Cost of Revenue

Cost of revenue, or COR, is the total cost of making and delivering a service or product.

It's normally used for service companies, while the cost of goods sold (COGS) is generally used for companies producing a physical product, though this is not always the case.

The cost of revenue is calculated by adding up the cost of labor, materials, marketing, distribution, and any sales discounts, like so:

COR = cost of labor + materials + marketing + distribution + sales discounts

Analyzing the cost of revenue provides key insights into core business profitability.

Below is a complete overview of the cost of revenue, including how it compares to COGS.

What is the cost of revenue?

The cost of revenue is the total cost of making and delivering a service or product.

The COR calculation includes the cost of labor, materials, marketing, distribution, and sales discounts. This differs from the cost of goods sold (COGS) since it does include marketing and distribution costs.

COR is commonly used for service companies, such as lawyers and decorators, since when tracking expenses it's difficult to separate out marketing and distribution costs.

However, COR can also be calculated for companies that produce physical goods, such as car manufacturers or oil companies.

The basic idea is to think about whether a cost would exist if the service has not been sold.

For example, consider a hotel. Staff costs, food for guest meals, and cleaning products would be included, but the hotel manager's salary and office rental would not be.

COR can also be used to calculate the cost of revenue ratio (CRR), which provides insights into how efficiently a company is generating profits from revenue. You can then compare these ratios year-over-year or to competitors to analyze trends.

SummaryThe cost of revenue represents the total costs that go into making and delivering a product or service. It's generally used for service companies, instead of the cost of goods sold, but can also be used for companies producing physical goods.

How is cost of revenue calculated?

Here is the formula for calculating the cost of revenue:

COR = cost of labor + materials + marketing + distribution + sales discounts

It's important to note that this formula only includes direct costs, not indirect costs, such as management salaries or administrative office rent.

Where can you find COR?

You can find COR quite high up on the income statement.

It's normally shown directly under revenue and is thus not considered an asset or a liability, as it would be on the balance sheet.

Stock data websites, such as Stock Analysis, also provide this information.

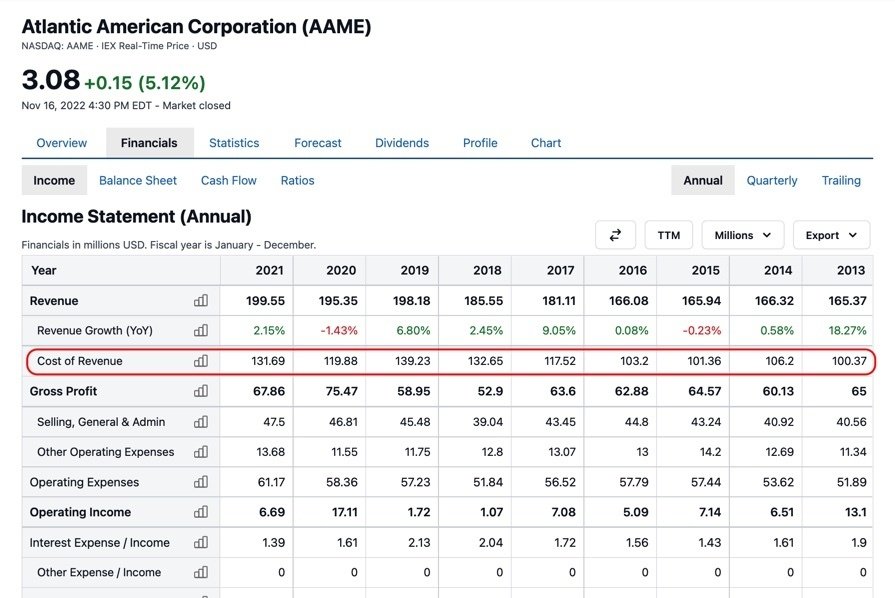

As an example, here is the cost of revenue for the insurance company Atlantic American Corporation (AAME) for the fiscal year ending on December 31, 2021:

Source: Atlantic American Corporation's Income Statement

SummaryThe cost of revenue is the sum of the cost of labor, materials, marketing, distribution, and sales discounts. It can be found relatively high up on a company's income statement.

COR vs COGS: what's the difference?

The main difference between the cost of revenue (COR) and the cost of goods sold (COGS) is that COGS does not include distribution and marketing costs, while COR does.

Thus, the reason service companies generally use COR over COGS is because it's difficult to split out the cost of making the service from the cost of marketing and distributing it.

Of note, neither COGS nor COR includes indirect costs, like administration, office rent, or management salaries.

Companies that sell physical goods have the added complication that COGS only includes the goods that have been sold, so have to clarify how these are accounted for in inventory.

This is not a consideration with COR, since services aren't stored up like physical products.

Companies producing physical goods do sometimes use COR instead of COGS, such as if they wanted to understand how marketing and distribution cost changes impacted profit margins. This can't be done using COGS, since these costs are not included.

Additionally, many industries, such as hotels and airlines, are not purely service companies since they sell food, drinks, and gifts alongside their accommodation and transport.

In these cases, the company would also need to account for its inventory via COGS.

SummaryBoth COR and COGS measure the costs that go into producing goods and services. The main difference between the two, in addition to how they are used, is that COR includes marketing and distribution costs, while COGS does not.

Why is the cost of revenue useful?

Since COR is the direct cost of generating revenues from a company's core operations, it's a good indicator of how efficiently the company is making profits from its business.

For this reason, COR is important to both a company and investors.

Companies need to understand what it's costing them to sell their service. With this information, they can set prices that yield good profit margins and strive for cheaper costs as needed, such as reducing labor or marketing expenses.

Of course, sometimes it may be the case that increasing revenue may improve profit margins more than cutting costs.

In either case, these changes can be assessed using the profit margin, which is normally done by analyzing the COR margin.

Investors can look at COR trends year-over-year and versus the industry or analysts' expectations, thereby determining how well a company is managing its costs.

SummaryCOR is a useful indicator of how well a company is generating revenue from its core operations. It can also be used to make decisions about operations, as well as to make comparisons year-over-year or to other companies in the same industry.

The cost of revenue ratio

The cost of revenue ratio (CRR) enables you to see what percentage of the revenue has been paid out in costs to create that revenue.

It's a useful metric for both companies and investors to analyze when assessing whether a company is efficiently generating revenue from its core business.

Here is the CRR formula:

Cost of revenue ratio (CRR) = cost of revenue / total revenue

Companies and investors want to see a low CRR since this shows that only a small proportion of the total revenue is being spent on the costs to generate them.

CRR trends can also be assessed year-over-year or compared to competitors.

Example CRR calculation

Consider a company with USD $1,000 in revenue in year one and $2,000 in year two. COR went up from $500 in year one to $1,500 in year two.

Calculating the cost of revenue ratio can help you assess if this would be a good investment.

| Year | Calculation | Percentage | CRR |

| Year 1 | $500 / $1,000 = 0.50 | 0.50 x 100 | 50% |

| Year 2 | $1,500 / $2,000 = 0.75 | 0.75 x 100 | 75% |

As you can see, the CRR has increased from 50% in year one to 75% in the second year.

So although revenue was higher, it's costing the company more to provide each service item. This means efficiency has dropped and the company may be a less attractive investment.

SummaryThe cost of revenue ratio (CRR) shows what percentage of revenue is going into the costs required to generate revenue. It's a useful metric for analyzing trends over time or for making comparisons to competitors.

Frequently asked questions

Below are some frequently asked questions about cost of revenue and how it's used.

Why would a company producing physical goods use COR?

Companies that produce physical goods tend to use COGS but may also use COR.

This is because including the costs of marketing and distribution can make sense in specific scenarios, like when analyzing the effects of a marketing campaign.

Additionally, there are many companies whose core operations are both a good and a service, such as hotels and airlines.

The downside of using COR versus COGS is that it will be a higher number, COR being COGS plus additional costs. Therefore, the profit margin will be lower.

However, if a company wants to know how marketing and distribution changes are affecting profitability, then COR is most useful.

Can companies choose which metric to use?

The short answer is yes, though companies producing physical goods usually use COGS while service companies tend to use COR.

If a physical goods company chooses to use COR, its profit margin will decrease, making them look less attractive to investors. Therefore, they are likely to only use COR if there is a strong reason to do so.

Generally, a service company will find it difficult to use COGS rather than COR.

This is because normally labor makes up the bulk of their costs and that same labor is engaged in distributing the service, so it's hard or impossible to separate the two.

In short, companies can choose whether to use COGS or COR, but typically have factors unique to their business that makes one metric a preferable choice over the other.

The takeaway

The cost of revenue is a useful metric for companies and investors.

It's generally used by companies that provide a service rather than a product, though it may also be used by companies that produce physical goods.

The main difference between COR and COGS is that COR includes marketing and distribution costs, while COGS does not. Like COGS, COR is shown on the income statement and is then used to calculate gross profit and efficiency ratios.

One such ratio, the cost of revenue ratio (CRR), is used to determine how efficiently a company is generating revenue compared to the costs required to do so.

As with other metrics, it's important to consider multiple measures when analyzing a company. Single metrics provide key insights but are just one part of the larger picture.