How to Invest $1 Million in 2026

Whether it's from an inheritance, the sale of a business, a legal settlement, or some other windfall, suddenly finding yourself with $1,000,000 to invest can feel daunting.

You should be focused on two things (in this order):

- Protecting your money

- Growing it

With those objectives in mind, here are the six best ways to invest one million dollars in 2026.

But first, you should answer a few questions that will guide your investment strategy.

Pre-investment checklist

Here are three questions that will form the foundation of your financial plan:

How old are you?

Your age and when you'll start drawing from your investments will play a large part in determining what you should invest in.

If you're 20 years away from retirement, you're still in your "wealth accumulation" phase and can afford to allocate more money to more volatile, higher-returning investments (like stocks).

On the other hand, if you're two years away from retirement, you're in “wealth preservation” mode and likely want to own more stable assets (like bonds).

Do you have any debt?

Oftentimes, the highest ROI investment you can make is paying off your high-interest debt.

If you have personal loans, credit card debt, or car loans with interest rates of 6% or higher, you should probably pay these off first, guaranteeing yourself a 6% (or higher) ROI.

What are your financial goals?

Every good financial plan starts with the end goals in mind.

- Are you investing for retirement?

- For a child's or grandchild's education?

- For charities or other social causes?

Once you know your goals, you can approximate how much money you'll need to fund them, and by when, then back into what investments you should include in your plan.

With those questions answered, here's my list of options for how to invest $1 million.

You'll need a brokerage account to invest in Treasury bills, ETFs, stocks, bonds, and more. If you need a brokerage account, we like Public.

The 6 best ways to invest $1 million

1. Stocks and ETFs

Almost every financial advisor constructs their clients' portfolios with two asset classes as the bedrock: stocks and bonds.

Stocks, while more volatile, offer the opportunity for higher long-term returns than bonds.

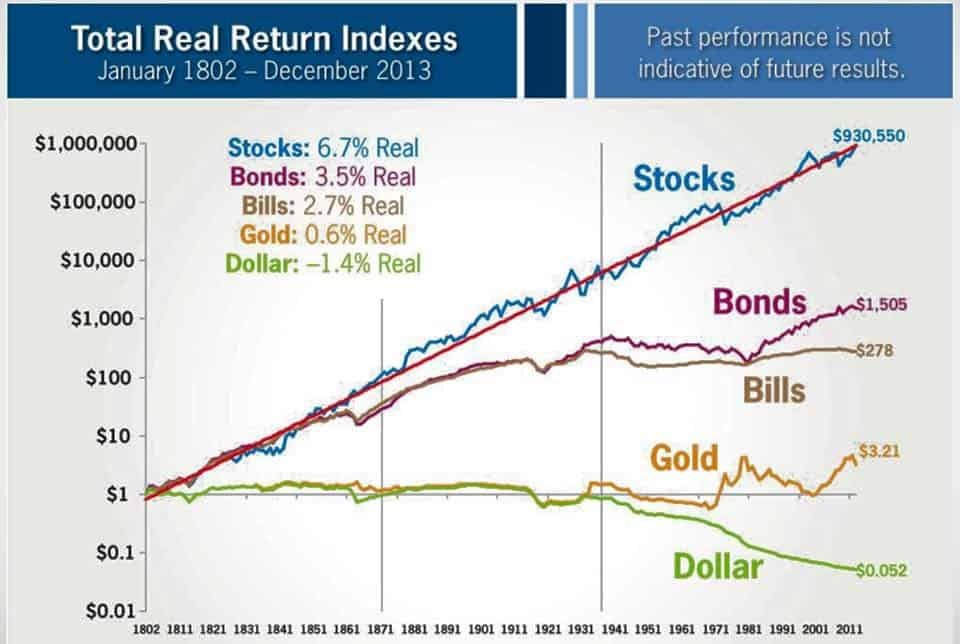

From 1802 to 2013, stocks returned 6.7% (net of inflation), which is almost double the return of bonds, at 3.5%, and more than double the return of Treasury bills:

Source: Wealth Capitalist

While 3.2% outperformance might not seem like much, the compounding effects can be quite large. For instance, the difference in earning 6.7% vs 3.5% on $1,000,000 over 20 years results in portfolio sizes of:

- At 6.7%: $3,658,376.41

- At 3.5%: $1,989,788.86

For this reason, stocks are used as the main driver of growth in most portfolios.

While you can invest in individual stocks (like AAPL, TSLA, and GOOGL), many financial advisors recommend ETFs. An ETF (exchange-traded fund) is an investment vehicle that holds a basket of stocks at once, making for easy diversification.

Because of this diversification, ETFs are generally less risky than buying individual stocks. A few of my favorite ETFs are VOO, VT, and QQQ.

How much of your portfolio should be allocated to stocks depends on your goals, time horizon, and risk tolerance. A 25-year-old with a moderate risk tolerance may hold 100% stocks, while a risk-averse 65-year-old may have an allocation closer to 20%.

2. Bonds

If stocks are the main drivers of growth in a portfolio, bonds provide the stability.

Governments and companies issue bonds to borrow money. In return for lending the borrower money, investors receive interest payments plus the original principal when the bond matures.

Unlike stock investments, the borrower is legally obligated to repay the loan.*

*Unless the borrower defaults on the loan, the return is guaranteed.

For this reason, bonds tend to be significantly less volatile than stocks. This stability, plus their steady cash flow, makes them a popular choice for many investors.

There are many types of bonds, but the two primary categories (based on their issuer) are:

a.) Government

Government bonds are issued and backed by the U.S. government, which is considered the safest issuer in the world.

It issues both short-term debt (known as Treasury bills) and long-term debt (known as Treasury bonds).

Instead of buying individual government bonds, many investors buy government bond ETFs. These ETFs are easier to buy and sell, pay a monthly income, and have lower minimum investments.

You can buy government bond ETFs, like SPTL or VGLT, in your brokerage account (such as Public).

b.) Corporate

Corporate bonds are issued by publicly traded companies (like Microsoft and General Motors).

Since corporations are more likely to go bankrupt than the government, interest rates on corporate bonds are typically higher than on government bonds.

Right now, investment-grade corporate bonds are yielding 5.36%, while Treasury bonds are yielding 4.29%.

For easier management and monthly distributions instead of semiannual payments, you can buy corporate bond ETFs (like SCHI and SPBO) instead of individual corporate bonds.

As mentioned above, the vast majority of investors own both stocks and bonds in their portfolios.

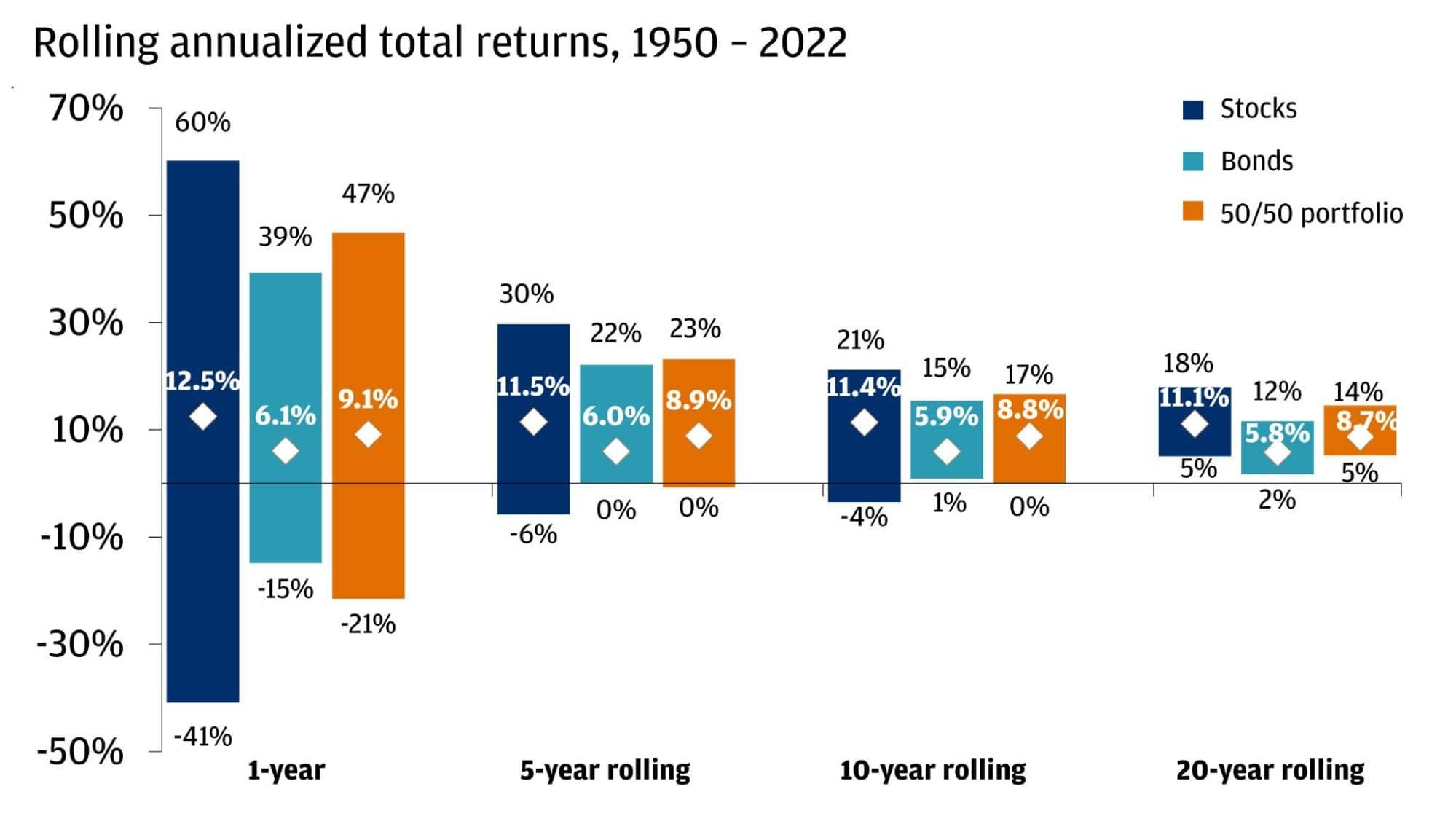

The chart below shows the historical range and average annual returns for stocks, bonds, and a 50/50 mix over different rolling time periods (1, 5, 10, and 20 years) from 1950–2022.

The bars show the best and worst returns for each period, and the diamonds show the averages.

Source: J.P. Morgan Private Bank

By holding both stocks and bonds, you can benefit from the growth aspects of stocks and the stability of bonds.

3. Real estate

You may not think of yourself as a real estate investor but if you own a home, then you are one.

In fact, most people have a considerable portion of their net worth in real estate. If you have a net worth of $1.5 million and you've paid off your mortgage on your $500,000 house, 1/3rd of your net worth is in real estate.

Still, if you want to allocate even more of your net worth to real estate and become a “real estate investor,” it's a great option.

Real estate investors have three ways to win:

- Rental income

- Price appreciation

- Tax advantages

Real estate has also served as an excellent hedge against inflation.

While real estate investing has its advantages, it comes with substantially more work. Real estate investors have to analyze potential deals, handle paperwork, manage renovations, interview tenants, perform maintenance, and more.

You could hire a management company to take care of some of this, but it will reduce your returns.

If you want to get into real estate investing but don't want all the headaches that come with it, you may be interested in using a real estate crowdfunding platform like Willow Wealth, EquityMultiple, or Arrived.

These platforms take care of everything — you just provide the capital.

4. Cash equivalents (CDs, MMFs, HYSAs)

Most financial advisors recommend having a few months' worth of cash on hand in addition to your emergency fund. This money is set aside for upcoming bills, any planned (or unplanned) purchases, and to stabilize your investment portfolio.

But you don't need to let this money just sit in a bank account — you can still invest it.

By investing in short-term Treasury bills, certificates of deposit (CDs), money market funds (MMFs), or a high-yield savings account (HYSA), you can earn extra interest on your cash while keeping it safe and accessible.

You can compare CDs, MMFs, HYSAs, and other banking options on Raisin.

My favorite place to park cash is in Treasury bills in a brokerage account. Instead of constantly buying individual Treasury bills, I own SGOV, a Treasury bills ETF.

5. Alternatives (private companies, art, cryptocurrency, collectibles, venture capital, and hedge funds)

Alternative investments (known simply as “alternatives”) are any investments outside of stocks, bonds, and cash.

Alternatives have exploded in popularity in the last 10 years, mainly because they:

- Offer diversification outside of public stock and bond markets

- May be good hedges against inflation

- May generate higher returns

These benefits have led investment managers like BlackRock to recommend supplementing a stock/bond portfolio with up to 20% in private market alternatives.

While I personally find this to be a little high, I do believe there is a place for alternatives in a modern portfolio, especially one with a million dollars in it.

A few of my favorite platforms for buying alternative assets are:

- Willow Wealth: Real estate, venture capital, private equity, short-term notes, and more

- Percent: Private credit

- Hiive: Private companies (like Stripe, OpenAI, and Plaid)

- Masterworks: Art

- Public: Cryptocurrency (alongside your traditional investments in stocks, bonds, and cash)

If you want to allocate a portion of your portfolio to alternatives but don't know what to invest in, Willow Wealth's Alternative Income Fund has you covered.

It's a professionally managed, income-generating portfolio filled with a variety of private market investments. Since its inception, it has averaged a 7.1% annualized distribution rate.

6. Hire a financial advisor

If all of this seems like a lot to you, you're not alone. There is a lot that goes into financial planning and creating an investment strategy perfectly suited to you.

If you'd rather not handle investing and managing your money yourself, consider hiring a financial advisor. Financial advisors are well-prepared to offer advice on an investment strategy, taxes, insurance, real estate, and more.

To hire an advisor, I recommend interviewing a few different local advisors and choosing your favorite.

Be sure they're a fee-only “fiduciary,” which means they are obligated to work in your best interest and will not receive kickbacks for putting your money in certain investments.

Want to work with my advisor? To see how they build portfolios for high net worth clients and to get a free, custom financial plan, go here.

Frequently asked questions

Below are a few more questions commonly asked about investing $1,000,000.

Where should I invest $1,000,000 right now?

The best way to invest $1 million right now depends on your age, financial goals, and risk tolerance.

Most people spread their money between stocks, bonds, cash, and real estate (via home ownership).

If you're risk-averse or are in or near retirement, you may want to have a higher allocation to bonds and other fixed income than someone who is younger and more comfortable with risk.

A popular rule of thumb to determine a good stock/bond split is to take your age and subtract 10, then allocate that percentage of your money to bonds. Using this rule, a 65-year-old would invest ~55% of their portfolio in bonds.

What is the safest investment for $1 million?

The safest way to invest $1 million is to buy Treasury bills. A Treasury bill (or T-bill) is a short-term debt obligation backed by the “full faith and credit” of the U.S. government.

The U.S. government is the least risky borrower, as it generates revenue through taxes. In 2024, it collected $4.92 trillion in tax revenue.

Because it comes from taxes, this money is nearly guaranteed (unless everybody moves out of the United States or stops paying their taxes).

Additionally, if the U.S. were ever at risk of defaulting on its debt, it could print more money to repay its obligations.

2-year T-bills are currently paying 3.73%, meaning an investment of $1 million would generate $37,300 in interest per year.

How much can you make if you invest $1 million?

How much you will earn from any investment depends on which assets you buy and how long your money is invested.

If you invest $1,000,000 in bonds that pay 4%, you will earn $40,000 per year in interest. Investing in other securities, like stocks, can generate higher returns but also comes with more risk.

For instance, the stock market has averaged about 8% per year over the last 100 years. If you invest $1,000,000 and it earns 8% per year, you will have $4,660,957 after 20 years.

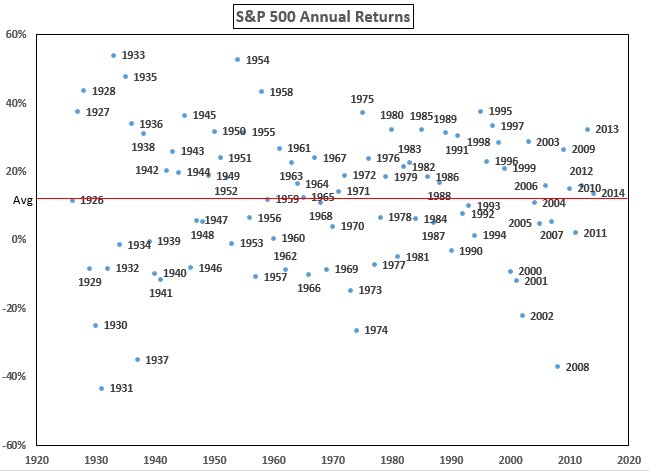

That said, if your investment time horizon is just one year, stock market returns are sporadic:

Source: A Wealth of Common Sense

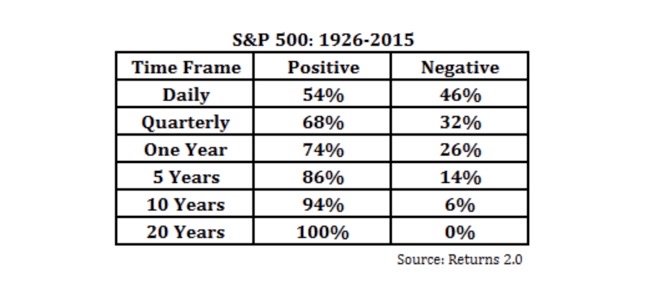

But when you extend your time horizon, the historical probabilities become heavily stacked in your favor:

Source: A Wealth of Common Sense

So, if you were to invest $1 million in the stock market, on average, you might earn $80,000 per year.

But, because of volatility, history tells us you could lose up to $431,000 or make as much as $542,000 in a single year.

How to invest $1 million to live off the interest?

You can live off the interest of $1 million by investing in assets that will generate more interest income than you spend in a year.

For example, 10-year Treasury bonds are currently paying 4.29% interest, so an investment of $1,000,000 would generate $42,900 in interest income per year.

If you need more than $42,900 in income, you could increase this amount by buying slightly more risky assets, such as corporate bonds or private credit (via Percent).

For more information on this, check out my article on how much interest you can earn on $1 million.

How we chose the best ways to invest $1,000,000

When evaluating investments, we consider the following:

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time, or is it relatively new? How likely is a financial advisor to recommend it?

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Accessibility: How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

Putting it all together

You may be wondering now how to put all this information into action.

As an example, let's assume I'm a 50-year-old who's saving for retirement and I have:

- A $500,000 home with a $50,000 mortgage balance

- Another $1,000,000 to invest

Let's also assume that I have a job that covers all my expenses, I'm slightly risk-averse, and I plan to retire in 15 years.

My portfolio might look something like this:

- 50% stocks (primarily VOO)

- 35% bonds (primarily SPTL)

- 10% alternatives (spread across Willow Wealth's Alternative Income Fund, Hiive, and Percent)

- 5% cash (primarily SGOV)

Obviously, this is a very rough, back-of-the-napkin example of how I would invest $1,000,000, but hopefully it's illustrative.

My best advice is to take your time, educate yourself, and write down your financial goals, time horizon, and risk tolerance.

After that, you'll be able to back into the investment strategy and financial plan that is best suited to you.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)