How to Buy Lightmatter Stock in 2026

Lightmatter is aiming to reinvent computation.

The company, founded by three MIT alumni, makes photonic chips that are capable of performing calculations at nearly the speed of light.

Instead of moving information between computer chips as electrical signals, Lightmatter's technology uses optical connections and "silicon photonics" to move the information using light.

Photonic computing not only enables dramatically faster data transfer but also slashes energy usage, simultaneously addressing two of AI's biggest constraints: latency and cost.

Lightmatter is one of just a few companies working on photonic computing and has drawn significant interest from investors. In its most recent funding round, the company raised $400 million at a $4.4 billion valuation (October 2024).

And, if you're an accredited investor, you can invest in Lightmatter stock today.

How to buy Lightmatter stock

Lightmatter is a private company, which means it doesn't have a stock symbol or public stock price, and you can't purchase shares in your regular brokerage.

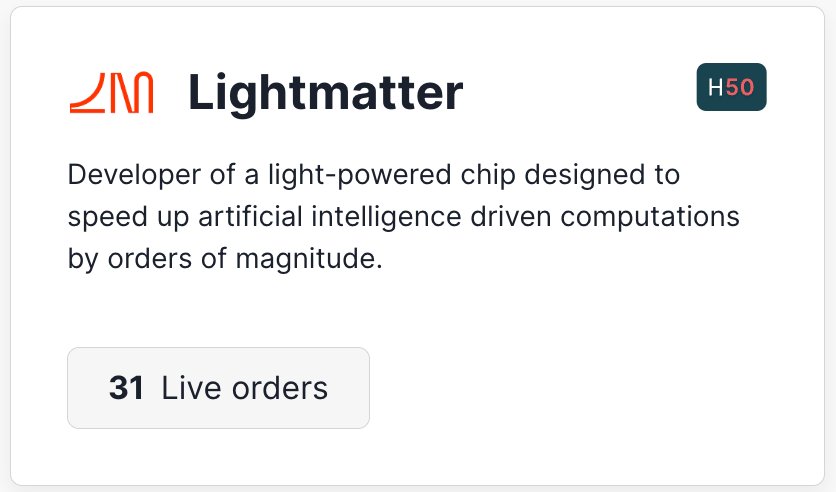

However, accredited investors can buy Lightmatter shares directly from existing shareholders through an investment platform called Hiive.

There are over 2,000 pre-IPO companies on Hiive's marketplace right now, including Databricks, Anthropic, and Lightmatter:

As of the time of this writing, there are 31 listings of Lightmatter stock on Hiive.

Here's how to invest in Lightmatter stock:

- Go to Hiive's website and click “Sign Up."

- Enter your name and basic details.

- Agree to the terms and click "Sign Up" at the bottom.

- Answer a series of eligibility questions.

- Wait for Hiive to get back to you regarding your account.

- After you receive confirmation, go to the site, log in, and search for “Lightmatter” stock.

- Browse listings and purchase the stock. You can either accept that price and buy directly or make an offer and negotiate directly with the seller.

Click the button to get started:

You can learn more about Hiive in our full review.

Can retail investors buy Lightmatter stock?

Lightmatter is a private company, which means retail investors can't buy its stock.

Lightmatter raised $400 million at $4.4 billion valuation in its Series D in October 2024, nearly quadrupling its previous valuation set just 10 months earlier in December 2023.

That round, which was led by Alphabet (GOOGL) through its venture capital arm GV (formerly Google Ventures), raised $155 million and valued the company at $1.2 billion.

GV also invested in the October 2024 round and the company's Series A — which raised $33 million — in February 2019.

Technically, because of its stake, an investment in Google would give you exposure to Lightmatter stock. However, that exposure is very indirect.

Assuming Google invested:

- $20 million in its Series A in February 2019 (which may now be worth $880 million)

- $75 million in its Series C-2 in December 2023 (which is now worth $275 million)

- $75 million in its Series D in the October 2024 round

...its total stake would be $1.23 billion.

Still, considering Google's $2.28 trillion market capitalization, this stake represents just 0.05% of its business — not exactly a needle-moving investment.

Still, as we've seen with Microsoft and OpenAI, there's a chance this investment could turn into a more robust partnership, which could have much larger implications for Google's business.

That may be something to keep an eye on.

When will Lightmatter IPO?

While the company has not provided any definitive timeline around a potential public offering, co-founder and CEO Nick Harris indicated that its October 2024 round will probably be the company's last.

Furthermore, the funding came shortly after the appointment of former Nvidia executive Simona Jankowski as CFO, who could help pave the way for the company's IPO.

When Lightmatter does go public, you'll need a brokerage account. You can check out our article on the best brokerage accounts or skip the details and open an account with Public, our top choice.

Who founded Lightmatter?

Lightermatter was founded by 3 MIT alumni: Nicholas Harris (CEO), Darius Bunandar (Chief Scientist), and Thomas Graham (CFO).

Prior to MIT, Harris worked at the semiconductor company Micron Technology (MU).

While there, he discovered that the traditional approach for improving computer performance — that is, cramming more transistors onto every chip — would eventually hit its limit.

Harris left Micron to work on photonic quantum computing for his PhD at MIT.

During that time, he developed silicon-based integrated photonic chips that use light, rather than electricity, to transmit and process information. This work led to dozens of patents and more than 80 research papers.

After studying and applying the use of photonic chips for deep learning applications, Harris realized he could attract more funding through a startup than as a researcher at MIT.

Harris then convinced Bunandar, who was studying in the same lab, and Graham to join him. The co-founders hit the ground running when they won the 2017 MIT $100K Entrepreneurship Competition.

What does Lightmatter do?

At the base of all computing operations is a lot of math. This is where the term “computing” comes from.

A general-purpose computer chip (CPU) can do normal math, but it solves complex problems by breaking them down into a series of smaller problems and solving those sequentially.

However, traditional computer chips struggle to solve the problems posed by artificial intelligence and machine learning applications as they perform millions (or even billions) of calculations simultaneously.

For these problems, we need special hardware (like that sold by Nvidia (NVDA)).

But as demand for AI-based applications increases, more and more of these calculations will need to be done, and at faster and faster speeds.

At some point, we may reach the limit of traditional computing technology, which relies on a series of basic operations with cascading logic gates and transistors. New technology and new architecture may be needed.

That's where Lightmatter comes in.

Lightmatter's photonic chips work by sending a beam of light through a number of tiny sensors. By tracking the changes in the phase or path of the light, the solution is found as fast as the light can reach the opposite end of the chip.

When compared to traditional computer chips, which use electricity (electrons), Lightmatter's photonic chips, which use light (photons), are both faster and more energy efficient.

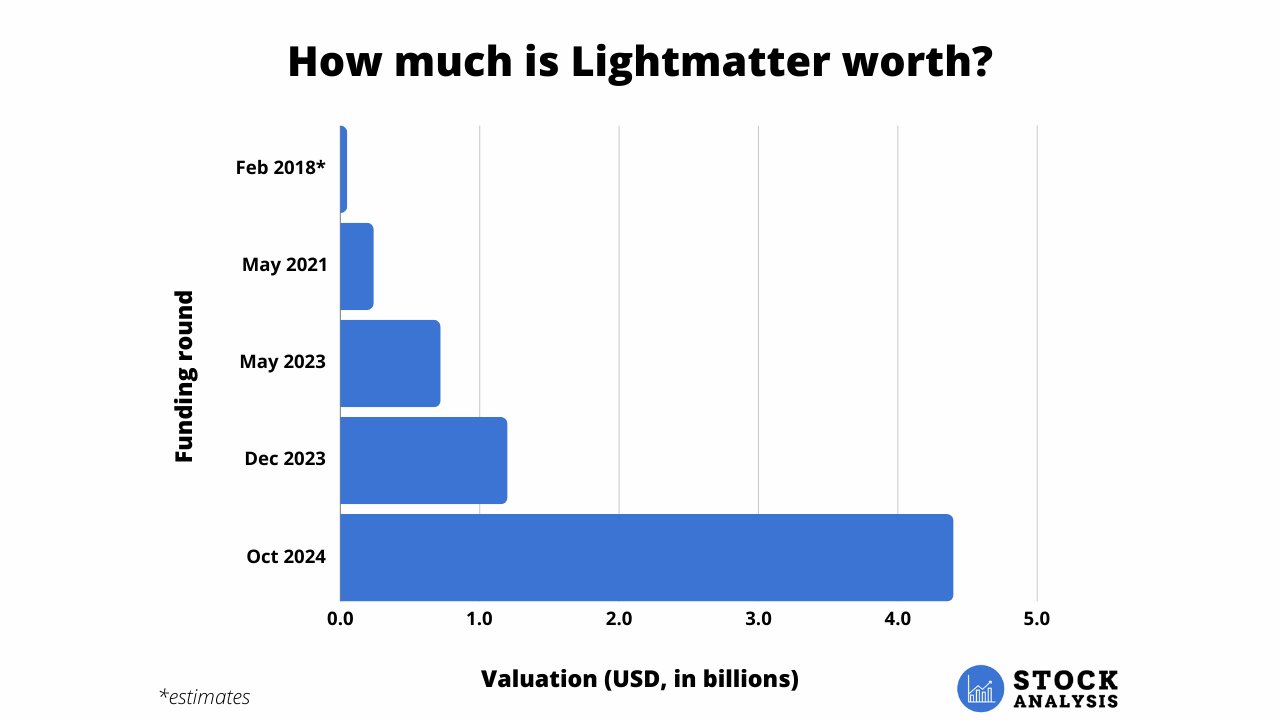

How much is Lightmatter worth?

Lightmatter most recently raised $400 million at a valuation of $4.4 billion in October 2024, bringing its total funding to around $850 million.

Here's how its valuation has changed over time:

At a $4.4 billion valuation, shares were trading for $80.23 each. Shares are currently trading for $53.27 on Hiive, implying a valuation of around $2.9 billion (assuming no new shares have been issued, which might not be the case).

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)