Industries and Sectors

Sectors and industries are ways to group similar businesses or stocks together.

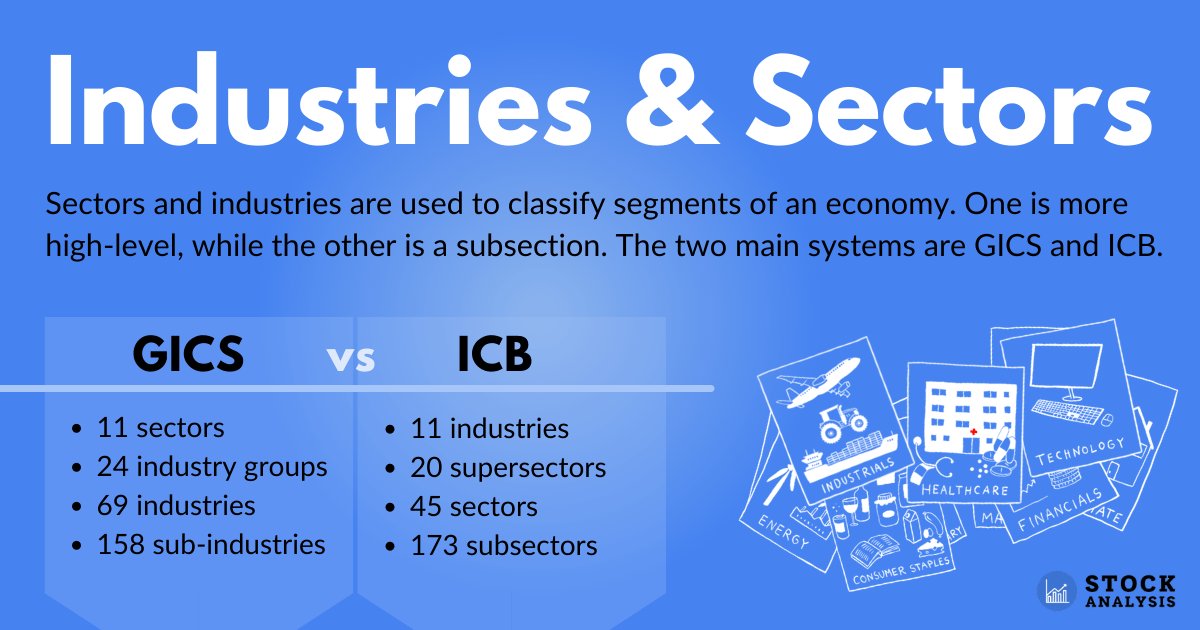

There are two main systems of classification: The Global Industry Classification Standard (GICS) and the Industrial Classification Benchmark (ICB).

Both systems group companies into broader and narrower categories, though the terminology they use differs.

Investors can use this segmentation to analyze industry averages, see how companies compare to peers, diversify a portfolio, or assess the impacts of external events.

This article will delve into both sectors and industries, explore GICS vs ICB, discuss how to use classification in investing, and include category lists.

Industry vs sector: what's the difference?

Sectors and industries are both ways to group business together, though their scope differs.

Below is one generally accepted definition of sector and industry. However, it should be noted that this changes depending on which classification system is used.

For the purposes of this section, the Global Industry Classification Standard (GICS) system of terminology is used. Classification systems will be discussed in detail in the following section.

Sector

A sector is a segment of an economy that's defined by a broad group of businesses sharing similar activities, products, or services.

Sectors are broad classifications, with each composed of many different industries.

Examples include industrials, financial services, and healthcare.

Industry

An industry is a subsection of a sector representing a group of businesses that have strong similarities in the markets in which they operate.

Industries are more specifically defined than sectors.

Examples include oil and gas drilling, heavy electrical equipment, commercial printing, and health insurance.

How they work together

Sector and industry classifications are both analyzed because they provide different insights.

The more you drill down in a sector to a specific industry, the more you will get into the details of a particular company's business and how it is performing compared to its peers.

For example, you can analyze leverage, profit margins, and other metrics that vary by industry.

However, at this level of detail, you can sometimes lose the bigger picture, such as more general trends or macroeconomic impacts.

Therefore, both classification levels are useful tools for understanding different aspects of a company's performance.

SummaryA sector is generally a broader grouping of companies while an industry is a more specific subsection. However, this can change depending on the classification system being used. Both higher and more granular classification levels provide critical insights.

Classification systems: GICS vs ICB

There are two main classification systems for sectors and industries: GICS and ICB.

The Global Industry Classification Standard (GICS) and the Industrial Classification Benchmark (ICB) were both created by financial institutions to standardize how sectors and industries are defined, making analysis and comparisons easier.

Both systems offer several levels of granularity, including sector and industry groups as well as subgroups. However, the naming of these items differs, since the terms “sector” and “industry” are used in opposite ways.

Their overall approach also differs, with GICS using a market-oriented approach and ICB using a production-oriented approach.

As an investor, it's important to know how these two systems work. Most of the time, the system you will use depends on the stock index you're using.

GICS — the market-orientated approach

GICS was developed in 1999 by Morgan Stanley Capital Investment and Standard & Poor's (1).

GICS breaks the economy down into 11 sectors, 24 industry groups, 69 industries, and 158 sub-industries. All big public companies are then categorized into these groupings.

This system is currently used by Morgan Stanley's indexes, or MSCI.

GICS uses a market-oriented approach to classification.

The idea is that the market will have a more significant impact on a company's performance than what the company does within that marketplace. GICS considers the selling environment for businesses, as opposed to the production environment.

GICS uses the term “sector” for the most generalized and therefore largest groupings. Industries are sub-sections of sectors, grouped by the market they serve.

An example would be the energy sector, which then can be broken into the following industries: energy equipment and services or oil, gas, and consumable fuels.

It's not always entirely clear which industry a company should be placed in, as many companies offer a range of goods and services. To solve this, GICS looks at a company's principal business, or its main source of revenue.

However, it will also consider earnings and the general view of the market since these also offer crucial insights into the most suitable grouping for analysis.

ICB — the production-orientated approach

The Industry Classification Benchmark, or ICB, was first launched in 2005 by Dow Jones and the London Stock Exchange's (LSE) Financial Times Stock Exchange (FTSE) (2).

It is used by the London Stock Exchange, Euronext, and other international exchanges.

The ICB organizes business into 11 industries, 20 super sectors, 45 sectors, and 173 subsectors.

You will note that within the GICS system, sectors are the broad category while industries are narrower. The opposite is true with ICB, with industries being the broader category.

Compared to GICS, ICB takes a different view of the most useful way to classify businesses. It uses a production-orientated approach, which considers what the company produces.

The ICB approach is based on the belief that the effect of external factors on production offers more insight than the market in which those products are sold.

To do this, ICB looks at the nature of the business and the use of the products it produces. This could be the immediate or end use, or even the process used to create the product.

An example would be the energy industry, classified into either the oil, gas, and coal or alternative energy sectors.

For companies that operate more than one type of business, ICB uses audited accounts and directors' reports to decide which is the more significant category.

SummaryGICS and ICB are the two main classification systems for grouping companies. The main differences are the terminology and overall approach to classifying companies. Within GICS, sector is the broadest category while with ICB, industry is the broadest.

GICs vs ICB: category overviews

Confusingly, GICS and ICB use “sector” and “industry” in completely opposite ways. GICS uses “sector” for the broadest classification, while ICB does the opposite.

Below is a quick overview of GICS and ICB, from broadest category to narrowest.

| GICS | ICB |

| 11 sectors | 11 industries |

| 24 industry groups | 20 supersectors |

| 69 industries | 45 sectors |

| 158 sub-industries | 173 subsectors |

And here are lists of the top-tier categories for both, so the 11 GICS sectors and the 11 ICB industries:

| GICS Sectors | ICB Industries |

| Consumer discretionary | Technology |

| Consumer staples | Telecommunications |

| Energy | Healthcare |

| Materials | Financials |

| Industrials | Real estate |

| Healthcare | Consumer discretionary |

| Financials | Consumer staples |

| Information technology | Industrials |

| Real estate | Basic materials |

| Communication services | Energy |

| Utilities | Utilities |

SummaryBoth GICS and ICB have 11 top-tier categories. These are then broken down into further categories, though the naming conventions differ.

Why are sectors and industries useful?

From an investor perspective, segmentation is useful for benchmarking a company's performance, assessing the impact of external events, and building diversification.

Looking at both a company's broader sector and narrower industry provides different but complementary insights as various factors come into play.

Sector analysis

Sector analysis is a useful tool for assessing how diversified a portfolio is. This effectively tells you how much specific factors are likely to affect the overall portfolio.

Although sector and industry analysis is a basic tool, it's very helpful for getting a good overall grasp of a portfolio's exposure to external events.

Businesses within a sector or industry are likely to have strong similarities in how they are affected by different external factors, for example:

- A change in interest rates in a key economy

- A global event like a shortage of oil or grain, perhaps caused by a war

- An announcement from a significant player in that sector or industry, perhaps regarding their profits or a new innovation

With some sectors, like energy, you will tend to see more pronounced common trends than in other sectors that house more diverse industries or may have more significant individual influences, such as information technology.

Since industries are more specific classifications than sectors, according to GICS, they will tend to have greater homogeneity in how they react to these external factors.

By understanding sector and industry characteristics, investors can get a broad idea of how much their overall portfolio is exposed to different risks.

Example

You can see this idea playing out in consumer discretionary and consumer staples.

The important differentiation here is that the latter is less sensitive to cyclicality since these products and services are necessities.

On the other hand, consumer discretionary is highly cyclical, since these companies tend to perform much worse during an economic slowdown when consumers have to cut back.

Industries like hotels, restaurants, and luxury goods fall into this category.

When building your portfolio, it's worth thinking through this. For example, you may want to limit exposure to cyclical downturns to lower the overall risk. Alternatively, you may decide that economic growth is on the horizon, so you want your portfolio more exposed to this.

Overall, the point is that by analyzing industries and sectors, you can gain a better understanding of the risks that your portfolio is exposed to.

Industry averages

Investors can also look at sector or industry averages and trends, making comparisons to the company they are assessing.

Once you have calibrated a company's performance versus its peer group or competitors, an investment decision can be made, or the need for further analysis will be highlighted.

Of course, there are always exceptions to the general principle that sectors' and industries' performance is correlated, but it works well overall.

Example

Let's say a company you are considering has a price-to-earnings (P/E) ratio or earnings growth that is significantly higher or lower than the industry average.

This shows you that further analysis is needed in order to understand why this happened.

There may be valid, company-specific reasons for this, such as increased investment, the company being in an early stage of growth, etc., or it could be cause for concern.

Either way, it's important to dig into this more before making an investment decision.

SummaryComparing a company to its industry or sector peers can provide critical performance information, helping inform investment decisions and encouraging diversity in a portfolio.

Is the idea of sectors outdated?

The two main systems for sector analysis, GICS and ICB, were created in decades past when economies were largely based around companies that tended to be well-defined businesses.

Today's companies, especially mega-companies like Meta (META) or Apple (AAPL), often evolve into many areas of business and seamlessly span several sectors.

Another example of this would be Amazon (AMZN), which offers both online retail and web services, falling solidly into two very different industries.

Currently, there are arguments for entirely different classifications of businesses, grouping those with similar business models together (3).

The thinking is this would offer investors better insight into how a company was performing and what external factors were affecting it, as well as who its true competition was.

But overall, neither solution is a perfect fit.

More importantly, investors should consider how well the sector's model fits for their particular analysis and purpose, and then investigate any discrepancies further with other tools.

SummaryThe current sector classification systems, GICS and ICB, were created to categorize economies that were very different from those of today. There is debate as to how useful they remain.

The takeaway

Sectors and industries are used to classify segments of an economy.

Generally speaking, one is more high-level, while the other is a more specific subsection, but it depends on the system of classification being used.

There are two main classification systems, GICS and ICB, which offer similar frameworks with different naming conventions. Within the GICS system, “sector” is the top tier.

Sectors and industries are used by investors to sort and group businesses, assessing averages and the effects of external factors. This helps identify competition and is useful when analyzing risk diversification in investment portfolios.

As economies develop further into non-industrial activities, there is debate as to how useful sector and industry analysis will remain.

The classification systems have undergone several revisions in the past and may do so again as the business world continues to evolve.