Fiscal Year

A fiscal year is a 12-month period of financial reporting.

It may differ from a calendar year, as it can span any 12-month period.

Companies can choose whether to use a calendar year or fiscal year for their reporting, though generally, the decision is made based on the nature of the business.

For example, a company may choose to use a fiscal year to better reflect seasonal effects on the business, for tax reporting purposes, or to align with an academic calendar.

Below is an overview of the fiscal year, including why and how it's used.

What is a fiscal year?

A fiscal year is a 12-month span that encapsulates a financial reporting and budgeting period.

Companies use a fiscal year to mark the start and end of their revenue and earnings for a set timeframe, which can then be used for reporting, analysis, comparisons, and more.

A fiscal year is different from a calendar year because it does not begin on January 1 and end on December 31.

Instead, a fiscal year ends 12 months after it begins. While a company can choose to start its fiscal year on any date, it must be exactly 12 months in duration.

Companies often choose to use fiscal years if they feel a non-calendrical 12 months better aligns with the nature of their business.

Two examples of companies using a fiscal year are Apple (AAPL), whose fiscal year ends on September 24th, and McKesson (MCK), whose fiscal year ends on March 31st.

Other publicly traded companies like AT&T (T), Berkshire Hathaway (BRK.A), and General Motors (GM) use a calendar-year reporting period.

Fiscal-year companies also file taxes based on their fiscal period. They are required by law to file their taxes by the 15th day of the fourth month after the close of their fiscal year.

SummaryA fiscal year is a 12-month period used by a business for reporting and planning. It may not align with a calendar 12 months and is usually chosen for reasons due to the nature of the business.

Why fiscal years are used

The Internal Revenue Service (IRS) permits companies to be either calendar year or fiscal year taxpayers.

Those who use a calendar year report their financials on a January 1 to December 31 basis, while those who use a fiscal year can choose a different 12-month period.

Companies that choose to report by fiscal year do so for different reasons, such as seasonality or timing. In most cases, the nature of the business is the deciding factor.

Seasonality

Companies affected by seasonality or holidays may choose to report fiscally.

For example, a company that regularly experiences a surge in holiday business may decide to choose a fiscal year that ends on January 31 to better reflect the seasonality of their business.

Gap Inc. (GPS) uses a fiscal year ending on January 29. Similarly, Home Depot (HD) uses a fiscal year ending on January 31, which gives them time to clear any remaining holiday merchandise before closing their books.

Agricultural companies also often choose a fiscal year that ends after the harvest.

Timing

In some cases, a company may choose to use fiscal year reporting simply to get a lower cost on tax preparation services.

Given that so many companies are in need of tax professionals at the end of the calendar year, a fiscal-year company might be able to get a lower rate at a less busy time.

Additionally, companies may choose to use a fiscal year to spare their employees the rush of closing the business year during the holidays, when many people take time off.

A fiscal year would then give them a more ideal time of year to report.

Nature of the business

In most cases, a fiscal year is selected simply because it corresponds to the nature of the business.

For example, companies that pursue government contracts often align their fiscal year to the U.S. government's fiscal year, which begins on October 1 and ends on September 30.

Many nonprofits also use a fiscal year because it allows them to deal with large fluctuations in revenue like big end-of-year donations.

An additional example is educational institutions, which may align their fiscal year with the academic calendar.

SummaryCompanies often use fiscal year reporting for seasonality or timing purposes. In most cases, the reporting type is selected based on the nature of the business.

Why a company might change its fiscal year-end

Sometimes, companies change their reporting periods.

For example, maybe the company discovered that its fiscal year did not align with peers, which made it difficult to make comparisons between the two.

However, even if two companies' reporting periods do not align, it's not impossible to make comparisons. In this case, you could then use the last twelve months, or trailing twelve months (TTM) metric to examine the activities of the last twelve months for both companies.

Companies planning to go public may also choose to shift from a calendar year to a fiscal year, to present a more enticing financial picture to potential investors. That is, by choosing a fiscal year that ends on a historically high note, the company may look like a better buy.

Businesses that have major sales targets may also choose to shift their fiscal year-end.

The reason for this is to avoid having to face customers who are in a position to demand lower prices given that other companies with big sales targets are trying to close big deals at the same time.

It's worth noting that switching from calendar-year reporting to fiscal-year reporting requires permission from the IRS. The company must fulfill the criteria explained on Form 1128, Application to Adopt, Change, or Retain a Tax Year.

SummaryA company may switch from calendar year reporting to fiscal year reporting, or shift their fiscal year reporting, to align with peers, appear more attractive to investors, and ease pricing demands from customers.

Examples of fiscal-year and calendar-year reporting

As explained above, the reporting period can vary from one publicly traded company to another.

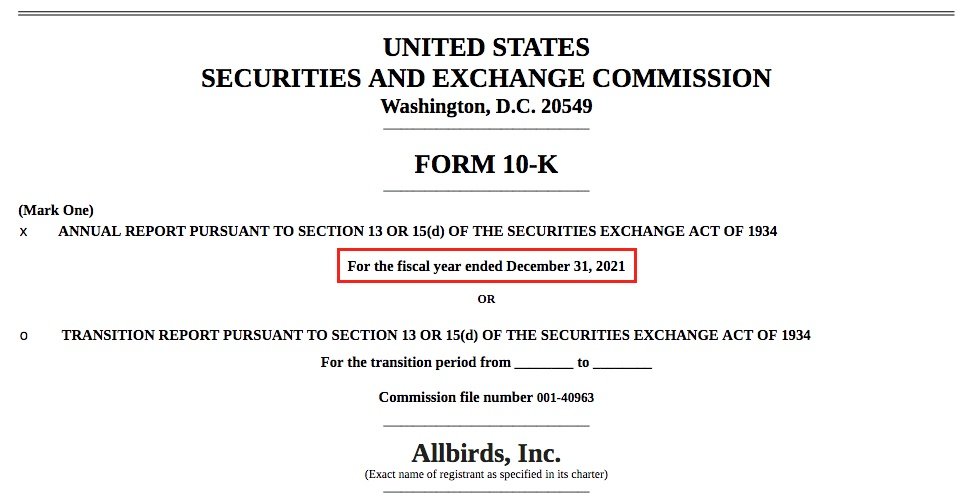

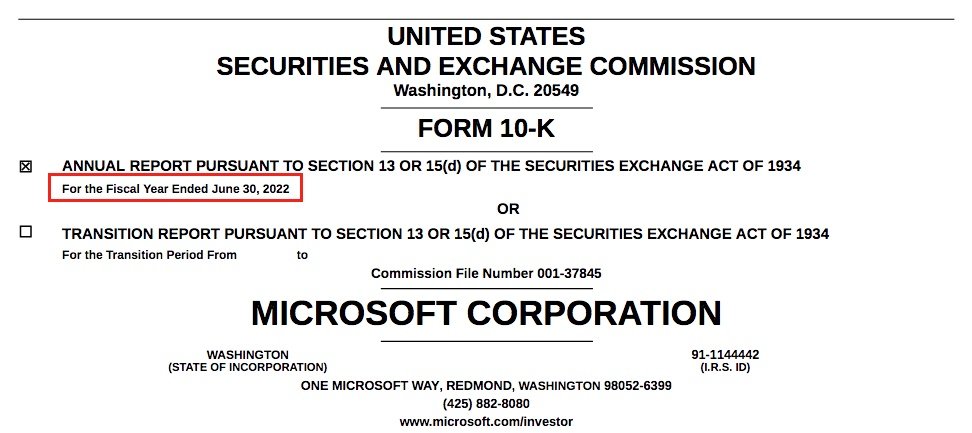

The examples below from Allbirds (BIRD) and Microsoft (MSFT) show one such variation, with Allbirds using calendar-year reporting and Microsoft using fiscal-year reporting.

Investors can see what reporting period a publicly traded company uses by looking at the first page of the 10-K form, which is a comprehensive annual report detailing a company's earnings, compensation, strategic plans, and more.

Source: Allbirds 10-K

Source: Microsoft's 10-K

10-K filings are available on the investor relations page of any publicly traded company or on the Securities and Exchange Commission (SEC) site.

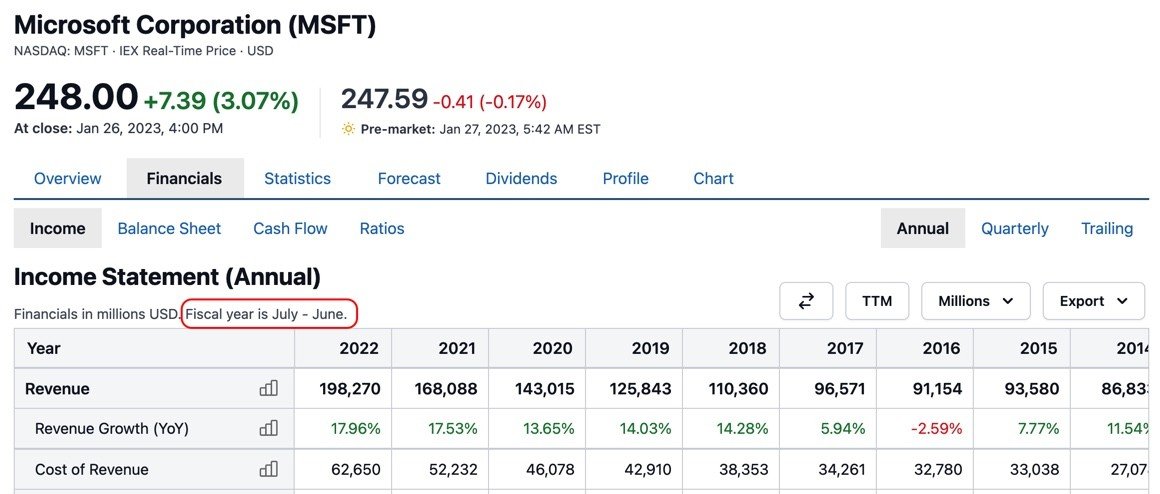

Additionally, when browsing financial data on sites like Stock Analysis, the fiscal year should be noted if the period differs from a calendar year.

SummaryAn investor can see if a company uses a calendar year or a fiscal year by looking at the first page of their 10-K found on the company's investor relations page or on the SEC site. Stock data websites may also report this alongside a company's financials.

The takeaway

A fiscal year is any 12-month reporting period that may not align with a calendar year.

Companies can choose whether to use a calendar year or fiscal year for their reporting. Those choosing to follow a fiscal year may do so to better align with their industry, more accurately reflect seasonality, or because it makes sense for the nature of their business.

When comparing the financial figures of two companies, it's important to note the reporting periods for both. Otherwise, the comparison might be unfair.