Working Capital

Working capital is a measure of a company's liquidity, specifically its short-term financial health and whether it has the cash on hand for normal business operations.

The number is the difference between a company's current assets and current liabilities:

Working capital = current assets - current liabilities

Working capital is an important number when assessing a company's financial health, as a positive number is a good sign while a negative number can be a sign of a failing business.

Of note, working capital is also known as net working capital.

Below is an overview of working capital including how to calculate it, how it's used, working capital management and its ratios, and the factors that affect working capital.

What is working capital?

Working capital is a measure of a company's liquidity. Essentially, it assesses short-term financial health since it shows whether a company has enough cash to keep running.

For reference, liquidity refers to the conversion of assets into cash. Being liquid means that a company can cover the difference between the cash going in and the cash going out of the business, or, in other terms, the difference between its current assets and liabilities.

In accounting, the word “current” refers to assets and liabilities that can be sold or used in less than one year. This means they are considered cash or cash-like.

Below is a table with examples of current assets and liabilities:

| Current assets | Current liabilities |

| Cash | Debts |

| Raw materials or supplies | Accounts payable |

| Inventory or finished goods | Interest |

| Prepaid expenses | Taxes |

| Unpaid bills or accounts receivable | Accrued expenses |

| Short-term investments | Utilities and rent |

If a company's short-term assets are not enough to cover its short-term liabilities, then the company may be forced to sell a long-term asset in order to cover those liabilities. An example of a long-term asset would be machinery, buildings, etc.

In this case, the company would be considered illiquid. An illiquid company may need to raise more capital, such as by taking on more debt, or even declare bankruptcy. Companies in this position are not considered to be healthy.

This is what the working capital number helps companies assess. In short, it answers the question “how financially healthy is this business?” by determining short-term liquidity.

It's also part of a business strategy called working capital management, which employs three ratios to ensure a good balance between staying liquid and using resources efficiently. These will be covered in a later section.

SummaryThe working capital calculation helps companies understand the difference between their current assets and liabilities. It shows whether they have enough cash to keep running, assessing their liquidity and short-term financial health.

How is working capital calculated?

Working capital is the difference between a company's current assets and current liabilities.

Both of these numbers can be found on the balance sheet, which is listed on a company's 10-Q or 10-K filing, its investor relations page, or on financial data sites like Stock Analysis.

Here's how to calculate working capital:

Working capital = current assets - current liabilities

Example calculation

Below is an example calculation of working capital for a clothing manufacturer.

The company has USD $500,000 in current assets, consisting of cash, fabric, and finished clothes. Its current liabilities are USD $350,000, consisting of bills and short-term debts.

Here is the calculation:

$500,000 - $350,000 = $150,000

This means the company has $150,000 available, indicating it has the ability to fund its short-term obligations. This is a sign of a healthy business.

If the numbers were reversed and the company had $500,000 in liabilities and $350,000 in assets — meaning its working capital was -$150,000 — it would fail to meet its short-term obligations and would need to seek additional financing or potentially trigger a credit default.

Working capital is a bit like having cash or savings in a short-term account versus having money tied up in a house or other asset that you wouldn't be planning to sell right away.

The more surplus a business has, the more cushion it has in times of economic uncertainty. On the other hand, too much surplus cash is not an efficient use of capital. It's a balance.

Where to find working capital listed

For publicly traded companies, you likely won't need to calculate working capital yourself.

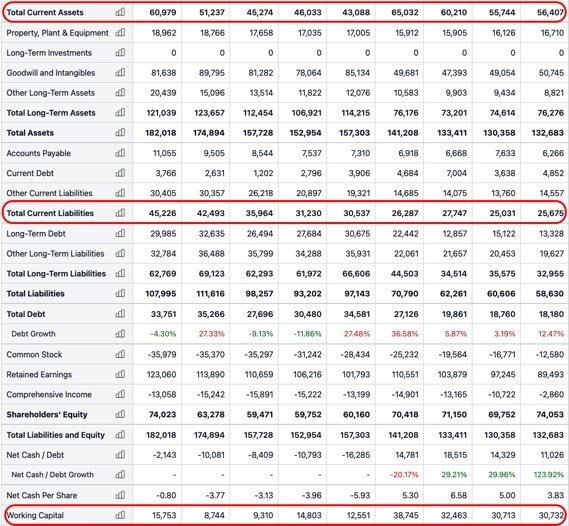

For example, below is a screenshot of Johnson and Johnson's (JNJ) balance sheet data. Total current assets and total current liabilities are both listed, as well as working capital, which is already calculated for you.

Source: Johnson & Johnson's Balance Sheet

SummaryWorking capital is calculated by deducting current liabilities from current assets. The numbers needed for the calculation can be found on a company's balance sheet or on stock data websites.

Why is working capital useful?

Working capital is a number that's useful for both companies and investors to know, as it shows whether or not a company is liquid. It can also provide insights into efficiencies.

It's a measure of liquidity and financial health

If a company has a positive working capital number, this means its current assets are greater than its current liabilities. Put simply, this indicates that the company would be able to access enough cash to cover its short-term needs.

A company in this position is financially strong and well-positioned to go forward.

If, on the other hand, a company has a negative working capital number, then it does not have the capacity to cover all of its short-term debts or cash needs using its current assets.

A company in this situation would need to sell a larger asset, such as equipment or property, if they suddenly needed to pay a debt. Or, they could consider raising funds by taking on more debt. In the worst-case scenario, the company may need to declare bankruptcy.

Such companies are considered to have poor liquidity, meaning they're financially weak.

It's an indicator of operational efficiency

Working capital is also an indicator of a company's operational efficiency, as companies that have high amounts of working capital can decide to use this to grow.

This would clearly not be an option for companies with negative working capital, since they can't even cover their short-term debts.

However, keep in mind that like all financial indicators, working capital should be used alongside other metrics to get a full picture of a company's financial situation.

SummaryWorking capital measures short-term financial health and operational efficiency. In short, a positive working capital number is a sign of financial strength, while a negative number is a sign of poor health, though it's still important to consider the larger picture.

Working capital management and financial ratios

Working capital management is a business strategy that companies use to monitor how efficiently they are using their current assets and liabilities.

Working capital management is focused on maintaining a sufficient cash flow that can meet short-term liabilities like operating costs or debt obligations. This is done by monitoring several ratios that are designed to ensure the company is using its resources efficiently.

The basic idea is to have enough cash or cash-like assets — that is, those that can be converted into cash in fewer than 12 months — to cover any short-term liabilities.

This focus also keeps the amount of time required to convert assets to a minimum, which is known as the net operating cycle or the cash conversion cycle.

Working capital management relies on the efficient management of the cash conversion cycle, which is the relationship of key activities that can be viewed through financial ratios.

The ratios are the current ratio, the collection ratio, and the inventory turnover ratio.

Ultimately, these ratios are a measurement of how well working capital is being managed.

The current ratio

The current ratio shows how well a company is able to meet short-term debts. It's similar to the working capital calculation, as the same inputs are used, but it results in a ratio instead.

Here is the formula:

Current ratio = current assets / current liabilities

If the current ratio is below one, then it's likely a company will struggle to cover its current liabilities, such as paying its suppliers or short-term debts.

As noted earlier, this is a sign of poor financial health and means a company may need to sell a long-term asset, take on debt, or even declare bankruptcy.

Nevertheless, it's important to note that sometimes a ratio below one is normal, though further investigation is required.

Most companies aim for a ratio between 1.2–2.0 since this shows the company has good liquidity but is not wasting money by holding on to cash or cash-like instruments that are not generating revenue. Companies with ratios above two are likely to be doing just that (1).

The collection ratio

The collection ratio looks at how well a company manages to receive payments from customers using who pay with credit.

The ratio will be lower if the company is good at getting its customers to pay within the required period but higher if not.

Effectively, this ratio looks at how easily a company can turn its accounts receivable into cash.

Here is the formula:

Collection ratio = (days in accounting period x average outstanding accounts receivables) / total net credit sales in the period

The inventory turnover ratio

The inventory turnover ratio looks at how well a company manages its inventory, which is another aspect of managing cash and cash-like assets that goes into working capital.

The balance here is between having enough inventory to meet customer needs and not miss out on any sales, versus having too much money tied up in inventory.

Here is the formula:

Inventory turnover ratio = cost of goods sold / average balance sheet inventory

If a company has a low ratio relative to its peers, then it's not selling many products from its inventory and its inventory management is likely inefficient.

If the ratio is high relative to peers, then the company is running its inventory very tightly and could end up missing out on sales if it doesn't have enough products to cover demand.

SummaryWorking capital management is a close analysis of assets and liabilities that focuses on maintaining sufficient cash flow to cover short-term liabilities. It relies on a few key ratios: the current ratio, the collection ratio, and the inventory turnover ratio.

Factors that affect working capital

Working capital needs vary by industry and business model. Below is more information about specific sectors as well as additional factors that play a role.

Working capital norms vary by sector

Different industries have varying norms around what's considered an ideal number.

The key consideration here is the production cycle, since this is how long it will take the company to generate liquid assets from its operations.

Some sectors, like manufacturing, have longer production cycles, meaning it takes more time to generate cash from their core operations. These industries will have higher working capital requirements since they have fewer options for covering urgent liquidity needs.

Sectors with quicker turnover, such as most service industries, will not need as much working capital because they can raise short-term funds more easily due to the nature of the business.

Other factors that affect working capital needs

In understanding whether a company or sector will have higher working capital needs, it's useful to look at the business model and operating cycle.

The operating cycle is the number of days between when a company has to spend money on inventory versus when it receives money from the sale of that inventory.

How and when companies have to fund regular expenses is also relevant.

For example, consider retail. Retail tends to have long operating cycles since companies have to buy their stock long before they can sell it. This is especially true for physical stores.

Generally, stores don't sell their goods on day one of operating. Their business model, therefore, requires them to have higher working capital in the form of inventory. This is because they can't rely on making sales if they suddenly need to pay a debt.

Retail also has periods of high sales that need to be prepared for, such as holidays. During these periods, working capital will need to be even more substantial.

Contrast this with many tech industries, which may not even sell a physical product. In these cases, working capital is lower because there are no large inventories being stored.

An example of this would be an online software company where customers download the product after purchase. Sometimes, a company like this can even get away with having a negative working capital.

Additionally, if this company was small, it could likely survive for quite some time on a very small amount of working capital. This is something to keep in mind when evaluating start-ups.

As a company grows, its overhead costs will increase. Therefore, it's important to keep an eye on the numbers as a company grows larger and its working capital needs increase. Beginning a startup is one thing, but managing it through growth is another altogether.

SummaryWhat's considered a good or normal number for working capital varies by industry, the length of the operating cycle, timelines, company size, and other factors.

The takeaway

Working capital reveals a company's financial health by assessing how liquid it is when it comes to assets and liabilities.

Companies with a positive working capital are in a good position to be able to cover their current liabilities using their current assets.

The opposite is true for companies with negative working capital, who may need to seek financing, such as by taking on debt or selling stock, or declare bankruptcy.

Additionally, companies with solid working capital are in a good position to pay unexpected short-term costs, as well as to grow their business.

What's considered a good or normal working capital number varies by industry, as it's closely related to the business model and operating cycle — that is, when cash goes in and out.

Working capital is also part of working capital management, which is a way for companies to make sure they are sufficiently liquid yet still using cash and assets wisely.

Keep in mind that while working capital is highly useful when assessing potential investments, it should always be considered in context and alongside other metrics.

To best assess a company's financials, it's important to have a well-rounded view.