Pretax Income

Pretax income refers to total income before taxes are deducted. It includes pretax deductions, depreciation and amortization, and interest income or expenses.

It's calculated by adding either net income plus taxes or by adding operating income plus other income and then subtracting other expenses.

Here are the two main formulas:

Pretax income = net income + taxes

Or

Pretax income = operating income + other income - other expenses

Pretax income is also commonly known as gross income, income before taxes, pretax profit, or earnings before taxes (EBT).

Below is an overview of pretax income, including the pretax margin.

What is pretax income?

Pretax income refers to total income before the impact of income tax expenses. This is why it's commonly known as income before taxes, pretax profit, or earnings before taxes.

It differs from metrics like earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation, and amortization (EBITDA) since it includes pretax deductions such as interest payments, depreciation and amortization, and other expenses.

Pretax income provides an unbiased look into a company's financial health over time.

The pretax margin — or pretax profit margin — divides pretax income by revenue, thus explaining how much profit a company generates per dollar of revenue without accounting for taxes.

Additionally, properly utilizing pretax income expenses, such as distributions to retirement accounts, can lead to enticing tax advantages.

SummaryPretax income is a term for total income before tax expenses are accounted for. It can provide useful insights into a company's financial health over time.

Why is pretax income useful?

There are five main ways the pretax income calculation is used.

1. Provides unbiased insight into a company's financial health

Pretax income can provide unbiased insights into a company's financial health and performance.

Taxes can considerably influence net income, cause variations due to accounting methods, and give a blurred view of a company's economic performance.

By looking at income before taxes are factored in, you can better evaluate core operations.

2. Useful when making comparisons

Tax expenses can fluctuate significantly by industry, location, and fiscal year.

Furthermore, companies can use tax credits or carry over losses to lower their tax bills, thus making comparisons more complicated.

When conducting company comparisons, pretax income is often a better metric than post-tax measures. Pretax income provides a company's raw financial numbers and eliminates disparities that can distort the true financial situation.

3. Helps measure a company's financial health over time

Pretax income is a consistent, reliable way to evaluate a company's financial health over time.

It removes inconsistencies that can stem from things like an ever-changing tax code or the disparities tax accounting can bring to an income statement.

4. Can function as a profitability ratio

Pretax income can also be used to calculate the pretax earnings margin, which is an excellent ratio to use when estimating a company's profitability prior to tax expenses.

The higher the ratio, the more profitable the company is.

5. There are tax advantages

Pretax income includes potential expenses or deductions that can lead to tax breaks. In other words, when you spend pretax income, it effectively becomes a tax deduction.

For example, consider the money a company pays into employee retirement funds. This would be considered a pretax income expense since it's deducted before taxes are paid.

SummaryPretax income has many uses, such as providing insight into a company's financial health, helping when making comparisons, as a profitability ratio, and for tax advantages.

How to calculate pretax income

To calculate pretax income, you'll need a company's income statement.

The formula is very straightforward and there are several ways to make the calculation, which can account for quarterly or annual periods.

The two easiest ways to calculate it are:

Pretax income = net income + taxes

Or

Pretax income = operating income + other income - other expenses

Example

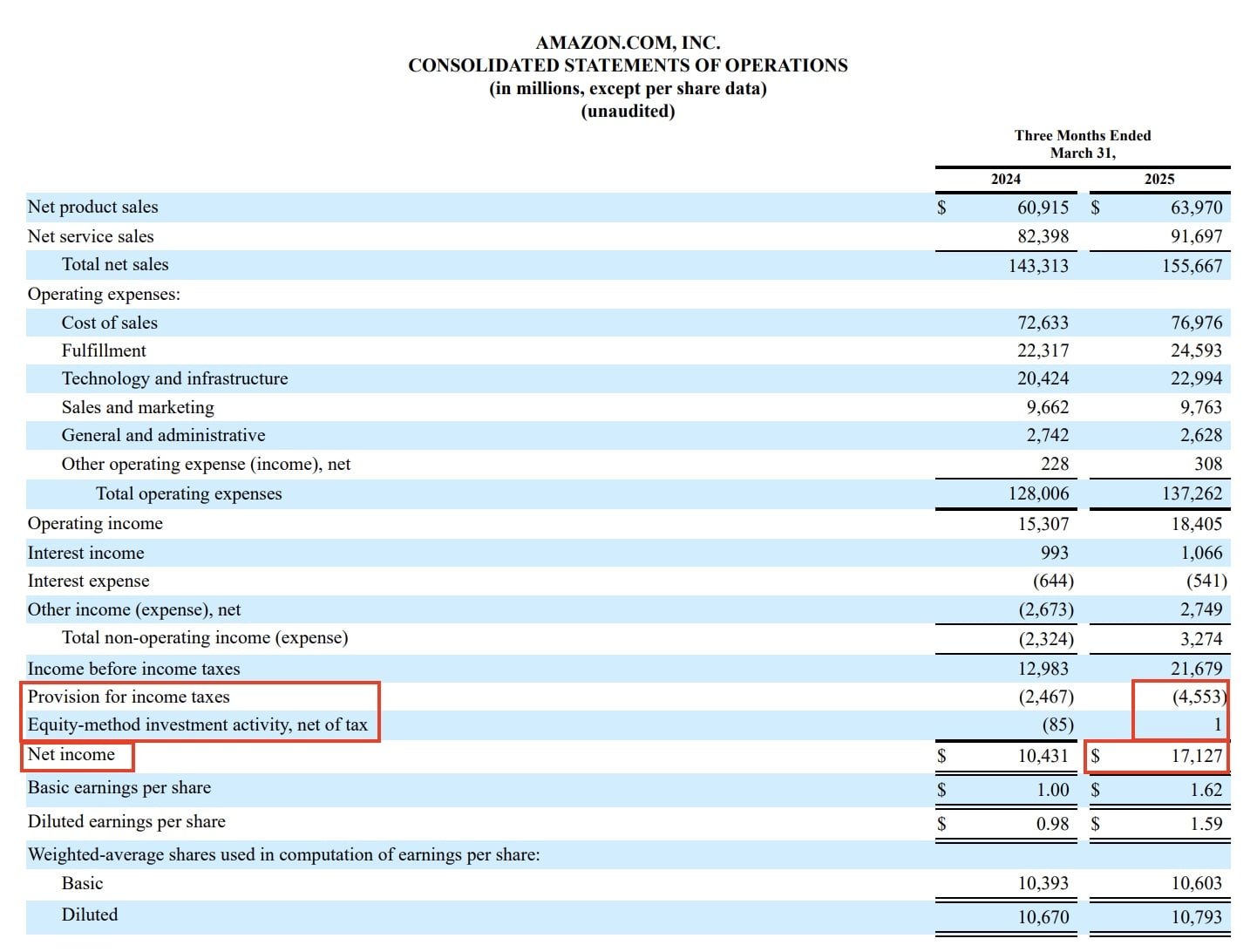

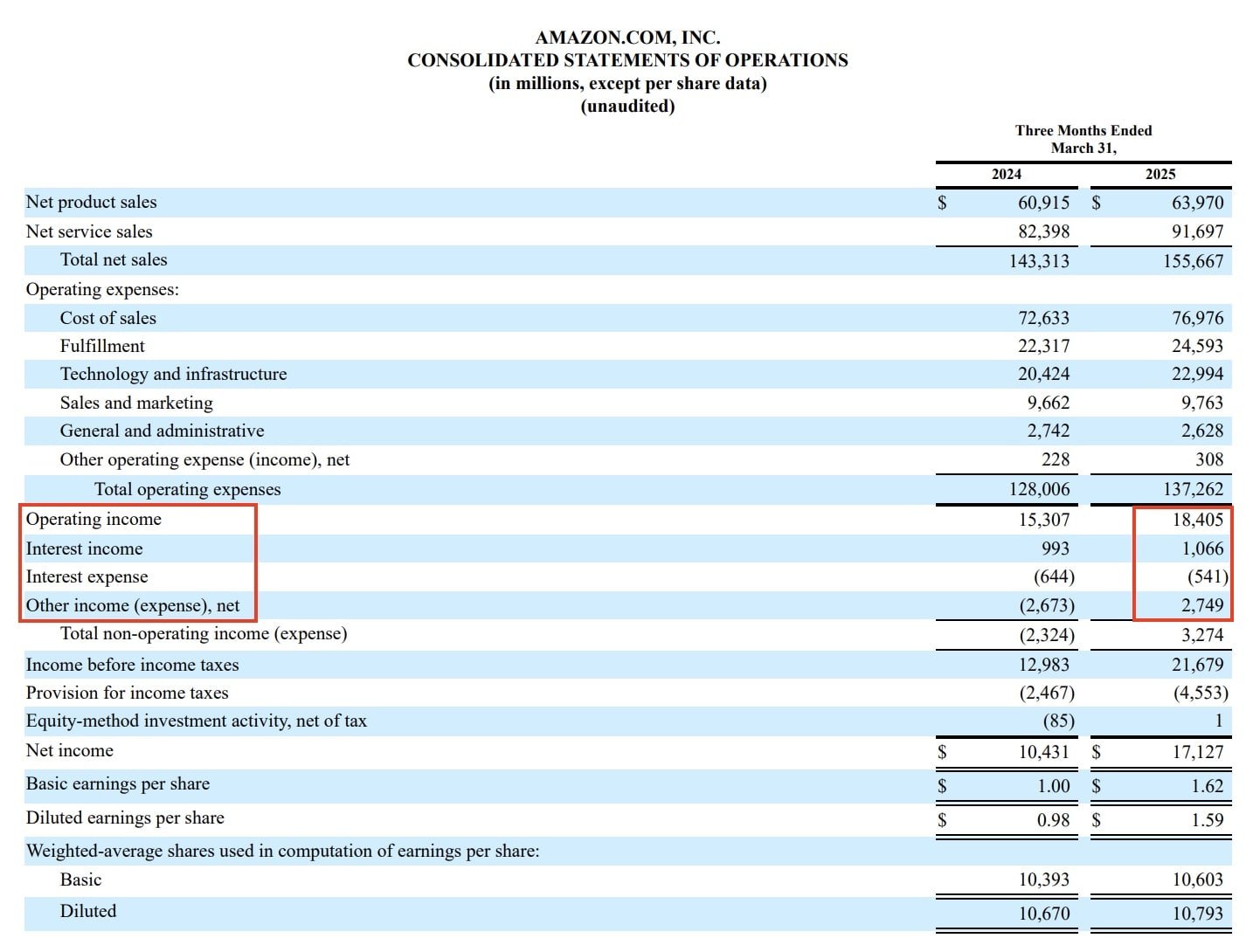

As an example, you can check out Amazon's (AMZN) latest 10-Q filing for the quarter that ended on September 30, 2022.

Amazon's income statement already has the line item: "income before income taxes,” which refers to its pretax income. For the 2025 column, it lists USD $21,679 million as the pretax income.

Here's how they calculated that figure, using both formulas:

1. Pretax income = net income + taxes

$21,679 = $4,553 + $17,127 + $1 (equity-method investment activity, net of tax)

Source: Amazon's 10-Q

2. Pretax income = operating income + other income - other expenses

$21,679 = $18,405 + ($1,066 + $2,769) - $541

Source: Amazon's 10-Q

SummaryThere are multiple ways to calculate a company's pretax income via the income statement, but the figure should be the same. This can be done either quarterly or annually.

The pretax margin

The pretax margin, or pretax profit margin, is a tool many companies and analysts use to measure and compare a company's operating efficiency.

The purpose of the pretax margin is to quantify and explain how much profit a company generates per dollar of revenue, without accounting for taxes.

Here's how to calculate it:

Pretax margin = pretax income / revenue

You can then multiply the result by 100.

Example

The pretax margin of similar companies can be used to make comparisons. For example, tech giants like Amazon (AMZN) and Alphabet (GOOG) can be compared this way.

As previously discussed, Amazon's latest 10-Q revealed $21,679 million in pretax income. It also listed $155,667 million in total net sales or revenue. If you divide $21,679 by 155,667, you can see that Amazon had a 13.9% pretax margin for the quarter.

SummaryThe pretax margin, or pretax profit margin, is used to measure a company's operating efficiency and make industry comparisons. The margin's purpose is to convey how much profit a company generates per dollar of revenue before taxes.

Pretax income vs related terms

Pretax income is often mistaken for other financial measurements, or they're used interchangeably. Although there are several critical differences, it typically gets confused for taxable income, net income, and EBIT/EBITDA.

Pretax income vs taxable income

There is one key difference between pretax income and taxable income — pretax income is an accounting figure, while taxable income is a corporate figure calculated to comply with IRS rules and regulations.

Pretax income vs net income or post-tax income

The difference between pretax income and net income is straightforward.

Pretax income is a company's profit before taxes get deducted. In contrast, net income refers to post-tax income or profits after taxes and other related deductions.

That's why net income is commonly referred to as a company's “bottom line.”

Pretax income (EBT) vs EBIT and EBITDA

EBT, or earnings before taxes, is one of pretax income's other names.

Since it contains similar items, it can be easy to confuse with earnings before interest and taxes (EBIT) and earnings before interest, taxes, depreciation, and amortization (EBITDA).

Pretax income accounts for depreciation and amortization, interest expenses, and interest income.

In comparison, EBIT is pretax income that excludes interest, while EBITDA is pretax income that excludes interest, depreciation, and amortization.

SummaryPretax income is an accounting figure, while taxable income is a tax regulation figure. Pretax and net income differ in that net income refers to post-tax income. And pretax income, or EBT, differs from EBIT and EBITDA due to what's included.

The takeaway

Evaluating a company's pretax income provides a comprehensive overview of the business's profitability and financial health.

Moreover, you can use this metric to compare companies in a more fair way, since variations in tax calculations can often make these comparisons difficult.

Tax regulations can vary by industry and jurisdiction. So when you remove them from the equation, it becomes easier to make comparisons and gauge performance over time.

For this reason, the pretax margin is often a more popular metric than the net profit margin.