5 Ways to Invest in Figure AI Stock

Figure AI is a humanoid robotics company.

Its robots can already perform a wide range of tasks, from moving a box onto a conveyor belt to making a cup of coffee.

Most of Figure AI's public demos have been filmed in controlled environments, but the company has also demonstrated real-world viability — deploying robots at a BMW manufacturing facility in December 2024 and signing an additional contract with UPS.

Those early signs of commercial adoption, combined with the vast range of potential use cases, have fueled strong investor interest.

In September 2025, Figure AI received over $1 billion at a $39 billion valuation, up ~15x from the $2.6 billion valuation it received just over 18 months earlier.

Notably, Figure AI was founded by Brett Adcock, who previously founded Archer Aviation (ACHR).

The company has many significant backers, including Microsoft, OpenAI, NVIDIA, and Jeff Bezos.

Although it's likely years away from an IPO, you don't need to wait for it to go public to invest. Here are 5 ways to invest in Figure AI stock today.

1. Buy shares directly (from shareholders)

Figure AI is a private company, so it has no stock symbol or public stock price.

However, accredited investors can still buy shares directly from existing shareholders through Hiive, a pre-IPO investment platform.

There are currently 50 unique listings for Figure AI stock on Hiive.

Each individual listing is created by a different seller who sets their own asking price and quantity of shares. Buyers can either accept the asking prices as listed or place bids and negotiate directly with the sellers.

Sellers may be current or former employees, venture capital firms, or angel investors. After registering, you'll be able to see the entire order book of asking prices, bids, and recently traded prices.

Check out the listings for Figure AI on Hiive here:

2. Invest in the ARK Venture Fund

Cathie Wood's ARK Venture Fund participated in the company's $675-million round in February 2024.

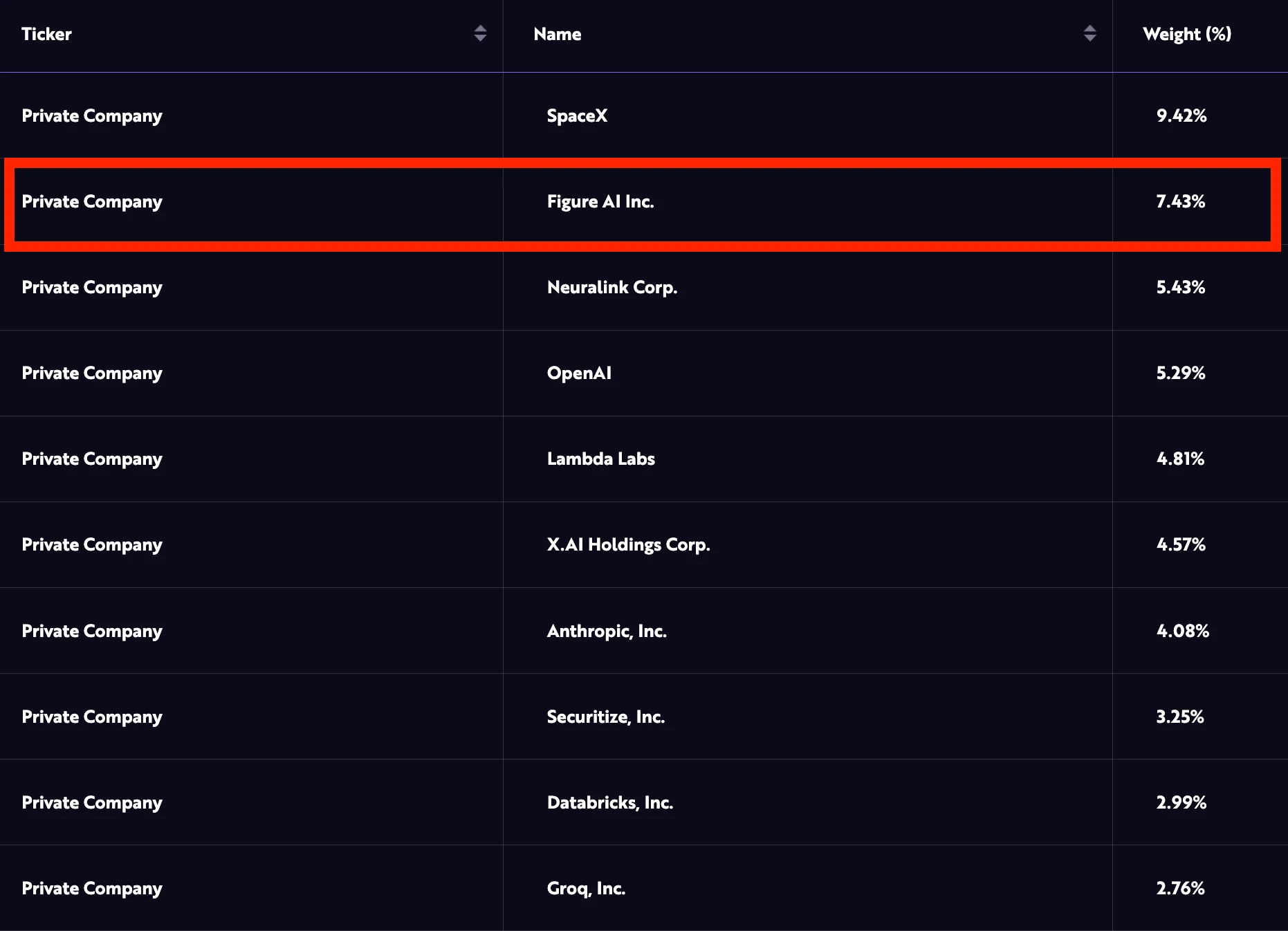

Following the company's Series C in September 2025, that stake 15x'd in value, propelling Figure AI up to the fund's second largest holding:

The Venture Fund invests in what they believe to be the world's most innovative companies, regardless of whether they're privately held or publicly traded.

Its top 10 holdings include SpaceX, Neuralink, OpenAI, Lambda Labs, xAI, Anthropic, Securitize, Databricks, and Groq.

All accredited investors can invest in the ARK Venture Fund via the company's website, and all retail investors can invest in the Fund via SoFi. The fund has total fees of 2.90%.

3. Invest indirectly (in public companies)

Another way to get exposure to Figure AI is to invest indirectly via publicly traded companies that have stakes in the robotics company.

Intel (INTC) has invested twice in the company, once back in July 2023 (in a round that raised $9 million at a valuation of $350 million) and in February 2024 (in a round that raised $675 million at a $2.6 billion valuation).

Microsoft (MSFT) and Nvidia (NVDA) also participated in its February 2024 round.

It's not publicly disclosed how much each of these companies invested. However, given their market capitalizations of $177 billion, $3.8 trillion, and $4.6 trillion, each of their stakes is likely an insignificant amount relative to the total size of their businesses.

For example, even if Microsoft invested $300 million of the $675 million raised in the most recent round, and despite Figure AI having 15x'd since that round, its stake would still only make up 0.1% of its total business.

4. Invest in other robotics companies or funds

As a whole, the humanoid robot market is expected to reach $38 billion by 2035.

And while Figure AI may be in a unique position, it's not the only company building robots. Here are a few publicly traded companies working on robotics:

- Tesla (TSLA) is involved in the humanoid robot race. Its robot, which it calls Optimus, can walk, fold clothes, and sort objects by color. After Figure AI announced its partnership with OpenAI, Elon Musk replied: “Bring it on.”

- UiPath (PATH) specializes in robotic process automation, in which software robots automate repetitive tasks in various industries and free up human workers for more meaningful tasks.

- Kratos Defense & Security (KTOS) develops unmanned systems for military purposes. While not directly impacting civilian life, the company's tech advancements contribute to the broader field of autonomous systems like self-driving vehicles and delivery drones.

- Trimble (TRMB) utilizes robotics in industries such as construction and agriculture to develop automated solutions that enhance efficiency and safety.

- Teradyne (TER) supplies automated test equipment for the semiconductor industry. Its robotics solutions help ensure the quality and reliability of electronic devices used in daily activities.

- Archer Aviation (ACHR) is developing electric vertical takeoff and landing aircraft for urban air mobility. Notably, Archer was co-founded by Brett Adcock, the founder of Figure AI.

This is not an exhaustive list, as there are more public companies with a presence in robotics.

Of note, if you don't know which stock to invest in, you may choose to diversify across many AI robotics companies via an ETF.

Here are a few you may be interested in:

- Global X Robotics & Artificial Intelligence ETF (BOTZ): This fund focuses on companies involved in the development and production of robots or AI.

- First Trust Nasdaq Artificial Intelligence and Robotics ETF (ROBT): This is another global fund focusing on artificial intelligence and robotics companies.

- ROBO Global Robotics & Automation ETF (ROBO): This fund buys companies from around the world that are focused on robotics and automation.

5. Wait for the Figure AI IPO

Finally, your last option is to simply wait for Figure's IPO. However, the company has made no indication of when it will go public.

Given the industry it's in and the capital available in the private market, I suspect Figure won't become publicly traded for at least a few more years. This would give it enough time to commercialize its product.

When asked about his vision for the company, CEO Brett Adcock said, “If we can just get humanoids to do work that humans are not wanting to do because there's a shortfall of humans, we can sell millions of humanoids, billions maybe.”

Figure will likely go public well before this vision becomes a reality.

If it does go public, you'll need a brokerage account to buy it. And if you're in the market, we recommend Public.

Figure AI's partnership with OpenAI

OpenAI also participated in the company's February 2024 funding.

As a part of its investment, OpenAI and Figure AI announced a partnership that includes OpenAI building specialized AI models for Figure's robots.

However, in February 2025, Adcock announced that his company had ended its collaboration with OpenAI, saying Figure had made a “major breakthrough on fully end-to-end robot AI, built entirely in-house.”

According to Adcock, the decision reflects the unique challenges of “embodied AI,” which brings artificial intelligence to physical objects (like robots).

Since embodied AI isn't OpenAI's primary focus, outsourcing that intelligence to the lab limits how tightly models can be optimized for specific hardware.

Instead, Figure AI is developing its own model (called Helix) alongside a large-scale training initiative called Project Go-Big.

How much is Figure AI worth?

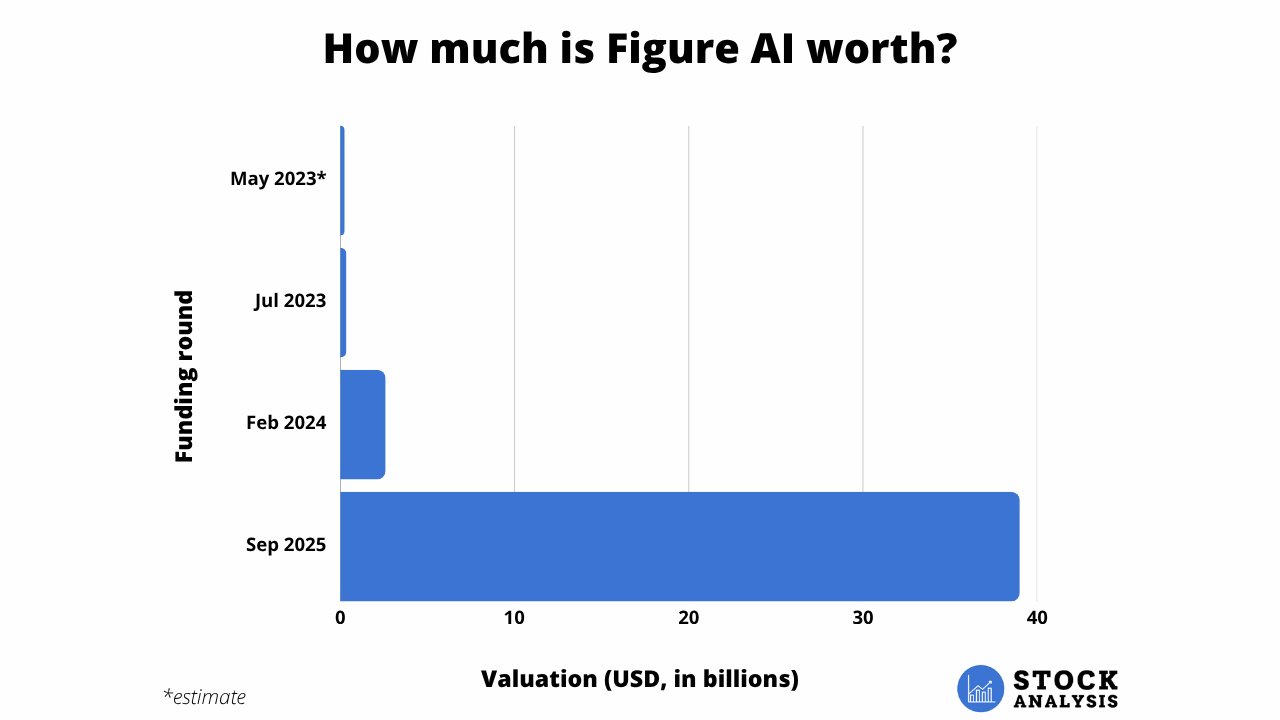

Figure AI was founded in May 2022 and has now raised more than $2.5 billion following its Series C in September 2025.

In the round, which was first announced in February 2025, the company raised over $1 billion at a $39 billion valuation.

The round was led by Parkway Venture Capital with investment from Brookfield Asset Management, NVIDIA, Macquarie Capital, Intel Capital, Align Ventures, Tamarack Global, LG Technology Ventures, Salesforce, T-Mobile Ventures, and Qualcomm Ventures.

Prior to this round, Figure AI raised $675 million at a post-money valuation of $2.6 billion in its Series B, which closed in February 2024.

Microsoft, OpenAI, Nvidia, Jeff Bezos, Parkway Venture Capital, Intel Capital, Align Ventures, and ARK Invest participated in this round.

Here's a look at how its valuation has changed over time:

Any views expressed here do not necessarily reflect the views of Hiive Markets Limited ("Hiive") or any of its affiliates. Stock Analysis is not a broker-dealer or investment adviser. This communication is for informational purposes only and is not a recommendation, solicitation, or research report relating to any investment strategy, security, or digital asset. All investments involve risk, including the potential loss of principal, and past performance does not guarantee future results. Additionally, there is no guarantee that any statements or opinions provided herein will prove to be correct. Stock Analysis may be compensated for user activity resulting from readers clicking on Hiive affiliate links. Hiive is a registered broker-dealer and a member of FINRA / SIPC. Find Hiive on BrokerCheck.