Property, Plant, and Equipment (PP&E)

Property, plant, and equipment (PP&E) are a company's physical assets that have a lifespan longer than one year and are not easily converted into cash.

Examples include buildings, undeveloped land, machinery, and vehicles. PP&E tends to be more prevalent in capital-intensive industries, like oil and manufacturing.

Net PP&E is calculated by adding gross PP&E and capital expenditures and then subtracting the accumulated depreciation:

Net PP&E = gross PP&E + capital expenditure - accumulated depreciation

Analyzing PP&E shows investors how a company is managing its capital, helping determine whether its capital expenditures will benefit or hinder future growth.

Notably, PP&E can also be called fixed assets.

Below is an overview of PP&E including how to calculate and use it.

What is property, plant, and equipment?

Property, plant, and equipment (PP&E) are the tangible, illiquid, and long-term assets that a company owns. This means they are physical, generally not easily converted into cash, and have a useful life of more than one year.

Examples of PP&E include:

- Buildings

- Undeveloped land

- Machinery

- Offices

- Office equipment

- Other equipment

- Vehicles

- Fittings

- Furniture

- IT hardware

- Fixtures

PP&E does not include intangible assets like goodwill, brand value, or trademarks.

The amount and importance of PP&E vary by industry, with capital-intensive industries having high PP&E representing a higher proportion of their value (or assets).

Examples include exploration and production, such as energy giant BP (BP), and manufacturers like auto company Ford (F) or steel production company Nucor (NUE).

Transportation companies, like United Airlines (UAL), and semiconductor producers, such as Intel (INTC), are also known for having high PP&E.

It is vital for these types of industries to manage their PP&E investment well, as this is critical for future success. Analyzing PP&E can tell investors where a company is spending money on capital investments and how it's balancing current earnings with future growth.

Not all companies have high PP&E value relative to their worth — consider, for example, consultancy or advertising firms that lease their offices. These would be considered to have low PP&E values relative to their worth. Overall, this varies greatly by industry.

Additionally, PP&E assets are assigned a lifespan, meaning how many years they will be of value to the company. As such, they depreciate over time. PP&E assets also have a salvage value, which is how much they can be sold for after their useful life.

SummaryPP&E are the tangible, long-term assets a company owns. Whether a company has few or many PP&E assets varies greatly by industry, with capital-intensive industries owning the most. Analyzing PP&E can help you see how a company is managing its capital.

How is PP&E calculated?

PP&E is calculated as net PP&E, meaning some adjustments are made to the gross number.

Net PP&E is how much remains after capital spend and depreciation are accounted for — that is, how much is “left” in fixed assets once you take into account spending and depreciation.

Here is the formula:

Net PP&E = gross PP&E + capital expenditure - accumulated depreciation

Factoring in depreciation is, in accounting terms, a method to compensate for the aging of the asset. This spreads the cost of the asset over its useful life.

PP&E is listed on a company's balance sheet. It can be any proportion of a company's total assets, depending mainly on the industry.

Companies need to carefully record their PP&E so that investors and analysts can see how the company is investing in its fixed assets. Companies that do this well are more likely to balance their current earnings with future growth.

SummaryPP&E is calculated by taking gross PP&E and then adding in capital expenditure minus accumulated depreciation. It is located on a company's balance sheet.

PP&E by industry: two examples

Below are two examples that illustrate how PP&E can vary as a proportion of a company's overall assets. The examples below compare two companies in two different industries.

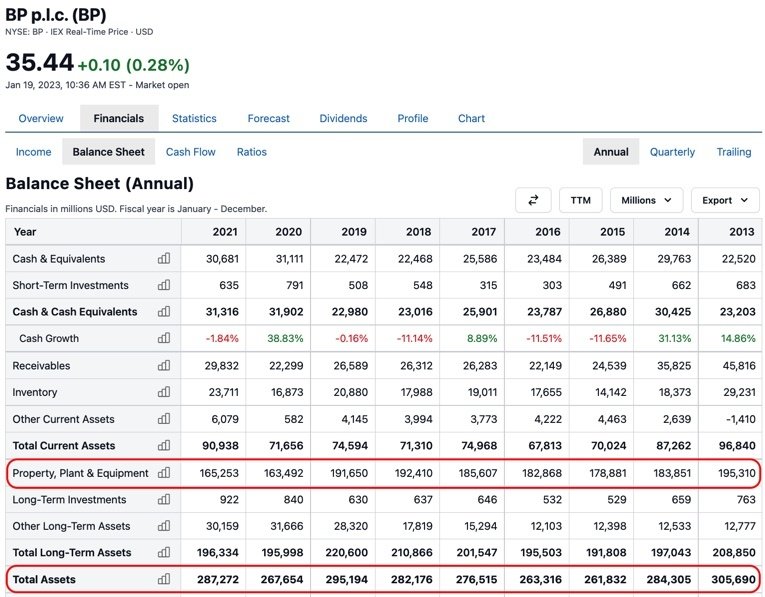

Example 1: BP

In the image below, you can see the PP&E for oil giant BP.

Source: BP's Balance Sheet

To see what percentage PP&E is of total assets, you can divide PP&E by total assets:

165,253 / 287,272 = 57%

Example 2: Semrush Holdings

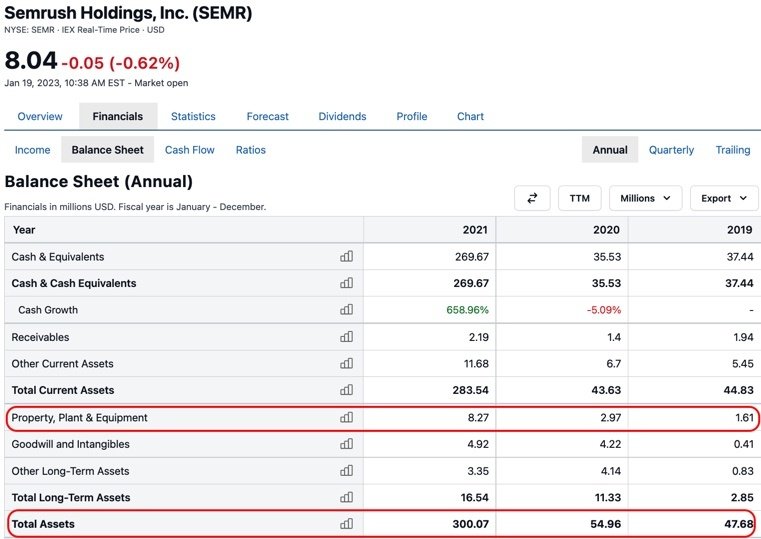

Next, let's look at the SaaS company Semrush Holdings (SEMR).

Source: Semrush's Balance Sheet

PP&E as a percentage of total assets can be determined like so:

8.27/300.07 = .027%

To compare, BP's PP&E is almost 60% of the value of its total assets, while Semrush's PP&E is less than 3%.

This is simply because they are very different types of companies. Overall, industry has a great impact on what proportion of a company's assets are PP&E.

SummaryIn the examples here, you can see how PP&E is listed under a company's assets. The proportion of PP&E in relation to total assets depends greatly on the industry.

Why is PP&E useful?

Studying PP&E can help you understand a company's strategy for generating profit.

This is because companies need to make choices about what to invest their capital in, as well as how much to invest. Many successful companies increase profitability partly through strong management of their PP&E.

Companies and managers may also be judged by how well they generate cash from assets.

PP&E is a concrete demonstration of how a company is implementing its strategy, as it shows if the company is putting its money where its mouth is.

For example, if a car manufacturer's strategy for growth is expansion into a new market, but it's not investing much in new plants and machinery in that location, investors could decide the company is not serious about following its strategy.

You can also look into PP&E to see what investments a company is making in its future, how it is spending in relation to competitors, and how strongly it believes in its own strategy.

For capital-intensive industries, PP&E is an even more important source of information for investors because companies in these industries spend even greater amounts on PP&E.

Investors want to understand how well the company's approach to these capital expenditures is working — that is, how much these investments will add to future profitability.

SummaryPP&E spending provides insights into a company's strategy and implementation. You can also get an idea of how the company is approaching its own future and how it is spending in relation to competitors.

The financial impact of PP&E

PP&E purchases are generally a large proportion of a company's assets, or worth. For this reason, it's important to consider how the company raises capital for them.

The company could use its own cash, though these purchases are often made via debt or equity, such as by taking out a loan or selling shares in the company.

There are advantages and disadvantages to these approaches. However, all three have an impact on the financial standing of the company.

For example, the company could be weakened by overspending on PP&E, stretching its finances too thin and then being vulnerable to increasing interest rates, etc.

If the company pays cash for the expenditure, this could also be seen as mismanagement if the PP&E is growing faster than the company, the company expects growth that never materializes, or the assets don't contribute to growing revenue.

If equity is used, then the company's share price might fall since investors may think that although there is value in the PP&E investment, it doesn't compensate for the dilution of shares.

If the company decides to use debt for financing, there will be costs associated with that. Investors and the market may decide these costs are too expensive for the value being added by the new PP&E or the company could find itself unable to cover the costs.

For capital-intensive companies, these issues can be critical to the success or failure of the business. Therefore, for sectors like oil and gas or manufacturing, investors need to pay special attention to these financing approaches.

SummaryPP&E are usually significant capital expenditures. For this reason, investors should consider how the company has chosen to finance such purchases, to see if they think that the company's financial management is solid.

Do companies sell PP&E?

PP&E are not generally very liquid assets, meaning they're not easily turned into cash.

Therefore, companies only sell them if they have to. This could be if they are in dire need of cash or because the asset has reached the end of its useful life and is being sold for scrap.

If a company finds itself in need of cash, it's likely it won't be able to easily sell many of its PP&E assets, which will have depreciated through time and use.

However, some types of PP&E, like land and buildings, may appreciate over time. They are also easier to sell and could provide the company with cash as needed.

Overall, resale scenarios depend greatly on the type of PP&E assets a company has.

SummaryCompanies don't generally sell their PP&E but if they are in need of money they can sell some types, such as buildings, land, etc.

The takeaway

PP&E refers to long-term, tangible assets. These are shown on a company's balance sheet and then depreciated over time.

Understanding PP&E is important for investors since it provides insights into how a company is managing its capital, helping determine how its expenditures will impact growth.

This is especially true for capital-intensive industries like energy and most types of manufacturing.

You can also compare a company's PP&E to that of its competitors or the industry norms to get a clearer picture of how the company relates to its peers.