How to Buy inDrive Stock

inDrive (formerly known as inDriver) is a ride-hailing, cargo, and delivery app that is aiming to revolutionize urban transportation.

inDrive works by connecting drivers and couriers to passengers and businesses. The company focuses on four pillars:

- City rides: Users can book and pay for rides within cities or for longer trips (think Uber or Lyft).

- City-to-city: Passengers can request intercity rides for transport between cities.

- Courier delivery: Businesses can book couriers to deliver packages up to 44 lbs (20 kg), door-to-door, 24 hours per day.

- Freight delivery: Businesses with heavier items or things that take up a lot of space can choose its Freight service. They can also request help loading and unloading the item(s) with the "movers needed" option.

inDrive operates in 888 cities across 48 countries worldwide. Its app has been downloaded more than 280 million times, and its drivers have completed over 5 billion rides and deliveries.

And it's just in the beginning stages of its global expansion.

But you already know how good the opportunity is. Here's how to invest in inDrive stock in 2026.

Can you buy inDrive stock? Is inDrive publicly traded?

inDrive is not a public company, which means there is no inDrive stock symbol and you can't invest in it with your regular brokerage account.

In February 2023, inDrive raised $150 million in private funding to fuel its global expansion, moving its total amount raised to $387 million.

Given the capital-light business model and how easy it is to raise funds in private markets, inDrive may not ever need to become a public company. That said, its current investors will be seeking some sort of liquidity event in the future, which means it will either have to go public or buy back all of its shares.

But just because inDrive isn't publicly traded doesn't mean you can't invest in it today. Here are a couple of options to gain exposure to the company changing urban mobility.

How to buy inDrive stock in 2026

If you're an accredited investor (you either earn more than $200,000 individually in annual income or have a net worth exceeding $1,000,000 excluding your primary residence), the next section is for you.

If you aren't an accredited investor, skip to the retail investor section below to learn about potential ways to invest in inDrive's future upside.

How to buy inDrive stock as an accredited investor

Hiive is an investment platform that allows accredited investors to invest in high-growth, VC-backed startups and private companies like SpaceX, Stripe, and Groq.

On Hiive, current shareholders (which typically include employees, venture capitalists, and angel investors) can create listings and sell their shares directly to accredited investors.

At this time, there is one listing of inDrive stock available:

Accredited investors can create an account on Hiive for free, see the secondary market transactions for over 2,000 private companies, and place bids on the companies they're interested in or add them to their watchlists.

You can get started with the button below.

Can you invest in inDrive stock as a retail investor?

Unfortunately, retail investors cannot direct or indirect exposure to inDrive.

inDrive currently has four investors: LETA Capital, Bond, Insight Partners, and General Catalyst, all of which are early- and late-stage venture capital firms. There are no public companies that have invested in inDrive.

This is rare for a company valued at more than $1 billion but, as I mentioned earlier, inDrive's business is extremely capital-light. At its core, it's just an app that connects freelancers with customers.

It is still in the beginning stages of its global expansion, however, and will likely seek more funding to grow its marketing and research & development divisions. When it does, look for investments from Google's parent company Alphabet (GOOGL), Uber (UBER), and/or Lyft (LYFT).

Also, keep an eye out for venture capital funds that may buy a stake in the company.

The ARK Venture Fund is a common investor in private, disruptive companies. The minimum investment is just $500 and all U.S.-based investors are eligible. But if you're going to invest in this fund, be sure you're comfortable investing in the rest of the companies the fund also owns.

You may also consider investing in Uber or Lyft, which should have the technology and existing networks to capitalize on the same opportunity inDrive is currently pursuing.

By the way, if you're interested in inDrive, you also may be interested in investing in Waymo stock (self-driving cars) or Alef Aeronautics stock (flying cars).

Who owns inDrive company stock?

inDrive has raised $387 million in four equity rounds and one bond funding. Four firms have invested: Leta, Bond, Insight Partners, and General Catalyst.

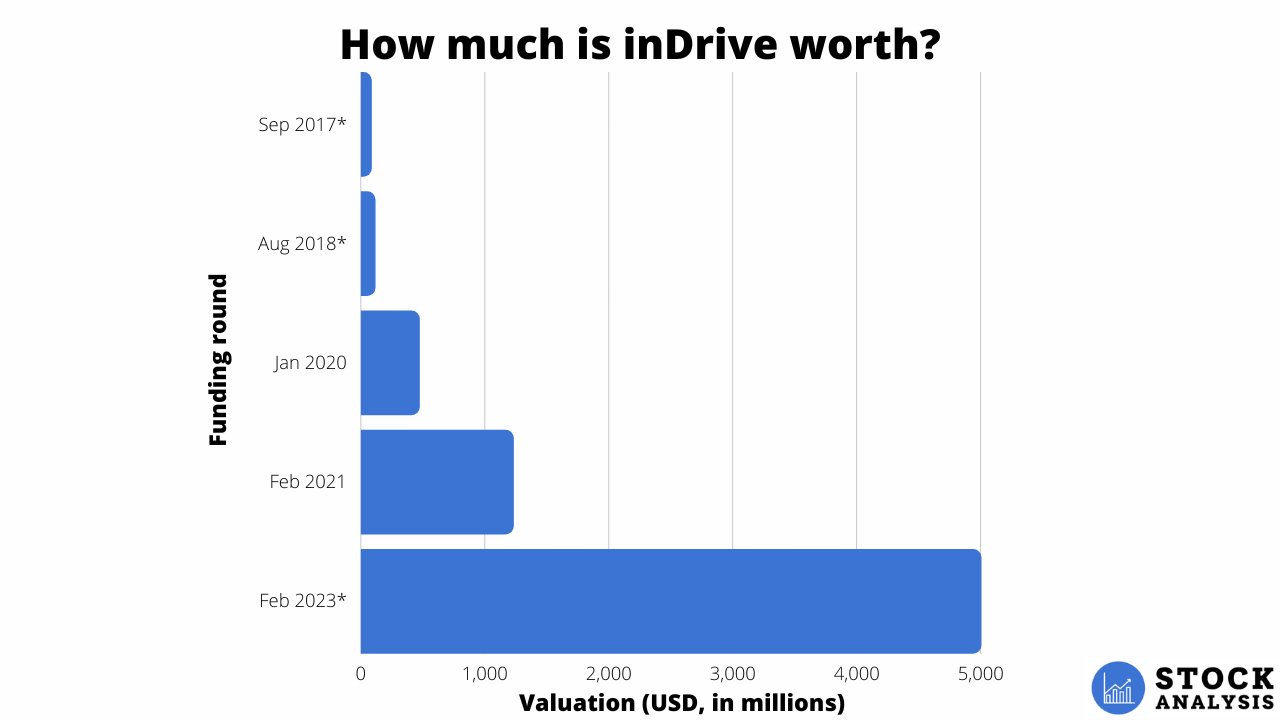

Here is an overview of the equity funding rounds, which total $237 million:

- September, 2017: Leta, $5M

- August, 2018: Leta, $10M

- January, 2020: Bond, $72M

- February, 2021: Bond, Insight Partners, and General Catalyst, totaling $150M

And here is the bond funding round:

- February, 2023: General Catalyst, $150M

Debt financing does not usually require there to be a valuation performed on the company's shares. As a result, the last valuation to reference is the equity raise in 2021, which placed the value at $1.23 billion.

Arsen Tomsky, founder and CEO, as well as other key employees, likely own significant portions of the company, although their exact stakes are unknown.

How to buy the inDrive IPO

There is no inDrive IPO date yet, as the company hasn't formally announced plans to go public.

As mentioned above, although I don't think the company will need the public markets for funding purposes, inDrive will likely go public so its current (private equity) investors can sell their stakes.

After its IPO, you will be able to look up its stock symbol and buy it in your brokerage account.

If you don't have a brokerage account, we recommend Public. Invest in stocks, ETFs, Treasuries, corporate bonds, and cryptocurrencies all under one login.

inDrive valuation chart

As mentioned above, inDrive's last official valuation was $1.23 billion, set back in 2021.

The company has experienced significant growth since 2021 and, while we don't have any official numbers, could likely garner a valuation of at least $5 billion.

Here is an overview of inDrive's previous funding rounds and valuations:

*The 2017, 2018, and 2023 valuation figures are estimates.

Frequently asked questions

Below are a few more questions people often ask about inDrive.

How can I buy inDrive stock?

inDrive is still a private company and has not yet been made available to the public. Accredited investors may have access to shares via a platform like Equitybee in the near future. inDrive has yet to set a date for its IPO, which I expect to happen in the future if it continues to grow.

How much is inDrive stock?

There is no inDrive stock, so there is no price per share.

What is the inDrive stock symbol?

inDrive is still a privately held company so there is no stock symbol.

Who owns inDrive?

inDrive is partially owned by founder and CEO Arsen Tomsky and other key employees, plus private equity firms LETA Capital, Bond, Insight Partners, and General Catalyst.

.png)