Return on Equity (ROE)

Return on equity (ROE) is a profitability metric that shows how efficiently a company uses its assets to produce profits.

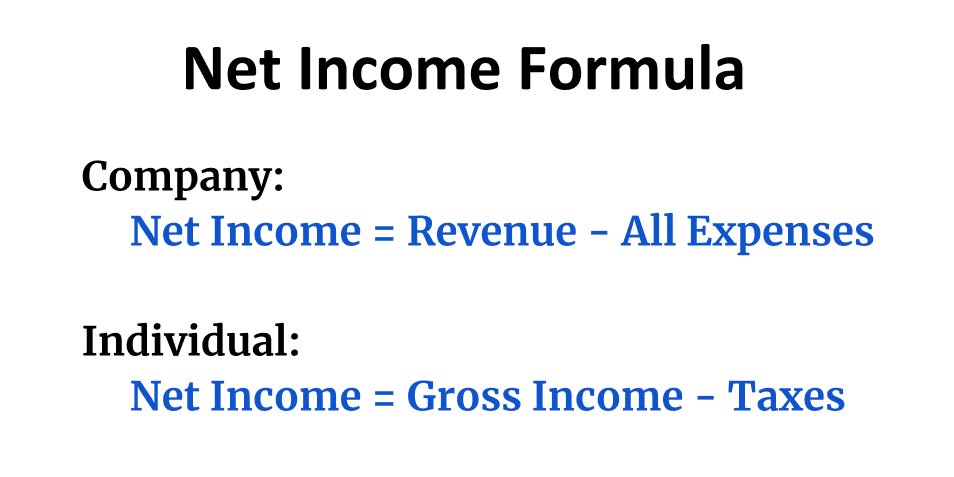

ROE is calculated by dividing net income by shareholders' equity, like so:

Return on equity = net income / shareholders' equity

Investors can analyze return on equity to assess a company's profit-making abilities. Generally, a higher return on equity means the company is more efficient at generating profits.

Below is an overview of return on equity including how to calculate and use it.

What is return on equity?

Return on equity (ROE) is a financial performance metric that's calculated by dividing a company's net income by shareholders' equity.

Shareholders' equity is calculated by subtracting liabilities from assets.

In simple terms, ROE tells you how efficiently a company uses its net assets to produce profits. A high return on equity means that a company is good at producing profits, which could then be used to grow earnings in the future.

Importantly, it's useful to know that ROE can vary considerably by sector or industry.

SummaryReturn on equity is a financial metric used to evaluate a company's efficiency in generating a profit. Generally, a higher number is better.

Why return on equity is important

A high ROE means a company is more effective at producing profits relative to equity.

In this case, equity is money that has been invested in the business by shareholders, plus money that investors have retained in the business.

In other words, equity is money from investors who hold ownership in the company.

The return on equity gives investors an idea of how effectively a company's management is using the money invested in it to produce profits.

For example, an ROE of 0.20 or 20% implies that the company can produce 20 cents of profit per year for each dollar of equity.

In other words, if shareholders invest a dollar in the business, the company will turn it into 20 cents of profit per year. Or, if investors let the company retain a dollar of earnings instead of paying it out as dividends, the company will make 20 cents of profit per year from that dollar.

A high return on equity makes it attractive for investors to not only invest in the business but also retain money in the business instead of paying it out as dividends.

Another benefit of having a high return on equity is growth potential.

A high number suggests that a company may be able to grow its earnings over time by reinvesting them back into the business, though this is not guaranteed.

SummaryA high ROE is a positive sign to investors, signaling that a company is effectively producing profits with the money invested into it. It's also a growth signal, as a high number indicates that a business may be able to increase its earnings over time.

How to calculate ROE

To calculate return on equity, simply divide the net income of the last twelve months by the shareholders' equity using the following formula:

Return on equity = net income / shareholders' equity

Net income can be found on the company's income statement. On finance sites, net income is usually shown as trailing twelve months (TTM).

Of note, preferred dividends are subtracted before calculating the net income in the ROE formula.

Shareholders' equity is listed on the balance sheet, though often it's simply listed as equity. It is the same as book value so can also be called net assets or net worth.

Using the average of the shareholders' equity from the beginning and end of the period is the most accurate. Below is the formula for calculating shareholders' equity:

Shareholder's equity = total assets - total liabilities

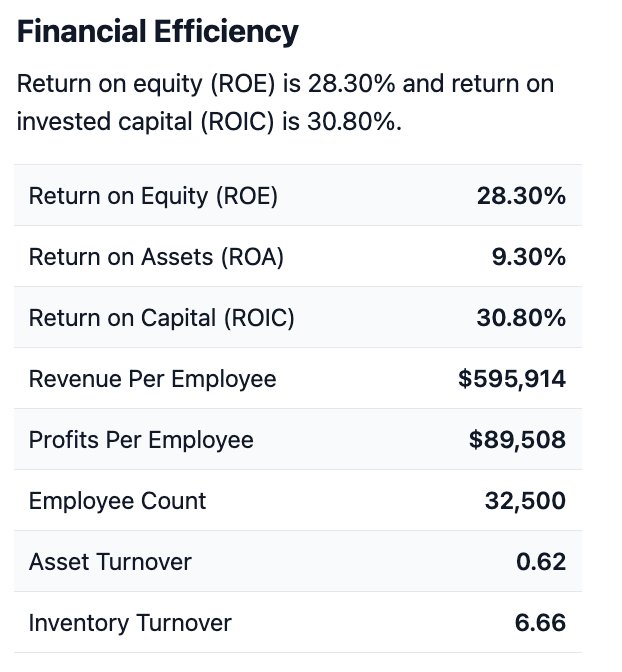

You can either calculate ROE yourself or view it on financial websites like Stock Analysis, where you can find it under the financial efficiency section of a stock's statistics tab.

Below is the ROE for General Mills (GIS):

ROE can be shown as either a ratio or a percentage. To convert from ratio to percentage, simply multiply by 100%.

Average shareholders' equity

To get a more balanced view over time, you can use the average shareholder's equity.

If you add up the most recent shareholders' equity and the shareholders' equity 12 months ago, then divide by 2, you will have the average shareholders' equity.

Average shareholders' equity = (SE 1y + SE latest) / 2

For example, imagine a company had $5 million in net income in the year 2019. At the start of the year, its shareholders' equity was $9 million. At the end of the year, the shareholders' equity had increased to $11 million.

This gives the company an average shareholders' equity of $10 million: (9 + 11) / 2 = 10. The resulting ROE is then $5 million / $10 million = 0.50 or 50%.

Using the average shareholders' equity during the past twelve months helps account for the different nature of the balance sheet compared to the income statement.

The income statement shows a time period, such as a year, while the balance sheet shows a snapshot of the time it was prepared.

Using the average shareholders' equity instead of either the beginning or ending value helps correct for this difference.

SummaryReturn on equity is calculated by dividing net income by shareholders' equity. To get a more even view, you can also use average shareholders' equity. You can either calculate ROE yourself or find it on financial websites like Stock Analysis.

What is a good return on equity?

Whether an ROE number should be considered good or bad depends on the industry.

Many industries inherently have either a low or high ROE. For example, utility companies tend to have low ROEs, while profitable tech companies tend to have high ROEs.

Because of this, ROE is mostly useful when comparing peers within the same industry.

But generally speaking, many consider an ROE of around 15–20% to be acceptable. To put that in perspective, the S&P500 index had a return on equity of 16.2% for Q4 of 2022 (1).

However, looking at a single ROE number can be unreliable.

This is because ROE depends on net income, which is a volatile number that often changes based on one-time accounting items, thus causing ROE to swing wildly from one year to the next.

To get a good idea of whether a company is doing well, it helps to look at how ROE has evolved over time. A stable or rising number is optimal.

Conversely, if ROE is declining over time, it could indicate that the company is making poor decisions on where to invest its money.

SummaryWhat's considered a good ROE number depends on a company's industry. Additionally, it's best to look at ROE trends over time, which you want to be either stable or rising, instead of relying solely on a single number.

Example of how to use ROE

To understand how to use ROE, it can be useful to walk through an example.

Let's say you're considering investing in Facebook (META) stock and want to know how its ROE compares to that of similar companies.

At the time of writing, Facebook had $23.20 billion in net income in the last 12 months. Its shareholders' equity 12 months ago was $124 billion but now it's $125 billion, making the average shareholders' equity $124.5 billion.

Facebook's ROE is then: 23.20 / 124.5 = 0.18 or 18.6%

This is a good ROE but you'd then want to see how it compares to that of its peers. Below are a few examples of ROE for the internet content and information industry:

| Company | Symbol | ROE |

| GOOGL | 23.50% | |

| Meta / Facebook | META | 18.60% |

| Baidu | BIDU | 3.50% |

| Spotify | SPOT | -18.90% |

| PINS | -3.00% |

You'll also want to dig into a company's ROE trends over time, especially if it's gotten lower. Then, you'd want to look into net income and check for one-time items such as fines. These can affect a company's ROE significantly, especially how it compares to its peers.

This is why it's not recommended to just look at a single ROE number for one point in time. It's much more useful to see how it evolves over time and how unusual items may have affected it.

SummaryTo understand a company's ROE number, you can compare it to industry peers and evaluate long-term trends. When assessing ROE, keep in mind that one-time items can affect net income, also affecting ROE.

Limitations of ROE

Like most financial ratios, ROE has several limitations. Most importantly, the ROE number can change drastically when the inputs to the equation change.

If unusual or large items cause the net income (numerator) or equity (denominator) to go up or down, then the calculated ROE may not be reliable.

For example, if a company takes on a lot of debt — which is not necessarily unusual — it will have less shareholders' equity. This is because debt is a liability, and shareholders' equity equals total assets minus total liabilities.

In this case, even if the ROE goes up, the stock may have become a riskier investment by taking on debt. However, this could also lead to greater returns over time.

A company with inconsistent profits can also have wild swings in ROE. A net loss reduces shareholders' equity, and if a company suddenly switches from losses to profits, the equity number may be so low that the ROE looks very large.

Additionally, stock buybacks lead to reduced shareholders' equity, so large-scale buybacks can increase ROE by reducing the equity part of the formula.

For this reason, an ROE that is very high is something to be suspicious of. If the ROE is either much lower or much higher than companies in the same industry, you should investigate further.

Finally, if either net income or shareholders' equity is negative, the ROE number also becomes negative. A negative ROE is hard to interpret and should probably be ignored by most investors.

SummaryThe biggest downside of the ROE metric is that it can change quite a bit depending on the inputs. Unusual items can cause the inputs to go up or down, making the calculation less reliable.

The takeaway

Return on equity (ROE) is a highly useful financial metric that shows you how efficiently a company's management uses shareholder money to produce profits.

You can use it to make comparisons between companies within the same industry, as well as to assess trends over time. It's a good idea to look at the larger context when analyzing ROE, not just relying on one calculation in isolation.

Worth noting, ROE does have some limitations, such as being affected by one-off events that impact a company's revenue.

For this reason, it should be considered alongside other financial metrics and the company's overall prospects.