How to Invest in Kraken Stock in 2026

Kraken is one of the largest crypto exchanges in the world.

As of the time of writing, over $2.8 billion has been traded on its platform in the last 24 hours alone. It also has more than 10 million active users, and its market share has doubled in the last two years among exchanges that support USD deposits.

Kraken's popularity is attributable to its low fees, altcoin market depth, and easy-to-use trading platform. It also recently announced plans to offer trading for U.S.-listed stocks and ETFs by the end of 2024.

In June 2024, Kraken was reportedly considering raising $100 million in a final funding round before its IPO, which could have happened as early as Q1 2025. However, the round has not yet materialized.

So, for now, Kraken remains a private company. There is no Kraken stock symbol for you to look up and buy in your brokerage account.

However, if you qualify, there is a way for you to buy its shares today. Here's how.

Buy Kraken shares from current shareholders

Hiive is a secondary marketplace where accredited investors can buy shares of private, VC-backed startups from existing shareholders.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

There are over 2,000 pre-IPO companies on Hiive, including Databricks, Consensys, and Kraken:

Kraken is one of the most active stocks on Hiive right now. There are 41 unique listings made by different sellers.

Each seller creates their own listing, which includes an asking price and a quantity of shares offered. Sellers may be employees, venture capitalists, or angel investors.

Buyers can either accept the asking price or place bids and negotiate directly with sellers.

After registering, you can view Hiive's order book, which includes all asking prices, bids, and recent transaction prices for every company on its platform.

You can register and view the order book for Kraken with the button below:

Other investments you may be interested in

Unfortunately, investing via a secondary marketplace is the only way to gain exposure to Kraken at this time. And it's only available to accredited investors.

If you're a retail investor, here are a few other investments you may want to consider.

1. Coinbase stock

Coinbase (COIN) is the second-largest crypto exchange in the world (after Binance).

In the last year, Coinbase generated $4.5 billion in revenue and net income of $1.5 billion.

While Coinbase and Kraken are not the same, the valuations of the two companies typically move in lock-step with one another.

They both generate revenue from trading fees and subscriptions, which are largely tied to how the crypto markets as a whole are moving. When bitcoin and other cryptocurrencies are in a bull market, Coinbase and Kraken do well.

Right now, both bitcoin and Coinbase's stock are near 52-week highs.

No, an investment in Coinbase is not the same as an investment in Kraken, but the investment may perform very similarly.

2. Crypto-themed ETFs

Instead of buying an individual stock like Coinbase, you can also invest in an exchange-traded fund (ETF).

An ETF will provide you with broad diversification into a number of crypto-related companies.

Some ETFs you may be interested in include:

- Schwab Crypto Thematic ETF (STCE)

- Bitwise Crypto Industry Innovators ETF (BITQ)

- Fidelity Crypto Industry and Digital Payments ETF (FDIG)

While these ETFs all have slightly different investment strategies and portfolios, their top 10 holdings largely overlap.

The most common stocks these ETFs hold are Coinbase (COIN), Marathon Digital Holdings (MARA), CleanSpark (CLSK), Riot Blockchain (RIOT), and MicroStrategy (MSTR).

3. Invest in cryptocurrency or bitcoin ETFs

As noted above, crypto exchanges tend to do better when the crypto market is performing well.

Therefore, you may see similar performance in owning cryptocurrencies as you would if you owned Kraken or Coinbase.

You can invest in crypto on Kraken or Coinbase.

An alternative and increasingly popular way to invest in bitcoin is via bitcoin ETFs. These funds offer exposure to and track the price of bitcoin. Since these are ETFs, you can buy them in your regular brokerage account.

A few of the most popular bitcoin ETFs are GBTC, IBIT, BITO, and ARKB.

When will Kraken IPO?

If you're not interested in any of the above investments and still want to invest in Kraken, you'll need to wait for it to go public.

In April 2021, Kraken said it was considering going public back sometime in 2022. Bitcoin had two significant rallies in 2021 (to over $60,000), which led to an uptick in trading volume, new users, and revenue for Kraken.

At that time, Kraken was in talks with several investors for a new round of funding, which would have valued it at up to $20 billion.

However, neither this funding round nor its IPO came to fruition.

2022 was a tough year for cryptocurrency. Bitcoin fell from a high of over $64,000 in November 2021 to a low near $16,000 in November 2022.

If it had raised money or gone public, Kraken likely would not have commanded the same valuation as it would have a year earlier.

Given its intentions to go public years ago, I anticipate Kraken is anxious to become publicly traded once the conditions are favorable.

When it does go public, you'll need a brokerage account to buy it. If you're in the market, we recommend Public.

Invest in stocks, ETFs, Treasuries, and cryptocurrencies, all on one of the most well-designed investing platforms.

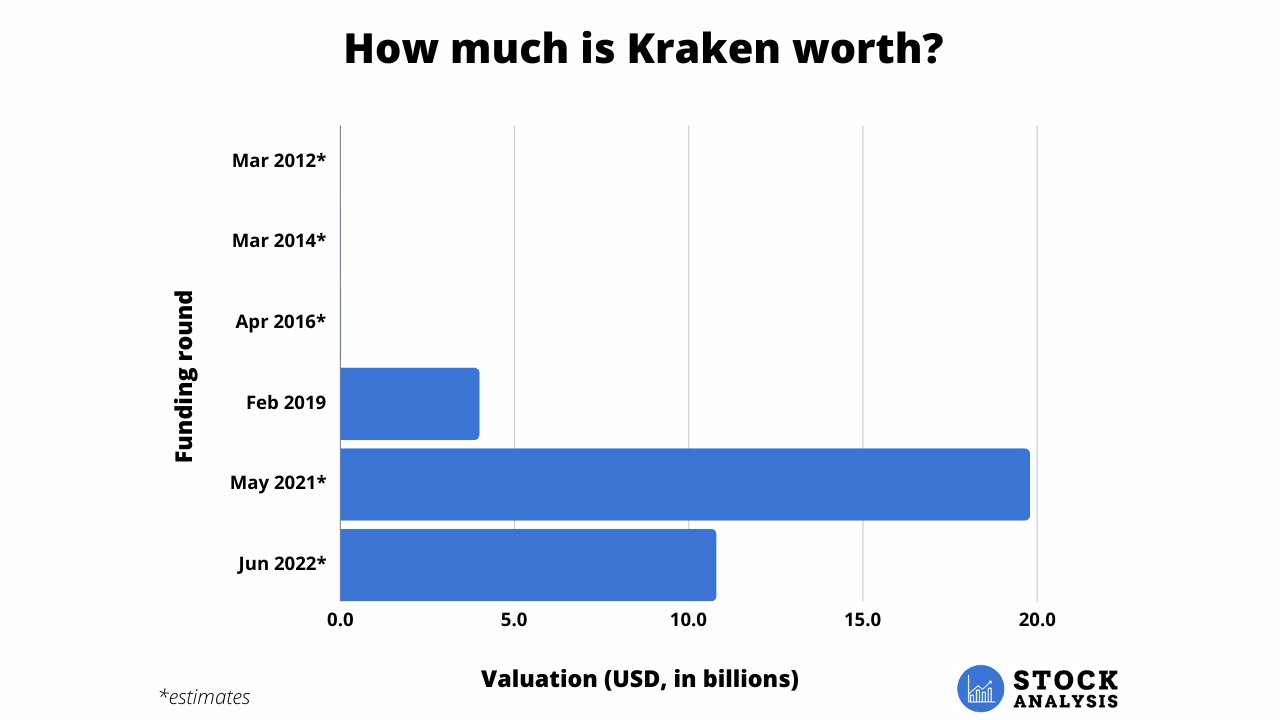

How much is Kraken worth?

Kraken was founded in 2011 and has raised $32.5 million over six rounds since then. However, only one of those rounds posted a public valuation figure — the $3.9 billion valuation it received in February 2019.

Additionally, Kraken was rumored to be valued at $10.8 billion in mid-2022.

For the rest of the figures below, I estimated its worth at various stages based on some unverified rumors and Coinbase's valuations at similar stages of growth.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.