How to Invest in xAI Stock in 2026

xAI is Elon Musk's artificial intelligence lab. It was built to compete directly with OpenAI, Anthropic, and Google's Gemini.

Founded in 2023, xAI's goal is to build “maximally curious” AI systems capable of understanding the true nature of the universe.

Put simply, the company wants to create models that can reason more deeply and think more independently than today's leading systems like ChatGPT, Gemini, and Claude.

Its first product, Grok, is an AI chatbot designed to bring that vision to life. It's available as a standalone app and is also integrated with X (Twitter) and Tesla vehicles.

Unsurprisingly, investors rushed to back Musk's latest venture. The company raised $62 billion in total funding, including a $20 billion round in January 2026 that came at a $230 billion valuation.

That momentum set the stage for one of the largest private-company transactions in history.

SpaceX acquires xAI

In February 2026, SpaceX acquired xAI in an all-stock deal that valued xAI at $250 billion and SpaceX at $1 trillion, giving the combined entity a $1.25 trillion valuation.

While Grok is xAI's most visible product, it wasn't the reason for the acquisition.

Over the past several years, xAI has spent billions of dollars building its own AI compute stack. That effort culminated in Colossus, the world's largest AI supercomputer, built to train and run next-generation models at massive scale.

The lab's decision to build its own data centers reflects a broader constraint facing the AI industry. Modern models require enormous amounts of power and cooling, and as systems grow larger, those requirements are becoming a bottleneck to progress.

One proposed solution is to move portions of that infrastructure off of Earth entirely.

In space, solar energy is abundant, cooling is effectively free, and many of the environmental, regulatory, and permitting constraints that slow terrestrial data center development disappear.

Elon Musk has been one of the most vocal advocates of this idea, repeatedly arguing that truly large-scale AI will eventually require moving compute beyond the planet. That belief is where SpaceX and xAI converge.

Viewed through that lens, the acquisition was not about a chatbot.

It was about combining launch capability, orbital infrastructure, and AI compute under one roof, positioning Musk's companies for a future in which large-scale, solar-powered compute operates in orbit rather than on the ground.

You can read more about Musk's vision here.

Can you buy xAI stock?

Now that xAI is a wholly owned subsidiary of SpaceX, the only way to invest in it is by investing in SpaceX.

Prior to the xAI acquisition, Musk hoped to take SpaceX public by July 2026.

The IPO was aiming to raise as much as $50 billion at a valuation of up to $1.5 trillion, but it's unclear whether the xAI acquisition will change the structure or the timing of the offering.

Still, SpaceX looks poised for an IPO in the not-too-distant future. But if you want to invest in it before then, there are a couple of options.

Here's how to invest in SpaceX, xAI's parent company, while it's a private company.

How to invest in xAI through SpaceX

1. Buy shares directly from existing shareholders

SpaceX is a private company, which means it doesn't have a stock symbol or trade on a public exchange.

However, accredited investors can buy shares on Hiive, a pre-IPO marketplace.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly.

- Have a net worth that exceeds $1,000,000, excluding your main residence.

- Be a qualifying financial professional.

Hiive is an investment platform where accredited investors can buy shares of private, VC-backed startups.

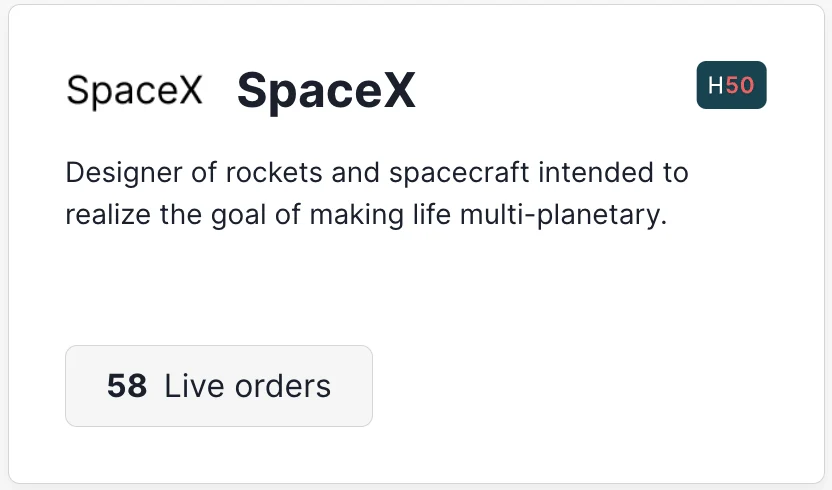

Unsurprisingly, SpaceX is one of the most actively traded companies on the platform:

Each listing of SpaceX stock is created by a unique seller who may be an employee, venture capitalist, or angel investor. Sellers set their own asking prices and quantity of shares for sale.

Buyers can see each listing, accept a seller's asking price as listed, place bids and negotiate with sellers, or add a company to their watchlist. They can also see all recent transactions (prices and quantity of shares traded).

See what shares of SpaceX are trading for on the pre-IPO market by creating an account:

SpaceX shares are also available on Forge, another large pre-IPO marketplace which may have different pricing and available listings. If you're serious about investing in SpaceX (or other private companies), you may want to create accounts on both platforms.

2. Invest in the ARK Venture Fund

Because of federal regulations, retail (non-accredited) investors are not able to invest in private companies.

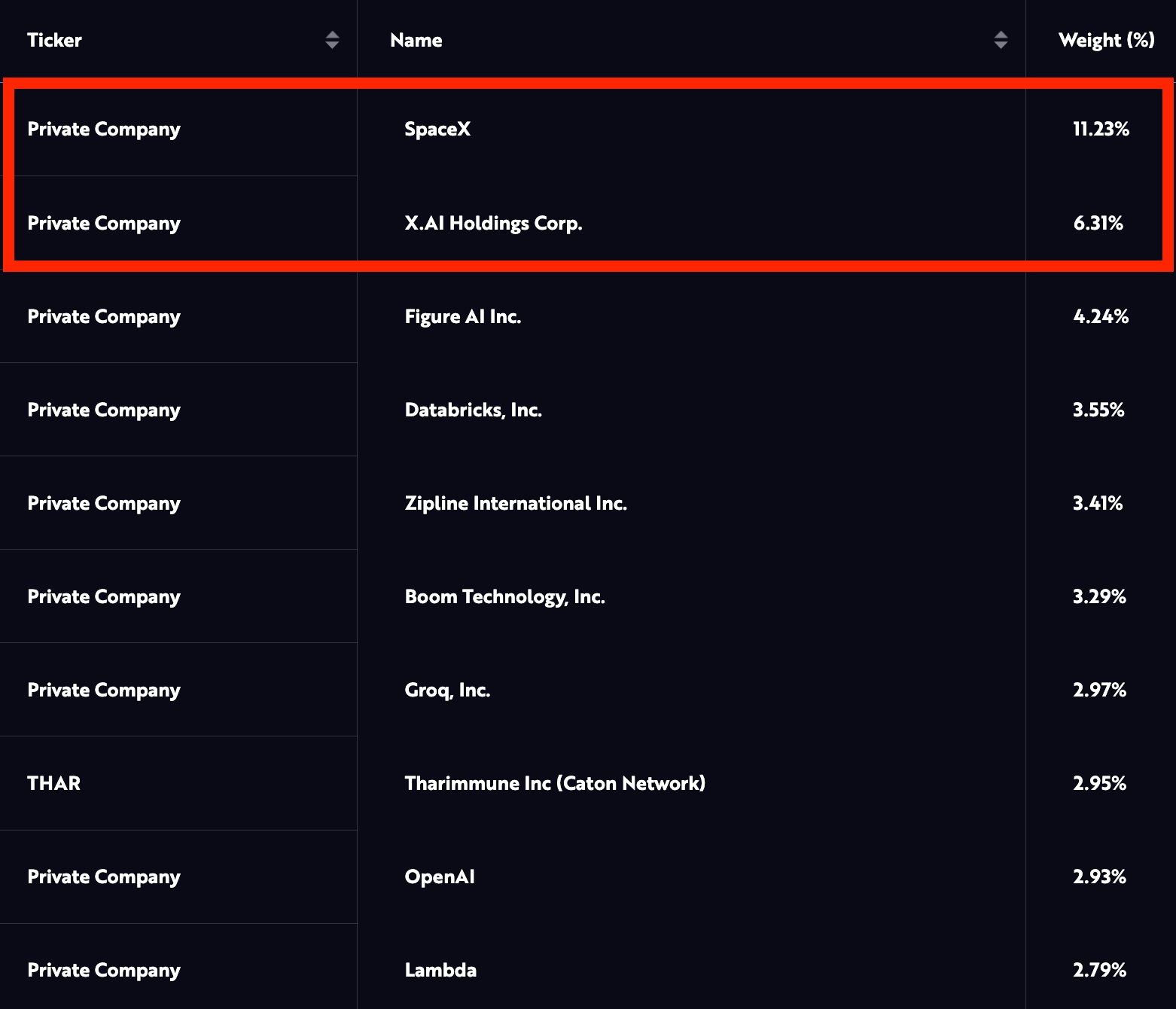

While there's no way for you to buy shares of SpaceX & xAI directly, you can get exposure to the company via the ARK Venture Fund. As of the end of January, SpaceX and xAI were its two largest holdings and made up a combined 17.54% of the fund:

The Venture Fund also has stakes in Figure AI, OpenAI, Neuralink, and Anthropic, and is one of the best ways for individual investors to gain exposure to these companies.

Retail investors can invest in the Fund via SoFi. Accredited investors can buy it directly from ARK's website. There is a 2.90% annual management fee.

Alternatives to investing in xAI

Here's a list of other AI-related investment opportunities you may be interested in.

1. Publicly traded AI companies

For retail investors, the easiest way to invest in AI is to buy publicly traded stock.

- Nvidia (NVDA) is the market leader in developing the chips used to train and run supercomputers and AI networks. It has also participated in xAI's last two rounds, with much of the capital raised in these rounds expected to go toward acquiring Nvidia chips.

- Taiwan Semiconductor (TSM) is the sole manufacturer of Nvidia's AI GPUs. The company does not design any of its own chips; it only builds chips for its clients.

- Microsoft (MSFT) owns 27% of OpenAI and is entitled to up to 20% of its revenue (up to an undisclosed cap). It's also integrating the lab's technology into its existing suite of products, including Office 365 and GitHub. You can read more about their partnership in this article.

- Alphabet (GOOGL) is positioned to be the biggest winner from AI-powered search. Additionally, its chatbot (Gemini) is a competitor to OpenAI, and its Google Cloud Platform is likely to host a number of future AI applications.

- Amazon (AMZN) runs Amazon Web Services (AWS), the world's largest cloud computing provider. A significant amount of future AI computing will likely be run on its servers. It also owns ~15% of Anthropic.

Dell (DELL) was also contracted to build half of the racks needed to power xAI's original supercomputer, and Cisco (CSCO) — in addition to being an investor in xAI — has partnered with Nvidia to help it deploy AI factories.

While none of these companies are working on the exact same problems as xAI, they either benefit from or are themselves investing heavily in artificial intelligence.

2. ETFs and private funds

If you don't want to invest in a specific stock but want exposure to the industry, here are a few options:

- The Roundhill Generative AI & Technology ETF (CHAT) invests in companies focused on generative AI.

- The Themes Generative Artificial Intelligence ETF (WISE) owns stocks that generate their revenue from AI, big analytics and data, natural language processing, or AI-driven services.

There are also funds that allow you to invest in privately held companies:

- The ARK Venture Fund (mentioned above) invests in innovative companies, regardless of whether they're publicly traded or privately held.

- The Fundrise Innovation Fund gives retail investors access to a portfolio of privately held tech companies like OpenAI, Anthropic, Anyscale, Anduril, Databricks, and more. The minimum investment is just $10.

3. Other private AI companies

Here are a few other AI-centric private companies I've written about:

All of these companies have shares available for purchase on Hiive.

For more investment ideas, check out our article on how to invest in artificial intelligence.

When will xAI IPO?

Now that xAI is part of SpaceX, it's effectively on a path to the public markets.

If SpaceX proceeds with its proposed IPO, xAI would be included as part of the combined entity, making it the first major AI lab with public market exposure.

That would put it ahead of rivals like OpenAI and Anthropic, both of which are widely expected to pursue their own IPOs later in 2026.*

*I can't help but imagine this played at least some part in Musk's decision to acquire xAI before SpaceX goes public.

In other words, investors may gain access to a leading AI lab sooner through SpaceX than by waiting for a standalone xAI, OpenAI, or Anthropic listing.

When it does go public, you'll need a brokerage account to invest in it. If you need a brokerage account, we recommend Public.

On Public, you can invest in stocks, ETFs, Treasuries, bonds, and more, all from one of the best-designed brokerages available.

xAI's acquisition of X (Twitter)

The stated mission of xAI is “to understand the true nature of the universe” and to seek truth, helping to filter out and prevent the spread of misinformation.

One obvious use case for this technology is X (formerly Twitter), Musk's social media company. Grok, xAI's chatbot, is heavily integrated with X.

In March 2025, in a move to further link the two companies, Musk announced that xAI acquired X in an all-stock deal, which valued xAI at $80 billion and X at $33 billion ($45 billion less $12 billion in debt).

Musk originally purchased X for $44 billion in October 2022. Its valuation had swung wildly since the purchase, at one point being valued at less than $10 billion, though it had risen in the months following President Trump's election.

Musk described the two companies' futures as "intertwined" and said the acquisition will help them "combine the data, models, compute, distribution and talent.”

More on Grok and xAI

As of September 2025, xAI reported that Grok had 64 million monthly active users.*

*In January 2026, xAI reported 600 million monthly active users, but that figure included both Grok and X (Twitter) apps.

For comparison, OpenAI said in December that ChatGPT had hit 900 million weekly users, while Google reported it had crossed 650 million monthly users for its Gemini app in November.

Despite having a fraction of the user base — Grok has less than 2% of ChatGPT's usage — xAI was valued at $230 billion in January 2026, or 46% of OpenAI's latest official valuation.*

*OpenAI is currently trying to raise money at an $830 billion valuation.

That premium reflects investor confidence in xAI's long-term potential, which is driven by several factors:

- Data centers: xAI has spent billions building its own compute infrastructure. Its flagship system, Colossus, is the largest AI-specific supercomputer on earth, powered by more than 200,000 GPUs. A follow-up system, Colossus 2, is currently under construction.

- Founder and strategic backing: Elon Musk's involvement continues to attract capital and media attention, helping xAI command a valuation that far exceeds what current usage or revenue would typically support.

- Integration: Grok is deeply integrated into X (Twitter) and Grok Voice is now available in Tesla vehicles, two powerful distribution channels that could unlock major monetization opportunities down the road.

That said, Grok hasn't escaped controversy. It's been criticized for producing politically charged, Musk-aligned responses, and is currently under regulatory scrutiny after its image generator was used to create sexualized images of other users.

Elon Musk and OpenAI

Musk was a co-founder of OpenAI and invested $50 million to start the lab.

In 2018, Musk sold his stake to Microsoft and left the company over disputes about the company's lack of safety guardrails.

He also filed a lawsuit against Sam Altman (which has since been withdrawn), his co-founder and the current CEO of OpenAI, claiming Altman breached their contract by abandoning their not-for-profit mission.

In November 2024, Musk amended the lawsuit to expand antitrust allegations and added Microsoft, Microsoft VP Dee Templeton, and LinkedIn co-founder Reid Hoffman as defendants.

xAI is a direct competitor of OpenAI. Musk has a golden opportunity to differentiate xAI with responsible and transparent practices, areas he's publicly criticized OpenAI for in the past.

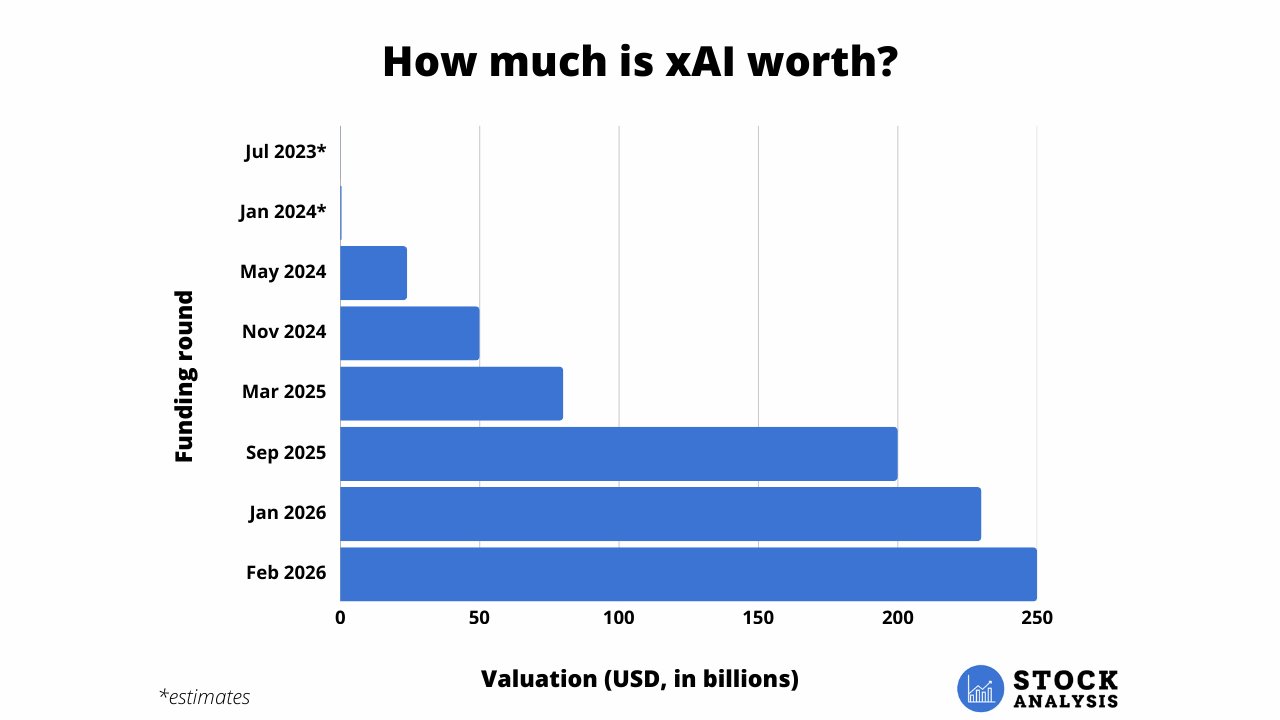

How much is xAI worth?

As mentioned above, xAI was valued at $250 billion when it was acquired by SpaceX.

Prior to the acquisition, the lab was valued at $230 billion in January 2026.

This is up 15% from the $200 billion valuation it received just four months earlier, which itself was up 2.5x from the $80 billion internal valuation it had as part of its acquisition of X (Twitter) in March 2025.

Here's a look at how xAI's valuation has changed since being founded in 2023:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.