for 106 consecutive months.

Compared to real estate crowdfunding, REIT investing is better for investors who prioritize high liquidity and instant diversification with a mostly passive, hands-off approach.

For all of these reasons, REITs are a go-to asset class for many retirees and high-net-worth individuals.

Quick facts

- Assets invested since inception: $1.2+ billion

- Number of investors: 300,000+

- Primary benefit: Private real estate investing via REITs

8. AcreTrader: Own farmland

- Our rating:

- Asset(s): Farmland

- Risk-reward*: Low-medium

- Minimum investment: $15,000

- Accreditation requirement: Accredited only

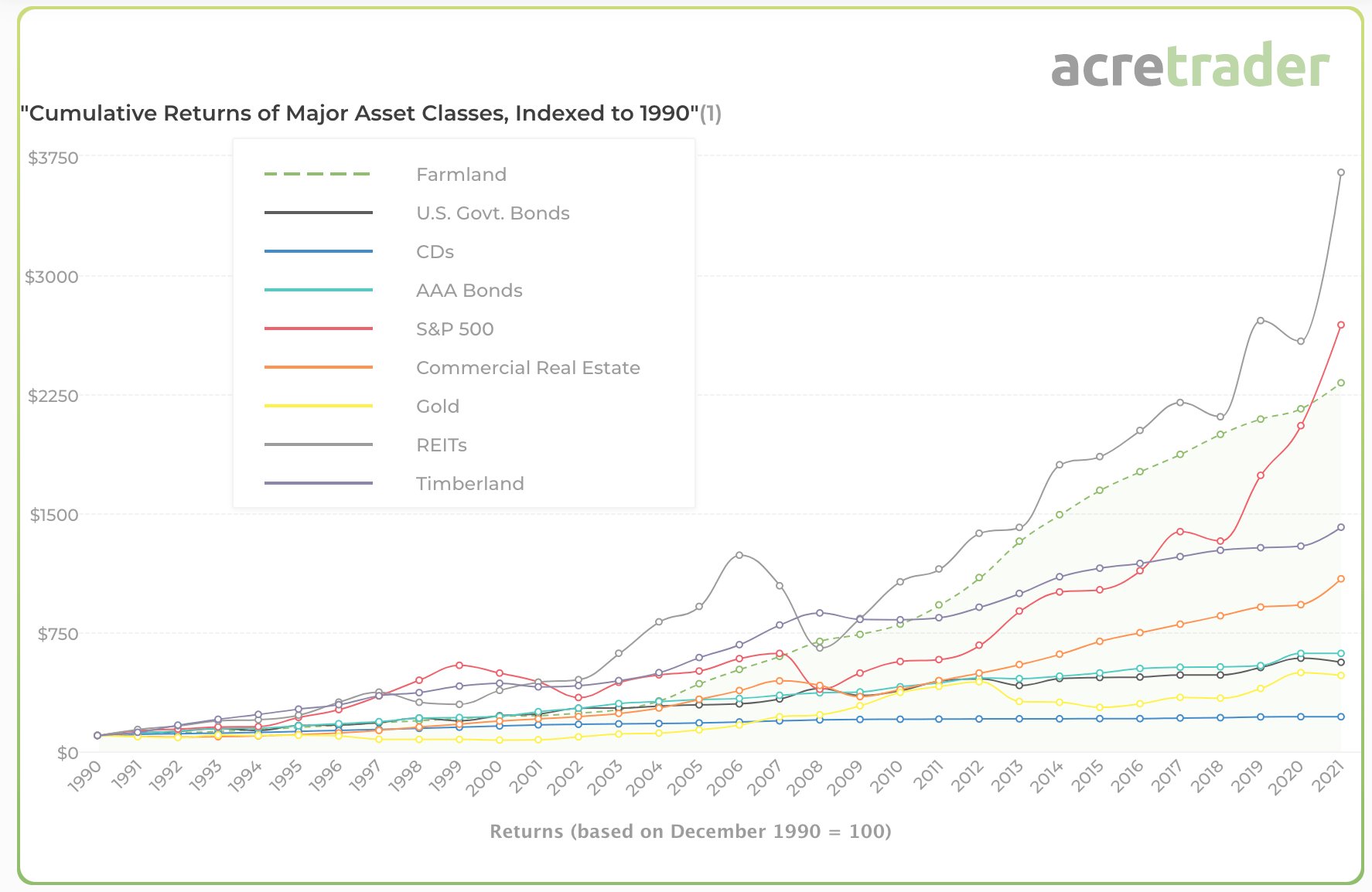

AcreTrader is the only crowdfunding platform that allows you to invest in farmland.

The demand for food will never go away. Regardless of inflation, economic conditions, or how the stock market is performing, we need food.

Couple that with a rapidly growing global population — which will require more food and more land — and farmland looks like a pretty compelling investment.

Unsurprisingly, its historical returns have only gone one direction (lagging REITs and the S&P 500 but with lower volatility):

Image source: AcreTrader

AcreTrader connects investors with farmers. Each new listing must pass a thorough due diligence process by the company's team of expert analysts, which only approves 5% of deals.

In a typical week, 1–2 new listings will become available to investors. The types of farms listed range from timber and alfalfa to soybeans and corn — if it's farmable, you can expect to see it on AcreTrader.

The target holding periods range from 5–10 years. During that period, the farmers pay rent to AcreTrader, who distributes it among the investors.

At the time of the sale, any price appreciation, pro rata rent, and principal are returned to investors. The median realized IRR has been around 15%.

Quick facts

- Assets invested since inception: $411+ million across 174 properties (39,900+ total acres)

- Number of investors: Undisclosed

- Primary benefit: The only platform where you can invest in shares of farmland

Price comparison

With many alternative investments, both direct and indirect fees must be considered.

Direct fees are paid by the investor and are typically disclosed in the offering documents. Indirect fees are less visible to the investor and include fees charged to the sponsor of the investment.

Some examples include property management fees, asset sale commissions, legal fees, and regulatory fees.

Indirect fees are netted out of the interest and dividends, or subtracted from the final sales price an investor would get upon the disposition of an asset.

Here's how these platforms' fees compare:

| Platform | Annual management fees | Other annual fees | Carry fees | Platform fees |

|---|---|---|---|---|

| Percent | 1% on blended note products | - | 10% of all interest payments | - |

| Willow Wealth | Most are between 1.5–2.5%; stated range is 1–4% | Varies by structure type, typically 0–0.5% | - | - |

| Hiive | - | - | - | Sellers are charged 5% |

| EquityMultiple | 0% on short-term notes; typically 1% on direct investments and fund investments | $0–$250 | - | - |

| Arrived | 0.15% of purchase price on long-term rentals; 5% of gross revenue on vacation rentals. | - | - | 3.5% on long-term rentals; 5% on vacation rentals |

| Masterworks | 1.50% | - | 20% of profits once a painting sells | - |

| RealtyMogul | 1–2% | - | - | 1–2% |

| AcreTrader | 0.75% | - | - | 2% or less of offer value upon purchase; 5% upon sale paid by seller |

What's an accredited investor?

An accredited investor is an individual classified by the SEC as being qualified to invest in complex or sophisticated financial products.

You can qualify as an accredited investor if you:

- Earn more than $200,000 (individually) or $300,000 (jointly) in income per year.

- Have a net worth of more than $1,000,000, excluding your primary residence.

- Are a qualifying financial professional.

The accredited investor rule was established to protect investors from unexpected losses due to misunderstanding investment risk.

Accredited investors — investors with large incomes and/or net worths — are considered by the SEC to be more savvy and more capable of withstanding the risks that come from investing in non-traditional assets.

How do you become an accredited investor?

To become an accredited investor, you must sign up for and register with a platform and prove to them that you meet one of the above requirements.

For example, if you want to invest via Willow Wealth, you must create an account and wait for their support team to reach out to you to confirm you meet the requirements. After confirmation, you will be able to invest in the different offerings on its platform.

You must register and confirm your status as an accredited investor with each platform you want to invest on.

How we chose the best accredited investment opportunities

When evaluating investing products and services, we take the following into consideration:

- Core offering: How good is the platform and its offerings?

- Price and fees: Overall fees, value for money, industry comparison, etc.

- Usability: What the interface looks like, whether the site is easy to use and navigate, the inclusion of modern design elements and features, and accessibility.

- Credibility: Quality of investments and information, as well as company and brand reputation.

- Offers: Whether there is a special offer for signing up or any discounts.

Final verdict

It's a good time to be an accredited investor. Investments that used to be reserved for institutions and the ultra-wealthy are now available to you.

The first platform I recommend is Percent. Because of its high yields, low default rates, and short-term durations, Percent is an extremely popular option among high-net-worth and income-focused investors.

If you're looking for a way to diversify your portfolio outside of public markets, Willow Wealth is another great option. It has almost every alternative asset you may be interested in, in some form or another.

Outside of those two, my most recommended platforms are Hiive, Arrived, Masterworks, RealtyMogul, and AcreTrader for their in-depth focus on their respective assets.

Between these seven platforms and your brokerage account (for traditional investments), you can build an extremely sophisticated portfolio.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)

.png)