How to Invest in Plaid Stock in 2026

Plaid is one of the most important companies in fintech, though many people have never heard of it.

It provides the behind-the-scenes infrastructure that lets apps securely connect to your bank account.

Its most popular tool, Plaid Link, powers apps like Venmo, SoFi, Rocket Money, Betterment, Chime, Acorns, Citi, and 7,000+ others. To illustrate its ubiquity: 1 in 2 U.S. adults have now connected to an app or service with Plaid Link.

Over time, Plaid has expanded well beyond account linking. Today, it offers tools for fraud detection, cybersecurity, data analytics, and banking services, and it partners directly with major financial institutions.

It's slowly evolving from a must-have tool for fintech startups into a piece of core infrastructure for the broader financial system.

In April 2025, the company raised money at a $6.1 billion valuation after posting record-setting revenue in 2024 (likely around $380 million) and nearing sustained profitability.

While Plaid has yet to set specific IPO plans (more on that below), there is a way for accredited investors to buy its stock right now.

Can you buy Plaid stock in your brokerage account?

No, you cannot buy Plaid stock in your brokerage account.

Plaid is still a private company, which means it does not have shares available for purchase on any stock exchange. Until its IPO, there will be no Plaid stock symbol and no way for retail investors to invest in it directly.

That said, accredited investors can buy it before its IPO. Retail investors can also get exposure to Plaid, albeit much more indirectly.

How to invest in Plaid before its IPO

There are two ways to invest in Plaid, depending on which type of investor you are.

The SEC has set regulations that allow accredited investors to invest in riskier asset classes (including private companies) than retail investors.

Accreditation requirements

To qualify as an accredited investor, you must meet one of the following criteria:

- Have an annual income of $200,000 individually or $300,000 jointly

- Have a net worth that exceeds $1,000,000, excluding your primary residence

If you meet one of these requirements, the first section is for you. If you don't qualify as an accredited investor, skip down to the section for retail investors below.

1. How to invest in Plaid as an accredited investor

Hiive is an investment platform that gives U.S.-based accredited investors access to high-growth, VC-backed startups.

There are over 3,000 private companies available for investment on Hiive, including Discord, Databricks, and Plaid:

At the time of writing, there are 4 orders of Plaid stock available on Hiive.

Each of these listings was created by a separate seller who sets their own asking price and quantity of shares for sale. Sellers may be employees, venture capital firms, or angel investors.

After creating an account, buyers can see the prices of all active listings, add companies to their watchlist, or place bids and buy shares from sellers.

Hit the button below to see the current order book for Plaid:

2. How to invest in Plaid as a retail investor

Unfortunately, to invest directly in Plaid at this time, you need to be an accredited investor.

However, here are a few ways retail investors can gain indirect exposure to its upside.

Invest in Plaid's publicly traded investors

Plaid has raised $1.32 billion from 69 investors over 10 rounds.

Most of these investors are private equity firms, but several publicly traded companies have also invested in Plaid, including:

- American Express (AXP) has invested twice, the first coming in its 2016 Series B and the second coming in its Series D in August 2021.

- Goldman Sachs (GS) participated in the Series B and Series C funding rounds, which raised $44 million in 2016 and $250 million in 2018.

- Mastercard (MA) and Visa (V) both invested during Plaid's Series C round in December 2018 and then re-invested in September 2019.

- J.P. Morgan (JPM) invested alongside American Express in the Series D round in August 2021.

- BlackRock (BLK) participated in its most recent round, its Series E, in April 2025.

While buying shares of any of these companies would give you exposure to Plaid, each of these companies' stakes is minor relative to the total size of their businesses.

For example, even if Goldman Sachs invested $150 million over the two rounds it participated in — and assuming the valuation rose from $2 billion to $6 billion — Goldman's investment would be worth $450 million.

Not a bad return, but its stake makes up just 0.15% of its $300 billion market capitalization.

Invest in its industry

Most of Plaid's direct competitors are also private companies (like Stripe, MX Technologies, and Tink), but there are a few public companies in the fintech space you may be interested in.

- SoFi Technologies (SOFI): SoFi provides lending, investing, and banking services online and through its mobile app. It generated $3.3 billion in the last 12 months and has a market capitalization of $32.4 billion.

- Block (XYZ): Block makes it easier for merchants to collect payments with its integrated system of technology solutions. It brought in $24 billion in sales over the last year and is worth $38.6 billion.

- PayPal Holdings (PYPL): PayPal offers several products that enable digital transactions between merchants, consumers, and friends. Over the last 12 months, PayPal has generated $32.9 billion in revenue and has a market capitalization of $52.3 billion.

- Affirm Holdings (AFRM): Affirm provides payment solutions via its pay-as-you-go lending terms. It generated $3.5 billion in the last year and is valued at $23.7 billion.

If none of these present themselves as compelling investment opportunities, you may decide to wait for the Plaid IPO.

When will Plaid IPO?

After the April 2025 round, Plaid CEO Zach Perret said Plaid was not quite IPO-ready but expected it to be the company's last round of financing before going public. The company has not provided an updated timeline since then.

As mentioned above, Plaid had agreed to be acquired by Visa back in early 2020 before the deal was nixed by the Department of Justice in January 2021.

Following the failed acquisition, Plaid went on to raise $425 million, made a few small acquisitions of its own, and continued to grow its business.

That growth continued through 2024, when the company posted record revenue and positive operating margins.

At this point, Plaid seems to be waiting for the IPO market to warm back up so it can command the highest valuation possible.

When Plaid does have its initial public offering, you'll need a brokerage account to buy its shares. If you need a brokerage account, we recommend Public.

Invest in stocks, ETFs, Treasuries, corporate bonds, cryptocurrencies, and more. all from one account on Public.

What is Plaid?

Plaid's primary business is building application programming interfaces (APIs) for the financial industry.

Its technology makes it seamless for users to connect their various financial institutions to fintech apps.

In all, Plaid offers connections to 12,000+ financial institutions, eliminating the need for each fintech app to build bank integrations from scratch.

For example, Seeking Alpha uses this feature to allow its users to connect their brokerage accounts to its portfolio tracker. In a few minutes, users can pull in their portfolios and see real-time updates on their holdings.

Because of its speed, ease of use, and security, Plaid has quickly become a must-use platform in the fintech space.

Who owns Plaid?

Plaid was founded by Zach Perret (CEO) and William Hockey in 2013. These two likely still own much of the company, though the exact split is not publicly available.

Beyond the two co-founders, Plaid is owned by 69 external investors. Some of its most prominent investors are Andreessen Horowitz (a16z), Goldman Sachs, Altimeter Capital, J.P. Morgan, Visa, and Mastercard.

Additionally, some percentage of the company is owned by current and former employees who have received stock options as part of their compensation.

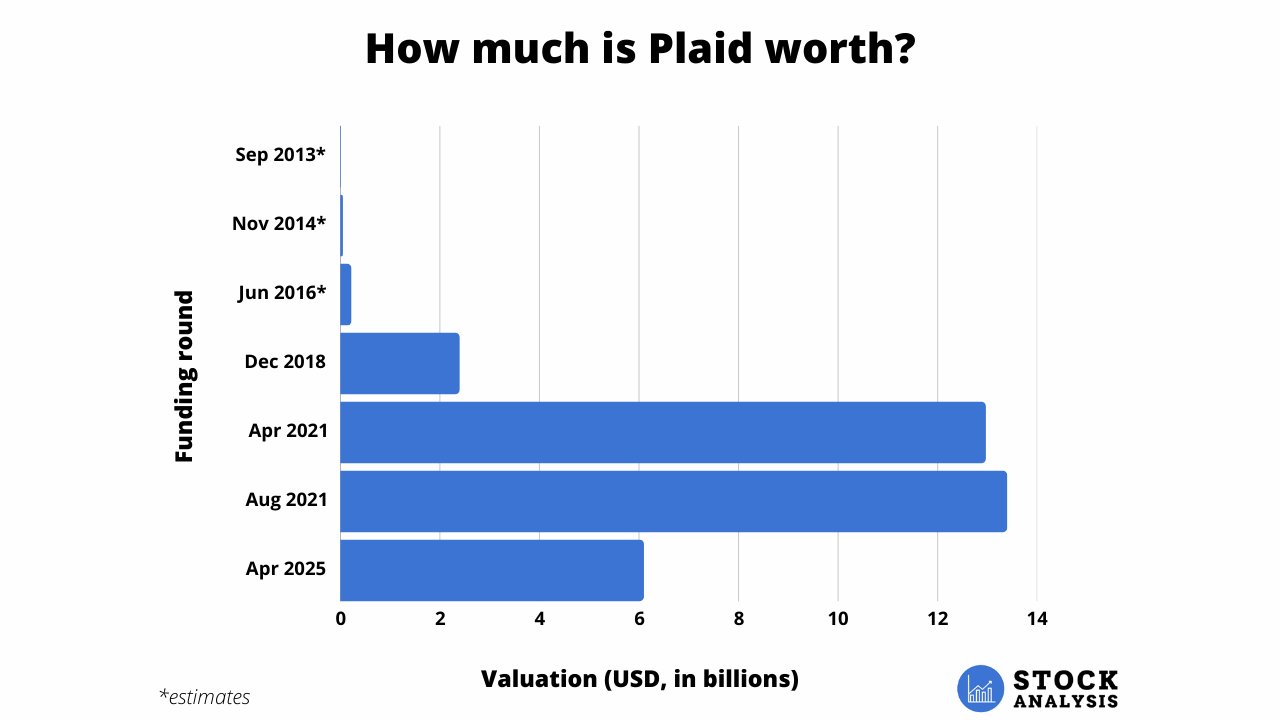

How much is Plaid worth?

Plaid's most recent funding round came in April 2025, when it raised $575 million at a $6.1 billion valuation, less than half the $13.4 billion valuation it received in August 2021 at the height of the fintech bubble.

Although lower than its peak, Plaid's valuation is still 15% higher than the $5.3 billion Visa was going to pay in early 2020 before the deal failed to pass regulatory standards.

Here's a look at how Plaid's valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.

.png)