9 Appreciating Assets to Build Wealth

Most people don't get wealthy by saving — they get wealthy by owning things that grow in value.

Imagine two people who both save $25,000 a year. One parks it in a savings account. The other puts it into assets that grow at a modest 5% annually. After 30 years, the first has $750,000. The second? Over $1.7 million.

That's the power of consistently investing in appreciating assets.

What is an appreciating asset?

An appreciating asset is an item or investment that increases in value over time.

For example, you may have bought a house for $400,000 that is now worth $600,000. In this instance, the house has “appreciated” by $200,000.

In this article, I cover 9 of the most common appreciating assets and how you can use them to build long-term wealth.

Summary view

There are many appreciating assets to choose from. Some come with higher risk and the potential for bigger returns, while others are more stable but tend to grow at a slower pace.

Here's our list of the 9 best appreciating assets:

- Real estate

- Stocks & ETFs

- Precious metals

- Cryptocurrencies

- Private equity

- High-end art

- Wine & whiskey

- Other commodities

- Other collectibles

Keep reading for more information on each, including what it is, how to invest, and what returns you can expect to earn.

The 9 best appreciating assets

1. Real estate

You may not think of yourself as a real estate investor, but if you own a home — or plan to buy one — you already are.

For most Americans, their primary residence is the biggest investment they'll ever make. Fortunately, real estate is one of the most reliable appreciating assets over the long term.

A study of housing returns across 16 major economies (such as the U.S., Germany, and Japan) from 1870 to 2015 found that residential real estate delivered an inflation-adjusted return of over 7% per year.

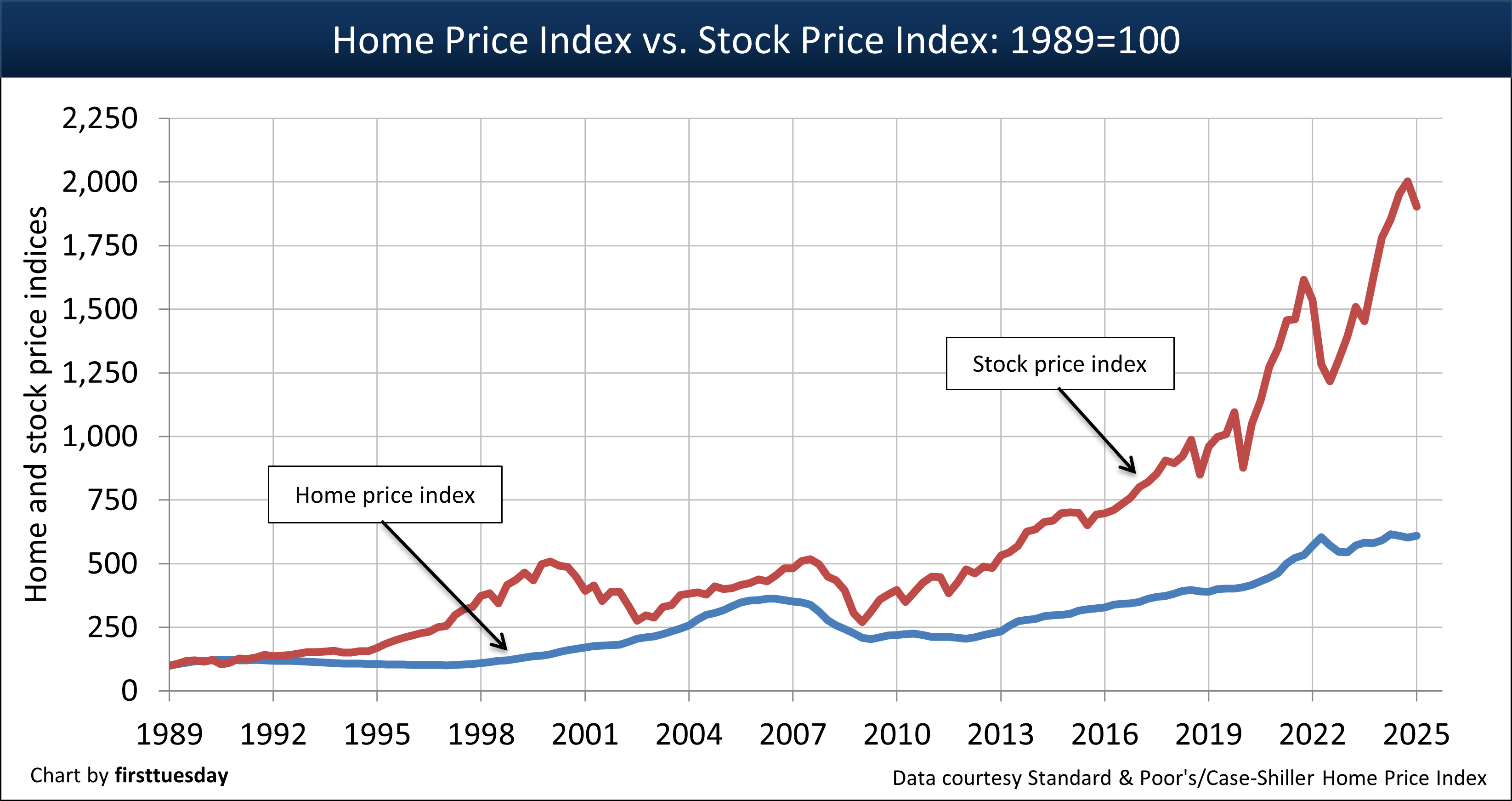

This is not far behind stocks, but with significantly less volatility.

That said, I wouldn't bank on 7% real returns going forward. In the U.S., housing appreciated at an average of 4.60% per year from 1992 to 2025. Still, real estate remains one of the most time-tested and dependable wealth-building assets out there.

The most common way to invest in real estate is by owning your own home, but it's not the only option. You can also buy rental properties.

Rental properties can provide price appreciation over time, monthly income from rent payments, and tax benefits (like depreciation and mortgage interest deductions).

However, being a real estate investor isn't easy. You'll need to screen tenants, maintain the property, cover repairs, and come up with a sizable down payment (often 20–25%) for each new property.

If you want exposure to real estate without the hands-on work, crowdfunding platforms are a great alternative. These companies pool capital from individual investors to buy and manage properties on your behalf.

Two of my top picks are:

- Arrived: Specializes in single-family rental homes. You can browse individual properties and buy fractional shares. Minimum investment: $100.

- Fundrise: Offers exposure to both residential and commercial properties, with portfolios designed for growth, income, or both. Minimum investment: $10.

With both platforms, you earn money through rental income and potential appreciation, without having to deal with tenants or toilets.

2. Stocks & index funds

You can own small pieces of the world's biggest and best companies — like Apple, Microsoft, and Costco — by investing in the stock market.

Historically, the stock market has been one of the most powerful tools for building long-term wealth. It's easily accessible, flexible, and — over time — delivers strong returns.

Source: First Tuesday Journal

While stocks are more volatile than real estate, the tradeoff has paid off. Since 1980, global stocks returned an average of 10.7% per year, compared to 6.4% for housing.

Although they can appreciate quickly, buying individual stocks can be risky. If you only invest in one or several companies, you could lose a significant portion of your investment, even if the market overall goes up.

That's why diversification — spreading your investment across multiple assets — is important.

One of the easiest ways to diversify in stocks is by buying index funds. An index fund is an investment that holds a basket of stocks that share a geography, size, or other characteristic.

For example, VOO tracks the S&P 500, giving you exposure to 500 of the largest U.S. companies in a single investment.

VTI tracks the entire U.S. stock market, including small and mid-sized companies, and VXUS offers exposure to international stocks outside the U.S.

You should expect short-term swings and frequent downturns in the stock market. But given a long enough time horizon, stocks have consistently appreciated in value.

You need a brokerage account to invest in stocks and index funds. You can open one for free on Public.

3. Precious metals

Gold, silver, platinum, and other precious metals have served as stores of value for thousands of years.

They tend to appreciate over time thanks to limited supply and steady global demand. From 1928 to 2024, gold delivered an average annual return of 5.12% — better than real estate (4.23%) but behind stocks (9.94%).

Precious metals are especially popular during times of economic uncertainty, high inflation, or market volatility. When confidence in financial systems weakens, investors often turn to hard assets like gold to preserve wealth.

For this reason, many long-term strategies — including Ray Dalio's All Weather Portfolio — include an allocation to gold as a hedge against inflation or to provide stability when stock prices are falling.

While you can buy physical bullion or coins, the easiest way to gain exposure is by buying ETFs in your brokerage account. For example:

These funds can be bought in any regular brokerage account, just like stocks or index funds. If you need one, we like Public.

Precious metals are the most popular commodity to invest in, but they're not the only option. Other hard assets like oil, natural gas, and agricultural commodities can also act as inflation hedges or portfolio diversifiers, though they tend to be more volatile. More on these below.

4. Cryptocurrency

Cryptocurrencies like Bitcoin, Ethereum, and others have become wildly popular over the last decade, especially among younger investors.

While it was originally positioned as an alternative to fiat currency or even digital gold, the reality is that crypto remains highly volatile, speculative, and unproven as a long-term store of value.

Take Bitcoin, for example. Its year-over-year performance shows just how dramatic the swings can be:

- 2012: 189%

- 2013: 5,429%

- 2014: -56%

- 2015: 34%

- 2016: 124%

- 2017: 1,336%

- 2018: -73%

- 2019: 94%

- 2020: 304%

- 2021: 59%

- 2022: -64%

- 2023: 156%

- 2024: 121%

This kind of volatility makes it hard to treat crypto as a reliable store of value. Even after years of strong gains, a single downturn can erase the majority of prior returns.

Because of that extreme volatility, crypto should be treated purely as a speculative investment, not a traditional appreciating asset.

Even if you're bullish on the long-term potential of Bitcoin, Ethereum, or blockchain as a whole, most experts recommend limiting exposure to 5–10% of your portfolio at most.

Fortunately, it's easier than ever to invest. Many brokerages (like Public, Robinhood, and Coinbase) allow you to buy and hold crypto directly in your account.

5. Private equity

In the 1990s and early 2000s, companies like Google (GOOGL) and Amazon (AMZN) went public relatively early in their growth cycles. That gave everyday investors a shot at massive returns.

Today, that's a different story.

Thanks to the rise of private equity and venture capital, private companies are staying private longer — meaning more of their growth happens before they hit the public markets.

As a result, early investors (mostly VCs and private equity firms) have captured an outsized share of the returns.

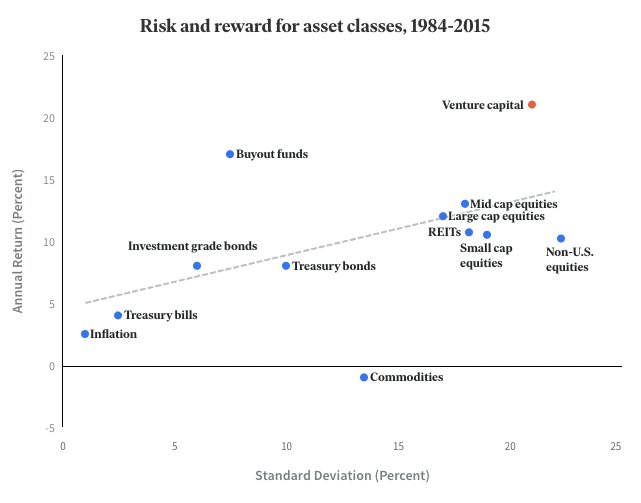

Unsurprisingly, venture capital has become one of the best-performing asset classes:

Source: Fundrise

Until recently, private equity was only available to ultra-high-net-worth and well-connected investors. But that's starting to change.

- Hiive is a secondary marketplace where accredited investors can buy shares in late-stage private companies. There are over 3,000 companies listed, including SpaceX, Stripe, and Epic Games.

- Fundrise's Innovation Fund gives non-accredited (retail) investors access to venture-style investments with a $10 minimum investment. The fund focuses on AI, machine learning, and data infrastructure, and holds positions in companies like OpenAI, Anthropic, Anduril, Databricks, and Canva.

Private equity is speculative, illiquid, and best suited for longer time horizons. But for investors looking to access high-growth companies before they go public, there are now options.

6. High-end art

Fine art is another popular appreciating asset, and has long been owned and collected by the wealthy as a store of value and a status symbol.

Traditionally, investing in blue-chip art required deep pockets. Works by artists like Basquiat, Warhol, or Banksy often sell for hundreds of thousands (or millions) of dollars, putting them out of reach for everyday investors.

Nowadays, on a platform called Masterworks, anyone can buy fractional shares of investment-grade artwork for just $10.

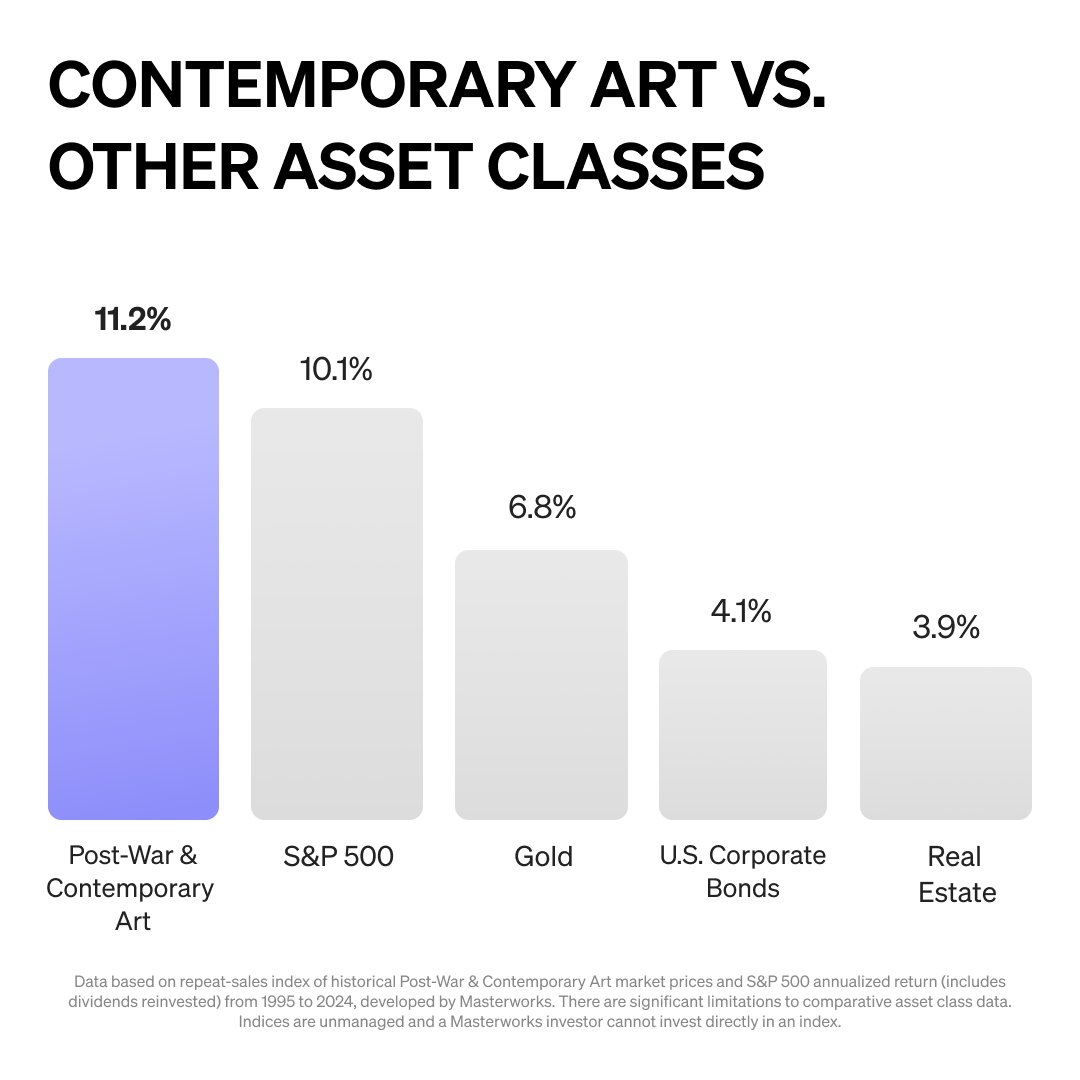

Masterworks focuses on Post-War and Contemporary art, two of the strongest-performing categories historically. From 1995 through 2024, these segments averaged 11.2% per year:

Source: Masterworks

Beyond returns, art also offers portfolio diversification (due to its low correlation with stocks and bonds), inflation protection, and tangible scarcity.

Here's how it works: Masterworks sources, acquires, and makes shares of each artwork available on its platform.

After buying shares, you can hold until the piece is sold (typically 3–10 years) or sell your shares on the platform's secondary marketplace (subject to liquidity).

For more information on Masterworks, check out our full Masterworks Review.

7. Wine & whiskey

In the last few years, fine wine and rare whiskey have quietly emerged as legitimate alternative investments, with strong historical returns and growing demand from collectors and investors alike.

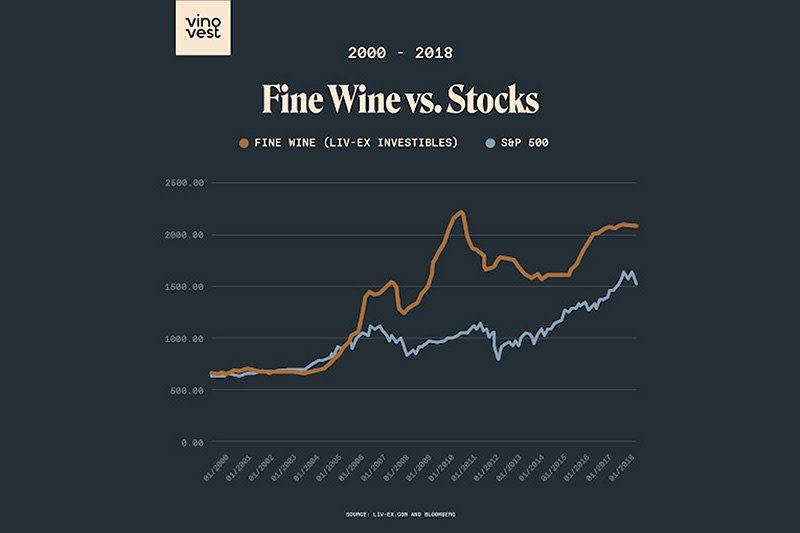

Over the past 30 years, wine has delivered annualized returns of 10.6%, and even outperformed the S&P 500 between 2000 and 2018:

Source: Vinovest

Several factors drive appreciation in wine and whiskey values:

- Scarcity: Wineries often make investment-grade wines in limited quantities, and the supply only declines over time as bottles are consumed.

- Brand: Iconic wineries and distilleries often command over $100,000 for a single bottle.

- Age: Many wines and whiskeys improve over time, making them more desirable.

Just like with fine art, building a portfolio of collectible wine or whiskey requires expertise, access, and storage. That's where Vinovest comes in.

Vinovest sources, authenticates, purchases, insures, and stores your bottles (unless you want to store them yourself). You can sell (or drink) your bottles whenever you like (subject to liquidity).

The downside to wine and whiskey investing is that prices are almost exclusively driven by collector sentiment, which can change at any time. It's also a relatively new asset class, and we don't yet know how it will perform across full economic cycles.

8. Other commodities

A commodity is a basic physical good — like a metal, fuel, or crop — that can be bought, sold, or traded on global markets. Commodities are typically the raw materials that power the economy.

The most common categories include:

- Metals: Gold, silver, copper, platinum, iron

- Energy: Oil, natural gas, coal

- Agriculture: Wheat, corn, coffee, orange juice

- Livestock: Pork, cattle

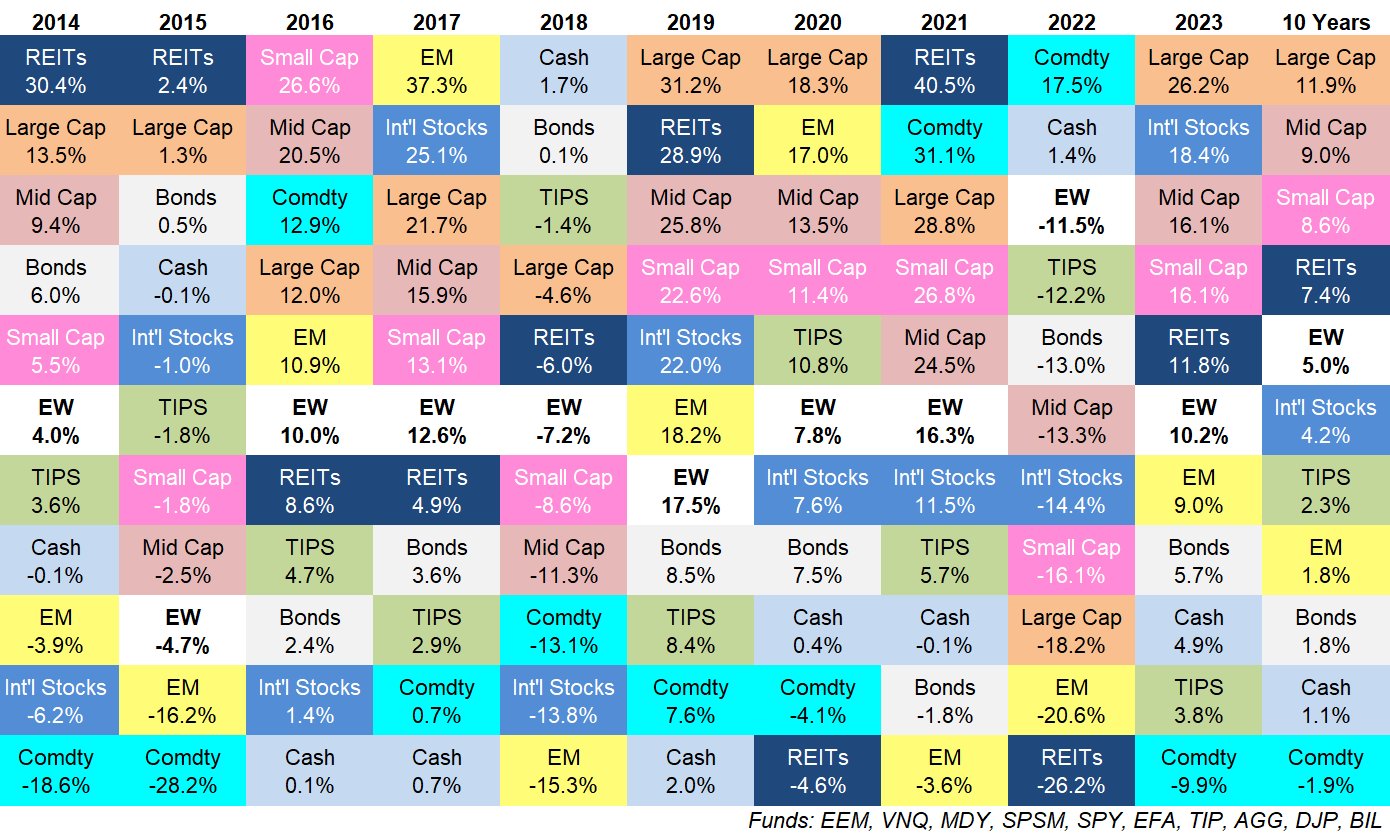

Commodities are often used to hedge against inflation and add diversification to a portfolio. That's because they tend to perform differently than traditional assets like stocks and bonds, as seen in the chart below:

Source: A Wealth of Common Sense

Commodities typically lag stocks and bonds, but they often outperform during years when traditional markets struggle. For example, when large-cap stocks and bonds fell -18.2% and -13% in 2022, commodities gained +17.5%.

However, commodity performance is notoriously inconsistent (just look at the turquoise squares above). Prices can swing wildly from year to year, depending on geopolitical events, weather, and global demand.

Commodities are also used for speculative bets on macroeconomic trends. For example, if you expect gas prices to rise, you may invest in crude oil futures.

Most investors don't want to deal with storing barrels of oil or bushels of wheat. Instead, they get exposure through ETFs and commodity-focused funds like DJP, USO, GLTR, and MOO.

You can buy these funds in your regular brokerage account.

9. Other collectibles

Collectibles are a unique way to diversify your portfolio outside of traditional markets, with returns driven more by scarcity, cultural relevance, and demand than by interest rates or earnings reports.

I've already covered several categories on this list — art, wine, and whiskey — but there are plenty of other widely-traded collectibles worth mentioning, including:

- Sports cards & memorabilia: Player performance, scarcity, and third-party grading drive value.

- Watches: High-end watches appreciate based on brand, production limits, and condition.

- Jewelry: Value is driven by precious metals, gemstones, craftsmanship, and brand recognition.

- Coins & currency: Rarity, precious metal content, and historical significance can make these worth far more than their face value.

- Vintage clothing & sneakers: Cultural relevance, brand, and condition determine prices.

- Toys & collectibles: Sealed or limited-run items tend to outperform opened or mass-produced pieces.

- Classic cars: Appreciation depends heavily on maintenance, storage, and historical importance.

Personally, I wouldn't allocate more than 5–10% of a portfolio to collectibles. That said, there are many examples of people making a full-time living trading within a niche they know extremely well.

Appreciating assets vs depreciating assets

An appreciating asset is one that increases in value over time. Conversely, a depreciating asset decreases in value over time.

| Appreciating assets | Depreciating assets |

| Real estate | Vehicles |

| Stocks | Electronics |

| Gold | Furniture |

| Silver | Appliances |

| Collectibles | Equipment |

While depreciating assets are typically useful and necessary, they generally become less valuable over time and with more use.

If you expect to sell something in the future for less than you paid for it, it's likely a depreciating asset.

Final verdict

As illustrated in the intro, it's difficult to save your way to serious wealth. If that's your goal, you should make it a priority to invest your savings in appreciating assets.

The most common appreciating assets to invest in are real estate and stocks. These two assets make up the bulk of most investors' portfolios and are also responsible for a significant amount of wealth creation.

If you make these two the core of your portfolio, add in some other assets that interest you, diversify within and across multiple assets, and have patience, you'll be giving yourself the best chance of building a significant net worth.

A frequently asked question

Does cash appreciate?

No, cash does not appreciate.

Technically, cash is a depreciating asset because it loses value over time due to inflation. However, you can turn cash into an appreciating asset — or, more specifically, an income-producing asset — by investing in cash equivalents.

Cash equivalents generate interest, which you can reinvest and earn a higher amount of interest on in the subsequent period. This creates a flywheel effect, simulating the effects of owning an appreciating asset.

Examples of cash equivalents are high-yield savings accounts (HYSAs), money market funds (MMFs), certificates of deposit (CDs), and Treasury bills (my personal favorite).*

*I put all of my cash into my brokerage account and invest it in SGOV, an ETF that owns Treasury bills. You can buy SGOV, and get a HYSA, on Public.

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.