Top 10 Investments with 10% Returns

First off, it's worth noting that there's no such thing as a guaranteed return on investment.

The stated returns of every asset class are based on its historical performance, and past performance does not guarantee future results.

What you can do, however, is focus on the investments that have most consistently averaged 10% returns in the past — because those are the ones most likely to earn similar returns in the future.

And as you'll see below, some assets have a far stronger track record of generating double-digit returns than others.

Here's my list of the 10 best investments to get a 10% return on your investment.

Summary of the best investments with 10% ROI

| Investment | Yield* | Risk level* | Timeframe |

| 1. Private credit | 14.3% | 2.5/5 | Short |

| 2. Stocks | 10.4% | 3/5 | Long |

| 3. Real estate | 8.94% | 2.5/5 | Long |

| 4. Fine art | 11.2% | 4/5 | Long |

| 5. Paying off debt | varies | 0/5 | Immediate |

| 6. Private startups | varies | 4.5/5 | Long |

| 7. Buying a business | varies | 4/5 | Long |

| 8. Cryptocurrency | varies | 5/5 | Medium-to-long |

| 9. Collectibles | varies | 3/5 | Medium-to-long |

| 10. Junk bonds | 6.75% | 3/5 | Medium-to-long |

*Disclaimer: I've given each investment below an overall rating, as well as a risk score of 0 (low) to 5 (high). These are personal opinions. Return information based on sources linked below. Actual results may vary. Be sure to conduct your own due diligence.

1. Private credit

- Overall rating:

- Risk level: 2/5

- Best for: Accredited investors who want short-term income and diversification outside of public markets

- Where to invest: Percent

Unlike public corporations — which can issue bonds on public markets — or small businesses that can borrow from banks, mid-sized private companies often struggle to access traditional financing.

To raise capital for growth or operations, they turn to private lenders.

This market — known as private credit — has grown into a $3.14 trillion asset class, and has become extremely popular among investment banks, hedge funds, insurance companies, and other institutional investors.

But now, platforms like Percent have opened the door for accredited investors to invest directly in private credit.

You can qualify as an accredited investor if you have $200,000 (individually) or $300,000 (jointly) in annual income, or a net worth of $1,000,000, excluding your primary residence.

Because this type of financing is harder for companies to obtain, private borrowers must offer more attractive terms. Across the private credit market, deals typically:

- Offer higher yields, generally between 9–20%

- Have short durations, most maturing within 9–24 months

- Are secured by assets such as machinery, real estate, or receivables

- Show low correlation with public stock and bond markets

On Percent, the averages as of July 2025 were:

- 14.3% average APY on matured deals

- 12.6-month average duration

- 2.41% default rate

Investors can either build their own portfolio of individual offerings or invest in pre-built, diversified portfolios managed by Percent.

If you're an income-seeking accredited investor, try Percent and discover why 89% of new investors reinvest after their first deal. You can also get a welcome bonus of up to $500 through our links.

Why I'd choose it: Short-duration income and diversification outside of public markets.

2. Stocks

- Overall rating:

- Risk level: 3/5

- Best for: Most investors

- Where to invest: Public

From 1926 to 2025, the S&P 500 has returned an average of 10.4% per year.

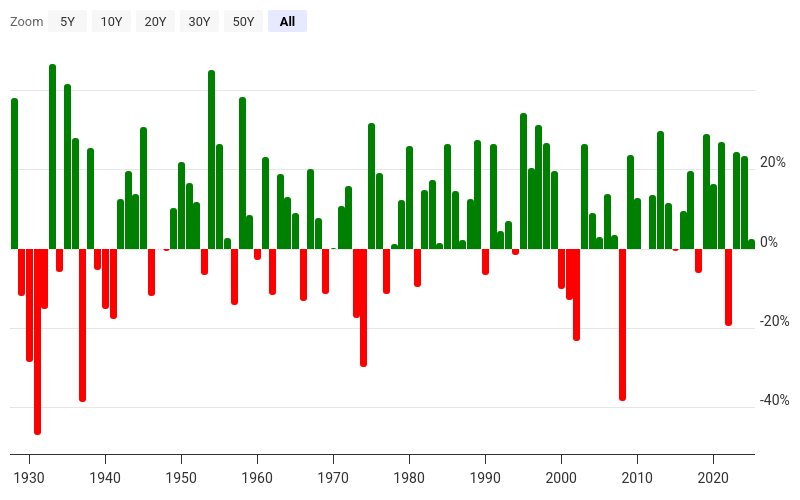

But that's just the average. As you can see in the image below, yearly returns vary widely — some years are up 30% or more, while others are down just as much:

Source: Macrotrends

Because of this volatility, you shouldn't expect to earn a 10% return each year.

To capture that long-term average, you need to be invested for the long term — at least 5-10 years. The longer you stay invested, the more likely you are to achieve returns that match the market's historical performance.

You can gain broad exposure to the S&P 500 by buying an index fund like VOO or SPY.

If you're looking for higher potential returns, you can also invest in individual stocks.

An index fund (like VOO) owns a large basket of stocks, which is helpful for diversification but also limits the upside.

Each year, a small number of high-performing stocks are responsible for the bulk of an index's returns. For example, while the S&P 500 has averaged roughly 10% since 1926, the top 25% of stocks averaged 50% per year over that same period.

So, if you can identify these winners in advance and avoid the losers, you can achieve significantly higher returns.

However, that's easier said than done. Over a 10-year period, 91.4% of professional fund managers underperformed the market. If you try to beat the market (by buying individual stocks instead of index funds), the odds are stacked against you.

To invest in stocks & ETFs, you'll need a brokerage account. I like Public, which gives you access to stocks, ETFs, Treasuries, cryptocurrency, and other alternatives through a well-designed website and mobile app.

If you want stock picks with big upside potential delivered straight to your inbox, you may want to subscribe to a paid investing newsletter. I recommend Motley Fool Stock Advisor (my favorite) or Alpha Picks (which I also subscribe to).

Why I'd choose it: Stocks are one of the most accessible asset classes and are one of the most reliable ways to generate a 10% ROI (or higher).

3. Real estate

- Overall rating:

- Risk level: 2.5/5

- Best for: Long-term investors who want to diversify their portfolios outside of public markets

- Where to invest: Arrived or Fundrise

Real estate has long been one of the most reliable ways to build wealth.

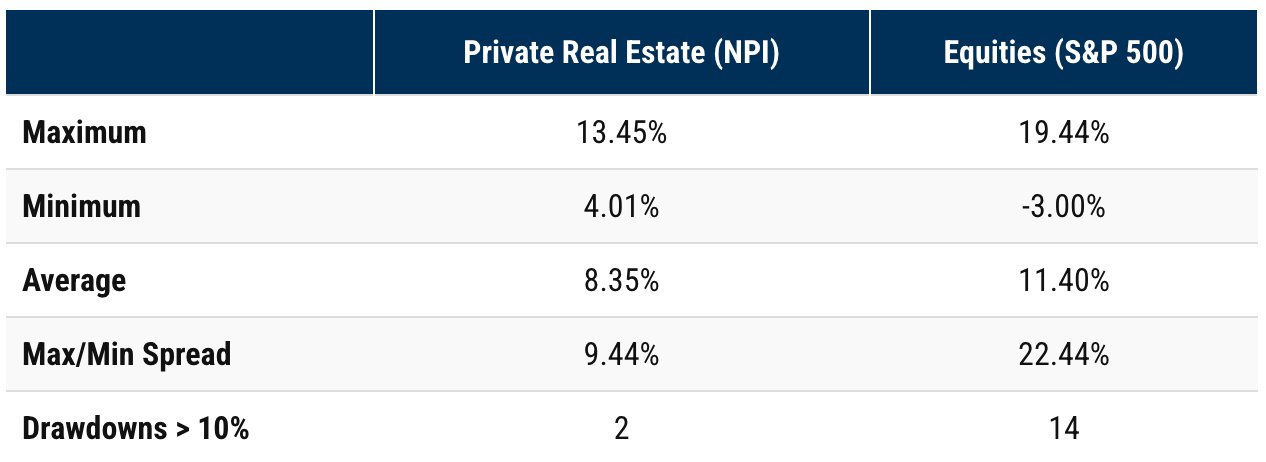

From 1978 to 2023, private real estate returned an average of 8.35% per year. While that trailed the S&P 500 by roughly 3%, it did so with much lower volatility:

Source: Bluerock

Real estate also offers multiple ways to generate returns: price appreciation, rental income, and tax advantages (like depreciation deductions and 1031 exchanges)

The main drawback is the upfront capital required to buy property. Most banks require 25% down payments on investment properties — that's $125,000 on a $500,000 house.

Fortunately, real estate crowdfunding platforms have made it much easier to get started. These platforms pool money from many investors to purchase and manage real estate on their behalf.

Two of my favorite options are Arrived and Fundrise:

- Arrived focuses on single-family homes used for both long-term and short-term rentals. As of June 2025, its properties were paying annualized yields up to 8.4%.

- Fundrise invests across single-family rentals, multi-family apartments, and industrial assets. Its portfolio now exceeds $7 billion in value and includes more than 2.1 million investors.

Both Arrived and Fundrise are available to all investors, and both have low minimum investments ($100 and $10, respectively).

Why I'd choose it: Real estate has a proven track record of creating wealth while providing consistent income. It's also more stable than the stock market, making it a good asset for diversifying a portfolio.

4. Fine art

- Overall rating:

- Risk level: 4/5

- Best for: Investors looking for diversification outside of public markets and are interested in a collectible with a track record of solid performance

- Where to invest: Masterworks

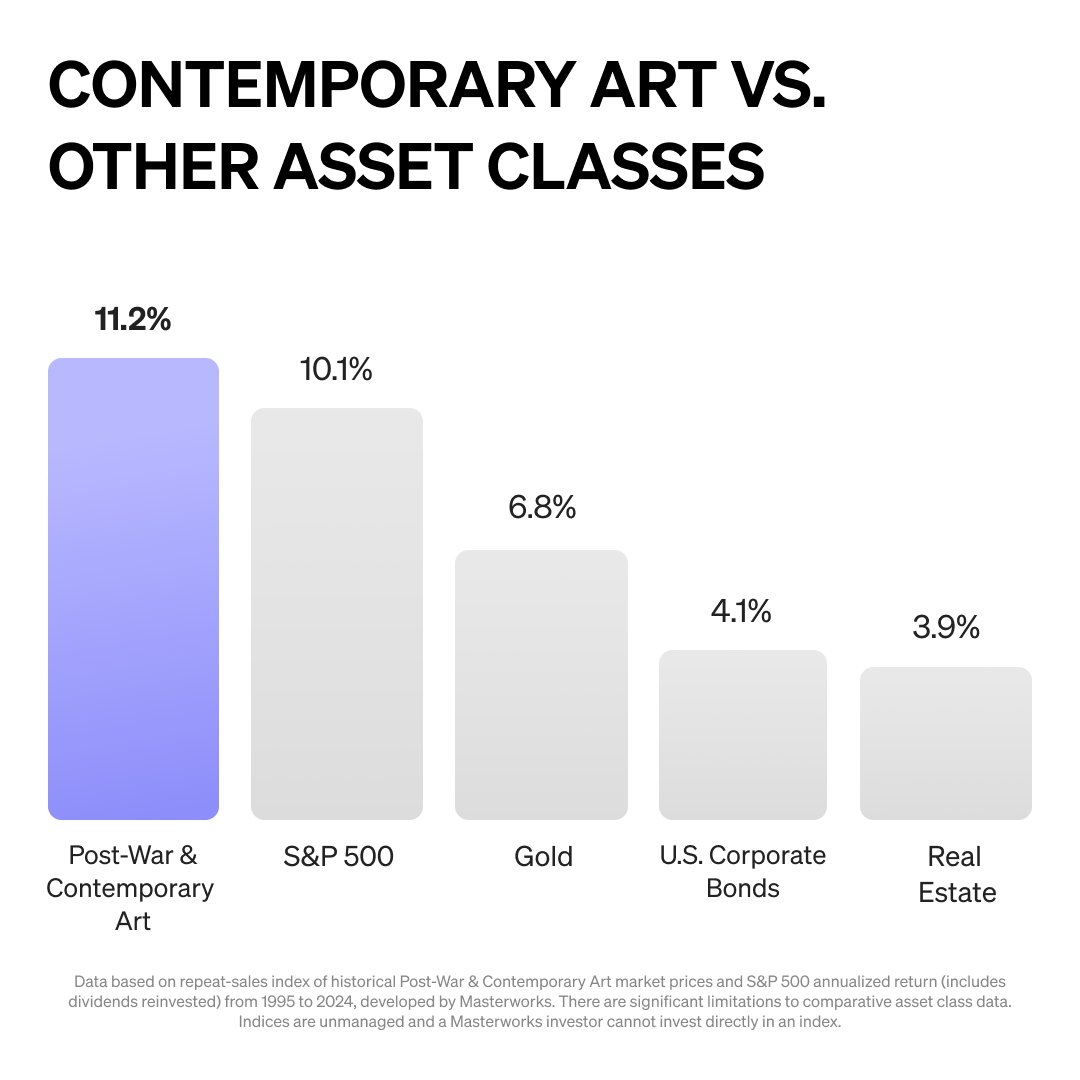

From 1995 to 2024, contemporary art outperformed the S&P 500 by an average of 1.1% per year:

Source: Masterworks, The Masterworks All Art Index

Furthermore, art has proven to be an excellent inflation hedge. During periods of elevated inflation, contemporary art sold at auction posted an average gain of 13.5%, compared to just 5.5% for stocks over the same time period.

Similar to real estate, art has historically only been available to the ultra-wealthy. But platforms like Masterworks — a crowdfunding art investing platform — changed that.

Its team identifies which artists and paintings are gaining momentum, acquires the pieces, and then “securitizes” them — allowing users to buy fractional shares in individual paintings.

When a painting is sold, any appreciation is distributed to shareholders. Investors have realized net returns of 14%, 27%, and 35% from recently sold Masterworks offerings.

That said, art investments are illiquid and typically require a multi-year holding period, so they're best suited for long-term, patient investors.

Why I'd choose it: Art is another asset class with a strong track record of returns and a low correlation with stocks, bonds, and gold. However, investors should be comfortable locking up capital for several years.

5. Paying off high-interest debt

- Overall rating:

- Risk level: 0/5

- Best for: Those with credit card or other high-interest consumer debt

- Where to invest: Your own credit card(s)

This one isn't technically an “investment,” but it deserves to be on this list.

If you're carrying a credit card balance at a 21% APR, paying it off is equivalent to earning a 21% rate of return. And that return is guaranteed.

It's surprising how many people start investing while still holding credit card debt. Other than taking advantage of a 401(k) employer match, there's no higher or more guaranteed return on investment than paying down high-interest loans.

As a rule of thumb, if you have any debt with an interest rate above 7–8%, it usually makes sense to eliminate that before making any investments.

Why I'd choose it: Paying off high-interest debt is the highest guaranteed return on investment you could make.

6. Private startups

- Overall rating:

- Risk level: 4.5/5

- Best for: Accredited investors who want to invest in private, VC-backed companies at past valuations

- Where to invest: Hiive and Linqto

As private equity and venture capital investors know, more and more of the real money is being made before a company's IPO, not after.

Investing in early-stage or pre-IPO startups can be highly speculative, but when a company succeeds, the returns can be enormous.

Until recently, only institutional investors and insiders had access to these opportunities. Platforms like Hiive are changing that.

Hiive is a pre-IPO marketplace that allows accredited investors to invest alongside private equity firms, venture capital funds, and hedge funds. The platform lists more than 3,500 private startups, including companies like SpaceX, Waymo, and Anduril.

Private startup investing isn't without risk. Valuations can fluctuate, liquidity is limited, and there's no guarantee the company will ever go public. But for those with large enough portfolios and the ability to handle that uncertainty, it can offer unique upside.

Why I'd choose it: For accredited investors comfortable with making high-risk, high-reward investments, investing in private companies offers the chance to gain early stakes in the next generation of breakout businesses.

7. Buying a business

- Overall rating:

- Risk level: 4/5

- Best for: Anybody willing to take on the risk and extra work of owning a business

- Where to invest: LoopNet, Craigslist, and Flippa

When most people think about investing, they rarely consider buying an existing business.

But many local businesses sell for between 2–5x annual profits. That implies a 20–50% annual return, assuming the company's profits remain stable.

Unlike stocks or bonds, owning a business gives you direct control over performance. You can increase revenue, improve operations, or expand margins — all of which can dramatically raise the value of your investment.

Of course, it's not easy. Buying and running a business is far less passive than owning shares or real estate property. It requires more time, work, and emotional bandwidth — and entrepreneurship simply isn't for everyone.

Plus, like real estate, it can be capital-intensive and lead you to idiosyncratic risk (having a large amount of money tied up in a single investment).

If you're interested, you can find businesses for sale on sites like LoopNet, Craigslist, or Flippa. You can also walk into a local business and ask the owner if they're open to selling or will be in the future.

Why I'd choose it: For those willing to get hands-on, buying a business gives you control over your investment's outcome, and can lead to huge ROIs.

8. Cryptocurrency

- Overall rating:

- Risk level: 5/5

- Best for: Believers in cryptocurrency and blockchain technology who don't mind the extremely speculative nature of the asset class

- Where to invest: Public and Coinbase

Cryptocurrency exploded onto the scene a few years ago, after Bitcoin surged from around $3,500 in 2019 to over $60,000 in 2021. Today, Bitcoin trades above $110,000.

Since then, crypto has become one of the most popular investments among those seeking high returns.

However, digital currencies remain highly speculative. Unlike a stock, which represents ownership in a company generating revenue and profits, cryptocurrencies aren't backed by underlying assets or cash flows.

The only way for investors to earn a profit from crypto is to sell it to another investor at a higher price. This investor, in turn, expects to sell it to another investor at a higher price in the future.

This dynamic, known as The Greater Fool Theory, often leads to massive swings in price.

Personally, I don't invest in crypto. But for those who deeply understand specific coins, projects, or macro events that could impact prices, it may make sense to allocate a small percentage of your portfolio to the asset class.

Why I'd choose it: If you believe cryptocurrency will play a larger role in the global financial system, you may consider allocating a modest portion of your portfolio to crypto.

Be aware that the crypto space is full of scams, and there is a history of major crypto platforms going bankrupt.

For this reason, it is recommended to invest in crypto through a trusted platform that is regulated as a broker, like Public or Coinbase.

9. Collectibles

- Overall rating:

- Risk level: 3/5

- Best for: Hobbyists or those with a particular affinity for a category of collectibles

- Where to invest: Locally, specialty websites, or eBay

I've developed a real appreciation for savvy collectors who deeply understand a specific niche — whether it's trains, coins, comic books, or sneakers — and can spot value when they see it.

Take one of my friends, for example.

He started collecting watches about ten years ago purely as a hobby. Today, it's the best-performing part of his portfolio. He's regularly doubling his money on his watches and has never lost money on a watch he's purchased.

The best part? He enjoys it.

Collectible investing requires both passion and expertise. You need a sharp eye for value and a genuine obsession with the category. It's not for the faint of heart, or for those chasing quick profits.

But if you already have a deep interest in a particular area, it can make sense to dedicate a small portion of your portfolio to it.

Done right, collectibles can deliver strong, even outsized, returns — while being one of the few investments that's also fun.

Why I'd choose it: If I had a real edge in a collectible market, I'd absolutely make it part of my portfolio. With the right knowledge, you can earn exceptional returns and enjoy the process along the way.

10. Junk bonds

- Overall rating:

- Risk level: 3/5

- Best for: Income-seeking investors comfortable with the risk/reward profiles of junk bonds

- Where to invest: Public

Corporate debt generally falls into two categories: investment-grade and non-investment-grade, with the latter often called junk bonds.

Junk bonds are those with credit ratings below BBB/BAA, meaning the bond's issuer carries a higher risk of default.

Junk bonds illustrate the classic risk-return tradeoff — the lowest-rated bonds pay the highest interest and are also most likely to default.

Issuers of junk bonds offer higher interest rates to compensate investors for taking on the additional risk. Currently, junk bonds are paying about 6.75% interest, compared to around 5.13% interest on investment-grade bonds.

Since 2001, the average default rate for junk bonds has been around 3.5% per year. During the 2008 financial crisis, defaults climbed to 5.3% for the highest-rated junk bonds and over 13% for the most speculative debt.

While this might not seem high, that's more than one default out of every twenty bonds issued.

For most investors, buying individual junk bonds isn't practical due to the complexity and risk involved.

Instead, you can gain diversified exposure through a high-yield bond ETF, such as the SPDR Bloomberg High Yield ETF (JNK). You can buy this ETF in any brokerage account.

Why I'd choose it: For investors comfortable with higher risk, junk bonds can offer attractive yields and a steady stream of income — especially when used as a small, diversified slice of a balanced portfolio.

How we chose the best investments with 10% ROIs

When evaluating investments, we consider the following:

- Returns: How has the investment performed historically? How is it expected to perform in the future? How stable/reliable are those returns expected to be?

- Risk: How much volatility should be expected? How much confidence can we place in the expected returns? How much downside is possible? How stable is the investment?

- Duration: How long should the investment timeline be? Should the investment be held for weeks, months, or years?

- Popularity: How popular is the asset among investors? Has the asset class been around for a long time, or is it relatively new?

- Accessibility: How easy is the investment to buy and sell? How simple is it to create an account and start investing? Are the recommended platforms easy to navigate?

Final verdict

That's my list of the 10 best investments with the potential to earn you a 10% ROI or more.

Just remember: Every investment comes with its own balance of risk and reward. Chasing higher returns often means accepting greater volatility and the possibility of loss.

The best way to manage that risk is by diversifying your portfolio, staying invested for the long term, and doing proper due diligence before you make an investment.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)

.png)